- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 2 weeks ago by GVI Forex 2.

-

AuthorPosts

-

March 27, 2025 at 9:29 pm #21574March 27, 2025 at 8:29 pm #21573March 27, 2025 at 8:17 pm #21572March 27, 2025 at 8:14 pm #21571March 27, 2025 at 8:12 pm #21570March 27, 2025 at 8:09 pm #21569March 27, 2025 at 7:58 pm #21568

Dora 7:04 .. retest … under my skin …

the ying yang about whichever s result of a “retest” is that it is game between buyers and sellrs and the chipping away at them and their respective reasons for flushout as multiple returns are a manifestations of new oand/or additional players.

I suggest that the gaming in FX is not subject to the traditional buy low sell high theories seen in stocks.

One can see market commentary here on g-v about something called “sustained” but without numerical value mentioned. For that, I suggest to study the meaning of “wick”s or “tail”s on a time bar – not to minimize the shape of the candle’s body – and see if that can help trade with bit more confidence.

March 27, 2025 at 7:52 pm #21567March 27, 2025 at 7:52 pm #21566GME – GameStop Corp.

GameStop Just Went Full Crypto–And Wall Street Is Panicking

GameStop GME just dropped a bombshell and investors are reeling. The company announced it’s ditching more of its retail footprint and diving headfirst into Bitcoin (BTC-USD), raising $1.3 billion via zero-coupon convertible bonds to buy the cryptocurrency as a treasury reserve asset. Shares initially surged 14% on the buzz, but that excitement didn’t last long. Within 24 hours, the stock nosedived nearly 25% at 2.07pm, giving back all its gains and then some. While retail traders lit up the meme-stock boards, analysts were quick to question whether this pivot is a bold reinvention or a desperate roll of the dice.

Let’s not sugar-coat it: GameStop’s core business is bleeding. Sales fell 28% year-over-year, and it’s closed a quarter of its stores in the past year. Management says the Bitcoin move is about optimizing returns and staying liquid, but the timing raised eyebrows. Crypto markets have already surged 27% since November so why now? Strategy MSTR pulled off a similar playbook in 2020 and saw its stock skyrocket, but it’s sitting on a massive Bitcoin stash and trades at a tighter premium. GameStop? Not quite the same setup, and investors know it.

Where is Roaring Kitty now…meow meow 😀

March 27, 2025 at 7:45 pm #21565March 27, 2025 at 7:40 pm #21564March 27, 2025 at 7:35 pm #21563March 27, 2025 at 7:30 pm #21562March 27, 2025 at 7:14 pm #21561

March 27, 2025 at 7:45 pm #21565March 27, 2025 at 7:40 pm #21564March 27, 2025 at 7:35 pm #21563March 27, 2025 at 7:30 pm #21562March 27, 2025 at 7:14 pm #21561USDJPY DAILY – Key resistance cited

Chart: Positive but faces a key resistance at 151.30, which stays at risk while above 150.50-60.

Note weak JPY crosses (e.g. firmer GBPJPY) adding to USDJPY demand’

I have not seen any specific news to account for the weaker JPY, which reminded me that March 31 is Japanese fiscal yearend.

I remember when this was a key time for FX and stocks but have not heard much talk about it in recent years. So, no clue whether this has been a factor but something to keep an eye on once March 31 passes.

March 27, 2025 at 7:04 pm #21560March 27, 2025 at 6:59 pm #21558March 27, 2025 at 6:32 pm #21557March 27, 2025 at 4:19 pm #21556March 27, 2025 at 4:12 pm #21555Stocks dip, gold hits record, after Trump’s latest tariff salvo

Auto stocks fall on latest Trump tariff shotDollar up against Canadian dollar, Mexican peso

Gold hits record high

Global stocks dipped and gold hit a record high on Thursday in the wake of U.S. President Donald Trump’s latest tariffs that expanded the trade war to auto imports.

Trump announced 25% tariffs on all vehicles and foreign-made auto parts imported into the United States late on Wednesday, scheduled to take effect on April 3. This weighed on Japan’s Nikkei <.N225> and South Korea’s KOSPI KOSPI stock markets.

Countries around the globe threatened retaliatory tariffs.

U.S. stocks shook off initial declines and were roughly unchanged while automakers slumped. General Motors GM tumbled about 8%, while Ford F dropped more than 4%, reflecting concerns about the impact on their supply chains. U.S.-listed shares of Stellantis STLAM fell about 3%.

The Dow Jones Industrial Average DJI rose 20.71 points, or 0.05%, to 42,478.39, the S&P 500 SPX climbed 6.42 points, or 0.12%, to 5,718.66 and the Nasdaq Composite IXIC advanced 21.25 points, or 0.09%, to 17,920.27.

March 27, 2025 at 4:08 pm #21554DAX Slumps as Auto Tariffs Take a Toll

Frankfurt’s DAX fell more than 1.5% to trade below 22,500 on Thursday, underperforming its regional peers, with auto stocks pushing down the index.

US President Donald Trump announced 25% tariffs on all car imports, exacerbating the trade dispute with the European Union.

He also warned that he would impose substantially higher tariffs on the EU and Canada if they coordinated efforts to counter trade tariffs.

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View

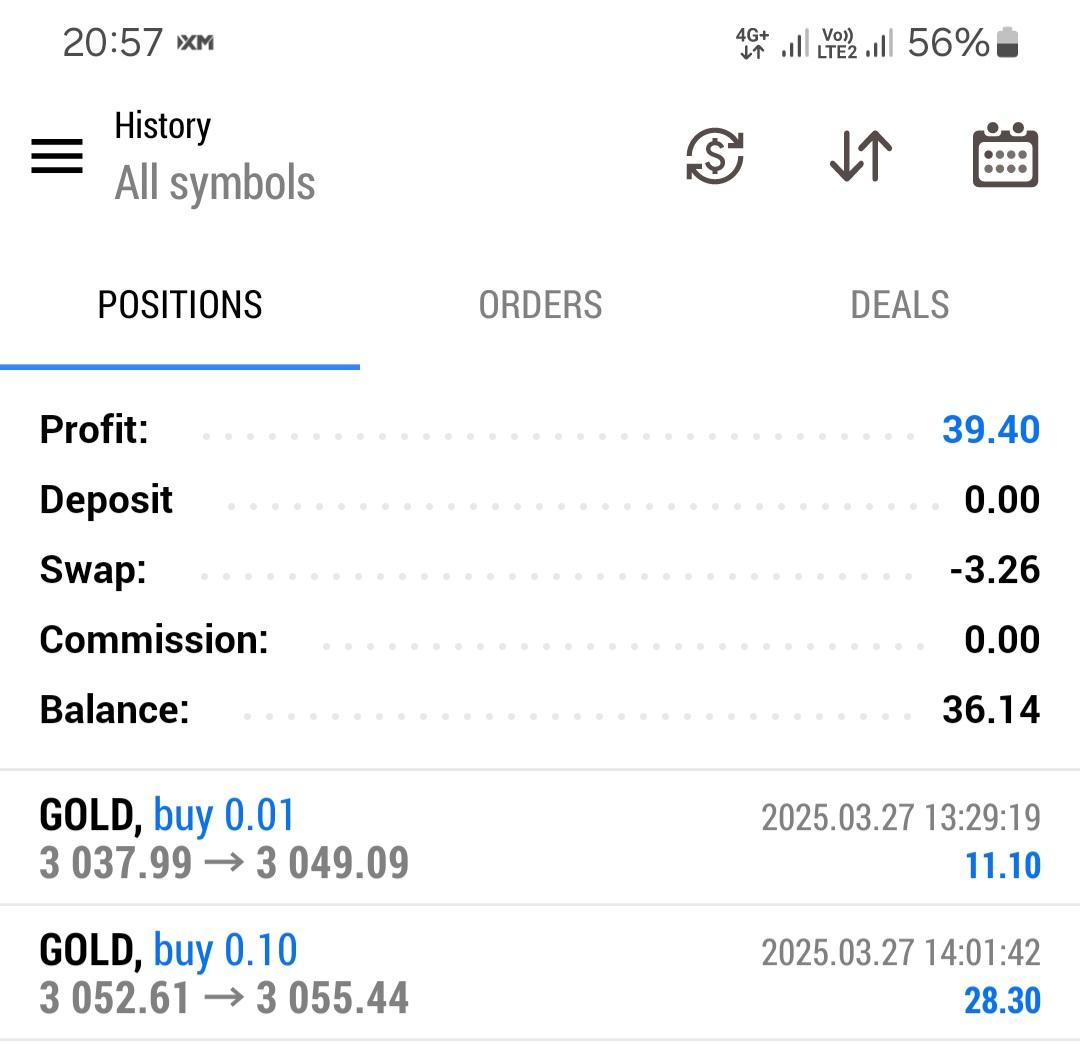

keep buying gold

keep buying gold