- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 3 weeks ago by GVI Forex 2.

-

AuthorPosts

-

February 23, 2024 at 3:42 pm #1994February 23, 2024 at 3:37 pm #1993February 23, 2024 at 3:33 pm #1992

bobby 1:41 / tol game these frothy puppies is replete with risk

–

to mitigate risk to your wallet u d have to be a “whale” with tons of margin (haha) or collusionability with your say 3 selections out of the “7 magnificant”s or … a very intimate insight into money in or out flowsotherwise it is good luck peasant

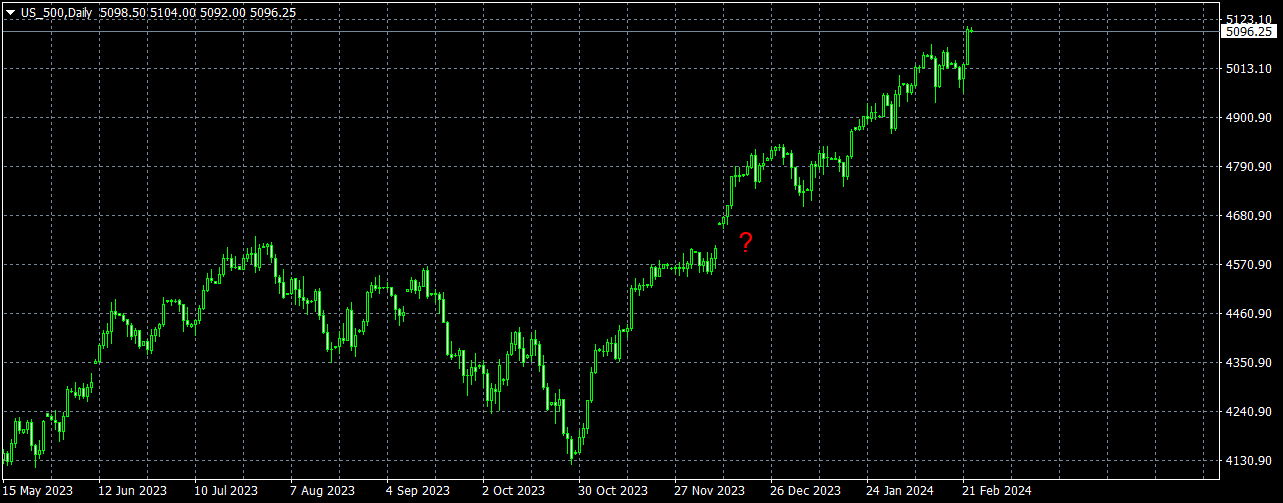

February 23, 2024 at 3:14 pm #1991February 23, 2024 at 3:09 pm #1990February 23, 2024 at 1:41 pm #1988NVIDIA – Whole planet talks about it….it is Viral…it is Hysterical

Even my wife asking about it ( and she couldn’t give a **** about it ) …my younger daughter asks about it ( at least she is just worried if the price for her next generation graphic card will go up )

Till yesterday it was Gold – half a planet bought it on the top….

Now the other half will buy NVIDIA stocks …on the top

Me….I don’t give a flying ****….EUR goes up, EUR goes down…that makes my day…

February 23, 2024 at 12:01 pm #1981

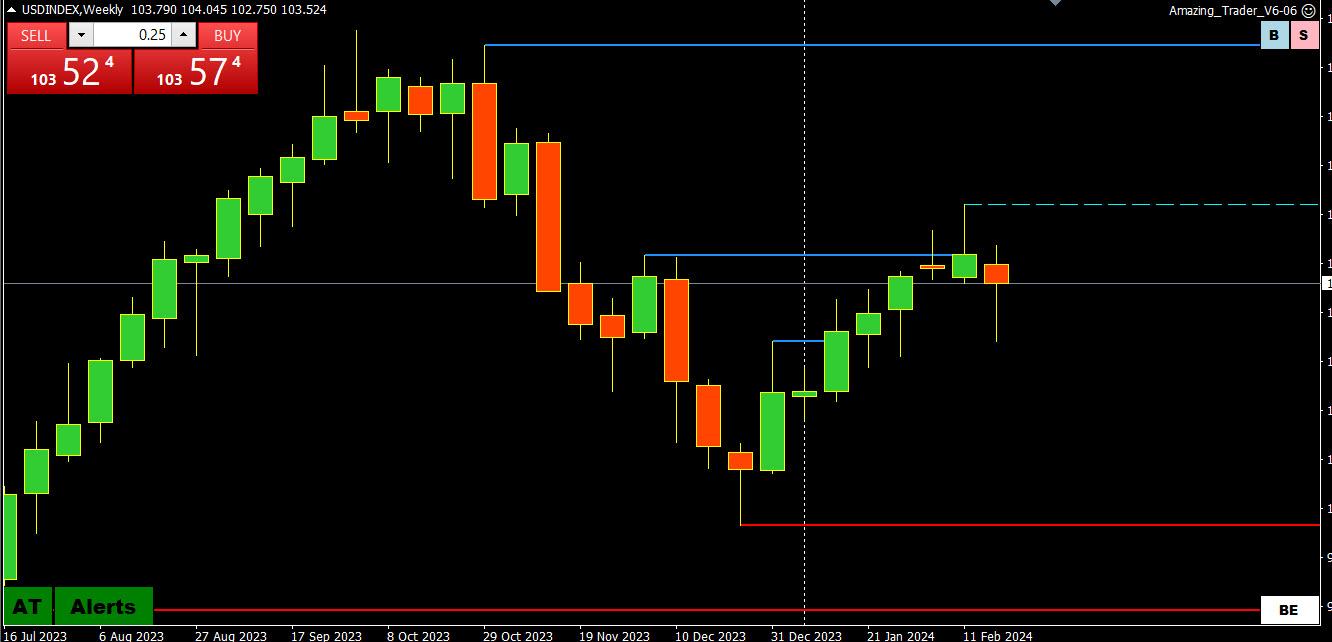

US Dollar Index Weekly Chart

Barring a burst higher, the US Dollar Index looks set for the first down week for the year (and in 8 weeks) although trading well off yesterday’s low.

By itself, this does not mean the dollar is about to reverse but does suggest the dollar has lost some steam.

in any case, those who follow me know I am always on the lookout for patterns and here is one that appears will be broken.

February 23, 2024 at 11:49 am #1979hear ye hear ye peasant

—

Bloomberg.com

Fed’s Harker Cautions Against Cutting Interest Rates Too Soon

Federal Reserve Bank of Philadelphia President Patrick Harker said that it will likely be appropriate to cut interest rates this year,…Federal Reserve Bank of Philadelphia

Economic Outlook: We Are in the Final Mile of the Marathon

Good afternoon! It is a pleasure to be back with you once again, and I thank today’s organizers and sponsors for making it all possible.MarketWatch

Fed’s Harker: Don’t look for any interest-rate cuts ‘right now and right away’

The Federal Reserve is getting close to cutting interest rates but a move in the near-term is unlikely, said Philadelphia Fed President…February 23, 2024 at 11:16 am #1978February 23, 2024 at 11:00 am #1977February 23, 2024 at 9:22 am #1975February 23, 2024 at 5:21 am #1971AUDUSD Breaks Free: Uptrend Resumption or False Dawn?

AUDUSD has clawed its way back from recent lows, breaking above the confines of the falling price channel on the 4-hour chart. This bullish breakout raises questions: Has the downtrend truly ended, or is this just a temporary reprieve?

Uptrend Resumed: Channel Breakout as Confirmation?

Channel Breach: The break above the falling channel, established from the 0.6870 high, signifies a potential shift in momentum. This suggests a possible end to the downtrend and the start of a new uptrend from the recent low of 0.6442.

Potential for Continued Rally:

Resistance Levels: If the uptrend continues, the next target for AUDUSD could be the 0.6624 resistance level. Surpassing this hurdle would open the door for further gains towards 0.6700, solidifying the bullish momentum.

Support Levels to Watch for Pullbacks:

Initial Support: The initial support to watch is at 0.6532. A breakdown below this level could indicate a loss of momentum and a potential pullback towards the 0.6500 area.

Key Support: A further breach below 0.6500 could trigger a decline towards the previous low of 0.6442, potentially signaling a resumption of the downtrend.Overall Sentiment:

The technical picture offers a mixed outlook for AUDUSD. The breakout from the channel suggests a potential trend reversal, but confirmation will come from holding above the 0.6532 support and pushing towards the 0.6624 resistance. Monitoring the price action around these key levels will be crucial in determining the pair’s next move.

Disclaimer: This analysis is for informational purposes only and should not be considered as investment advice. Please conduct your own research before making any trading decisions.

February 23, 2024 at 12:01 am #1970February 22, 2024 at 11:54 pm #1969February 22, 2024 at 10:27 pm #1968Monedge tah would be FED’s no. 2

–

US Fed official warns of inflationary risk of over-consumption

Washington (AFP) – A senior Federal Reserve official said Thursday that the US central bank will likely start cutting interest rates “at some point this year,” but warned against the potentially inflationary effect of over-consumption.February 22, 2024 at 7:36 pm #1967Gold

Resistance at 2050.00 and 2070.00

Supports at 1990.00 and 1900.00

There is a chance that 1990.00 might hold for another attempt for Highs, but overall pattern suggests that Gold is destined to go in a correction phase.

It is more likely that we’ll first see 1900.00 then new high.

For those that trade CFD’s this might be an opportunity to go Short.

February 22, 2024 at 7:20 pm #1966

February 22, 2024 at 7:20 pm #1966

USDJPY 4-Hour Chart: Key resistance looms

Looking at this chart USDJPY has been in a 149.53-150.89 range for nearly 2 weeks

With rising red lines, momentum is swinging upwards but faces the key resistance level (recent high) at 150.89

A move through 150.89 would leave little until the major 151.90 level

Expect support on dips as long as 150+ trades

Beware as always of verbal intervention with the major level looming above..

February 22, 2024 at 7:00 pm #1963Of note – another Fed official stated today that he feels it is too early to cut rates. Also – If I caught this correctly, A company named Abbvie, a pharmaceutical company, just received $80 billion in M&A financing on offer, and was initially only looking for $14 billion. That is what is called a grand slam and speaks to the fact that money is continuing to move and investors are not in as much fear of risk as some might think at present in my view. Something to consider with relation to currencies that tend to ride risk and the climate overall in my view

February 22, 2024 at 5:14 pm #1959USDJPY

With bond yields edging up and BoJ dragging its feet there are probably a lot of carry trades being put on

With Nikkei soaring to record highs, there seems no rush for the BoJ unless it wants to replace verbal intervention with a rate hike hint risk comment.

Markets will soon start looking ahead to a hot PCE inflation release next week, which is also on month end.

February 22, 2024 at 4:17 pm #1956 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View