- This topic has 11,679 replies, 48 voices, and was last updated 3 months ago by GVI Forex 2.

-

AuthorPosts

-

February 24, 2025 at 10:10 am #19991February 24, 2025 at 10:08 am #19990February 24, 2025 at 10:07 am #19989February 24, 2025 at 10:05 am #19988February 24, 2025 at 9:13 am #19987

XAU/USD (GOLD) was at an all high price of 2955 as at lastweek Friday. From there it went bearish to the price at 2918 area. It has slowly climbed back and it is now at 2947 area. I see it getting to resistance point at 2955 and further breaking above it to 2980 area.

The Metal Gold is a bullish one. It has been steadily on the climb since 1996 and it is not yet tired of climbing. Let’s Trade carefully with tight Stoploss/Takeprofits. Do not risk more than 2-5% of your Capital. A word is enough for the wise.

Thanks,

TOPNINE.February 23, 2025 at 10:27 pm #19985February 23, 2025 at 10:13 pm #19984GVI 10:04 / you should look at the boatloads of houses for sale in washington …

and also take a look at canadian’s sentiment about the cad$ being in and potentially heading deeper in the toilet about the effect on their not just current but also future financial well-being.

to the fine tune “A Change Would Do You Good” (Sherryl Crow)

February 23, 2025 at 10:08 pm #19983February 23, 2025 at 10:04 pm #19982THIS WEEK’S MARKET-MOVING EVENTS (all days local)

Between the drop in the February NAHB/Wells Fargo housing market index by 5 points to 42 and the 4.9 percent fall in January existing home sales to 4.08 million units, there are emerging signs of weakening in the housing market. Despite moderation in home prices, builders and buyers are reacting to uncertain economic conditions with increased caution. Builders aren’t as optimistic about the outlook despite the prospect of loosened regulation. They are facing renewed upward price pressures on materials and labor, and potentially shortages of needed inputs. Consumers are worried about decreasing purchasing power with an uptick in inflation and their job security. And finally, there is little chance of meaningfully lower mortgage rates in the near future with the FOMC set to maintain restrictive monetary policy for the time being.

Econoday

February 23, 2025 at 9:21 pm #19981another joke. no, actually two jokes:

–

RBC among four banks to settle U.K. bonds collusion case for US$127 million

Traders unlawfully shared details on pricing and trading between 2009 and 2013, says U.K. markets authorityTraders at Citigroup Inc., HSBC Holdings PLC, Morgan Stanley and Royal Bank of Canada unlawfully shared details on pricing and trading in chatrooms between 2009 and 2013, the Competition and Markets Authority(CMA) said on Friday. Deutsche Bank AG, was exempted from the penalty as it was the first to self report its involvement. … – financialpost

February 23, 2025 at 8:30 pm #19980POOF! … the end

“Zelenskyy ‘willing to step down’ in return for Ukraine’s NATO accession

The Ukrainian president said that he is focused on Ukraine’s security today and called for further guarantees from Europe and the US.” – euronewscould not step down fast enough. but nooooo he still tries to set conditions

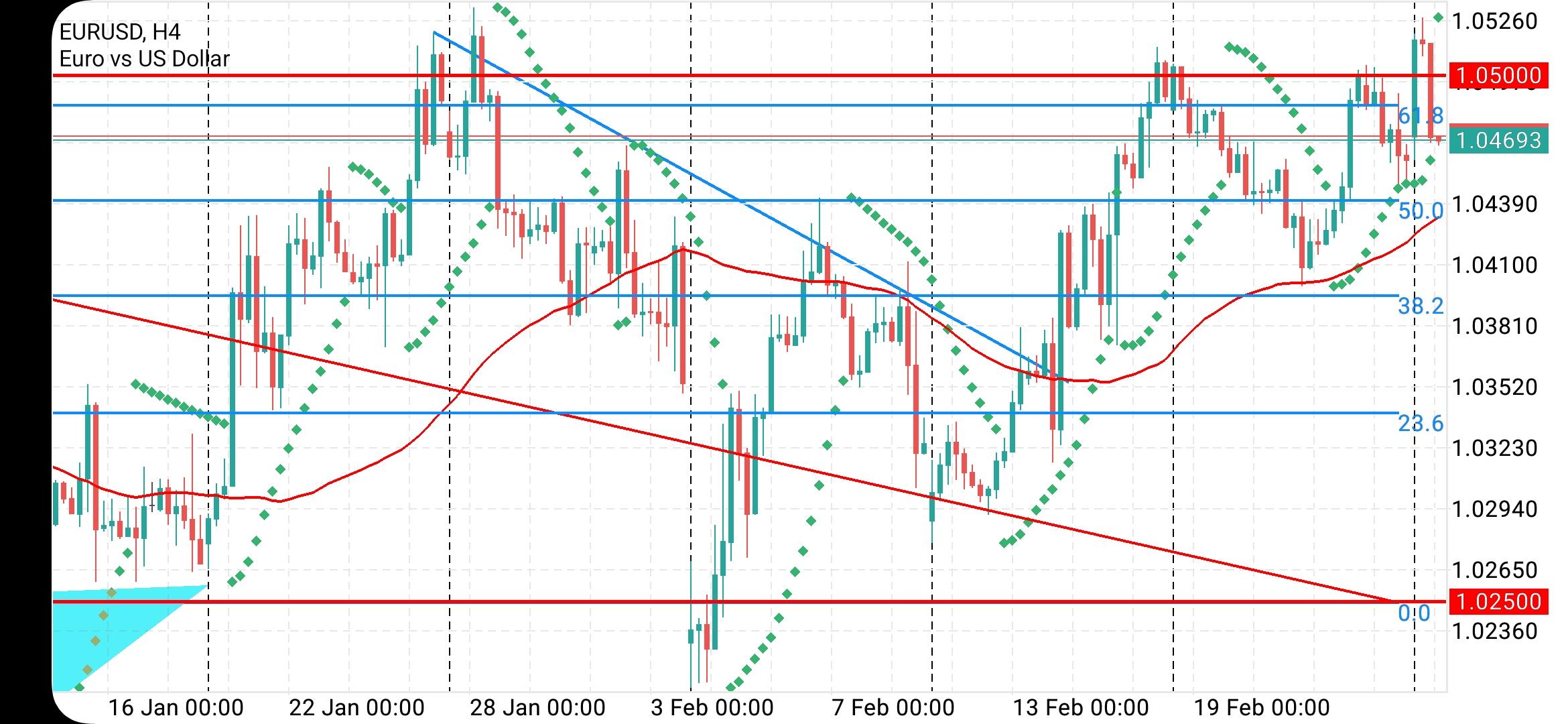

February 23, 2025 at 6:28 pm #19979February 23, 2025 at 4:49 pm #19978February 23, 2025 at 4:48 pm #19977February 23, 2025 at 4:09 pm #19976February 23, 2025 at 4:04 pm #19975February 23, 2025 at 1:51 pm #19974February 23, 2025 at 11:38 am #19968The German election has not been much of a factor but with the result coming later today, it pays to take a closer look.

February 23, 2025 at 10:41 am #19966German election

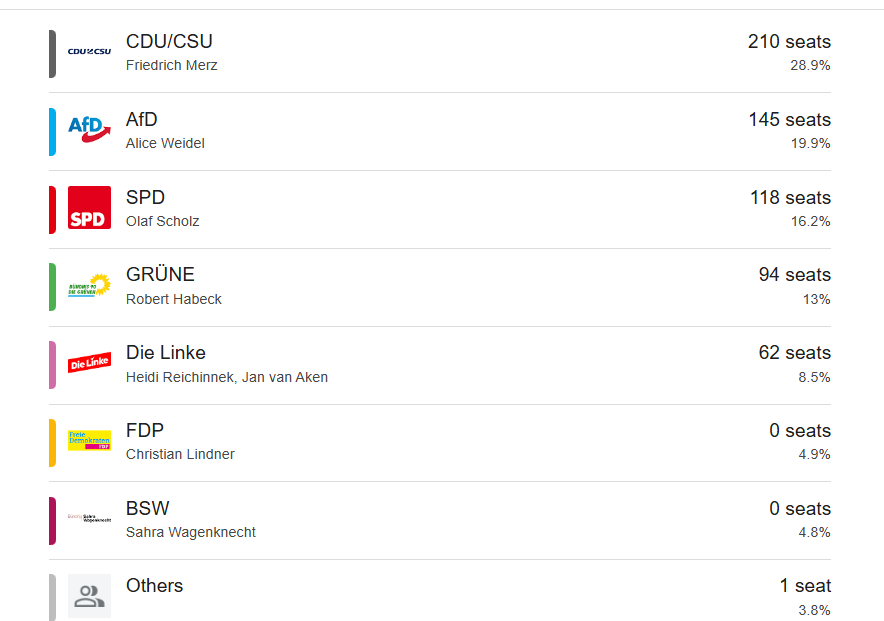

…First projections will come in once the polls close at 6 p.m. Sunday in Germany (noon E.S.T. in the United States). Because they are based on extensive exit polling, those numbers tend to be very accurate. During the last election, the exit polls were within 1 percent of the final vote that was posted hours later, once all ballots were counted.

But this year, exit polling could be less predictive. An unusual number of voters have told pollsters they had not yet made up their minds and an increasing number of voters use mail-in ballots and so they do not figure in exit polls…. (NYT)

February 23, 2025 at 9:45 am #19965As of February 23, 2025, Germans have begun voting in a national election anticipated to shift power to the conservative CDU/CSU bloc under Friedrich Merz. Pre-election polls suggest the far-right Alternative for Germany (AfD) is poised to achieve its best results to date. However, the CDU/CSU is unlikely to secure an outright majority, leading to potential coalition negotiations in a fragmented political environment. The election follows the collapse of Chancellor Olaf Scholz’s government and reflects public concerns over living standards and immigration. Exit polls are expected shortly after polls close at 6:00 PM local time (12:00 PM EST). From the internet

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View