- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 3 weeks ago by GVI Forex 2.

-

AuthorPosts

-

March 14, 2024 at 11:57 am #2991March 14, 2024 at 11:53 am #2990March 14, 2024 at 11:49 am #2989March 14, 2024 at 11:46 am #2988

Bobby my sister warned me lol. I run really fast, and I literally am a kung fu instructor. So I timed it and it was looking at me like (man that hooomin move quick) lol. They are stubborn. It will be back lol. I am old school Italian and my nickname when I was a fighter was …. Wait for it …. Puma. Patient but if you get me upset enough lightning strikes lol. There is no way we as traders will survive without an attitude lol.

March 14, 2024 at 11:30 am #2987March 14, 2024 at 11:27 am #2986March 14, 2024 at 11:22 am #2985Ok this is what caused the bad yen trade. I live on very nice property in California, and there are wild turkeys. They are stubborn. So the turkey and I have a long standing fight going on lol. So it distracted me while I was in Yen and lost money. So I got really peeved, understand I run really fast, so I chased the turkey up the hill, but it is fast. So I went back inside, collected myself, and hid. I caught it. I let it go. I believe we have an understanding lol. The life of a trader. Good music and a good heart helps. I let the turkey go. 😊

March 14, 2024 at 11:09 am #2984March 14, 2024 at 11:00 am #2983March 14, 2024 at 10:51 am #2982March 14, 2024 at 10:44 am #2981March 14, 2024 at 10:41 am #2980Bobby we are here lol…I got my backside handed to me in yen, took a break, put on silly music, made it back in UsdChf like I posted yesterday, was on the wrong side, grew a pair and got right back in it out of spite lol, even at 8797 (wanted 8800 like I said yesterday). Purely a po’d trade. Made it back. Correct me if I am wrong, sometimes traders go with probabilities and it worked again.

March 14, 2024 at 10:40 am #2979Next up

US RETAIL SALES (THU): US retail sales are expected to rise +0.3% M/M (prev. -0.8%), and the ex-autos measure is seen rising +0.3% M/M too (prev. -0.6%). Bank of America’s Consumer Checkpoint update for February notes that weather conditions were largely to blame for the weakness in January, but where the weather was better, spending was resilient, and in the later part of January, total card spending per household rebounded across the country. The bank notes that while consumer confidence has rebounded recently, it remains relatively weak given the consumer has been resilient over the last year and the labour market has been solid, likely a result of ‘sticker shock’ from higher prices. But ahead, BofA says that “as the rate of inflation comes down, this sticker shock should begin to fade, particularly as aftertax wages and salaries growth remains healthy for low and middle-income households in our data,” adding that “consumers’ savings buffers remain elevated and shows no significant sign that people are tapping into their longer-term retirement savings.”Newsquawk.com

March 14, 2024 at 9:58 am #2977March 14, 2024 at 8:44 am #297610-yr 4.206% Yield | 3:38 AM EDT

yellen watch

(Bloomberg) March 13, 2024 — US Treasury Secretary Janet Yellen said it’s “unlikely” that market interest rates will return to levels that prevailed before the Covid-19 pandemic triggered a wave of inflation and higher yields.

“I think it reflects current market realities and the forecasts that we’re seeing in the private sector — that it seems unlikely that yields are going to go back to being as low as they were before the pandemic,”

The yield on 10-year US Treasury notes averaged 2.39% in the decade through 2019 — low by historical standards. It spiked above 5% last October after the Federal Reserve raised rates aggressively to combat inflation, and now sits just below 4.2%

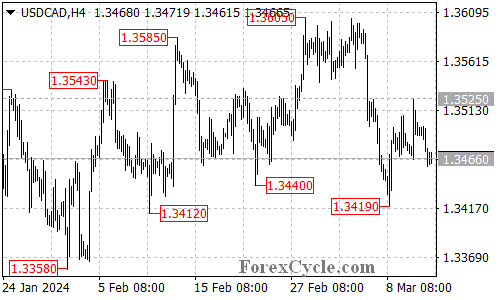

March 14, 2024 at 8:38 am #2975March 14, 2024 at 3:05 am #2974USDCAD Analysis: Breakdown Below Support and Potential Price Movements

USDCAD has recently breached the support level at 1.3466, signaling a resumption of the downward movement from 1.3605.

A further decline towards testing the 1.3419 support level is anticipated in the upcoming days. Should there be a breakdown below this level, it could potentially trigger an extended downward move towards the 1.3340 area.

The initial resistance to monitor stands at 1.3490. A successful breakout above this level could lead to a retest of the 1.3525 resistance level. Surpassing this level would suggest that the downward movement from 1.3605 may have concluded at 1.3419, with the next target likely at 1.3560, followed by the previous high at 1.3605.

March 13, 2024 at 10:30 pm #2972EURUSD Daily

Supports at 1.09300 & 1.08700

Resistances at : 1.09650 , 1.09800 & 1.10500

For the pair to continue Upwards and target 1.10500 , it has to stay Tomorrow above 1.09300. Any break bellow would lead it to Channel Support at 1.08700.

1.09650 is a Major Obstacle on the road to new highs .

In the case it shows as a tough cookie, EURUSD will start the Inevitable deeper correction .

Buying it above 1.09300 , with the very tight stop just bellow it is the strategy if you feel the need to be involved.

The other approach is wait and see, and if 1.09300 taken out, Sell for the run to 1.08700 area.

March 13, 2024 at 7:56 pm #2966March 13, 2024 at 6:38 pm #2963

March 13, 2024 at 7:56 pm #2966March 13, 2024 at 6:38 pm #2963 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View