- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 3 weeks ago by GVI Forex 2.

-

AuthorPosts

-

February 18, 2024 at 10:49 am #1723

USDJPY – Week Ahead

Yen is losing it’s ground last 7 weeks, with some sudden waves of strength here and there, mainly coming from Japanese officials blubber (seems to me that they just want to keep it steady and slow – the decline) .

Resistances at: 150.900, 151.950 and target one in 154.000 area.

Supports at : 150.100, 149.900, 148.800 and the last one at 148.450

Major levels of interest right now are Supp 149.900 and Res 150.900

Not much data in coming week, but check it always in Economic Calendar

February 17, 2024 at 11:06 pm #1719February 17, 2024 at 9:20 pm #1718

February 17, 2024 at 11:06 pm #1719February 17, 2024 at 9:20 pm #1718Elvira Nabiullina, Bank of Russia representing President Putin VS Janet Yellen, US Sec of the Treasury representing President Biden

• Says leaders see value of tapping ‘economic value’ of assets

• Treasury chief also urges House to pass aid bill for UkraineYellen had lunch with ECB President Christine Lagarde Monday in Washington and met with German Chancellor Olaf Scholz last week alongside President Joe Biden.

“These are topics I’ve discussed,” she said. “I’m not going to elaborate on private conversations, but all of us recognize that an ongoing, committed support for Ukraine is essential.”Yellen DFiscussed Russian Asset Seizure With European Leaders Bbrg Feb 14, 2024

Oh … and lest I forget about the “on the other hand” ….“There are a range of risks involved and potential adverse repercussions, and we’re studying those very carefully and thinking through how these can be mitigated,” Yellen said

February 17, 2024 at 4:48 pm #1717honest vs truthful, cont’d …

–

trading forex raises another issue, namely that of

using people as means or as ends i.e

using others to meet one’s needssome ponderables:

– is one trader’s relationship with the market about shared goal(s) ?

— is singular trader asking what and how can the market do for me bad if not immoral ?February 17, 2024 at 4:34 pm #1716February 17, 2024 at 4:01 pm #1707EURUSD Week Ahead

Resistances at : 1.07900 , 1.08350 and 1.09250

Supports at : 1.07400, 1.07200 and 1.06950

Pattern wise, Resistance at 1.07900 should Hold, and Down move should continue…but is it going to happen like that this time ?? Well, this Down trend that started on 27.12.2023. doesn’t have the usual angle for it…although it is very similar , still…makes me cautious…

1.07900 is The Major point right now, as break of it would lead the pair straight to 1.09250 , even 1.09400 . Mind you, we would still be in Sell mode !

Now let’s talk about the Ideal development – Res at 1.07900 holds it’s ground – we have a sharp drop to 1.07 area and continue down , with the 1.05600 in cross hairs.

So let’s see how it develops on Monday….

February 17, 2024 at 1:24 pm #1703

February 17, 2024 at 1:24 pm #1703Any politically motivated act , that undermines International Laws is plain Wrong.

It is one thing to confiscate a property of a known criminal , Dictator and such, but a country’s CB funds….that is a Pandora’s box , and it is open wide now…

There are procedures that MUST be followed , or we’ll have a world of lawlessness , where the one with the biggest club is always right, without any chance for small countries to survive.

International Court has to be the place to settle such issues….Sue them ffs, and if found guilty , rip them off…

Politicians just follow the inertia of the moment, love the publicity that it brings them and happily share their so “wise” thoughts over social media. Clowns that rule….

I totally agree that Russia has to pay for the mayhem and suffering they induced on Ukraine , but it has to be done through the proper channels .

Everything is allowed in the war, but actions like this one will spill all over….If they can do this to them…OMG , what are they going to do to me…that is the question to be asked….

February 17, 2024 at 1:05 pm #1702Elvira Nabiullina, Bank of Russia

–

“Essentially, (confiscation) is a breach of the basic principles of central bank reserve protection,” Nabiullina said. “In international law, this is one of the key, basic principles of immunity of central bank assets from coercive measures of seizure.“In our view, deviation from this principle, will lead to the, albeit gradual, undermining of the system of international finance and the position of reserve currencies in the world.”

Confiscating Russia’s assets would send negative signal, says central bank Reuters, February 16, 2024

February 16, 2024 at 11:04 pm #1701who is jamie dimon

–

JPMorgan reported $49.6 billion of net income last year, beating its own record set in 2021.

That marks a higher annual profit than any other firm in US banking history, per Bloomberg.

The bank attributed the record results to a surge in interest income as rates rose through 2023.

a Jamie Dimon keeps winning. JPMorgan just booked a bigger annual profit than any US bank in history.a celebrated and – maybe envied – banker

February 16, 2024 at 10:50 pm #1700February 16, 2024 at 10:16 pm #1699connected ?

–

Jamie Dimon believes U.S. debt is the ‘most predictable crisis’ in history—and experts say it could cost Americans their homes, spending power, and national security – Fortune 11/02/202412:10 PM Fed’s Daly: “Navigating Geopolitical Turbulence and Domestic Uncertainty”

Don’t know who’s jamie dimon and just read the name here a few times but nevertheless… That’s why I said… keep buying paper… if US markets lose anymore of their credibility then the world is headed for even more geo-political turbulence…

February 16, 2024 at 9:57 pm #1698February 16, 2024 at 8:44 pm #1697February 16, 2024 at 8:44 pm #1696February 16, 2024 at 7:21 pm #1689February 16, 2024 at 6:54 pm #1688February 16, 2024 at 6:35 pm #1687and markets zzs

–

Three rate cuts in 2024 is a ‘reasonable baseline,’ San Francisco Fed President Mary Daly saysFed’s Daly says patience is needed to finish the job on inflation – By Greg Robb

February 16, 2024 at 5:37 pm #1686Our friends @GTWO3 are looking for EUR/JPY to turn lower from the 162.00 area as the rally from 12/27 is short covering rather than new buyers …

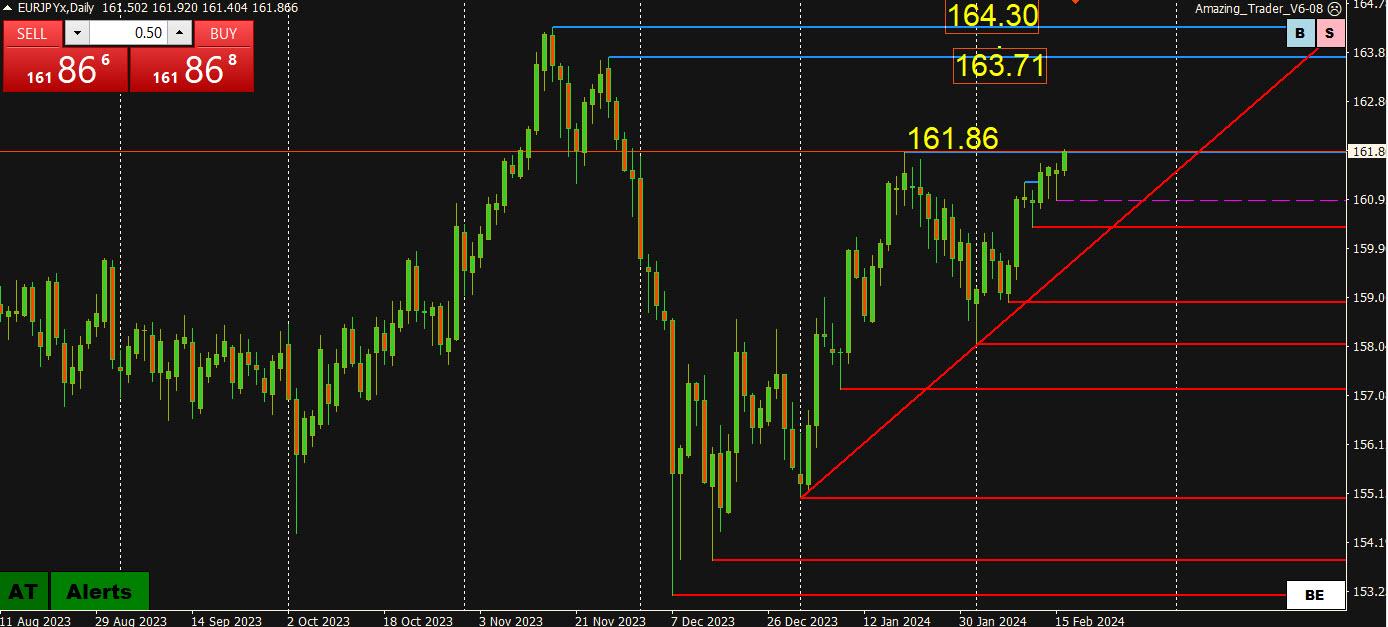

February 16, 2024 at 4:57 pm #1685EURJPY Daily Chart

Testing res at 161.86

Question is can EURJPY make a run at…

Key res 163.71 and 164.30

To do so, either USDJPY would need to move sharply higher, EURUSD would need to move sharply higher, a combination of the two or EURUSD would need to lag a sharp move up in USDJPY. It’s simple algebra.

Whatever the case, given broader USD trends, it would probably take JPY weakness for the key EURJPY resistance to come into play.

February 16, 2024 at 4:27 pm #1684 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View

XAUUSD 4-Hour Chart

XAUUSD 4-Hour Chart