- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 3 weeks ago by GVI Forex 2.

-

AuthorPosts

-

March 8, 2024 at 12:24 pm #2697

EURUSD

Supports : 1.09000, 1.08900 and 1.08400

Resistances : 1.09400 ad 1.09550

This is an Ancient Pattern called Jumping Rabbit ( can be a Squirrel or even a Wild Cat ), that indicates two possible scenarios : Jump high and stick to the Three or Jump, miss the branch and Fall quickly.

Now it depends on the Wise Man Data :

USD Unemployment Rate

USD Non Farm Payrolls

USD Average Hourly Earnings MoM

Economic Calendar

Following the Prophecy of the I-Know-It-all Guru and some analysis by Bleeding Edge Growth Fund & We Are So Tight , We Won’t Let Your Mother In Technology Fund , followed by behaviour of my Cat, we should see 1.10150 soon enough… March 8, 2024 at 11:04 am #2696

March 8, 2024 at 11:04 am #2696

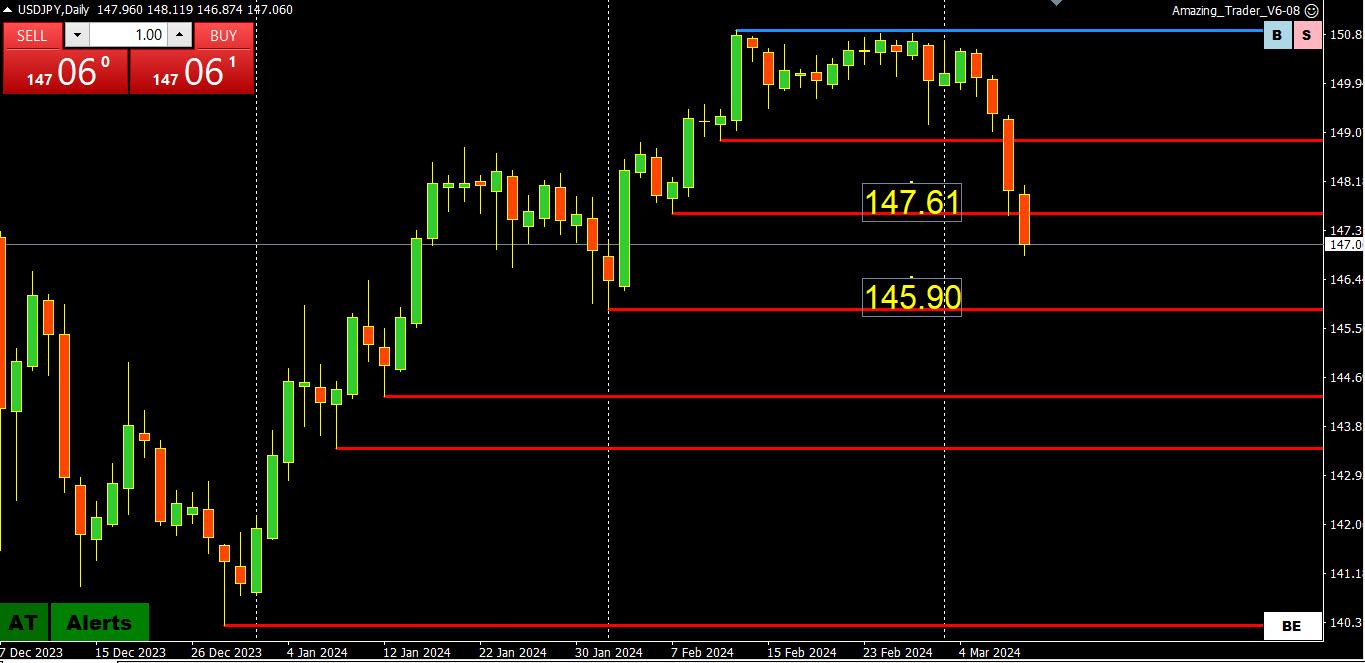

USDJPY DAILY CHART: MELTDOWN

Red AT support lines are being broken like Swiss cheese in a market likely thinned awaiting the US jobs report today.

With consolidation around 148 failing to last, the break of 147.61 leaves a void until 145.90.

On the upside, resistance is now between 147.61=148.00. Only back above 148 would deflect the risk

From the earlier Reuters article, suggests a limited USDJPY upside ahead of the BoJ meeting:

Bank of Japan (BOJ) officials have begun ramping up their hawkish rhetoric and shown increasing confidence that the Japanese economy was moving towards the BOJ’s 2% inflation target, just ahead of the central bank’s March 18-19 policy meeting.

March 8, 2024 at 10:43 am #2694March 8, 2024 at 10:26 am #2692March 8, 2024 at 9:58 am #2691March 8, 2024 at 9:34 am #2690March 8, 2024 at 8:57 am #2689EURUSD backed off on this

PARIS, March 8 (Reuters) – There was a strong consensus at the European Central Bank that interest rates will be lowered this spring, French central bank head and ECB policymaker Francois Villeroy de Galhau said on Friday, adding “spring is from April until June 21”.

March 8, 2024 at 7:25 am #2688A look at the day ahead in European and global markets from Rae Wee

The dollar’s 1% fall for the week thus far is set to be its steepest in nearly three months, and tonight’s U.S. jobs data is the next test for the greenback.

March 8, 2024 at 2:04 am #2687

USDX (US Dollar Index) Daily Chart

Why am I posting this chart if I do not trade USDX?

– The dollar sell-off was broad-based so I took a look at a composite USD index

– EURUSD makes up 57.6% of USDX and can be an indicator for this pair

The two blue AT blue lines were a sign of a shift in directional risk to the downside and you can see how this played out.

The break of 1.0332 exposed 1.0779 as the next key target, so far it has paused just above it.

Look for a pause if 1.0279 holds but only a move back above 1.0332 would negate the breakdown.

March 8, 2024 at 1:40 am #2686USDCAD Update: Recent Movement and Key Levels

USDCAD has continued its downward trajectory from 1.3605, reaching a low of 1.3451 and breaching the ascending trend line on the 4-hour chart.

Currently, the pair is testing the support level at 1.2440. A potential breakdown below this level might lead to further downside movement towards the 1.3400 region, followed by the 1.3360 area.

The initial resistance is identified at 1.3470. A successful breach of this resistance level could pave the way for a potential return towards the 1.3485 region.

March 7, 2024 at 8:58 pm #2684EURUSD Daily

Tomorrows play will heavily depend on data :

EUR GDP Growth Rate YoY & QoQ

USD Unemployment Rate

USD Non Farm Payrolls

USD Average Hourly Earnings MoM

Check the Economic Calendar

However, it is clear that Buying is the name of the game

As Long as 1.08800 holds , we are eyeing 1.10000 area.

In the case the support is lost, it can only slow down the ascent as 1.08350 should underpin the pair .

March 7, 2024 at 8:36 pm #2683March 7, 2024 at 8:09 pm #2682March 7, 2024 at 8:03 pm #2681March 7, 2024 at 6:25 pm #2680March 7, 2024 at 6:17 pm #2679March 7, 2024 at 6:13 pm #2678March 7, 2024 at 6:11 pm #2677March 7, 2024 at 6:09 pm #2676March 7, 2024 at 5:58 pm #2675

March 7, 2024 at 8:36 pm #2683March 7, 2024 at 8:09 pm #2682March 7, 2024 at 8:03 pm #2681March 7, 2024 at 6:25 pm #2680March 7, 2024 at 6:17 pm #2679March 7, 2024 at 6:13 pm #2678March 7, 2024 at 6:11 pm #2677March 7, 2024 at 6:09 pm #2676March 7, 2024 at 5:58 pm #2675 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View