- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 3 weeks ago by GVI Forex 2.

-

AuthorPosts

-

February 14, 2025 at 4:06 pm #19579

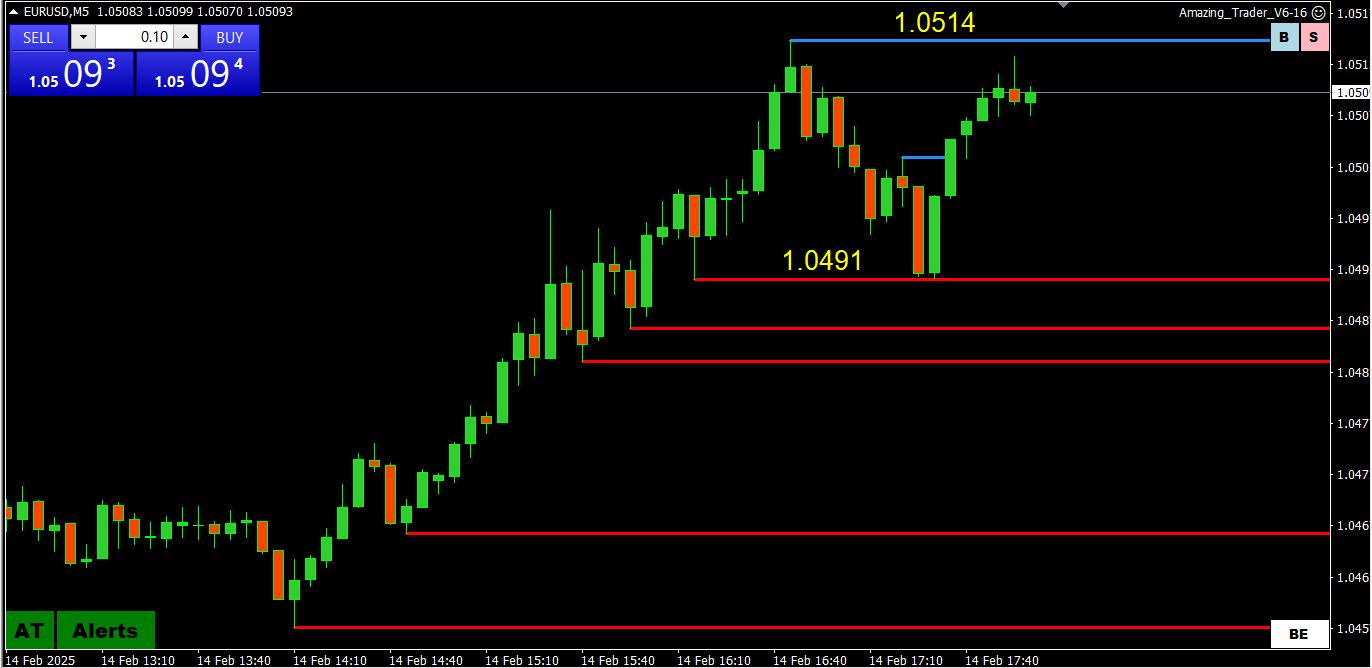

I can’t resist posting this Amazing Trader 5 minute chart… what should stand out os the bounce off support and then a run at the high for a near double top- no coincidence if you are using AT)

February 14, 2025 at 4:00 pm #19578

February 14, 2025 at 4:00 pm #19578re (10 yr last 4.457%) …

I am sensing that in the backdrop of trumps tariffs AND increasingly load voices screaming “inflationary” , the risk is that manufacturers are increasingly ably to pass along their increased costs and that without fear as , again me sensing, that “inflationary expectaions” are getting closer to becoming acceptable and run the risk of becoming anchored. with a non-chalant attitude.February 14, 2025 at 3:51 pm #19576DLRx 106.50

puppy looks lets say softish. close around here or lower would portend lower still next week

looks like players are starting to be annoyed by donald’s tariff theatricks.

and , having watched early morning plebian news w / journos sticking a microphone in front of folks on the street about prices of eggs and most folks just shrugging “so-what” shoulders about inflation .. a danger for donald I suggestFebruary 14, 2025 at 3:49 pm #19575February 14, 2025 at 2:55 pm #19568February 14, 2025 at 12:52 pm #19567February 14, 2025 at 12:44 pm #19566Europe to bat away U.S. tariffs, weaker currency to help

Another day, another story on tariffs.This time, U.S. President Trump has tasked his economics team with devising plans for reciprocal tariffs on every country that taxes U.S. imports, starting from April.

While that may look bad for Europe on the surface, Barclays is sanguine about the possible impact, especially as the delayed implementation opens the door for negotiation.

“The actual hit to growth is likely manageable and largely offset by weaker EURUSD,” Barclays says.

The staples, autos and chemicals sectors exhibit the widest tariff gaps, Barclays notes, so they would be most exposed to reciprocal tariffs, but these sectors have underperformed since the U.S. election.

“Some of the earnings downside is arguably priced in already,” Barclays notes.

February 14, 2025 at 12:41 pm #19565February 14, 2025 at 12:38 pm #19564February 14, 2025 at 12:29 pm #19563February 14, 2025 at 11:37 am #19562A look at the day ahead in U.S. and global markets from Mike Dolan

As world stocks got a fresh lift, the U.S. dollar has retreated to its lowest of the year so far on a mix of reversing U.S. Treasury yields and another delay in tariff implementation.

Multiple cross-currents have hit macro markets this week – a whipsaw effect from two big U.S. inflation reports, Washington’s push for Ukraine peace talks alongside threats of sweeping tariffs and another heavy schedule of corporate earnings and Treasury debt sales.

But as Friday trading gets underway, the net impact on the dollar index has been to sink it to its lowest in almost two months – driven in part by a benign take on January’s U.S. producer price report and a Ukraine-related rally in the euro.

Morning Bid: Unloved dollar hit by tariff delays, yield recoil

February 14, 2025 at 11:35 am #19561NEWSQYAWK US OPEN’

Indices mixed amid varied Russia/Ukraine commentary, USD lower ahead of Retail Sales

Good morning USA traders, hope your day is off to a great start! Here are the top 5 things you need to know for today’s market.

5 Things You Need to Know

European bourses & US futures began the session mixed but have deteriorated on geopols; Luxury lifted by Hermes post-earnings.

USD remains pressured post-Trump tariff announcement, Antipodeans lead.

Bonds retain a bearish biasbut are off lows as geopolitics drives recent price action

Gas continues to deflate, crude rangebound & metals advance.

Russia has said its officials are not attending the Munich conference, US VP Vance & Ukraine’s Zelensky set to meet at 11:00EST; recent remarks from Zelensky have tempered recent optimism

Source: Newsquawk.com

February 14, 2025 at 11:14 am #19560February 14, 2025 at 10:29 am #19559February 14, 2025 at 10:23 am #19558February 14, 2025 at 10:17 am #19557February 14, 2025 at 9:21 am #19556February 14, 2025 at 6:36 am #19555February 14, 2025 at 6:33 am #19554February 14, 2025 at 6:30 am #19553 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View

TGIF

TGIF