- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 3 weeks ago by GVI Forex 2.

-

AuthorPosts

-

February 6, 2025 at 3:33 pm #19123February 6, 2025 at 3:30 pm #19122February 6, 2025 at 3:12 pm #19121

Newsquawk reported this a little while ago and it has since been doing the rounds,,, not ckear whether this is a factor but XAUUSD has retreated further from yesterday’s 2882 high

Source: Newsquawk.com

February 6, 2025 at 2:41 pm #19120February 6, 2025 at 2:32 pm #19119February 6, 2025 at 2:17 pm #19118February 6, 2025 at 1:36 pm #19117February 6, 2025 at 1:25 pm #19116February 6, 2025 at 12:14 pm #19115February 6, 2025 at 11:47 am #19114A look at the day ahead in U.S. and global markets from Mike Dolan

With tariff tensions easing a touch for now and price pressures coming off the boil, U.S. Treasury yields have plunged this week – defusing a tense January for bond markets and helping stocks find a foothold in the thick of a noisy earnings season.

Although they backed up a touch early Thursday, 10-year Treasury yields have sliced below 4.5% – dropping more than 10 basis points at one point on Wednesday to their lowest of the year as January ISM service sector readings showed a surprise drop in the prices paid by businesses.

February 6, 2025 at 11:43 am #19113NEWSQUAWK US OPEN

Stocks gain, USD bid ahead of jobless claims, GBP lower with the BoE in vieW

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses at highs; US futures edge higher ahead of a slew of earnings.

USD attempts to recoup lost ground, EUR/USD back below 1.04, GBP awaits BoE.

Bonds in the red but off lows via a strong French auction & stagflationary UK data amid reports of a UK Cabinet reshuffle.

Metals trade mixed amid the Dollar but crude holds an upward bias.

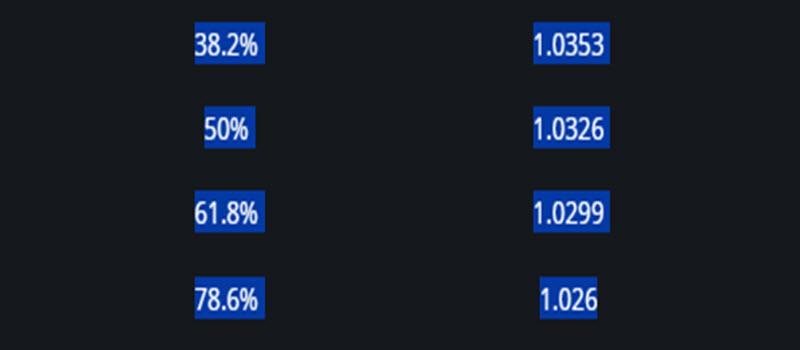

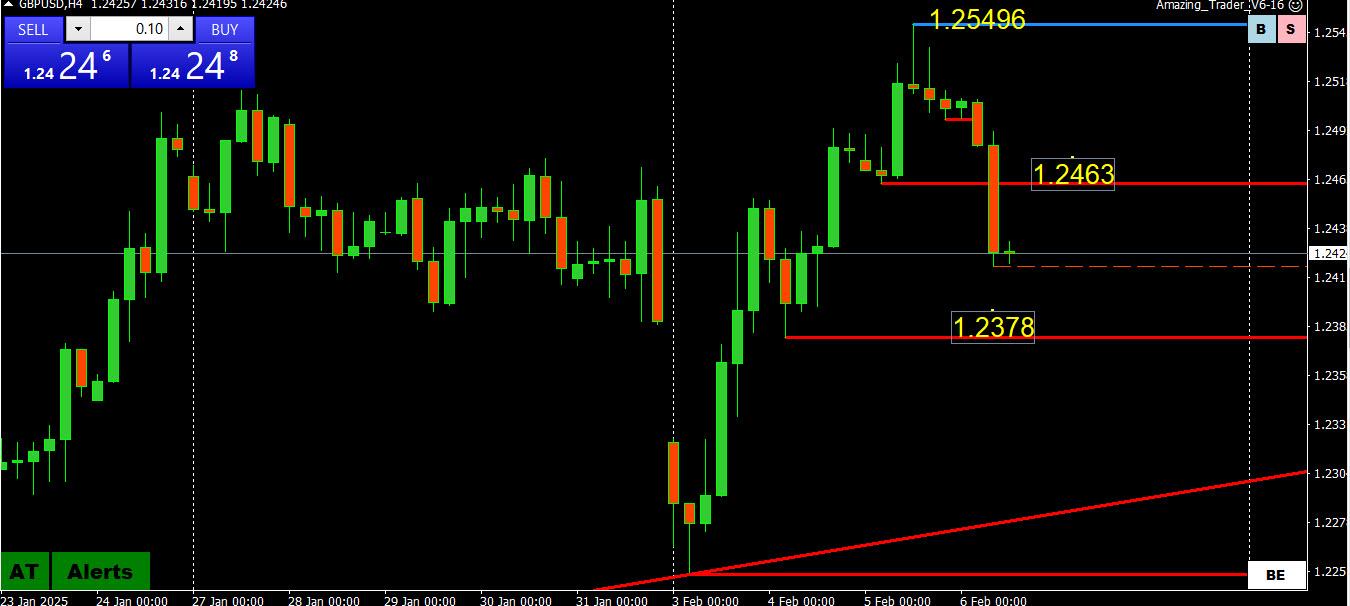

February 6, 2025 at 11:17 am #19112February 6, 2025 at 11:06 am #19109February 6, 2025 at 10:54 am #19108February 6, 2025 at 10:47 am #19107February 6, 2025 at 10:36 am #19106February 6, 2025 at 10:32 am #19105GBPUSD 4 HOUR CHART – Waiting for the BOE

My only question is why was GBPUSD bid at this time yesterday with a rate cut looming today.

What caught my eye at this time was the Power of 50 level after a high at 1.25496, so there is a method to my madness.

Note, a clue of a vulnerable GBPUSD, as I pointed out yesterday was GBP weakness vs the EUR and JPY, evident again today.

Back to charts

Move below 1.2463 breaks the upward momentum… back above this level would put 1.25 in play again.

Below 1.2378 would shift the risk back to this week’s low.

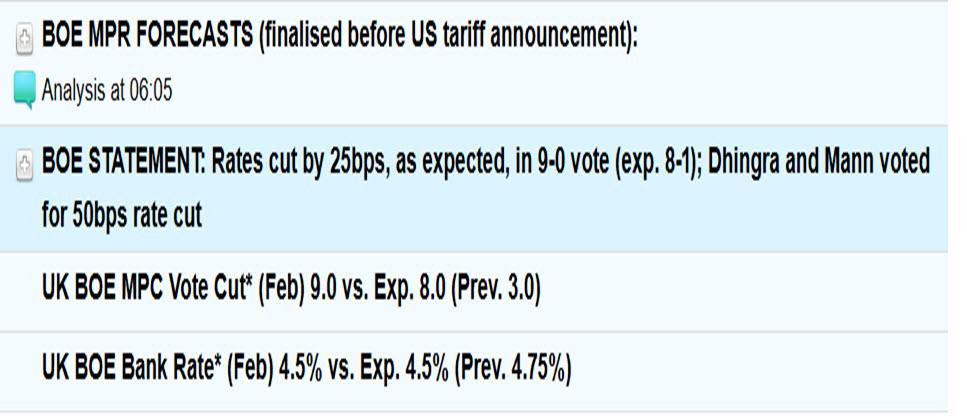

Re the BOE, a rate cut is widely expected and will not be a surprise.

February 6, 2025 at 10:09 am #19104Using my planform as a HEATMAP

Dollar is trading firmerm except vs JPY… but well within this week’s wide ranges

USDJPY back above 152 after brief dip below this pivotal level

GBPUSD softer ahead of expected BOE rate cut (note GBPJPY, EURGBP)

Bond yields are higher after plunging yesterday

Stocks are trading slightly firmer

Gold has backed off from yesterday’s record 2882 high… indicator of tariff sentiment?

February 6, 2025 at 12:46 am #19102GVI 11:39 – donald’s use of promise to apply tariff is akin to extracting information or some action from a counterparty you promise to drill their knee or pull their fingernail(s). It is just a tool to extract action from someone. No interest in actual trade war – only to bend to one’s desired bend-angle.

February 5, 2025 at 11:39 pm #19100It feels like markets have begun trading in anticipation of Trump’s tariffs since August. Signals are mixed (i.e. gold up, bond yields down, dollar well of its highs, stocks uncertain) as to whether Trump’s tariffs will turn out to be a Nothing Burger.

Will Trump’s Tariffs Turn into a Nothing Burger?

https://global-test.financialmarkets.media/will-trumps-tariffs-turn-into-a-nothing-burger/

https://global-test.financialmarkets.media/will-trumps-tariffs-turn-into-a-nothing-burger/ -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View