- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 3 weeks ago by GVI Forex 2.

-

AuthorPosts

-

February 9, 2025 at 9:29 pm #19253

THIS WEEK’S MARKET-MOVING EVENTS (all days local)

On Monday, Chinese CPI is expected to pick up to show a year on year increase of 0.5 percent for January, propelled by Lunar New Year demand, after barely rising by 0.1 percent in December. For Chinese PPI, no change in the deflationary trend is seen with wholesale prices down 2.4 percent in January after a 2.3 percent decline in December.

On Wednesday, headline and core US CPI are both expected up 0.3 percent on the month, not a pretty picture for an inflation-weary market. Food and energy prices have been rising, along with vehicles and shelter costs, the usual suspects. Total CPI is seen up 2.9 percent and core up 3.2 percent on year.

On Thursday, for German CPI, forecasters see no change in the final reading for January from the preliminary report at down 0.2 percent on the month and up 2.3 percent on year. For UK monthly GDP, the consensus looks for monthly GDP up a marginal 0.1 percent again in December after the same 0.1 percent rise in November. For UK quarterly GDP, no growth is the call for Q4 from Q3, with a 1.1 percent rise from a year ago in Q4. Eurozone industrial production is expected down 0.2 percent in December after a 0.2 percent increase in November. Output is expected down 2.7 percent on year.

In the US on Thursday, jobless claims are expected to fall back to 215,000 in the latest week after rising unexpectedly by 11,000 to 219,000 a week ago. For US PPI-FD, the consensus sees an increase of 0.2 percent on the month and a gain of 3.2 percent on the year. Ex-food & energy, PPI-FD is seen up 0.3 percent and up 3.3 percent on the year.

On Friday, US retail sales, the consensus looks for an unusual flat reading on the month, with sales up 0.3 percent ex-autos. Lower auto sales dampened the result along with nasty winter weather. For US industrial production, forecasters expect a moderate 0.3 percent rise after a good gain of 0.9 percent in December. Capacity utilization is seen ticking up to 77.7 percent from 77.6 in December. That rate remains about 2 percentage points below average

Econoday

February 9, 2025 at 9:10 pm #19252Mr Bobby, I wanted to ask a question, is it possible for a trader to have an 80% win rate trading on the daily or a weekly timeframe?

You people are much more experienced than me. From your years of experience trading, what do you believe is the highest win rate possible, and at what risk to reward can someone easily achieve that, is it 1:1, 1:2 or higher?

I know that the higher your risk to reward, the lower ur win rate. And which timeframes do you think give the highest probability of not hitting your stop losses, is it the daily, weekly or Monthly? Because I know very well that from the H4 downwards are extremely choppy

February 9, 2025 at 8:26 pm #19251Trading insights you may not find elsewwhere

Do you ever wonder what is behind market reactions to headline news?

February 9, 2025 at 1:22 pm #19227February 9, 2025 at 1:02 pm #19226Could not happen in the financial trading world . Or could it ?

Sony PlayStation Network outage enrages gamers around the world

ROME (AP) — A major outage of Sony’s PlayStation Network (PSN) on Saturday has left tens of thousands of gamers unable to access online services, stores and multimedia apps. …/.

February 8, 2025 at 6:16 pm #19225XAUUSD: I checked out gold and the targets are wayyyy out… I don’t wanna post them and cause wild global panic… There may be some corrections along the way but the trend on gold is simply just too strong…

2025 is a geopolitical year. Hence all I can say for now is hang on to your gold… It’s pretty likely that we can range at this level, which is a good opportunity to keep adding like as in a SIP…

However on a global long term outlook the targets are way wayyyy out and higher than the markets can imagine… And I just won’t say it simply out of concern that it might cause markets to go cowabunga.

And believe me when I say BTC is a mouse when compared to Gold, as Gold will surpass the wildest Bitcoin prediction with lot more room left for it to soar…. wayyy out like I say…

In the PF in the early years I had a discussion with BC and my call on gold was 5000 (from those early days) when gold was at USD$200, before that I called 1000+,… now 20 years later gold is closer to USD$3000, and in those days I was told that I was talking my book… lol…

February 8, 2025 at 12:06 am #19224Insights you wont find elsewhere *click below)

Trading Tip of the week:

A Warning to All Traders: Your Stop May Not Be a StopFebruary 7, 2025 at 11:54 pm #19223Newsquawk Week Ahead Highlights – 10-14th February 2025

Highlights include Fed Chair Powell Testimonies, US, China and Swiss CPI,

US RetailSales, UK GDP and NZ Inflation Forecasts

February 7, 2025 at 8:30 pm #19222February 7, 2025 at 8:26 pm #19221DAX – GER 30

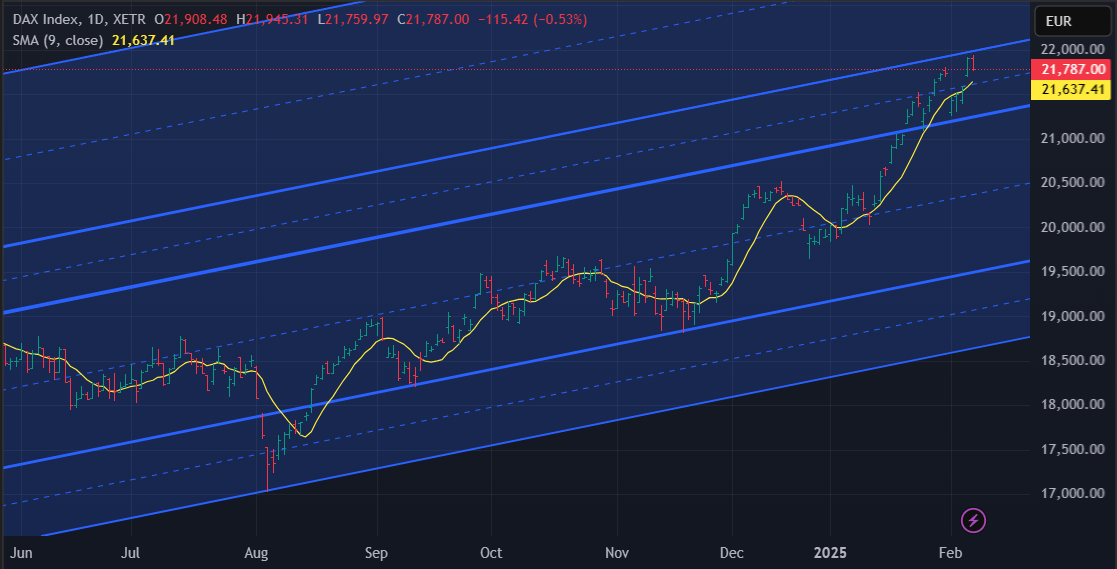

21.945 – new high – close enough to 22K and in my opinion Hero can get some rest now.

Supports : 21.500 & 21.250

I am not a guy to call for a change of trend – ever, until I get some charting facts to support such a claim, but I have to warn you once again – This might be the top and buying it now for some imagined coming Rally is not a way to go.

In the case DAX breaks 22K , it will have to stay above it – so enough time to get some action.

Otherwise you might end up buying a top….

February 7, 2025 at 8:19 pm #19220February 7, 2025 at 7:04 pm #19219February 7, 2025 at 5:24 pm #19216

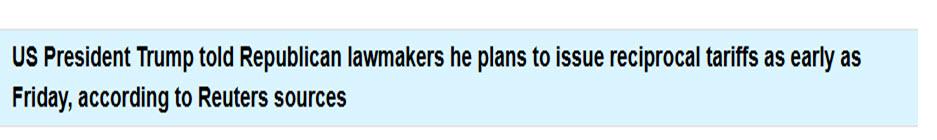

February 7, 2025 at 8:19 pm #19220February 7, 2025 at 7:04 pm #19219February 7, 2025 at 5:24 pm #19216Headline roulette Friday… News algos in overdrive…Dollar pops up on these comments, including vs JPY

Source: Newsquawk.com

February 7, 2025 at 4:42 pm #19206February 7, 2025 at 3:59 pm #19199I spoke too soon… here is your surprise headline… dollar pops, stocks fall,,, BUT no details

Source: Newsquawk.com

February 7, 2025 at 3:44 pm #19197February 7, 2025 at 3:02 pm #19195February 7, 2025 at 2:07 pm #19188February 7, 2025 at 1:57 pm #19187February 7, 2025 at 1:54 pm #19186 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View