- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 3 weeks ago by GVI Forex 2.

-

AuthorPosts

-

February 27, 2024 at 2:43 pm #2117February 27, 2024 at 2:39 pm #2116February 27, 2024 at 2:34 pm #2115February 27, 2024 at 2:10 pm #2112February 27, 2024 at 1:26 pm #2100February 27, 2024 at 1:19 pm #2099February 27, 2024 at 1:16 pm #2098February 27, 2024 at 1:09 pm #2097February 27, 2024 at 1:02 pm #2096February 27, 2024 at 12:30 pm #2095

HEADS UP

US durable goods are to be reported today

The headline is forecast to fall sharply due to Boeing’s issues

So watch the ex-transport number instead as that is forecast to be up in case the market overreacts to the headlkine drop

See our Economic Calendar

February 27, 2024 at 11:44 am #2094February 27, 2024 at 11:37 am #2093…”Imagine if one of the major currencies had moves like this?”…

–

degenerate traders’ heart rate and bloodpressure needles would be past the red zone in anticipation of “authorities” potential intervention against “rapid” price changes. (i.e. animal sprits gone wild)why would “authorities” take a skewed view of such price moves in one of the majors but not in btc

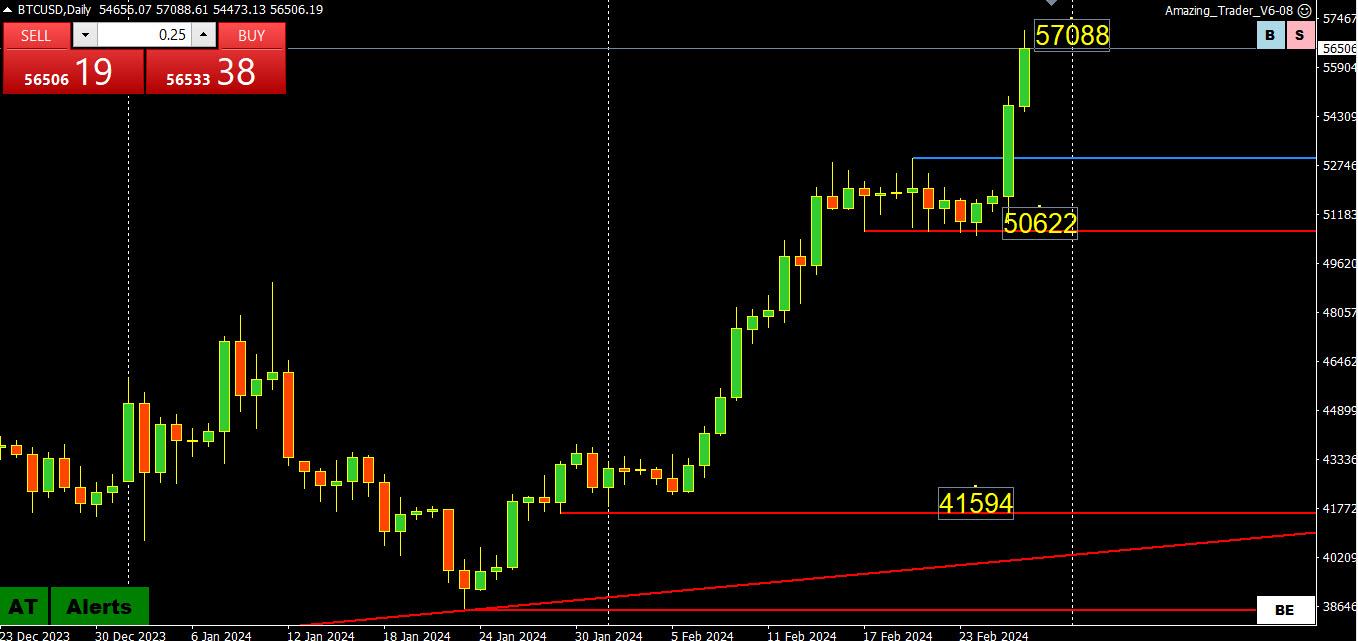

one might ask …February 27, 2024 at 11:13 am #2092February 27, 2024 at 11:06 am #2091BTC Daily Chart

Bitcoin continues to make its relentless move higher, leaving the record 68915 level as the only one left on the upside.

To be clear, I do not trade cryptos but it is hard to ignore its meteoric rise this year, up over 12% in 2 days and around +35% this year. Imagine if one of the major currencies had moves like this?

So, I will just post the chart and follow up with a monthly chart.

February 27, 2024 at 10:07 am #2090USDJPY 1-Hour Chart

Blue lines dominating, indicating some shift in risk to the downside or more of a two-sided market after another failure to take out 150.89

However, price action remains contained while within 149.53 and 150.89 where 150 should continue to set the bias

Supports on either side of 150: 149.93-150.01-150.12

150.54 needs to hold on top to keep the focus on 150 and away from 150.84-89

Why did USDJPY fall today?

Technicians will cite another failed run at 150.89 and market positioning that is heavily short JPY, both vs. the USD and on its crosses

Those who say news matters will cite the release of a smaller-than-expected fall in annual Japanese inflation in a market that is hypersensitive to any data that might prompt the BoJ to raise interest rates.,

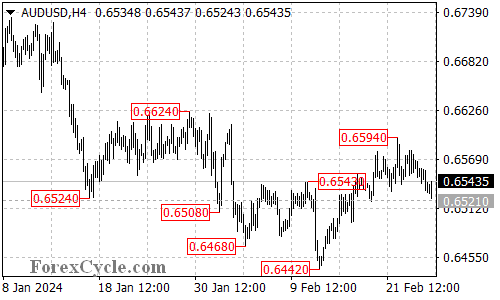

February 27, 2024 at 5:12 am #2089AUDUSD Analysis: Sideways Move Continues, Resistance and Support Levels

The AUDUSD pair has been moving sideways within a trading range between 0.6521 and 0.6594.

As long as the 0.6521 support level holds, the pullback from 0.6594 could be seen as corrective consolidation for the uptrend from 0.6442. Another rise is still possible after the consolidation.

The initial resistance level is located at 0.6555. A breakthrough of this level could trigger another rise to test the 0.6594 resistance level. A breakthrough of this level would aim for the 0.6624 resistance level.

On the downside, a breakdown below the 0.6521 support level would indicate that the upside move has already completed at 0.6594. In this case, another fall towards the 0.6442 previous low could be seen.

February 26, 2024 at 10:47 pm #2088NZDUSD: This is an earlier recap

NZD witnesses a quick decline as we approach this week’s central bank decision & press conference.📉

NZD falls 0.50% within the first three hours of trading and 0.65% against GBP. Investors voice concern over the struggling New Zealand economy while inflation remains higher than other regions Economists advise RBNZ to opt for a “harsh” landing scenario to bring inflation down to its 2% target.

28 Feb 2024 Wed 2:00pm. February Monetary Policy Statement and Official Cash Rate (OCR) Details.

See our Economic Calendar

February 26, 2024 at 8:48 pm #2087NZDUSD 1-hour chart

Blue lines dominate, indicating risk on the downside.

Key support is clear at .6156-61, which needs to hold to prevent a further push to the downside. Should the support zone give way then .6150 (psychological) and .6128 are next.

On the upside, .6200 is the key resistance, minor at .6185 ahead of it.

Underperformers

NZDUSD and AUDUSD were the underperformers today,

February 26, 2024 at 7:43 pm #2086AnonymousFebruary 26, 2024 at 7:05 pm #2080the promise ?

–

A shutdown is approaching. Biden and Johnson’s lack of relationship isn’t helping.

https://www.politico.com/news/2024/02/26/biden-johnson-government-funding-ukraine-00143206 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View