- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 3 weeks ago by GVI Forex 2.

-

AuthorPosts

-

February 12, 2025 at 7:56 pm #19437

I came across a headline yesterday in which the USA is considering a sovereign wealth fund,… well call me late… but just the other day I was considering saying they should have a sovereign wealth fund along the likes of other countries such as Norway and my dear Saudi Arabia etc… But then in order to start that fund the USA wants to offload gold which they purchased at 42 bucks each. Ditching an asset which gives capital appreciation, and superior returns above inflation which stocks have not been able to give. Gold existed ever since the beginning of time even centuries before the USA was even discovered, as a matter of fact that is why they were discovered, it was because of an explorer’s search for Gold and Spices… Trump wants to bail out tiktok and do crypto by dumping money into Moore’s law? He should be negotiating treaties to buy as much gold as can be produced in the world for the next 50 years.

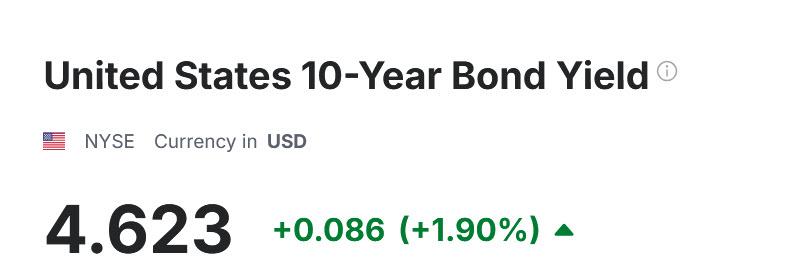

If the FED invests in bond yields then that would fill the void left behind when USAID was dismantled. Bonds are indirect investments into the welfare systems of countries… They got some great non-calleable bond deals going on somewhere in the world. And last I heard on 1 year paper was 6.55%+.

Gold and Bond’s are the only 2 bets for that kind of money.,.. and no other countries know the world like the United States does. What was all that spying done for?

Stock investments are limited by the amount of capital which can be invested in companies. under performance of stocks causes capital erosion which is counter intuitive. Companies won’t last as long as Physical Gold and the countries obviously. eg. India has been around for 5000+ years and which company in the world has been doing business for even 10% of that time?. Additionally, in how many companies in the world can an investor buy 75 billion dollars worth of stock for a 5% stake and be confident that the money is safe,… only maybe 3 or 4 companies if that many.

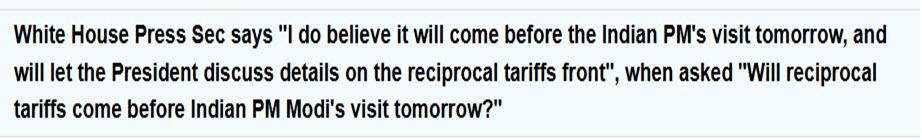

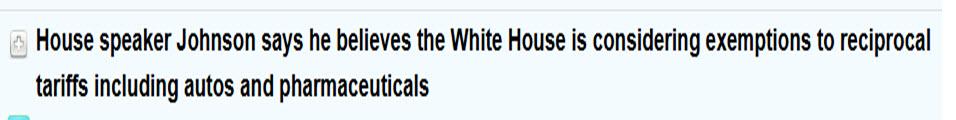

February 12, 2025 at 7:56 pm #19436Hedline whipsaq continues… out a little while ago and will have everyone glued to the TV and headlines on Thursday.

It also cyt short the EURUSDF rally that paused just below a key AT level at 1.9432 (high 1.0430, lasr 1.0389)

Source: Newsquawk.comFebruary 12, 2025 at 6:16 pm #19435XAUUSD ONE HOUR CHART – Retracement contained for now

Pause above the 2852 level cited earlier (low 2863) contained the retracement but would need to regain 2898_ to put the 2942 and talk of 3000 back on the table.

So far XAUUSD has not suffered from hopes of easing geopolitical tensions but bears watching.

February 12, 2025 at 6:11 pm #19434There has been enoiugh news today to last a week. In the end, it is the reaction that counts.

This came out earlier but we need to hear it from Trump.

Source: Newsquawk.com

February 12, 2025 at 5:33 pm #19433February 12, 2025 at 5:29 pm #19432February 12, 2025 at 5:14 pm #19431February 12, 2025 at 4:44 pm #19430February 12, 2025 at 4:37 pm #19429February 12, 2025 at 4:30 pm #19428EURUSD 4h Update

EUR bounced sharply and reached 1.03800 once again.

Now the question is how is it going to Close this bar in about hour and half.

Options:

– Close above 1.03600 – Bullish – it would go way above 1.03800 and change the Daily direction to Up

– Close below 1.03500 – Bearish – Another leg down testing at least 1.02900

Later tonight I’ll reassess the situation and post another update

February 12, 2025 at 4:24 pm #19427February 12, 2025 at 4:11 pm #19426February 12, 2025 at 3:45 pm #19425

February 12, 2025 at 4:24 pm #19427February 12, 2025 at 4:11 pm #19426February 12, 2025 at 3:45 pm #19425News trading algos reacting to keyword phrases and any hint of a way out of a tariff trade war.

Source: Newsquawk.com

February 12, 2025 at 3:32 pm #19424USD spikes down on these tariff related comments, suggests no definitive announcement today.

Source: Newsquawk.com

February 12, 2025 at 3:05 pm #19423February 12, 2025 at 2:39 pm #19422February 12, 2025 at 2:35 pm #19421February 12, 2025 at 1:49 pm #19420February 12, 2025 at 1:38 pm #19419February 12, 2025 at 1:31 pm #19418Hotter CPI, both headline and core… details in our Economic Data Calendar

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View