- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 3 weeks ago by GVI Forex 2.

-

AuthorPosts

-

February 26, 2025 at 11:47 am #20122

A look at the day ahead in U.S. and global markets from Mike Dolan

Hit by draining consumer and business confidence amid uncertainty about Washington’s economic policies, Wall Street stock indexes are all tripping into the red for 2025 – with the slide stalling for now, awaiting megacap Nvidia (NASDAQ:NVDA)’s earnings today.

The latest sideswipe from main street has unnerved stock, bond and credit markets across the piece.

Morning Bid: Confidence-sapped stocks find foothold as Nvidia awaited

February 26, 2025 at 11:43 am #20121US OPEN

NQ bid ahead of NVIDIA earnings; USD gains & copper benefits on Trump tariff investigations.

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses gain and currently reside at highs; US futures also stronger with NQ outperforming ahead of key NVIDIA results.DXY attempts to claw back recent losses, EUR/USD lingers around 1.05.

USTs are off lows but remain in the red while EGBs inch higher.

Crude choppy, gas subdued, but metals hold a positive bias as the complex digests Trump tariff investigations into copper.

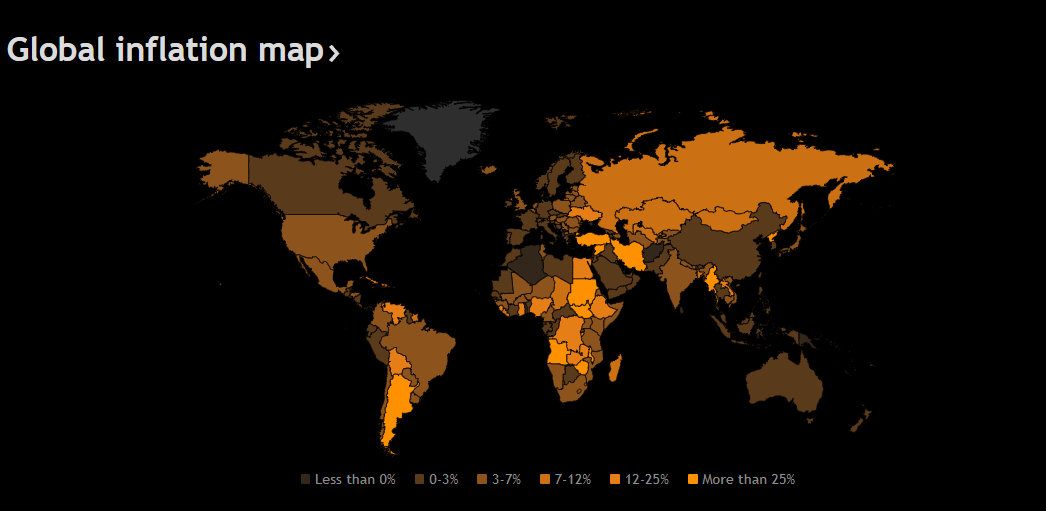

February 26, 2025 at 11:26 am #20120GVI Forex 11:20 “Stagflation”

– a dirty word or a nightmare scenario for a central bank ?

How about a long period of galloping prices (high inflation) , an economic depression combo and wild opportunities for profits ?Stagflation is a pretend mystery of the conventional macro-economists and central banker policymakers because it ultimately demonstrates the failure of their fiats and publicly stated economic objectives.

Bottom Line

THE ultimate question is how to position for profits from the consequences of crapping fiat and galloping interest.February 26, 2025 at 11:01 am #20119February 26, 2025 at 10:52 am #20118February 26, 2025 at 9:59 am #20113EURUSD DAILY CHART – -1.05 trading pattern

1.05 level has traded for 5th day in a row (and 7 out of past 9 days)

NOTE 1.05 is one of my key pivotal levels. The longer the pattern around a pivotal level goes on the greater the risk of a directional move once it ends.

Current range -1.0400/50-1.0530/34

February 26, 2025 at 9:47 am #20112Using my platform as a HEATMAP

Dollar trading a touch firmer bu

EURUSD continues its trade around 1.05

USDCAD remains bid awaiting the March 4 tariff deadline

AUDUSD slips after CPI raises talk of another rate cut

Stocks up a touch waiting for Nvidia earnings after the close

Trump holds first cabinet meeting, watch for headlines

February 26, 2025 at 9:42 am #20111Month-end FX hedge rebalancing expectations

Banks are releasing their month end rebalancing expectations for February and there is a consensus for USD demand.Deutsche Bank’s model signals for February, based on current equity performance, suggest a reasonable shift toward USD buying. The largest relative outperformance is most pronounced versus European equities and therefore points towards EUR/USD supply.

In combination with the standard corporate month-end flows being more USD positive, sales of EUR/USD are one of Deutsche’s higher conviction views for the week ahead from a flow prospective.

The bank also notes how this is the first time in a while that the U.S. equity underperformance has been versus all of the rest-of-the-world indices that they track. This adds to its more bullish USD bias in the short term, especially due to the lack of other news flow for the week ahead.

Deutsche also highlights its seasonality charts and a sizable selling of NZD/USD on the day before month end, February 27, of 0.58% on average over the last 10 years. AUD/USD also shows a skew towards average selling on the month end date itself (February 28) and the day before.

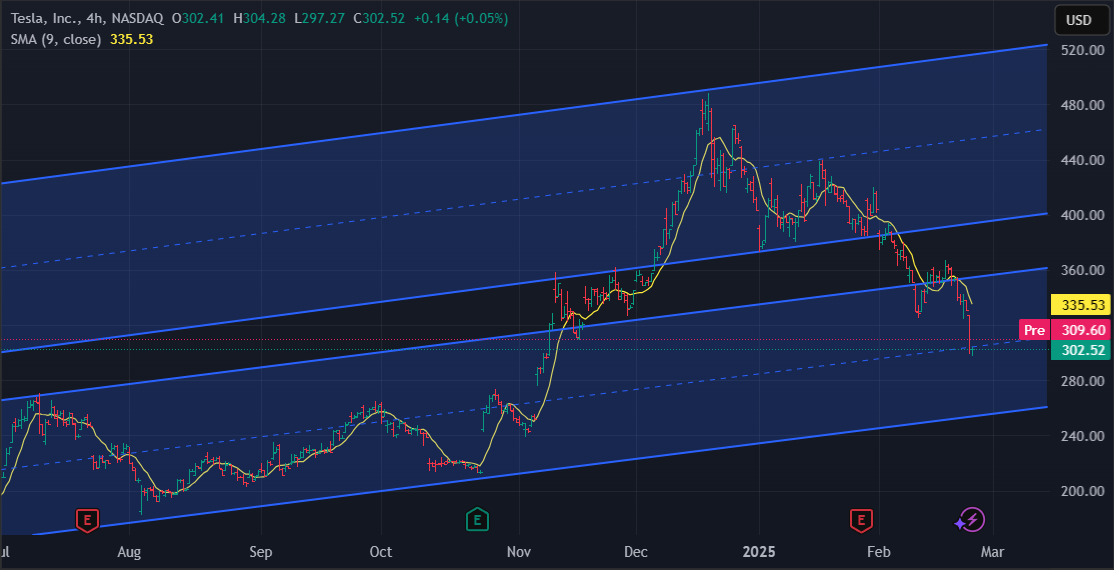

February 26, 2025 at 9:37 am #20110February 26, 2025 at 9:30 am #20109Tesla – TSLA

Something to spice up this dull EUR morning…

Tesla Has Lost $400 Billion In Value During Trump Presidency. What the Charts Say Comes Next

Data Shows Europe Sales Are Down 45%

Charts are clear – Tesla tried to hold on 350 level, but banana slide was too slippery for it.We are looking at 255 as a potentially base building level, unless….Tesla just slides through it as well.

Some support might be seen between 295 and 310, but resistance at 325 is looming dangerously.

For those of us that are endlessly in love with V6 Turbo engines it is a very pleasing development, but those of you that hold this losing stock is painful…I know…time to change your driving habits…

February 25, 2025 at 11:20 pm #20108

February 25, 2025 at 11:20 pm #20108Stagflation is a dirty word in a central bank’s handbook. Given recent U.S. economic growth concerns while inflation remains sticky, it is a good time to take a closer look at stagflation and what it might mean for the markets.

Is Stagflation a Risk for the U.S. Economy and How Would Markets React?

February 25, 2025 at 9:35 pm #20095Out a bit earlier… giving EURUSD some support as market starts to factor in the Russia-Ukraine war end game

February 25, 2025 at 9:18 pm #20094NAS100 DAILY CHART – Can it avoid an outside month?\

NAS100 needs to stay above 20834 to avoid an outside month. This is the key level into month end as a close below it would produce an outside month key reversal.

Back above 21340, at a minimum, is needed to slow the risk.

The market may take a breather on Wednesday awaiting Nvidia earnings after the close.

February 25, 2025 at 9:14 pm #20093February 25, 2025 at 9:12 pm #20092XAUUSD 4 hOUR CHART – No outside week

I posted this earlier

Looking at this chart and trying to be objective, it has taken a lot of effort just to extend the record high from 2942 to 2956.

This would normally suggest a tired trend but given the failure to follow through on retracement attempts, it is hard to suggest anything but a pause until the pattern changes.

In this regard,

– Would need to establish 2950 as support to send a signal for a run at 3000–

– Would need to move below 2878 (last week’s low) to break the 9 week up pattern,

Update: Low so far 2888 but would need at least to regain 2916+ to slow the retracement risk and 2945+ to negate it.

February 25, 2025 at 9:06 pm #20091USDCAD 4 HOUR CHART Tariff Roulette

Clearly an underperformer along with AUD and NZD weaken vs the USD in a risk off market as it continues to feel the impact of Trump’s tariff on track comments on Monday..

Above 1.4300-05 exposes 1.4340-75.

Keeps a bid while above 1.4200-40, stronger if above 1.4300-05

Keep an eye on headlines as the March 4 tariff deadline nears.

February 25, 2025 at 8:21 pm #20090February 25, 2025 at 8:13 pm #20089February 25, 2025 at 8:08 pm #20088February 25, 2025 at 8:03 pm #20087XAUUSD – Gold

Gold came very close to the support at 2880.00

Now I have seen some crazy moves in my carrier, but never really an instant come back from a dive like this.

It is possible of course, but Pattern wise – if tomorrow Gold hits straight up again, and doesn’t break to the new high , it will be just mere dying fish reaction – and then it will start downwards.

It was overdue for a decent correction for quite some time, so let’s see how it develops.

Supports: 2880.00, 2805.00 & 2735.00

Resistances: 2915.00, 2935.00 & 2955.00

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View