- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 2 weeks ago by GVI Forex 2.

-

AuthorPosts

-

January 29, 2025 at 3:56 pm #18646

Switzerland to Lift Protective Measure for EU Stock Exchanges in May

Switzerland will remove the European Union from its stock exchange protection list aimed at safeguarding the Swiss stock exchange infrastructure, effective May 1.With the EU revising the relevant legal basis in 2024 and lifting the restrictions on EU securities companies trading Swiss equities, the Swiss Federal Council deemed the protective measure no longer necessary, according to a Wednesday release.

January 29, 2025 at 3:48 pm #18645EURO 1.0413 as I type at 10.40nyt

–

with jerome having gotten himself into the corner ropes with his alleged dependence on data and his of fear of trump policies, the aggregate market view seems to be FED to remain flat AND that if any rate cutting is to come sometime long long time in the future would be slower than slow in light of FED’s magicianipulation to bring it to their 2% target not working swimmingly.Trade idea:

I am biased to go long DLR if n when it should spurt uP on Jerome’s wishi-washi unenthusiasm for cut and some yakiing about prudent for longer AND therefore relatively hawkish to other rate-cutting themed CBs.January 29, 2025 at 3:48 pm #18644DAX – GER30

DAX Hit New Record Peak

Stocks in Germany Hit All-time High

The DAX rose toward 21650 on Wednesday, hitting fresh record highs, in line with other European indices, fuelled by strong quarterly results from ASML. Market sentiment was also helped by easing concern over the impact of DeepSeek on AI demand.

Interesting technical fact : Previous Resistance line acted as a perfect Support to underpin this renewed Rally.

Now the sky is the limit – 22.200/400 might be in reach. January 29, 2025 at 3:40 pm #18641

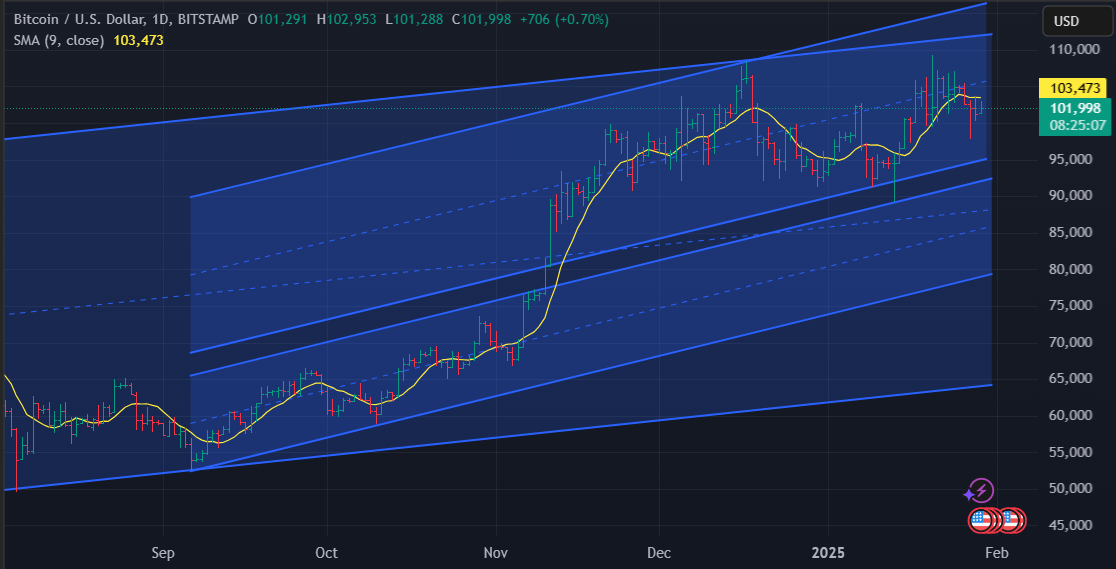

January 29, 2025 at 3:40 pm #18641BTCUSD – Bitcoin

Bitcoin Whales Resume Accumulation: Is a Rally Imminent?

The crypto market is recording a surge in bitcoin (BTC) inflows to whale wallets, indicating that this cohort of investors has begun to accumulate the digital asset again amid the recent downturn.

Sudden break of 104K upwards would be the first signal that the wave is starting.

However, this current consolidation might take few more days with a visit to 95K

January 29, 2025 at 3:20 pm #18640January 29, 2025 at 2:50 pm #18638January 29, 2025 at 2:36 pm #18637January 29, 2025 at 2:11 pm #18635

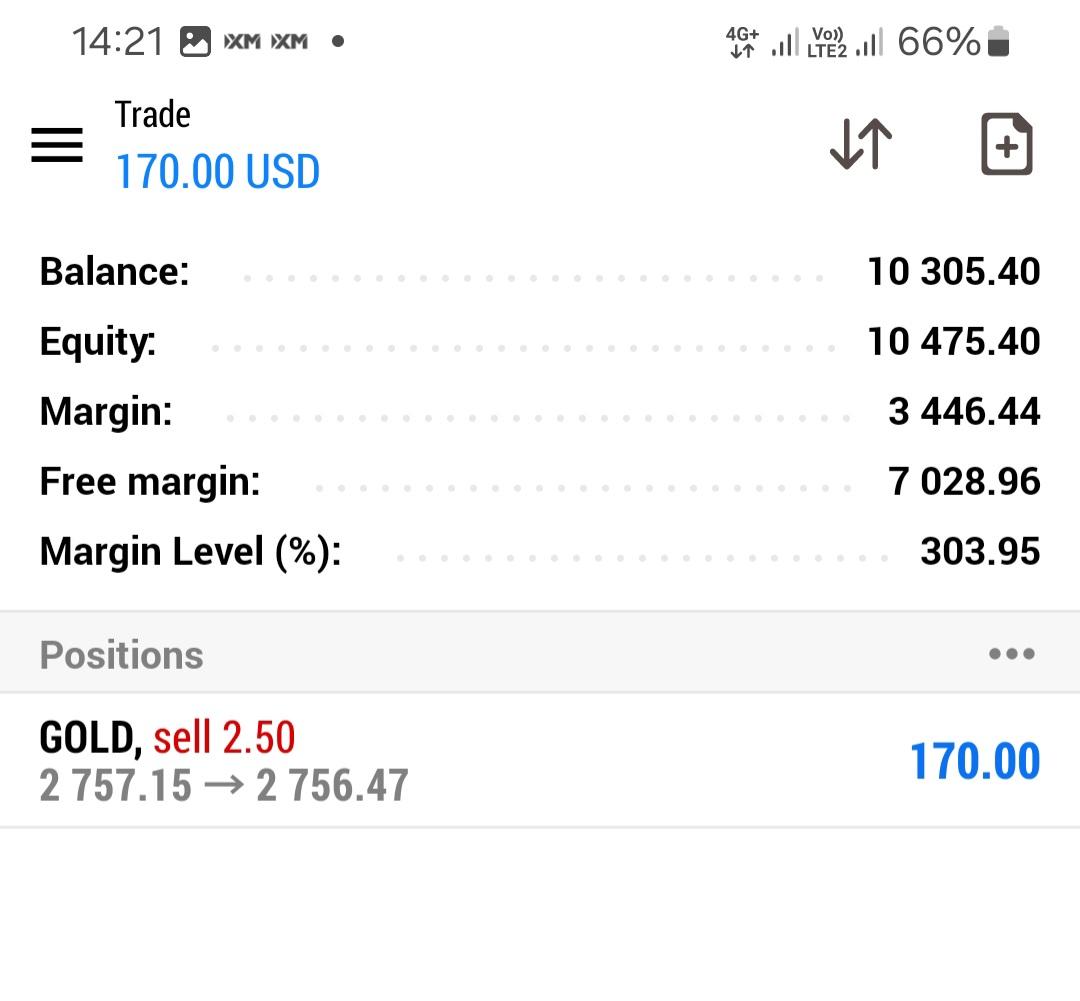

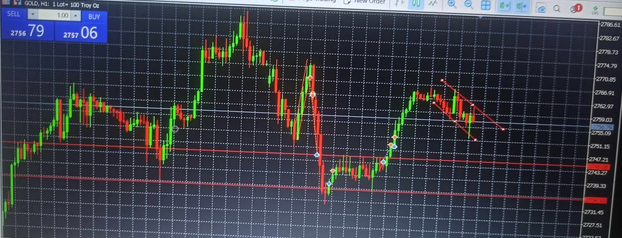

January 29, 2025 at 3:20 pm #18640January 29, 2025 at 2:50 pm #18638January 29, 2025 at 2:36 pm #18637January 29, 2025 at 2:11 pm #18635THIS IS EXACTLY 3PM NIGERIAN TIME AND GOLD (XAU/USD) IS AT PRICE 2758.80 ON THE 30 MINUTES CHART IT CAN EASILY BE SEEN THAT THERE IS AN UPWARD CONSOLIDATION. AS A PRICE ACTION TRADER WHEN TWO CANDLES OF SIMILAR HEIGHT ARE FORMING NEXT TO EACH OTHER IN OPPOSITE DIRECTION ,THE LATER CANDLES’ DIRECTION IS WHERE THE MARKET IS GOING

ON THE 30′ CHART THE GOLD HAS A BUY CANDLE OF SAME HEIGHT AS THE PREVIOUS SELL (BEARISH) CANDLE. SO THIS IS MOST LIKELY A BUY MARKET. I WILL NOT GO FOR MUCH PIPS AS I WILL EXIT THE MARKET AT PRICE 2763.0 AREA.

I’VE BEEN USING THIS TECHNICAL ANALYSIS FOR AGES NOW AND IT WORKS SUPREME.SO I WILL BE BUYING XAU/USD AT 3PM NIGERIAN TIME FOR A COUPLE OF PIPS BEFORE EXITING THE MARKET FOR ANOTHER OPPORTUNITY. REMEMBER GREED IS NOT GOOD. SO RISKING A SMALL LOT SIZE OF 2-5% SHOULD SUFFICE FOR THIS TRADE.

THIS IS MY POSITION FOR THIS PERIOD.

THANKS,

TOPE AJALA

FROM NIGERIA.January 29, 2025 at 1:45 pm #18634January 29, 2025 at 1:44 pm #18633January 29, 2025 at 1:32 pm #18632USDCAD 4 HOUR CHART – NEXT UP THE BOC

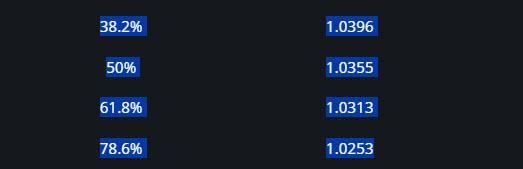

Focus will be on the BoC statement assuming there is a rate cut as expected. The reaction will be what matters and with USDCAD bid heading into the decision it would have to break 1.4516 and then stay above 1.45 to have a lasting impact.

On the downside, the bottom of the range is far away at 1.4261.

January 29, 2025 at 1:27 pm #18631January 29, 2025 at 1:07 pm #18630EUR/USD (EURO) HAS CONSOLIDATED AND IS SET TO GO ALL THE WAY UP FROM ITS PRESENT PRICE AT 1.04024 AND IT WILL GO TO AROUND 1.0500, A MOVE OF OVER 100 PIPS. I SAW THIS PROPOSED MOVE YESTERDAY WHEN PRICE CAME DOWN TO 1.039 AREA.

MARKET CAME TO THAT SUPPORT AREA AND IS ABOUT TO RETURN UPWARDS. TODAY’S VOLATILE NEWS IS GOING TO PUSH THE EURO FAR UP. B.O.E GOVERNOR BAILEY’S SPEECH TODAY IS GOING TO SHAKE THE MARKET. WE ARE EPECTING THE ACTUAL OUTCOME OF THIS NEWS TO BE HIGHER THAN THE FORCAST AND THE PREVIOUS PREDICTIONS.

LET’S WAIT AND SEE AS TIME WILL TELL. THIS IS MY EURO PREDICTION FOR TODAY’S NEWS. THANKS, TOPE AJALA, FROM NIGERIA.

January 29, 2025 at 12:29 pm #18629January 29, 2025 at 12:27 pm #18628January 29, 2025 at 12:15 pm #18627USD firmer, CAD undecisive into policy decisions, blockbuster ASML results lift tech

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses mostly firmer, with Tech surging after blockbuster ASML bookings; NQ slightly outperforms.

USD is a little firmer ahead of the FOMC, CAD awaits BoC, AUD softer post-CPI.

Bonds are bid into the FOMC. BTPs & OATs attentive to domestic matters

Crude slides and metals trade mixed ahead of FOMC.

Try Newsquawk for 7 Days FreeJanuary 29, 2025 at 11:42 am #18626A look at the day ahead in U.S. and global markets from Mike Dolan

The AI-related stock shakeout seems to have calmed as investors turn to megacap tech earnings – with the Federal Reserve set to pause its easing campaign in its first policy decision for 2025 just as central banks in Canada and Sweden cut again.

Morning Bid: Tech bounces as eyes turn to ‘Mag7’, Fed meet and Canada cut

January 29, 2025 at 11:35 am #18624January 29, 2025 at 11:33 am #18623EURUSD 4H

Support – trend line taken out – important is how it is going to close this bar (in 2h).

Resistances : 1.04150, 1.04250 & 1.04400

Supports: 1.03900, 1.03700 & 1.03500 ( back to that pivotal level…)

As FOMC come tonight, levels can be breached, trendlines broken, but reaction of the market tonight is going to be wild…so everything is really possible at the end of the day.

I am treating it right now as a Bearish situation and unless I see decisive move back Up , I keep selling on smaller time frames.

January 29, 2025 at 10:41 am #18622

January 29, 2025 at 10:41 am #18622Insights you might now find elsewhere

This popular article in our blog is worth revisiting after looking at a EURUSD chart today

I first heard the term “feels bid in an offered market” on the Global-View.com Forex Forum many years ago. It was posted by one of our professional trader members, LA Mel, who used the term mainly for the EURUSD. However, it soon became apparent that it could be applied to all currencies and on both sides of the market (e.g. feels offered in a bid market and vice versa). I soon added to my trader toolbox and still use it today

What Does it Mean When a Currency Feels “Bid in an Offered Market?”

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View

by next week I should start giving people signals

by next week I should start giving people signals