- This topic has 11,679 replies, 48 voices, and was last updated 3 months ago by GVI Forex 2.

-

AuthorPosts

-

February 21, 2025 at 1:28 pm #19910

Yes, German Elections is another important moment, but I don’t think that the fate of EUR is in their hands…any more…Trumps dealings with Russia / Ukraine is way more important.

Aside feelings of honourable European politicians ( finally someone to make them sweat and lose some sleep) , if Trump manages it till the end, Europe as a region/continent will get another chance.

It all falls back to question of Gas and Minerals coming from Russia- so Europe might ( will ) lose this one – as in the eyes of local politicians Piece is a loss…but Europe will win in many ways…

Of course waves will be felt for months to come, but we like to say : every miracle lasts three days…

February 21, 2025 at 1:18 pm #19909February 21, 2025 at 12:59 pm #19908EURUSD Daily

Is it going to be the decision day today for EUR?

Supports at : 1.04600 & 1.04350

Resistances at: 1.05050 & 1.05550

Data today should finally gives us a clue – Economic Data Calendar

February 21, 2025 at 11:43 am #19905

February 21, 2025 at 11:43 am #19905A look at the day ahead in U.S. and global markets from Mike Dolan

Wall Street nursed a bruising on Walmart (NYSE:WMT)’s downbeat results, casting a cloud over the U.S. consumer just as more buoyant European markets awaited the weekend’s German election.

Another blizzard of often conflicting influences from geopolitics, trade, monetary policy and corporate earnings barrelled into world markets over the past 24 hours.

But it was the retailing giant’s miss on its sales and profit forecasts – citing the turbulent political environment and trade uncertainties ahead – that cut deepest.

February 21, 2025 at 11:37 am #19904February 21, 2025 at 11:30 am #19903US OPEN

EUR weighed on by PMIs & JPY hit by Ueda remarks, Commodities are pressured by the firmer Dollar ahead of US PMIs

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses are mostly higher after paring initial pressure following dire French PMIs; US futures are modestly mixed.

DXY attempts to recoup lost ground, EUR weighed on by PMIs, JPY hit by Ueda remarks.

BoJ Governor Ueda said if markets make abnormal moves, the BoJ stands ready to respond nimbly, such as through market operations, to smooth market moves.

Bunds bolstered by soft PMI metrics; Commodities are pressured by the firmer Dollar.

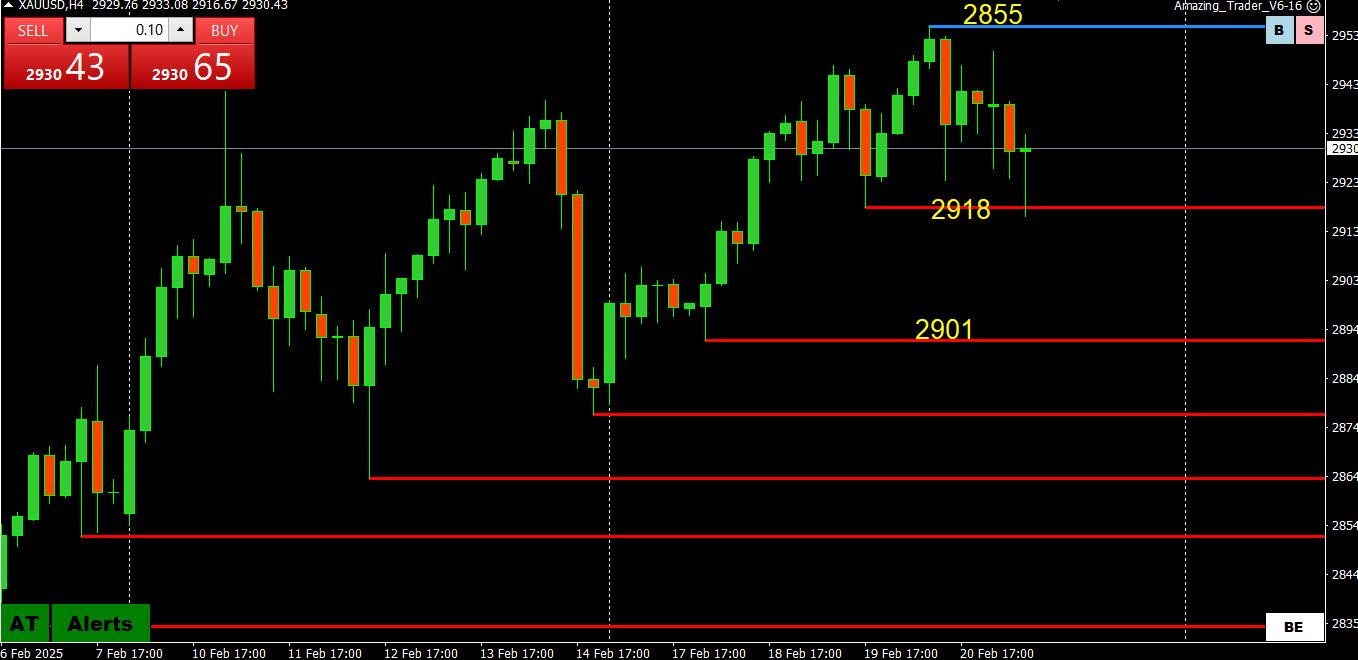

February 21, 2025 at 10:32 am #19902February 21, 2025 at 10:13 am #19901XAUUSD 4 HOUR CHART – Tests support

XAUUSD so far fighting off retracement pressure by holding (just) below support at 2918 cited yesterday.

This leaves it consolidating within a 2917-2950/55 range with a lingering retracement risk unless the upper end is taken out,

To repeat, betting on a retracement has been a losing bet and why I have been citing 2918 as the level hat needs to hold to contain the retrace risk

February 21, 2025 at 9:58 am #19900Using my platform as a HEATMAP

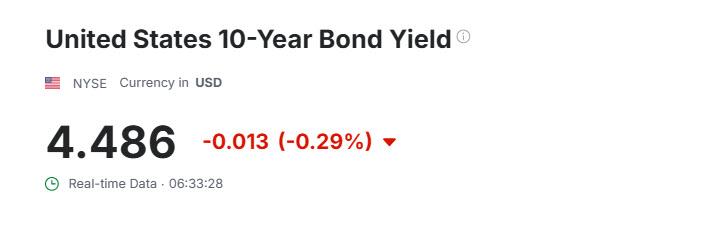

Dollar is firmer after yesterday’s sell-off

Led by USDJPY which had bounced back above 150 but remains below yesterday’s 150.91 breakdown level.

Only news I have seen is a pushback by several officials on rising JGB yields (10 year hit a 15+ year high)

EURUSD backed off from 1.05 awaiting Sunday’s German elections…. 1.0450 = neutral while within 1.04-1.05

Stocks steady after yesterday’s sell offs.

Gold extended its retreat from yesterday from a new record high but so far contained after testing 2918 support (low 2917).

Highlights:

Flash EZ and UK PMIs

Japan CPI (hotter but ignored)

See our Economic Calendar for upcoming US data

TGIF

February 21, 2025 at 9:49 am #19899February 21, 2025 at 9:45 am #19898February 21, 2025 at 9:43 am #19897February 21, 2025 at 9:41 am #19896February 21, 2025 at 9:39 am #19895February 21, 2025 at 9:37 am #19894February 20, 2025 at 11:00 pm #19893There has not been a lot of attention on the German elections but with the vote scheduled for Sunday, let’s take a closer look by asking the followung question

February 20, 2025 at 9:43 pm #19892NAS100 4 HOUR CHART – Failure for now?

The failure to retest the record 22225 has raised a risk oif a retracement as long as it trades below 22134.

Keep in mind that betting on retracements following through has been painful so keep an eye on 22000 as this level will dictate whether retracement pressures can build.

The negative reaction to Walmart’s Guidabce Warning is a sign the risk has turned two-soded.

February 20, 2025 at 9:38 pm #19891February 20, 2025 at 9:32 pm #19890XAUUSD – Gold

New day – new high – and again just marginally higher.

To explain about these marginally higher highs – what it means?

It means that there are no stops above it – once there are no stops ( orders) interest to move higher is fading .

Without some serious news/fundamental reason it is now going to be very difficult to push it further Up.

Once stops are placed below 2.900 , it is going to become very interesting to start bidding lower….

Then it is going to be interesting – is Support at 2.870 going to hold, or deeper correction will be on cards.

February 20, 2025 at 9:24 pm #19889

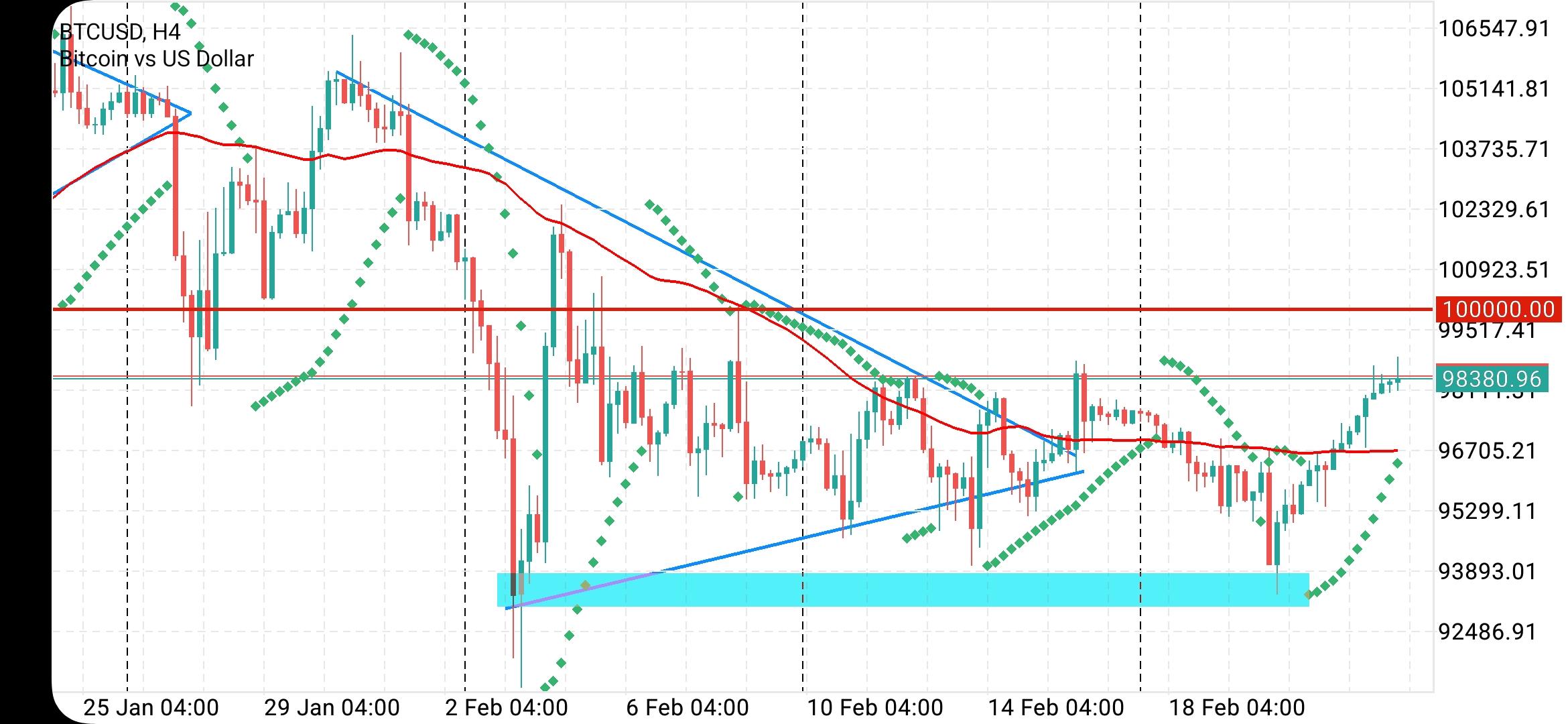

February 20, 2025 at 9:24 pm #19889BTCUSD – Daily

Resistances: 98.895, 100.200 & 102.600

Supports: 96.300, 93.300 & 89.450

Carefully with expectations – this is sideways and will be until some levels are broken.

It looks like the creation of a Bull formation, but it is not yet formed – this can turn sour in a day – so wait till you really see it happening.

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View