- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 2 weeks ago by GVI Forex 2.

-

AuthorPosts

-

February 9, 2024 at 10:41 am #1390

JPY and CHF officials have recently voiced more policy clarity which has underscored rate differentials as a more predominant driver. EUR and USD officials have been more well we’ll see maybe sooner but probably later not sure how much we’re following the data but sometimes the data is questionable but have to see…

February 9, 2024 at 10:31 am #1389February 9, 2024 at 10:17 am #1388These revisions seem like the outcome can only be skewed towards worse than what was reported. Better seems like a non starter as better has already been priced into rates markets which the employment number took care of in brief order, and even if the revisions show more improvement, who’s gonna believe it….

February 9, 2024 at 9:26 am #1387JP, thanks for the alert. Here is the full story

The markets will keep a keen eye on Friday’s annual revisions to the seasonal adjustment factors for U.S. consumer price data. The annual revisions to the CPI are usually a non-event. However, the markets were spooked last year after large revisions to the seasonal adjustment factors sowed doubts about overall progress on inflation.

Will Annual Revisions to U.S. Consumer Prices Surprise Again?

February 9, 2024 at 2:25 am #1386February 9, 2024 at 12:39 am #1384February 9, 2024 at 12:39 am #1383February 8, 2024 at 7:50 pm #1382February 8, 2024 at 7:32 pm #1381couple headlines off zh that caught my eye, fwiw:

–

“Boy, Markets Do Not Want To Sober Up When They Read The News”

As long as we get January March May June(?), or even second-half 2024 *deep* rate cuts from the Fed, markets will remain drunkBiden Admin Is “All Gas, No Brakes” On Economic Reflation; Nomura Warns “Running It Hot” Into Election Wrecks Powell’s Plan

…beware of “animal spirits 2.0″…and the ides of March.February 8, 2024 at 6:51 pm #1380February 8, 2024 at 6:06 pm #1379EURUSD Daily view

Resistances are at 1.07900 and 1.08450/500 – break of would open the road for Up Trend and the test of Major 1.11000 area. That would be a game changer.

Supports are waiting at 1.07550 and 1.07150 , break of targets directly ( ideally ) 1.06100 over period of 2-3 days.

Outcome for tomorrow – if we get a close bellow 1.07700 tonight, there is a higher possibility for immediate continuation of the down move. There is always a possibility to see uptick up to 1.08200 , and then down.

February 8, 2024 at 4:01 pm #1371February 8, 2024 at 3:19 pm #1368February 8, 2024 at 3:06 pm #1366

February 8, 2024 at 4:01 pm #1371February 8, 2024 at 3:19 pm #1368February 8, 2024 at 3:06 pm #1366not on gv’s calendar, so fwiw:

–

Last time this puppy came out players got a “surprise” (kick in their trading teeth)

Updated seasonal factors to be introduced February 9, 2024

Bureau of Labor Statistics (.gov)https://www.bls.gov › cpi › 2024 › seasonal-adjustment

The revised indexes and seasonal factors will be available at Seasonal Adjustment in the CPI.February 8, 2024 at 2:54 pm #1363February 8, 2024 at 2:47 pm #1362February 8, 2024 at 2:42 pm #1360DLRx 104.17 / 10-YR 4.144% +0.046

–

so … the dlr s getting some love now after few days of ambivalence

BoJ deputy complained about his eyesight earlier, claiming hard to see rapid rise in rates post-end of zero rate policy.

barkin already yakked on bbrg (peasants … be patient with the FED Cutting Interest Rates)

12:05 barkin delivers a 2nd yik yak

and

13:00 – yellen’s dept peddles off 25bl of 30-yr paper

February 8, 2024 at 2:38 pm #1359February 8, 2024 at 1:34 pm #1351This is what you get if you click on the exact data in our Economic Calendar

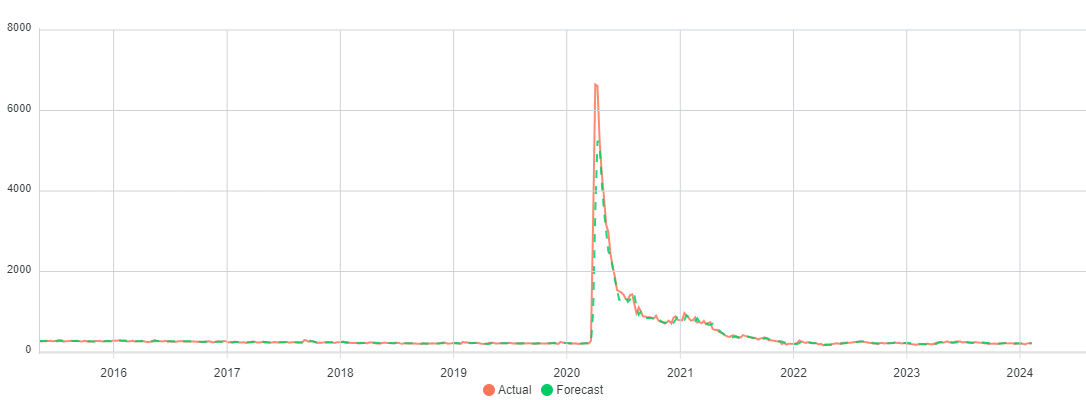

US Initial Jobless claims

February 8, 2024 at 12:49 pm #1349

February 8, 2024 at 12:49 pm #1349What I found really amazing looking at the charts that you posted here is the fact that even after almost 30 years of trading, I can not concentrate enough on different pairs at the same time, to be able to trade them. When I try to look for opportunities elsewhere (grass is greener in the other yard ), I end up either missing a trade on EURUSD ( my main trade) or screwing it up because of looking at some cross . Long time ago, it was even worse – get into position, it goes sour….and then I go over every single pair , trying to find a reason to hold on…of course it ends up in tears..

Now when I see how your thingy works , must admit that Amazing Trader is a very valuable tool even for veteran traders with their own proven systems. First thing that comes to my mind is the fact that I can continue trading my own system, and have this one working on it’s own in the back…to help me chose the trade, execute it, and take care of the most important part of trading – Risk Management !

If you think that this is some kind of kissing ass , well it’s not…I woke up a bit pissy , and looking at these charts , it just hit me…this is a great stuff…I should use it. -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View