- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 3 weeks ago by GVI Forex 2.

-

AuthorPosts

-

February 5, 2025 at 6:55 pm #19065February 5, 2025 at 6:29 pm #19062February 5, 2025 at 5:44 pm #19060February 5, 2025 at 5:35 pm #19059February 5, 2025 at 5:25 pm #19058

JP// Re: Your proposal and IF I don’t object… This is the most I will do for now…

I have always said/done everything with kindness, freedom, transparently and honestly…

You wanna make money then gold offers opportunities… I have posted Gold forecasts, if you like them then you may trade them at your leisure and at your own risk.

No offense meant to you or anyone for that matter.

GL GT

February 5, 2025 at 5:16 pm #19057XAUUSD:- TARGET @ $3000.40.

My model has sounded the alarm and other targets have cropped up flashing for Gold since the past few days and I will post them in a few days time probably over the weekend however until then USD$$3000.40 should be okay.

Word of caution is that once at $$3000.40 then we need to check if momentum is sufficient to push it higher… that is until I post the updated levels.

Additionally, it does not mean that my posting updated levels nullifies 3000.40, as my levels become important when prices come closer towards them, irrespective whether in a few days of time or come back down towards it in market corrections further down the line.

GL GT

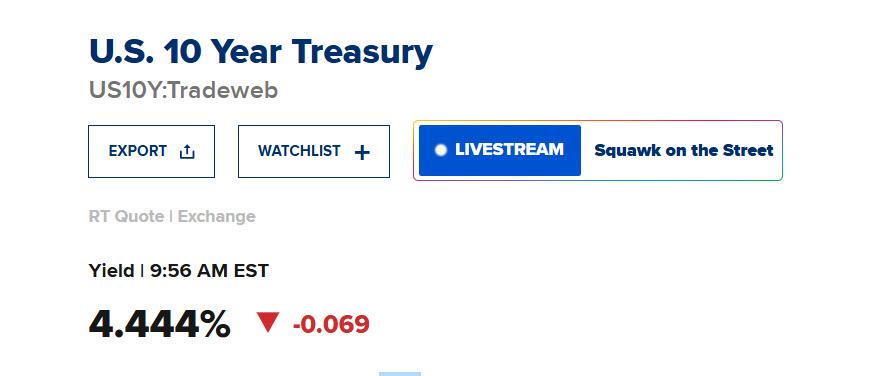

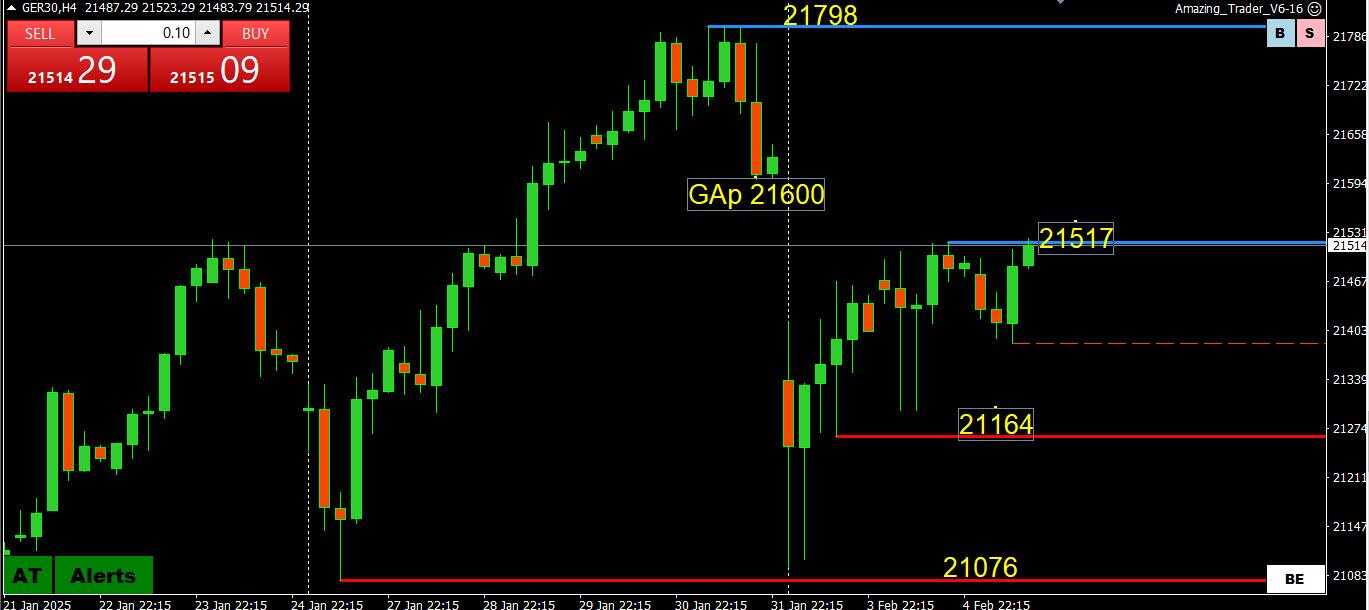

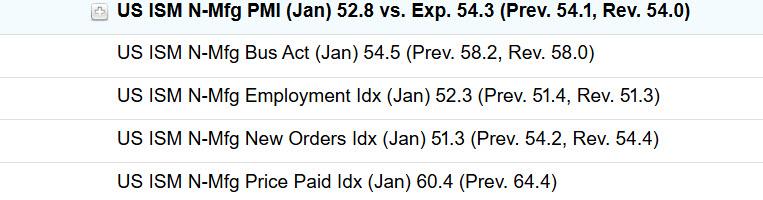

February 5, 2025 at 4:18 pm #19051February 5, 2025 at 3:05 pm #19048Big downside miss in ISM Services PMI..Bond yields down… USDJPY showing biggest FX reaction…

Source: Newsquawk.com

February 5, 2025 at 2:58 pm #19047February 5, 2025 at 2:33 pm #19046February 5, 2025 at 2:27 pm #19045February 5, 2025 at 1:32 pm #19040February 5, 2025 at 1:20 pm #19035ADP Employment beats on the upside… Note ADP does not correkate with NFP (due Frida).

Source: Newsquawk.com

February 5, 2025 at 12:22 pm #19034Through the previous week, we have seen increased volatility within the market with many eyes looking at NVDA historic loss. Many question as to whether or not DeepSeek brought the end of NVDA’s market dominance or if it will continue its bull run. Looking ahead to figure out which scenario will play out, for NVDA to continue its bull-run has to break past that previous lower high at $130.29, eventually to hopefully reclaim some of the gap left in the DeepSeek wake. If it fails to reclaim that lower high and push down to a lower low, I would then be watching the lower key levels at $100.95 and $90.69 as a resistance level.

February 5, 2025 at 12:15 pm #19033

February 5, 2025 at 12:15 pm #19033Yen Hourly

USDJPY 1 hour

On the 1 hour chart, we can see that we have a minor downward trendline adding confluence to the resistance zone. This should technically strengthen the resistance and give the sellers more conviction to step in there targeting new lows.

The buyers, on the other hand, will look for a break above the resistance and the trendline to position for a pullback into the 155.00 handle. The red lines define the average daily range for today.

February 5, 2025 at 12:09 pm #19032

February 5, 2025 at 12:09 pm #19032GBPUSD 1h – Intraday

Supports : 1.25250, 1.24950 & 1.24600

Resistances : 1.25450, 1.25850 & 1.26200

If it wants to test previous high in next couple of hours, Cable has to close this hour above 1.25250

Loss of that support doesn’t mean change of trend – as long as above 1.24950 it is going to push Up towards 1.26, but with a delay.

February 5, 2025 at 11:59 am #19031

February 5, 2025 at 11:59 am #19031EURUSD Daily

Supports: 1.04000, 1.03700 & 1.03200

Resistances: 1.04300, 1.04500 & 1.04650

Intraday direction – Up

Possible reach on the Up side – 1.05050

Downside – 1.02700

That 1.02700 is the historical angle that holds the uptrend – once lost we see new low.

On the Big picture – we are in downtrend – as long as it stays below 1.06150

However, unless 1.01800 taken out, EUR can form a bottom here.

February 5, 2025 at 11:54 am #19030February 5, 2025 at 11:51 am #19029February 5, 2025 at 11:42 am #19028

February 5, 2025 at 11:54 am #19030February 5, 2025 at 11:51 am #19029February 5, 2025 at 11:42 am #19028A look at the day ahead in U.S. and global markets from Mike Dolan

As the week’s tariff rollercoaster levels out a bit, Wall Street stocks are tilting lower again – clouded by a poor reception for Alphabet (NASDAQ:GOOGL)’s results, lingering China tariff hike plans and fresh interest rate rise speculation in Japan.

U.S. stock futures were back in the red ahead of Wednesday’s bell as shares in megacap Alphabet plunged 7% overnight. The drop came amid doubts about the Google parent’s cloud computing business, much like Microsoft (NASDAQ:MSFT) last week, and anxiety about its huge investment in artificial intelligence – especially in the light of last week’s DeepSeek news.

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View