- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 3 weeks ago by GVI Forex 2.

-

AuthorPosts

-

February 14, 2025 at 6:27 am #19552February 14, 2025 at 6:25 am #19551February 14, 2025 at 12:18 am #19549February 14, 2025 at 12:18 am #19550February 13, 2025 at 11:58 pm #19548

As I noted, Trading in the New Trump Effect Era: Actions Speak Louder Than Words.

Well, President Trump is never at a loss for words as he has followed through on his campaign promise to impose tariffs.

However, these are still just words until tariffs are actually enacted.

February 13, 2025 at 9:30 pm #19535Many have seen me say when there is a geopolitical event or crisis, markets tend to price in the worst-case outcome and reassess later. The Trump tariff soap opera feels like a combination of the two (geopolitical event/crisis)..

After President Trump took office markets started to price in the worst-case impact of tariffs (e.g. inflation/higher bond yields/trade war, etc).

EURUSD, for example, set its low at 1.01777 on January 13 and one month later it has had an erratic recovery that has 1.05 on its radar, helped by hope for an end to the Ukraine war.

My point is if you take a step back after the frenetic headline driven whipsaw trading seen each day this week, there is some logic to the price action. The worst-case outcome does not appear will materialize

As you can see in forex, equities and bonds, markets have adjusted accordingly to reality. At a minimum, a two-way risk has been restored to what looked like might become a one-way street.

February 13, 2025 at 9:11 pm #19534February 13, 2025 at 9:06 pm #19533February 13, 2025 at 8:36 pm #19531February 13, 2025 at 8:35 pm #19530ETHUSD – Ethereum

This coin behaved perfectly technical so far – after very sharp drop of almost 50% it bounced strongly of the long term support line .

Pattern still suggests more downward pressure and tests of the supports, but as long as 2.190 holds on there is a good probability of renewed Up trend.

I would like to warn you all that time wise it might take another month, unless some news/data sparks immediate interest.

February 13, 2025 at 8:32 pm #19528February 13, 2025 at 8:26 pm #19525

February 13, 2025 at 8:32 pm #19528February 13, 2025 at 8:26 pm #19525DAX – GER 30

DAX Surges to New High

Nice move away from support at 22.000 and making it very clear now where it tends to go.First target in 23.000 area, next 24K

Market sentiment remained upbeat amid strong corporate earnings and optimism over a potential end to the war in Ukraine, though caution persisted over US trade policy.

February 13, 2025 at 8:21 pm #19524February 13, 2025 at 8:15 pm #19523

February 13, 2025 at 8:21 pm #19524February 13, 2025 at 8:15 pm #19523Robinhood Markets Inc. – HOOD

Fundamentals at it’s best

Robinhood Stock Jumps as Earnings Blow Past Forecasts

Robinhood Markets Up Over 13%, on Track for Highest Close Since August 2021

Robinhood Markets, Inc. Class A (HOOD) is currently at $63.48, up $7.58 or 13.55%· Would be highest close since Aug. 4, 2021, when it closed at $70.39

· On pace for largest percent increase since Nov. 6, 2024, when it rose 19.63%

· Currently up four of the past five days

· Currently up two consecutive days; up 19.02% over this period

· Best two day stretch since the two days ending Nov. 6, 2024, when it rose 22.78%

· Up 22.2% month-to-date

· Up 70.38% year-to-date

February 13, 2025 at 7:56 pm #19522February 13, 2025 at 7:48 pm #19520February 13, 2025 at 7:17 pm #19514February 13, 2025 at 7:14 pm #19513

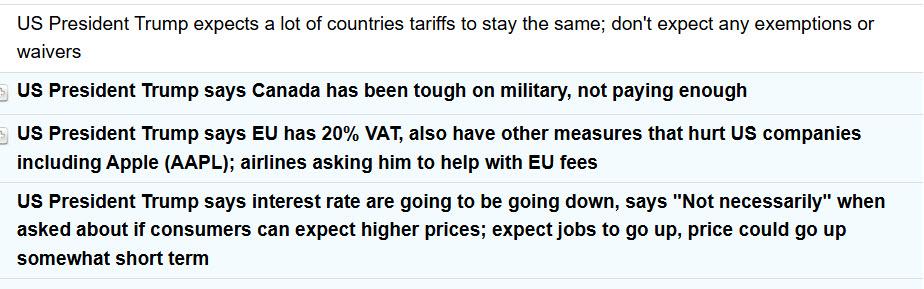

February 13, 2025 at 7:56 pm #19522February 13, 2025 at 7:48 pm #19520February 13, 2025 at 7:17 pm #19514February 13, 2025 at 7:14 pm #19513EURUSD spooked by VAT comment but has since bounced back. Here are some highlights

Source: Newsquawk.com

February 13, 2025 at 6:51 pm #19512February 13, 2025 at 4:53 pm #19509 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View