- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 3 weeks ago by GVI Forex 2.

-

AuthorPosts

-

March 16, 2024 at 3:09 pm #3114

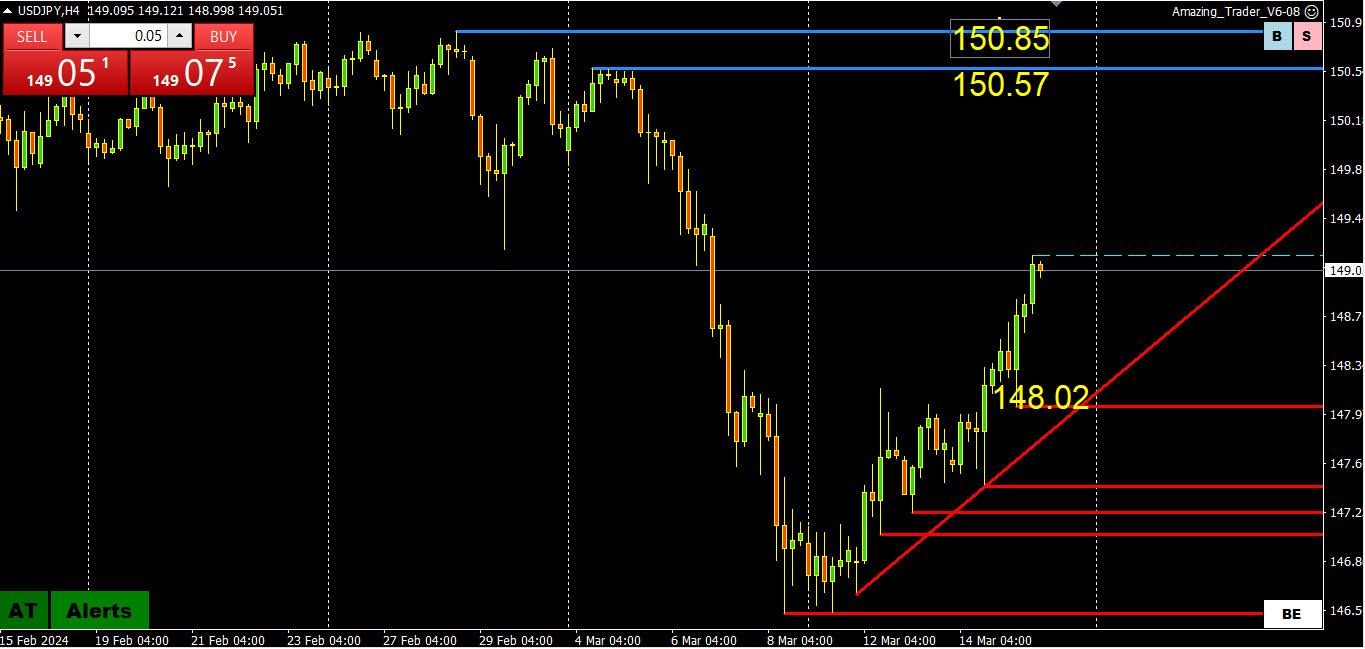

USDJPY 4 HOUR CHART

THE FOCUS TO START THE WEEK WILL BE ON USDJPY AND JJPYCROSSES AHEAD OF THE BOJ MARCH 19 DECISION.

The only levels that really matter are 148 and 150 as key levels lie outside of it although 148.03 (and the trendline) are key supports on this chart (suggests 149 as the midpoint)

There are several articles on the BoJ and JPT in our new and outstanding blog

March 16, 2024 at 11:52 am #3101March 16, 2024 at 8:42 am #3100March 16, 2024 at 12:35 am #3099Newsquawk Week Ahead March 18-22nd

MON: Chinese Retail Sales (Feb), EZ Final CPI (Feb)

TUE: BoJ Announcement, RBA Announcement; German ZEW Survey (Mar), Canadian CPI (Feb)

WED: FOMC Announcement, PBoC LPR, BCB Announcement, CNB Announcement, BoI Announcement, Japan Market Holiday (Vernal Equinox Day); UK CPI (Feb), New Zealand GDP (Q4)

THU: BoE Announcement, SNB Announcement, Norges Announcement, CBRT Announcement, European Council Meeting; EZ/UK/US Flash PMIs (Mar), US Philly Fed (Mar), New Zealand Trade Balance (Feb), Japanese CPI (Feb).

FRI: Japan’s Rengo (labour union) 2nd Pay Tally, CBR Announcement, European Council Meeting; Australian Jobs Report (Feb), UK Retail Sales (Feb), German Ifo Survey (Mar)

Click below for an in-depth analysis by Newsquawk

March 15, 2024 at 8:18 pm #3098March 15, 2024 at 7:53 pm #3096March 15, 2024 at 7:40 pm #3094March 15, 2024 at 5:57 pm #3093March 15, 2024 at 5:39 pm #3092March 15, 2024 at 5:21 pm #3091EURO 1.0887

–

parked just abouve earlier 1.0875the risk to the puppy going higher is jerome

IF he somehow thins out the smoke of recent likely rate cuts later in 2024 smoke signalingsMarch 15, 2024 at 5:18 pm #3090JP -EU needs s safe haven kitty. Next week UsdChf should target 8800 and 8860 to open Monday. Just my parameters. Usually does not miss. Ordinarilly currencies reverse the flow of Monday and Tuesday on Wednesday and continue Thursday only to make everyone nuts on Friday when portfolio managers are seeking balance. A bad word lol. This week it stuck, hence why we are all shaking our heads.

March 15, 2024 at 5:08 pm #3089March 15, 2024 at 5:03 pm #3088Hah…. Thanks, I think. Funny day. Just when I thought ok we’re set for some across the board directional follow thru -> Nothing.

Lets review

– Quad witching today.

– US yields higher.

– BoJ guy hints at policy rate change (higher) at next weeks meeting.

– Dovish comments on economy and rates (lower) from ECB guys.Yet-> JPY weaker, EUR stronger against some flat against others, Copper Silver higher. Not a whole lot of logic found here.

FX market (read EUR) remains as non-comital as it’s been over the last year. I think it’ll stay that way with a bias against the weak links (chf) over the next few weeks.

Stocks I think are running on air which could see a downdraft the next six weeks or so. That said is it really worth trying to time the stock market as in the long run it only goes up.

Bonds not going up any time in the forseeable future. There’s A LOT of people that enjoy earning an effortless 5%……

March 15, 2024 at 5:02 pm #3087March 15, 2024 at 4:56 pm #3085March 15, 2024 at 4:56 pm #3086March 15, 2024 at 4:54 pm #3084March 15, 2024 at 4:50 pm #3083CBs, rates and make or lose trading opps 3rd week of March

–

Frank what is your take on SNB (in)action next 03/21 ?

tiaFor a few reasons I do not think SNB will cut despite – relatively to other jurisdictions – nice inflation/ary numbers.

As I am biased (i.e. opinionated) I am expecting to continue to be swissy negative in my trading it.March 15, 2024 at 4:49 pm #3082March 15, 2024 at 4:47 pm #3081 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View

GBPUSD signal for the coming week:

GBPUSD signal for the coming week: