- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 3 weeks ago by GVI Forex 2.

-

AuthorPosts

-

March 7, 2024 at 12:26 pm #2638March 7, 2024 at 12:23 pm #2637March 7, 2024 at 12:19 pm #2636March 7, 2024 at 12:17 pm #2633March 7, 2024 at 12:13 pm #2631March 7, 2024 at 12:10 pm #2629March 7, 2024 at 12:08 pm #2628March 7, 2024 at 12:04 pm #2627

EURUSD

Supports at 1.08850 1.08700 and 1.08300

Resistances at 1.09100 1.09250 and 1.09350

Now it all comes to the ECB later on.

If we just put aside that little fact, what is obvious is the Ascend Angle from the February 12th – it is Corrective and not exactly Bullish.

It might prove exactly right after ECB decision …we’ll see – anyways I do not trade just prior to such a big events ( even when I know they are hollow ones – but maybe that is even more dangerous )

March 7, 2024 at 11:55 am #2624March 7, 2024 at 11:51 am #2623March 7, 2024 at 10:57 am #2620

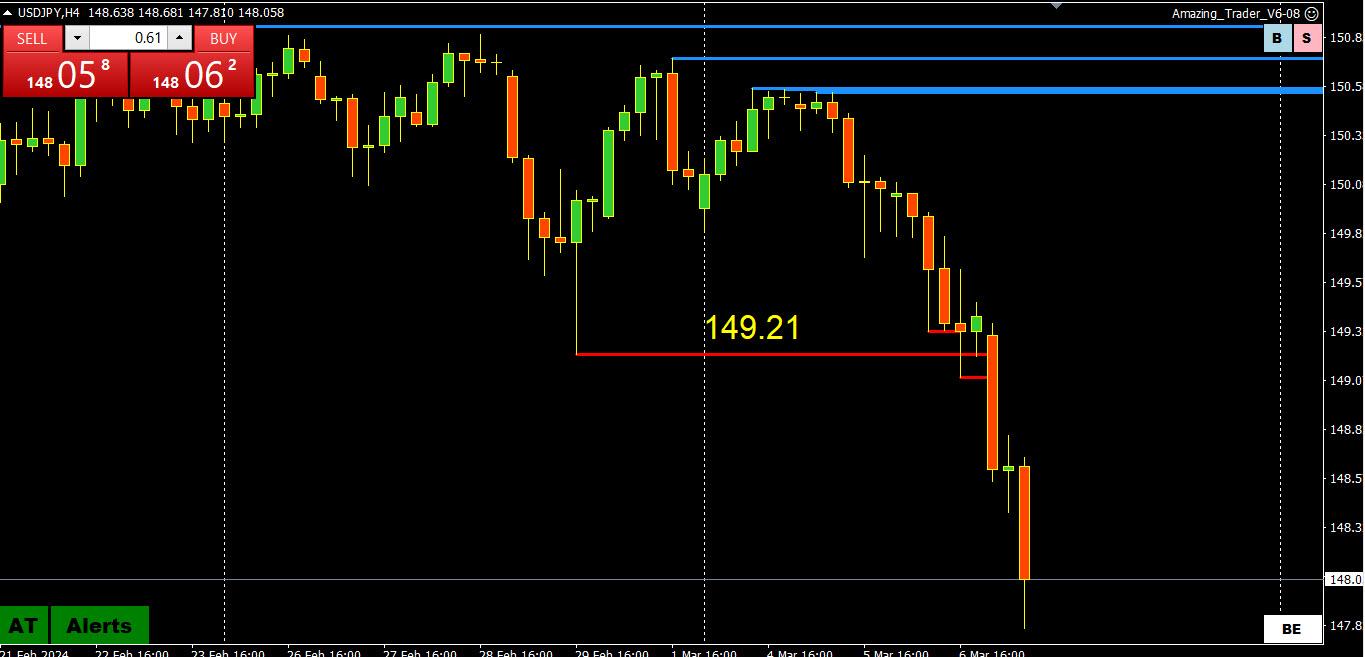

USDJPY 4-HOUR CHART — THE INVISIBLE HAND WINS

Those following my posts have seen me use the term “invisible hand” to describe some force preventing USDJPY from breaking the 150.89 level.

Looking at this 4-hour chart shows (note 3 lower AT blue lines on top) a currency running out of steam.

When you look at my charts take notice when you see 3 higher red or 3 lower blue lines (using The Amazing Trader = AT) as it is often followed by an acceleration of a move in the direction of the lines (applies to any time frame).

March 7, 2024 at 10:48 am #2619

USDJPY DAILY CHART — THE DEVIL STRIKES BACK

An old-time Global-View member used to refer to the YEN as “The Devil” as it has ruined more trading careers than any other currency.

The YEN may have gotten its “Devil” nickname from this debacle: Rise and Demise of a Hedge Fund or How to Blow up Billions in One Year

I am posting a daily chart to show the next key support level at 147.61 but in the absence of any nearby resistance after the sharp fall, look for 148 to replace 150 as the new pivotal level. Below 147.61 shows a void until 145.90.

Back above 148.91-149.21 would be needed to negate the risk and shift the risk back to 150.

I will post a 4-hour chart next to show the top was pretty clear.

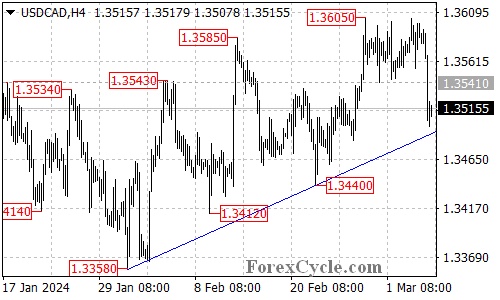

March 7, 2024 at 2:48 am #2618USDCAD Technical Analysis: Key Levels and Potential Scenarios

USDCAD has recently breached below the critical support level of 1.3541 and is currently confronting the support provided by the ascending trend line on the 4-hour chart.

A successful breakthrough below the trend line support may initiate additional downward momentum, potentially leading to a test of the 1.3440 support level. Subsequent downside movement could target the 1.3360 area.

At present, the initial resistance is situated at 1.3550. Only a decisive break above this resistance level has the potential to trigger another upward movement, aiming to retest the previous high resistance at 1.3605.

March 7, 2024 at 2:32 am #2617March 7, 2024 at 1:42 am #2616JP – I have been waiting for something like this. You bet he got the terms he wants or they will lose their pants and maybe more considering things those brass don’t want people to know. His team isn’t entirely dumb so there must be some potential for a turnaround ala corporate raider style but salvaging the ship with a new twist or three in the future model. Somebody(s) is getting fired and somebody else(s) is getting a different parachute than they expected a year ago. Could be worth a look actually if the new team, and there will be one, demonstratively vocalizes a new immediate and 10 year plan. We minnows can buy the stock at a discount if we like the music. Regardless nobody in power wants a bank failure right now.

March 7, 2024 at 1:28 am #2615Thursday – ECB Decision and Fed Chair Powell talking – Economic Calendar

March 7, 2024 at 12:37 am #2614March 7, 2024 at 12:32 am #2613monege / NYCB + lipstick for the pig

–

Why private equity has been involved in every recent bank deal – cnbc… “Public markets are too slow for this kind of capital raise,” said Steven Kelly of the Yale Program on Financial Stability. “They’re great if you are doing an IPO and you aren’t in a sensitive environment.” … .. “Furthermore, if a bank is known to be actively raising capital before being able to close the deal, its stock could face intense pressure and speculation about its balance sheet. That happened to Silicon Valley Bank, whose failure to raise funding last year was effectively its death knell.”

Hahaha. what that says is that there are still incompetents at banks’ executive suites and that the one lesson from SVB has not served a cleansing and weeding process. So rubber meeting real world eventually does so.

makes me wonder what “they” promised Mnuchin in return

March 6, 2024 at 11:42 pm #2611March 6, 2024 at 11:41 pm #2610 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View