- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 3 weeks ago by GVI Forex 2.

-

AuthorPosts

-

February 19, 2024 at 3:58 pm #1769February 19, 2024 at 3:54 pm #1768February 19, 2024 at 3:32 pm #1766February 19, 2024 at 3:21 pm #1765February 19, 2024 at 3:11 pm #1764February 19, 2024 at 1:57 pm #1760

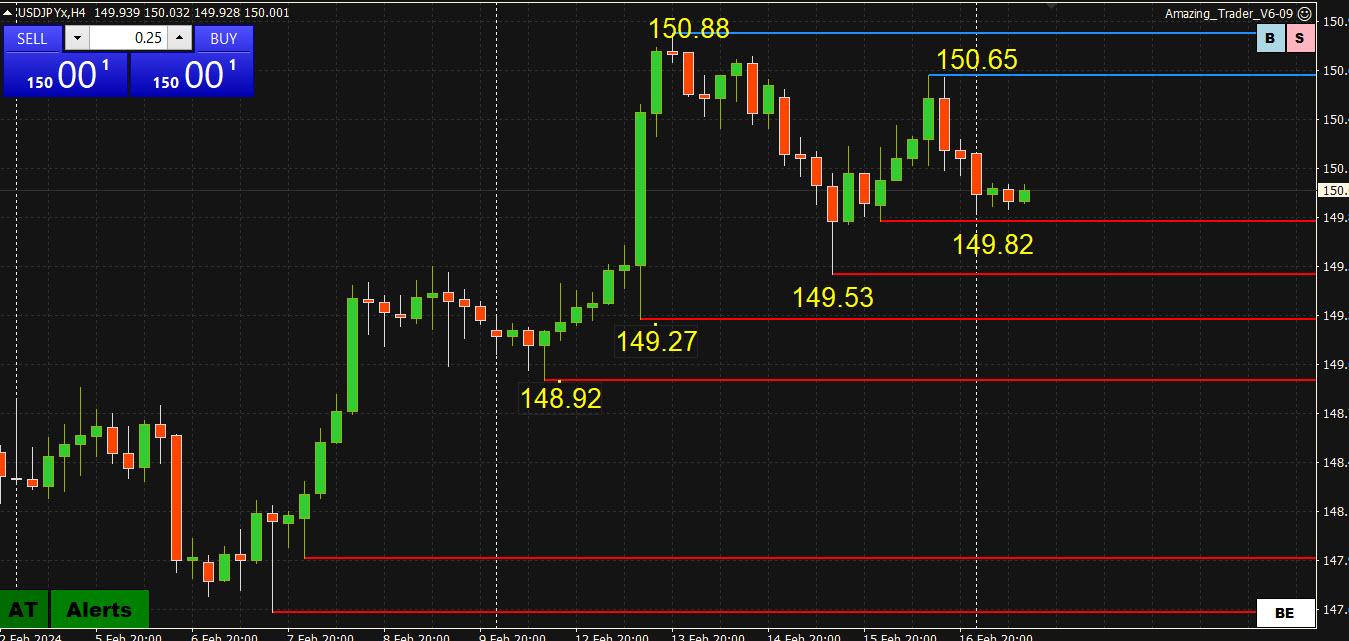

USDJPY 4 Hour Chart – Uptrend consolidating

150.00 is the bias-setting level going forward.

4-hour Levels are very clear

Sup: 148.92/149.52/149.82

Res: 140.65/150.88

Note, USDJPY tends to be most sensitive currency to moves in US bond yields

Scross down the forum to see USDJPY analysis from ForexCycle

February 19, 2024 at 1:25 pm #1758February 19, 2024 at 1:13 pm #1756EURUSD

From yesterday’s Week Ahead :

EURUSD Week Ahead

Resistances at : 1.07900 , 1.08350 and 1.09250

Supports at : 1.07400, 1.07200 and 1.06950

Pattern wise, Resistance at 1.07900 should Hold, and Down move should continue…

They came, they touched and they bumped ( 1.07894)

We need it to go through 1.07500 to confirm the pattern and continue down.

Let’s see how it’s played…

February 19, 2024 at 11:44 am #1750

February 19, 2024 at 11:44 am #1750gooddy gooddy … just like the FED likes it:

–

CNBC Daily Open: Fears over yet another hot inflation gauge

February 19, 2024 at 11:37 am #1749February 19, 2024 at 11:33 am #1748sofar quiete on the trading front

–

Trump says truckers boycotting driving to New York City are great patriotsFebruary 19, 2024 at 10:45 am #1747This article is worth trading as it covers the week ahead

Morning Bid: China markets look like they need another holiday

February 19, 2024 at 2:52 am #1745USDJPY Analysis: Uptrend Continues, Resistance and Support Levels

The USDJPY pair is currently within a rising price channel on the 4-hour chart, indicating that the pair remains in an uptrend from 145.89.

As long as the channel support holds, the upside move is likely to continue. A breakthrough of the 150.88 resistance level could potentially take the price towards the 151.90 resistance level.

On the downside, a breakdown below the channel support could bring the price to test the 149.52 support level. If the price breaks below this level, it would indicate that the upside move has already completed at 150.88, and the next downside target would be around the 147.50 area.

February 19, 2024 at 12:55 am #1744player sentiment heading into new week

–

Just one of a number of a gathering of similar takes I have read over last few days about the market:

‘Peak Euphoria’ Warning Blares as Stress Vanishes on Wall Street

(Bloomberg)…Fed officials seem sanguine about it all, and indicate that the next move is a cut, just further out. … “A hot CPI woke markets up to the fact that risks are two sided. But still, mindsets are hard to change, as most people anchor to recent history,” the firm’s team including Christopher Metli wrote in a note.

Technically, there a number of instruments in the “overbaught” territory. In itself not a strong sell signal, just a prescient one without a precise timing.

February 18, 2024 at 11:46 pm #1743February 18, 2024 at 10:56 pm #1742 EURUSD daily chart – major trend down but consolidating

EURUSD daily chart – major trend down but consolidating1.0805 is the key level as it appears not just on the daily but on multipole time grant charts

There is a trendline at 1.0793 but 1.0805 is the key on top.

Only a firm break and 1.08+ then being established would suggest the low (1.0696) is ion for now.

Take your pick of support within 1.07-1.98 with 1.0730 being the only one worth noting ahead of the key low.

February 18, 2024 at 9:43 pm #1738February 18, 2024 at 9:42 pm #1737JP// Wanna know why USA is the greatest economic superpower in the world…

Answer: the FED. That organization is the one who took responsibility for you and by putting money into your pocket, they have given you such a good life… Do you appreciate that?

Go along… according to the long term financial visions of the harbingers of sound economic policy…

Think Modi is the reason for India’s growth story?… No… it is RBI… they were around and working on the long term visions for the country long before Modi entered politics…

February 18, 2024 at 9:18 pm #1735Gold

Looking as ready to fly again – Support at 1985.00 held its ground , and all eyes are targeting Resistance at 2018.00, followed by 2055.00, break of would lead the way to previous high at 2145.00.

Watch your 6 , as there is an abyss bellow 1985.00 …

And for those that know:

Gold

Always believe in your soul

You’ve got the power to know

You’re indestructible

Always believe in, because you are

Gold

Glad that you’re bound to return

There’s something I could have learned

You’re indestructible, always believe inWho doesn’t get it…don’t even ask….

February 18, 2024 at 8:58 pm #1734

February 18, 2024 at 8:58 pm #1734February 17, 2024 at 1:24 pm #1703

bobby//I wonder who scared the piss out of you… it is safer to watch criminals as a science, like that it might keep you out of harms way and save the lives of others until help arrives…

—————————————————————–

February 17, 2024 at 4:34 pm #1716

JP//it is not required to have an opinion on your posts, never had one and never will… there’s a saying don’t judge others unless you want them to judge you.

—————————————————————–

February 17, 2024 at 4:48 pm #1717JP//always try to be helpful…

—————————————————————–

February 17, 2024 at 11:06 pm #1719

JP//90-day paper is the best thing to buy irrespective of yields, rather that buying them for a profit motive it’s best to save your country which has given you so much…

read my below quote,… hehe =)

Be grateful, buy 90-day paper…

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View