- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 2 weeks ago by GVI Forex 2.

-

AuthorPosts

-

January 31, 2025 at 2:55 pm #18820January 31, 2025 at 2:44 pm #18815

EUR/USD is at 1.03754 and the market looks good for a sell. Mind you, in the past 2 hours market has been on a steady ascention. I have been expecting the decline until a perfect candle emerged. The long sell candle on the 15′ chart and the market took a tumble as expected. I will sell from its present position at 1.03754 and exit at 1.03623 for a small profit and then rest a while.

Mind you, taking few pips at a time ensures that you retain your capital and with good money Management skills you keep growing your Account. Just Trade 2-5% of your capital at most. Being consistent is the key.

I will make further analysis soon.THANKS,

TOPNINE.January 31, 2025 at 2:10 pm #18810January 31, 2025 at 1:33 pm #18808January 31, 2025 at 1:21 pm #18807JP// January 30, 2025 at 10:45 pm #18774

If Trump doesn’t put the tariff on oil imports then those exporter countries will levy export tax on their oil exports… so in that way exporter countries make many gains… but then what would happen if those countries tax their oil exports and USA places tariff’s on the imported oil. Then what?

January 31, 2025 at 1:15 pm #18806USDCAD 4 HOUR CHART – Waiting for Trump

The risk in USDCAD is a gap opening Sunday night depending on what Trump’s threat to impose tariffs on Canada and Mexico on Feb 1 turns out to be..

If I was a Canadian official, I would be relieved that Trump’s focus is on the border rather than addressing the trade gap. There is uncertainty, whether Trump will levy a tariff on Canadian oil exports. However, logic says given his push for lower oil prices such a levy would be counterproductive.

The knee jerk reaction leaves 1.4595 as the top of the range.

Key area on the downside is not until 1.4261-1.4300. To keep the focus on the bias wetting 1.45 level, 1.4390-00 need to hold aw zuppot.

As of charts, the range is 1.44-1.46 where 1.45 will dictate the tone. Just in case, the broad range is 1.4261/1.4300. – 1.4595.

January 31, 2025 at 1:06 pm #18805bleepbleep!! The Roadrunner show…

…it’s a conspiracy! Whoa!! no way dude… no sayyy… hmmm… sayyy maybe popcorn and coca-cola might come in useful in times like these… cool! dude… yeaahhh!!

Exposed DeepSeek Database Revealed Chat Prompts and Internal Data

China-based DeepSeek has exploded in popularity, drawing greater scrutiny. Case in point: Security researchers found more than 1 million records, including user data and API keys, in an open database.

https://www.wired.com/story/exposed-deepseek-database-revealed-chat-prompts-and-internal-data/

January 31, 2025 at 11:54 am #18804A look at the day ahead in U.S. and global markets from Mike Dolan

As a hectic January ends, world markets continue to brace for U.S. import tariff rises as soon as this weekend – lifting the dollar in anticipation as interest rates in Europe tumble.

Morning Bid: Higher dollar braces for tariffs, Apple rallies

January 31, 2025 at 11:28 am #18803January 31, 2025 at 11:21 am #18802Newsquawk US Open

DXY mixed ahead of PCE, NQ bid with AAPL +3.5% pre-market, Bunds outperform on soft state CPIs

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses gain, NQ outperforms with AAPL +3.5% in the pre-market after strong growth in services segment.

USD mixed vs. peers ahead of core PCE; JPY underperforms.

Fixed benchmarks bounce on cool German State CPIs, which has led to outperformance in Bunds.

Crude pares initial premia awaiting updates from Trump regarding tariffs on Canada/Mexico oil.

January 31, 2025 at 11:21 am #18801Newsquawk US Open

DXY mixed ahead of PCE, NQ bid with AAPL +3.5% pre-market, Bunds outperform on soft state CPIs

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses gain, NQ outperforms with AAPL +3.5% in the pre-market after strong growth in services segment.

USD mixed vs. peers ahead of core PCE; JPY underperforms.

Fixed benchmarks bounce on cool German State CPIs, which has led to outperformance in Bunds.

Crude pares initial premia awaiting updates from Trump regarding tariffs on Canada/Mexico oil.

Try Newsquawk for 7 Days Free

January 31, 2025 at 11:05 am #18800January 31, 2025 at 10:55 am #18799EURGBP 4 HOIUR CHARTT – MONTH END

I have observed EURGBP being one of the more active flows at month end. So, keep an eye on this cross, not only by itself but its influence of EURUSD and GBPUSD, especially ahead of the 4PM London fix.

Charts show the retreat from a failure to reach .85 only sees minor support within .83-.84 so look for .8350 to be pivotal.

Note, looking ahead, the BOE is expected to cut rates by 25bps next week.

January 31, 2025 at 10:07 am #18798XAUUSD DAILY CHART – Mission accomplished?

The break of 2790 opened a clear path to test 2800. So, is it mission accomplished or is there more on the upside?

So far, 2800 has been met with profit taking and now needs to hold 2885-90 as support to keep 2800 (and potentially above) on the radar..

Only back below 2745 would suggest the top is in for now. `

January 31, 2025 at 9:59 am #18797Using my platform as a HEATMAP

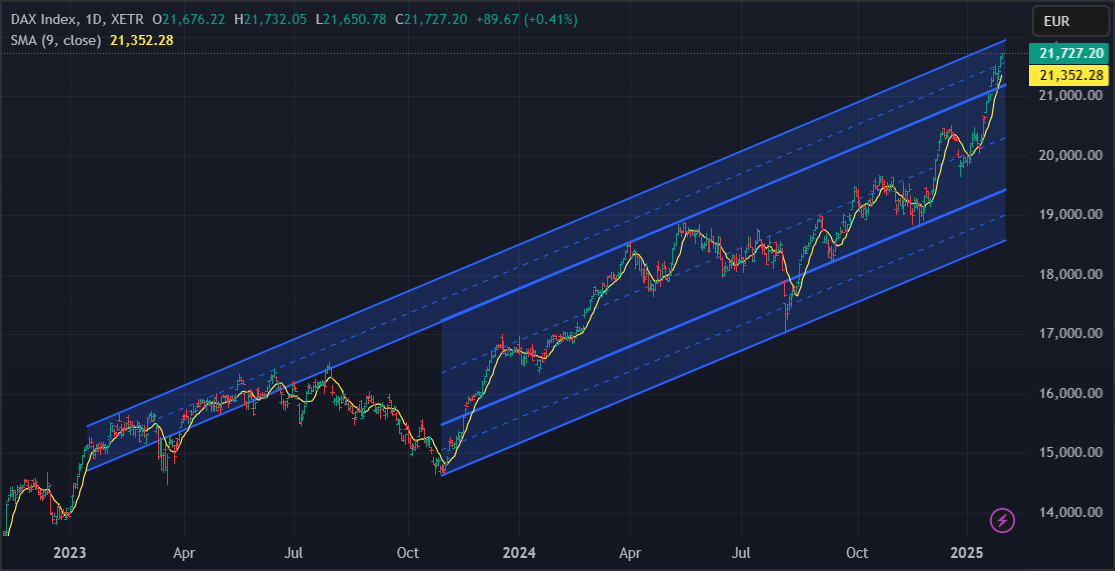

It’s month end and with stocks up this month, there should be some rebalancing of fx hedges. While I am not privy to such flows, given the surge in the DAX this month, rebalancing would see EUR selling and could account for some of the early EURUSD weakness.

Whatever the case, just be aware of month end erratic price action, especially heading into the 4PM London fix.

With US stocks up this month as well there could be some rebalancing of fx hedges here as well but so far any such flows have been adsorbed.

January 31, 2025 at 9:34 am #18796January 31, 2025 at 9:24 am #18795EUR/USD has just busted through a downward spiral at exactly 10am this Friday nigerian time. Market reach the highest price at 1.04129 today and has since been descending. Market was at 1.03818 by 10am before it busted in the bearish direction. Market has since been going down and i see a further sell to at least 1.0340 area as this movement is a strong one and may continue for a while.

There areno major news releases until 2:30pm nigerian time when the core price index news will come out with the Employment cost index. Let’s wait till then to see if the news will change the market’s direction.

January 31, 2025 at 12:03 am #18792As I have noted many times, identifying the side to trade is more than half the battle in putting on successful trades. In this regard, one way to do this is by drilling down on your charts as I will explain in the following:

January 30, 2025 at 11:58 pm #18791US stocks are higher this month… read this very popular and timely article in our blog

Many international equity managers like to minimize the forex exposure of their equity portfolio and put on forex hedges to reduce that risk. Thus, at the end of each month they adjust the size of their hedges to bring them back into line with the current size of their portfolio.

What does this mean for the forex trader?

January 30, 2025 at 11:12 pm #18778 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View