- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 3 weeks ago by GVI Forex 2.

-

AuthorPosts

-

February 17, 2025 at 9:24 pm #19679February 17, 2025 at 9:07 pm #19678

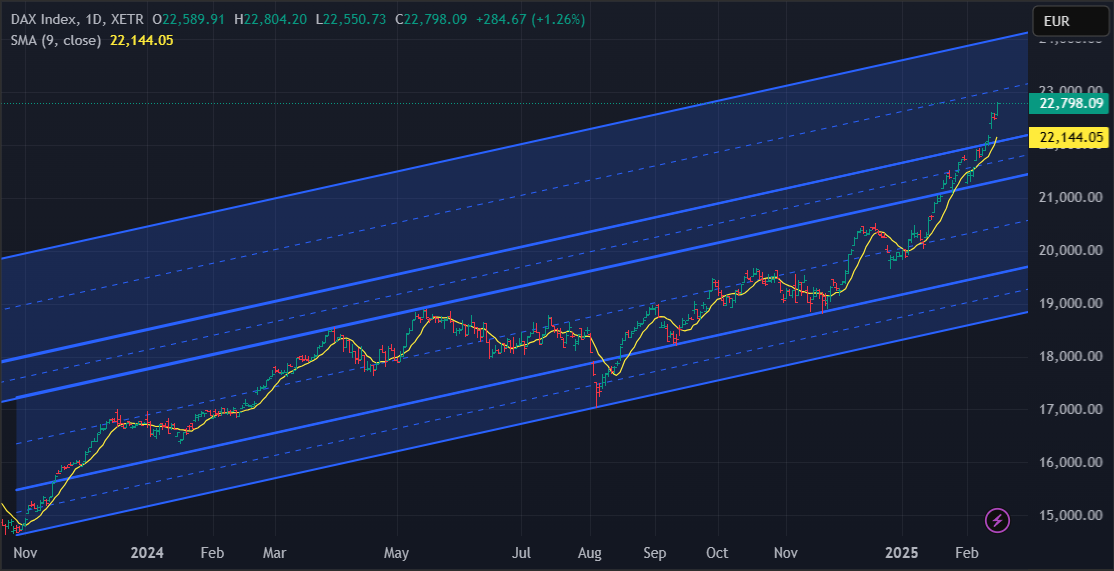

DAX – GER 30

The DAX Index Closes 1.26% Higher

In Frankfurt, the DAX Index went up by 285 points or 1.26 percent on Monday.

Top gainers were Rheinmetall (14.67%), Siemens Energy (3.74%) and Munich RE (2.50%).

Now headlines aside, what can we expect next?

Frankly, this is an uncharted territory and so far it behaved very technical.

Having that fact on mind, now we have to use something that many would laugh at – Thumb analysis…after you laughed long and loud, pay attention :

– Whenever I want to avoid that laughing I call it Time-Space analysis, and so far it worked like a charm

– No rally can go on for ever

– Without a decent correction, we have to assume that any instrument that goes so sharply Up will go down the same way

– So either a correction soon or it is going to be a classic Blow of Rally

I would like to see DAX testing 22K again

I wouldn’t like to see Savage Profit taking that might end up changing the trend at the end.

February 17, 2025 at 8:09 pm #19677February 17, 2025 at 7:39 pm #19672February 17, 2025 at 7:30 pm #19671

February 17, 2025 at 8:09 pm #19677February 17, 2025 at 7:39 pm #19672February 17, 2025 at 7:30 pm #19671How Do Leads and Lags Impact Currency Trading?

I remember the term leads and lags from my studies in economics but it is not a term I see these days. While I am not privy to the way corporates hedge currency risk, leads and lags are important to understand as they can have an impact when a currency is trending as a business looks to hedge risk or take advantage of it. .

February 17, 2025 at 6:51 pm #19667February 17, 2025 at 6:31 pm #19666February 17, 2025 at 6:30 pm #19665February 17, 2025 at 2:21 pm #19655The Amazing Trader (AT) — all you need to trade

Real time charting lalgo , amazing trading linesa that form patterns to trade.

AT identifies imbalances in a market where one side is having trouble absorbing the flows. It then shares a strategy to take advantage of these patterns to execute “high probability” trades.

Illustration:

One-hour USDJPY chart

Blue at lines indicate an Imbalance to the downside

Sell with stop above a blue line.

Ride the trend down.

February 17, 2025 at 1:48 pm #19654February 17, 2025 at 1:46 pm #19653February 17, 2025 at 1:38 pm #19652February 17, 2025 at 1:36 pm #19651DAX – GER 30

Dax continues to hit new highs – trend that started in late 2024.

And it goes stronger and faster.

So what might be behind this latest run – last 8 days?

Reuters claims : European stocks hover near record high on defence boost

European shares hovered near a record high on Monday, boosted by defence stocks amid growing U.S. calls for the region to amplify military spending for security.But in my own view – this was all “written” on charts months ago, and especially after DAX broke above 22.000

So Targets are at 23 & 24 K

February 17, 2025 at 1:30 pm #19650February 17, 2025 at 1:27 pm #19649February 17, 2025 at 1:25 pm #19648

February 17, 2025 at 1:30 pm #19650February 17, 2025 at 1:27 pm #19649February 17, 2025 at 1:25 pm #19648EURUSD Daily

Supports: 1.04350, 1.03950 & 1.03650

Resistances: 1.05050, 1.05150 & 1.05500

Aside of my previous statement that this is a Correctional angle ( current uptrend) , let’s avoid any predictions right now.

Test of Supports is on the cards and 1.04350 is a level to watch – if taken out this move Up is over.

February 17, 2025 at 1:18 pm #19647February 17, 2025 at 12:07 pm #19646February 17, 2025 at 12:03 pm #19645

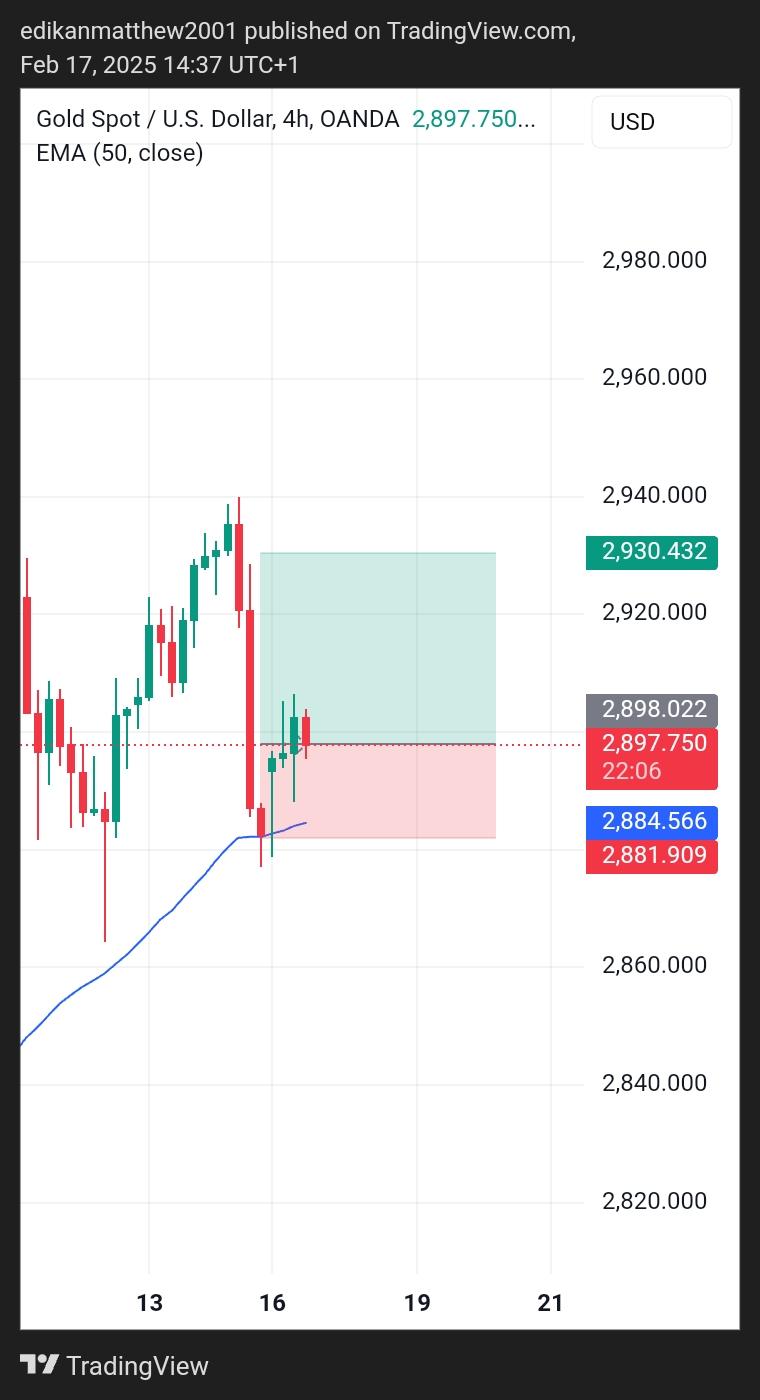

February 17, 2025 at 1:18 pm #19647February 17, 2025 at 12:07 pm #19646February 17, 2025 at 12:03 pm #19645GOLD (XAU/USD) opened at around price 2881 early this morning. It then went long (bullish) to the area of 2906, the highest point it ever got to till this moment. We see a retracement to the area of 2895 after which it went a bit long to its former position. The time is 1pm Nigerian time this Monday afternoon and the mood is good.

The price at 1pm is 2901 now. I forsee a small sell to tje price of 2895 to form a support level before a return to its former buy position. Happy Trading.

Please do not overtrade as it might ship wreck your Account. 2-5% of your Capital is what I recommend. Aword is enough for the wise.

Thanks,

TOPNINE.February 17, 2025 at 12:01 pm #19644 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View