- This topic has 57 replies, 3 voices, and was last updated 6 months, 1 week ago by GVI Forex 2.

-

AuthorPosts

-

February 6, 2025 at 5:21 pm #19127

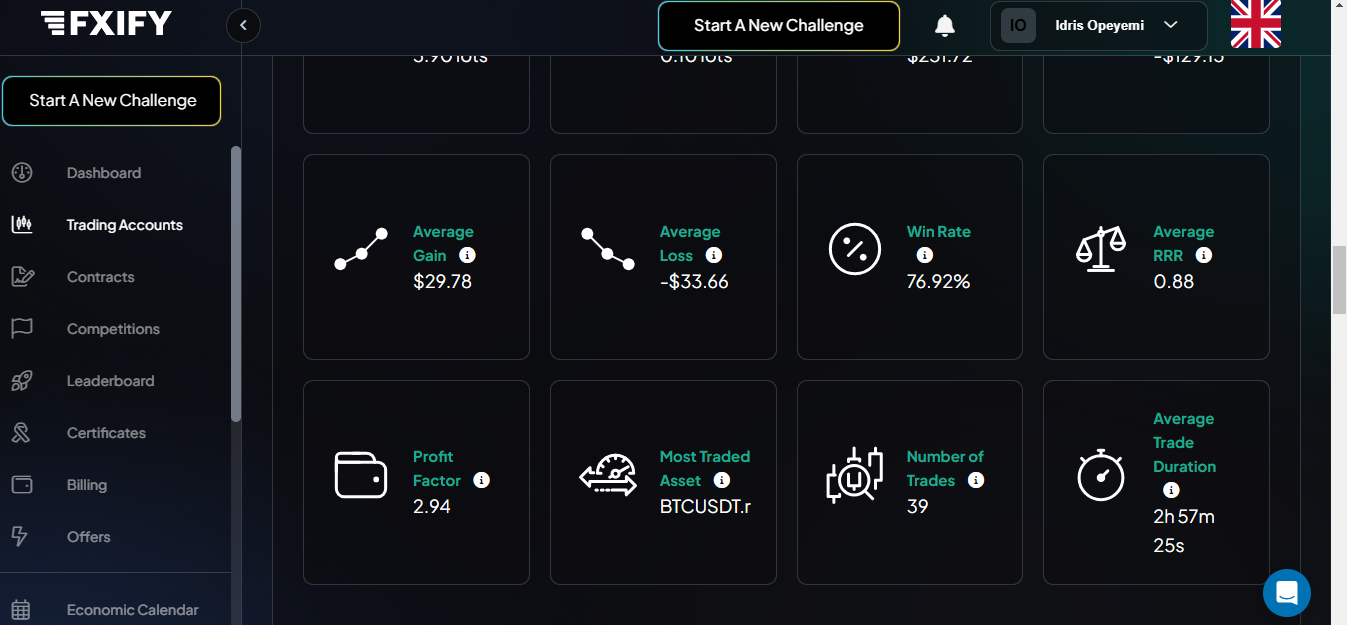

Look at his GBPUSD 15 minute chart and tell me whether you would keep selling (as many did) when the red lines started building to the upside.

This is my Amazing Trader charting algo in action with a pattern that repeats itself qith any instrument that your broker has on its MT4 platfiorm.

Contact me for a free trial of a half price GTA discount access.

January 29, 2025 at 7:10 pm #18667January 29, 2025 at 6:27 pm #18661January 29, 2025 at 6:08 pm #18658

January 29, 2025 at 7:10 pm #18667January 29, 2025 at 6:27 pm #18661January 29, 2025 at 6:08 pm #18658Idris – Retail Traders are all those that trade for their own account , using retail brokerages.

Doesn’t matter the size of the account – from 1$ to millions.

So individuals like you and me.

And for the strategy – it depends on many aspects of one’s trading.

It includes R/R , Probability, Size of trade, stop loss positioning, time frame on which you trade…

We’ll talk more on this issue and I am going to write several examples on Strategy that suits our needs

January 29, 2025 at 5:33 pm #18657January 27, 2025 at 4:00 pm #18503Take a look at these charts and then go to the Welcome Package in the Member Benefits page and watch the Day Trader’s Guide to Beating the Market video.

Look at this US500 chart after sell stops were exhausted and the low for the day was set.

Look at this EURUSD chart and the price action after buy stops were run and the high for the day was set.

October 22, 2024 at 1:57 pm #13209

October 22, 2024 at 1:57 pm #13209I suggest reading this timely article in our bloh

How Does a Currency Options Defense Affect the Spot FX Market?

October 17, 2024 at 5:51 pm #13063October 9, 2024 at 2:14 pm #12682Read this article I posted in our blog and then read below

What is the one word that makes the forex market move?

The word is FAILURE

These two charts how the logic where a failed rally was needed before setting up a new low.

DAILY CHART (STRONG DOWNTREND SO RISK IS ON THE DOWNSIDE

ONE HOUR CHART SHOWING THE FAILED RALLY THAT WAS NEEDED TO SETUP A FRESH RUN TOI A NEW LOW

The more mature a trend the more it needs a failure to setup a fresh run at a new low or high

Same logic can be applied to an intra-day short-term trend

October 2, 2024 at 11:44 am #12383September 30, 2024 at 11:01 am #12271To keep it simple

1) Identifying the side to trade is more than half the battle in putting on successful trade

2) The side most vulnerable is the one where there are market stops at risk

It is as simple as that although with the caveat that there are no guarantee in trading, only looking for ways to out the odds on your side.

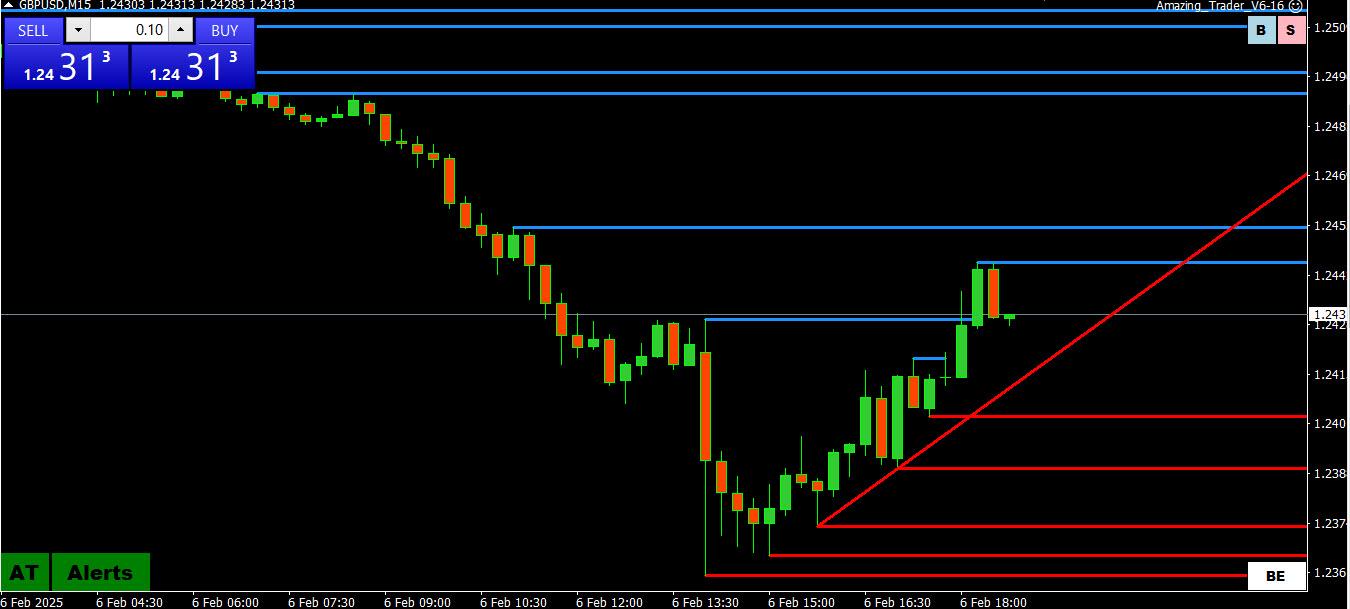

September 26, 2024 at 12:57 pm #12101September 25, 2024 at 3:27 pm #12070Here is a lesson that will at a minimum save you money

This chart is an example of a falling knife

Every trader likes to try and pick tops and bottoms.

EURUSD has been moving higher this week and in fact traded to a new 2024 high earlier before retreating.

So the temptation is to look to pick a bottom at every pause and mini uptick.

BUT WHAT IS THIUS CHART TELLING YOU?

9 red down candles in a row with no retracement.

It is telling you not to try and catch the falling knife as the odds are against you unless you get lucky.

If you want to buy, be patient.

The better play, with hindsight, was to be short but that is easy to say than do. Those who subscribe to The Amazing Trader are shown how to do so in what I call The hard (to find a good entry) trade is more often than not the right trade.

The takeaway is when you see a one way move with no retracement, assume there is real money selling and don’t look to bottom or top pick until charts tell you it is okay to do so. This is not meant as a plug but the best way I know is by using The Amazing Trader.

In any case, don’t be a sucker when you see a one way move.

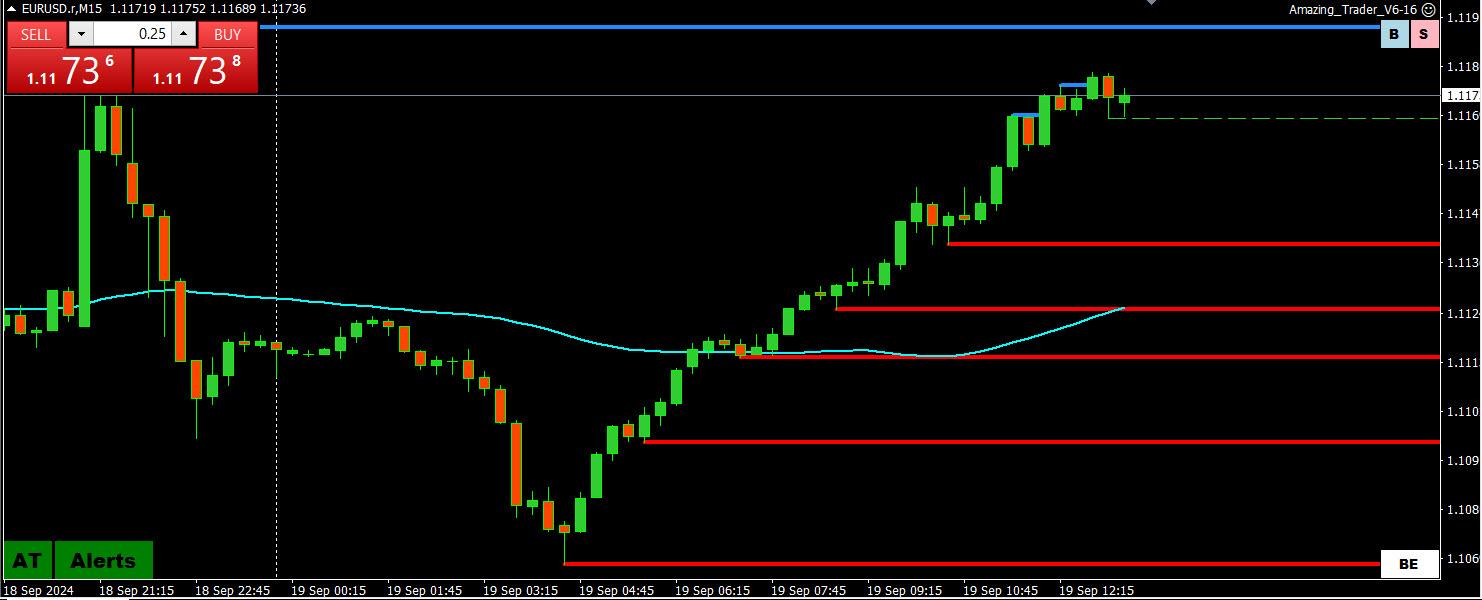

September 25, 2024 at 12:36 pm #12047AT Ladder Pattern – EURJPY 4 Hour Chart

Look at the rising red AT ladder lines … this is a classic AT ladder pattern.. buying with a stop below the most recent preceding red line anywhere along the pathway would never have gotten stopped out.

This pattern can be seen on any time frame. If you don;t trade 4 hour charts, this pattern would tell you only to trade from the long side and look for an up ladder pattern on shorter time frames to trade.

September 19, 2024 at 10:34 am #11846

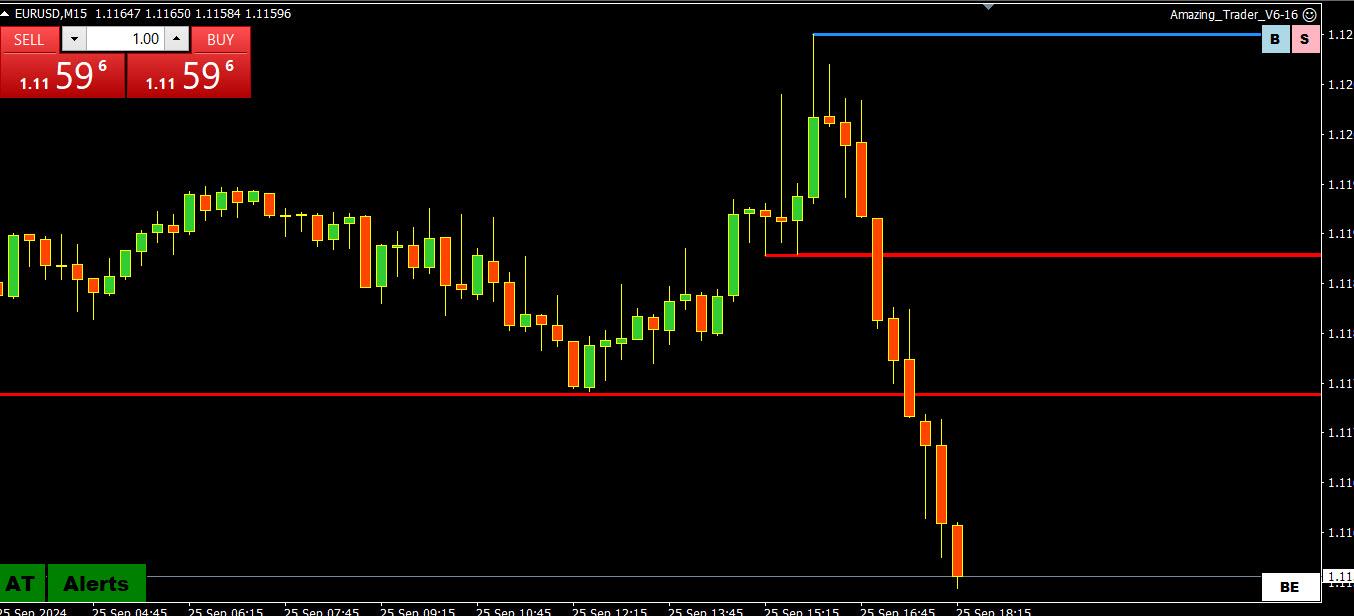

September 19, 2024 at 10:34 am #11846EURUSD 15 minute chart – Amazing Trader Ladder Strategy

1) Red support lines = ladder lines

2) As long as the last red line that preceded a new high is intact (called a preceding line), risk is pointed up

3) Strategy=> buy, preferably a dip with a stop below the most recent preceding line.

Contact me (jay@localhost) for a half price offer and a free AT trial

September 16, 2024 at 10:50 am #11695September 10, 2024 at 9:53 pm #11504

Using what I call AT (Amazing Trader) logic, key levels are the last key low that preceded a new high or the last key high that preceded a new low.

What I mean by a preceding low or high is an AT line.

If you look at this daily EURUSD chart, there were no red AT lines from 1.0949 => 1.1201.

This makes 1.0949 the preceding low/line ahead of the 1.1201 high and the key one on this chart.The same logic can be used for shorter time frame trends.

But in any case, you can see why 1.0949 was more important than 1.1026 on a daily chart.

s always feel free to ask us any questions in the Q&A.

September 10, 2024 at 10:15 am #11488September 6, 2024 at 8:09 am #11365September 4, 2024 at 3:54 pm #11281The Amazing Trader Story

Those who have seen my charts posted have noticed that I use The Amazing Trader charting algo on them.

To be fully transparent, I hope our club members subscribe, not just to increase our subscriber base but because I feel there is nothing like it for trading. See why I say this…

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View