- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 2 weeks ago by GVI Forex 2.

-

AuthorPosts

-

January 30, 2025 at 10:18 am #18712January 30, 2025 at 10:07 am #18711January 30, 2025 at 9:59 am #18710

USDJPY 4 HOUR CHART – Watch bond yields

Posted yesterday after the Fed rate announcement…

FX is following US bond yields… back to square one after post Fed pop as Powell walks about hawkish part of statement.

Keep this one simple:

Chart is bearish bit as you can see very choppy.

Bearish while below 155 but..

Only below 153.70 would break the current range

January 30, 2025 at 9:53 am #18709January 30, 2025 at 9:48 am #18708January 30, 2025 at 9:40 am #18707Using my platform as a HEATMAP shows

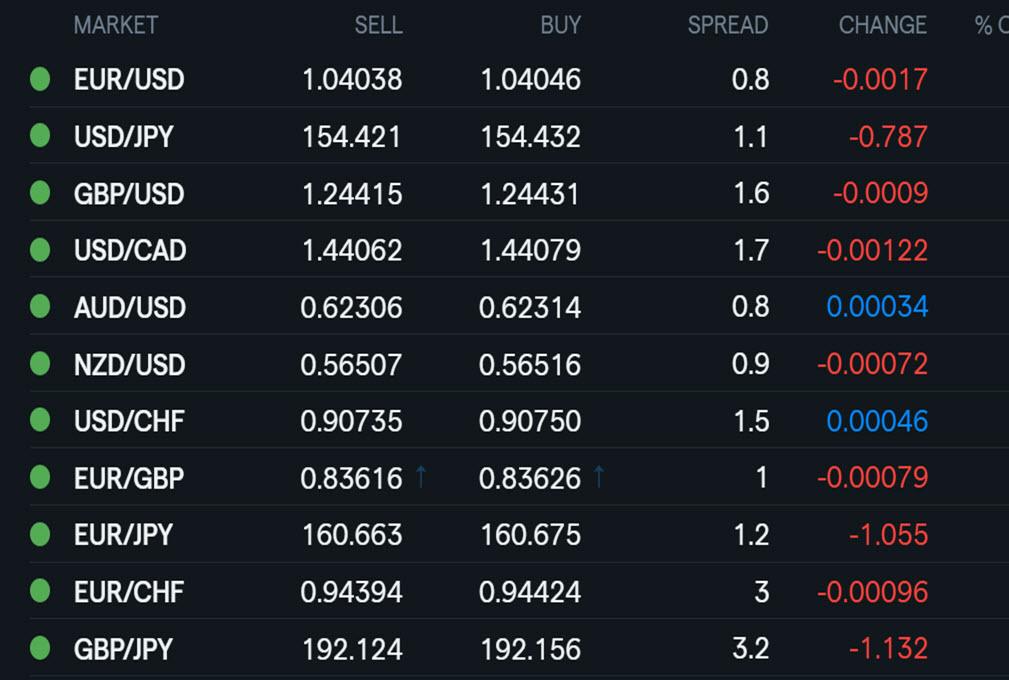

JPY outperforming… look no father than US interest rates, which peaked at 4.59% for the 10-year after the Fed announcement, then slipped back and were last quoted at 4.506^

Next up is the ECB decision, the 3rd in the CB trifecta, where a 25bps cur is widely expected, leaving the focus on the forward guidance. Given the lack of strong reactions to the other CB decisions yesterday, it is hard to predict one here.

EURUSD a touch softer, levels to watch

1.0371/92 – 1.0444/57

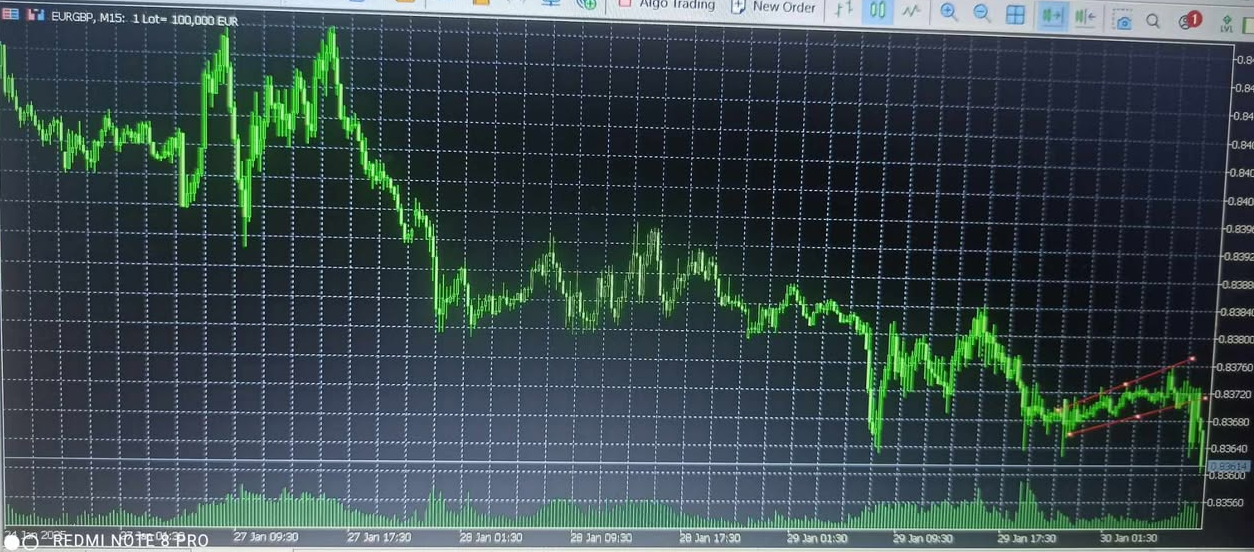

January 30, 2025 at 8:36 am #18706A good mornign to you guys from the capital city of Africa, Nigeria. This is 9:30AM and market is looking beautiful. I am on the EUR/GBP chart and market is about to break long (buy). Market was in a sideways range all yesterday before breaking short early this morning to the price area of 0.8362 Price then rose to the price of 0.8372 as we speak now, but if you look at the 15′ chart candle of the same pair eur/gbp, you will see an almost perfectly paired candles standing next to each other.

The prior bearish candle and the just formed bull candle on the 15′ chart are of same height and length. This signals a continuation of the just formed candle which is a buy in this case. So market will continue to go upwards but for a while. From the present price at 0.8372 i see a pull up to the area of price 0.8375 where I hope to exit the market.

It is not much but a little profit is good, just be consistent and don’t over leverage your Account.

Thanks,

TOPNINE.January 30, 2025 at 6:06 am #18705January 30, 2025 at 3:18 am #18704January 30, 2025 at 3:16 am #18703January 30, 2025 at 3:14 am #18702January 30, 2025 at 3:09 am #18701January 29, 2025 at 11:56 pm #18700In our blog

Although at a first glance it seems pretty simple and straight forward, applying Risk/Reward Ratio to your trade takes some serious homework and lots of fine tuning to achieve good results.

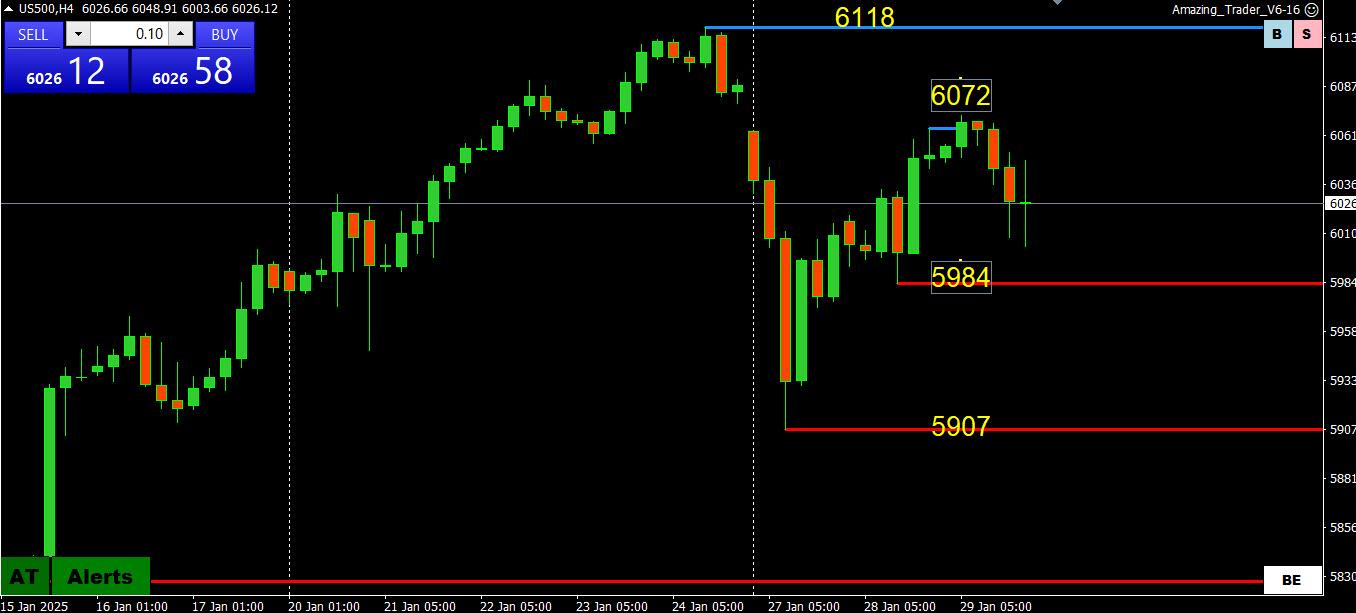

January 29, 2025 at 9:24 pm #18684NAS100 4 HOUR CHART – Trapped

Betting against the NAS has been a losing battle but so far it has been unable to fill the opening week gap. This leaves it trapped between the gap and this week’s low (20600).

On the downside, keeps a bid and thoughts away from this week’s low as long as it stays above 20931-21000.

January 29, 2025 at 9:16 pm #18683British American Tobacco.

A long throw from the other side of the city into a basketball sized hoop…

BAT now trading at 3171.00.

My forecast on BAT is @ GBP 6515.28. It will take good time but will be done… You have my word on this call.

—

I know that it might sound more than a little crazy, but I believe

I knew I loved you before I met you

I think I dreamed you into life

I knew I loved you before I met you

I have been waiting all my lifeThere’s just no rhyme or reason

Only a sense of completion——

UBS upgraded British American Tobacco on Monday to ‘buy’ from ‘neutral’, hiked the price target to GBP3,900 from GBP3,000 and made the stock its ‘top pick’.

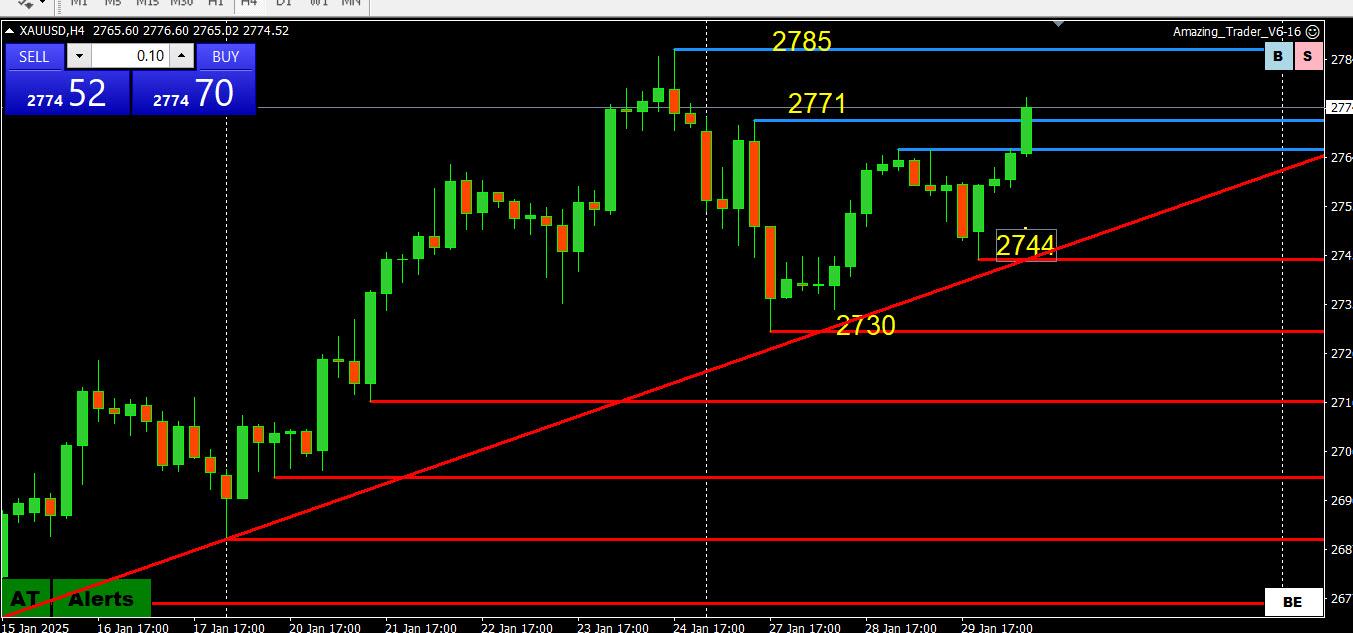

https://www.sharecast.com/news/broker-recommendations/ubs-upgrades-bat-to-buy-shares-spark–18661778.htmlJanuary 29, 2025 at 9:14 pm #18682January 29, 2025 at 8:34 pm #18681XAUUSD 4 HOUR CHART – MORE CONSOLIDATION

Consolidating within 2700-2800

The bounce from the midpoint of 2725-35 so far unable to break 2771… while a break would expose the 2785 record high, it keeps alive a risk on downside (would need a 2730 break).. .

On the other hand, expect support as long as it trades above 2730 and the trendline.

January 29, 2025 at 8:32 pm #18680USDCAD 4 HOUR CHART – Survivor

Broad range has survived a BoC rate cut and a no change by the Fed.

Expect more choppy trade until/unless either side of 1.43-1.45 is firmly broken.

Next key date is Feb 1, a date when Trump has threatened to levy tariffs. However, there was an olive branch held out by the new US Commerce Secretary (scroll below) and if true, it would ease a headwind risk for the CAD.

January 29, 2025 at 8:18 pm #18679January 29, 2025 at 8:15 pm #18678EURUSD Daily

Well, day dreaming aside, EUR succeeded in holding above 1.04000 and even briefly went all the way till 1.03824 , but it will most probably close the day above.

Any close above 1.04250 will leave a chance for tomorrow to make another straight leg Up.

This is not a full blown Up trend, so we have more of a 50-50 situation on our hands.

Watch for overnight unfolding…

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View