- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 3 weeks ago by GVI Forex 2.

-

AuthorPosts

-

February 6, 2025 at 11:54 pm #19152February 6, 2025 at 11:26 pm #19147

Anyone trading this week has seen how hyper sensitive markets are to key events and economic data. Well, on Friday we have the mother load of data, the US January Jobs Report.

So, be prepared and see one of the best

of this key event..

February 6, 2025 at 11:05 pm #19145February 6, 2025 at 10:55 pm #19144Anyone trading this week has seen how hyper sensitive markets are to key events and economic data. Well, on Friday we have the mother load of data, the US January Jobs Report.

So, be prepared and see one of the best

of this key event..

February 6, 2025 at 10:46 pm #19143February 6, 2025 at 10:41 pm #19142US500 4 HOUR CHART – Little Engine That Could

Do you remember the children’s book, The Little Engine That Could who said I think I can, I think I can” as it tried to chug up a hill.

Well, US500 is trying to chug up to its record high ay 6119 but so far it does not have the power to do so.

This leaves it consolidating within a 5900-6100 range, where it keeps a bid as long as it stays above 6000.

February 6, 2025 at 10:12 pm #19141Nvidia – NVDA

Morgan Stanley Reaffirms Nvidia as Top AI Pick Despite DeepSeek Concerns

Nvidia (NVDA, Financials) shares rose 2.5% to $127.90 as of 12:36 p.m. ET on Thursday, after Morgan Stanley (MS, Financials) reiterated its bullish stance, viewing the recent DeepSeek selloff as a buying opportunity.

Analysts at the company insisted that Nvidia remains in a good position in the AI scene despite mounting worries about competition dangers and long-term investment impediments.

In my opinion, before it can break above 130 it is all water under bridge – and maybe even Morgan got too deep into it…so never a bad idea to get rid of some of it on any rally…But that’s just my speculation 😀

February 6, 2025 at 10:03 pm #19140

February 6, 2025 at 10:03 pm #19140NIO Inc.

There are lots of talks about Nio future and a possibility that it can outperform the broader market in the near term. But those are market chatters , wishful thinking and speculations that are coming from Nio itself, those that are holding its stocks and some that would like to jump on the Upwards train if it leaves the station.

What I see on the charts is that it entered a sideways really in last 3 weeks.

It is possible for Nio to change the direction and starts its journey to fame and fortune, but do not forget that one wrong word is enough to send it to oblivion – not to mention sentences about Tariffs and similar…

So stay put and wait for this sideways to end and new Daily trend emerge.

February 6, 2025 at 9:52 pm #19139February 6, 2025 at 9:47 pm #19138February 6, 2025 at 9:43 pm #19137

February 6, 2025 at 9:52 pm #19139February 6, 2025 at 9:47 pm #19138February 6, 2025 at 9:43 pm #19137DAX – GER30

And here it comes – Hero is just below 22.000 ( high so far 21.921 )

Now things are going to become very tricky.

I must repeat aout probability – more and more probability goes in favour of a sizeable correction.

I have started calling for 22K from the moment DAX broke above 21K – hope it is clear from my charts what was the logic.

Last night I mentioned this possibility , with a great probability for a sudden drop from here – so let’s see what happens tomorrow.

Technically – if it breaks above 22.000 and stays above for couple of days, this top channel will be in play.

February 6, 2025 at 8:32 pm #19136February 6, 2025 at 8:29 pm #19135

February 6, 2025 at 8:32 pm #19136February 6, 2025 at 8:29 pm #19135USDJPY DAILY CHART – ENTERING THE STICKY ZONE

The break of 153.15 leaves a black hole on the downside with the psychological 150 and 149.35 standing in the way of key support until 148.61.

Only back above 152 would postpone the risk.

This suggests 150-152 has potential to be a sticky zine.

Next up: US January jobs report on Friday. With lower US bond yields a weight on USDJPY, use the 10-year 4.50%

yield as a pivotal level (meaning below 4.50% is a USDJPY negative). .

February 6, 2025 at 7:26 pm #19134fwiw… RBI interest rate decision tomorrow… Market is calling a 25bps rate cut (in some cases) I read up to 70% of the market is forecasting a 25bps rate cut…

I’m calling it otherwise… markets are still very over valued and there is a lot more ground left to cover by way of a market correction which will persist for yet some more time to come. 3 out of 4 companies saw EPS cuts in Jan 2025 because they simply are too overvalued, and need to be frugal with their spending for the time being…

Hence my subjective opinion on RBI rates is that they will hike.

comments appreciated

GL GT

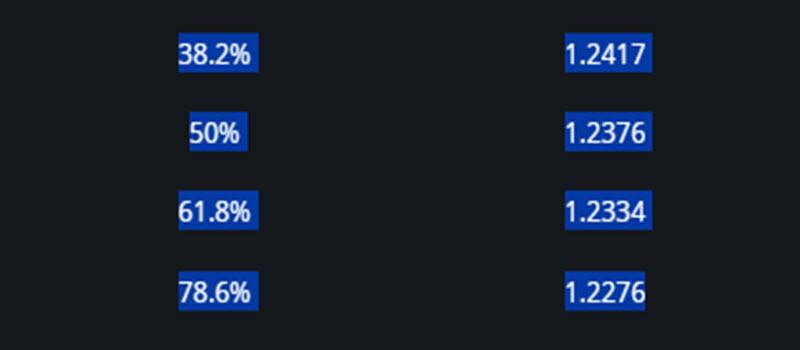

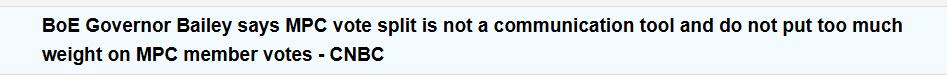

February 6, 2025 at 7:12 pm #19132February 6, 2025 at 6:39 pm #19131February 6, 2025 at 6:09 pm #19129February 6, 2025 at 5:31 pm #19128February 6, 2025 at 4:19 pm #19126Here are BOE GOV Bailey’s comments… as we noted after the rate cut deciaion the 9-0 vote was a trigger to sell GBP. Bailey just downplayed it. As always, the reaction to the news is what matters.

Source: Newsquawk.com

February 6, 2025 at 4:16 pm #19125 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View