- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 3 weeks ago by GVI Forex 2.

-

AuthorPosts

-

February 27, 2025 at 1:36 pm #20171February 27, 2025 at 1:34 pm #20170

Big miss in weekly jobless claims but offset by upward revision to inflation in the GBP revision. .

See our Economic Data Calendar

February 27, 2025 at 12:13 pm #20169February 27, 2025 at 11:44 am #20168US OPEN

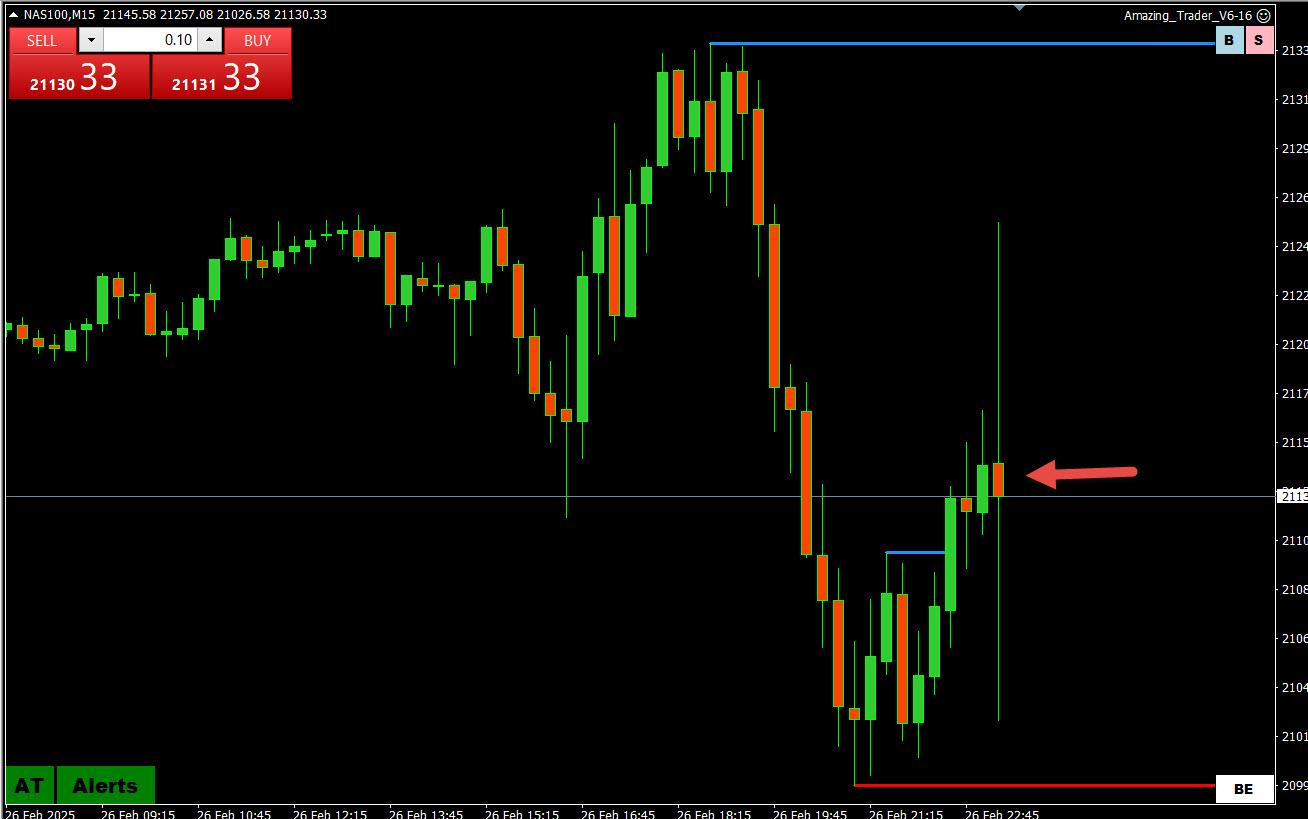

NVIDIA +1% in pre-market after Q4 results, a pick up in yields lift the Dollar ahead of US data

Good morning USA traders, hope your day is off to a great start!

Here are the top 4 things you need to know for today’s market.

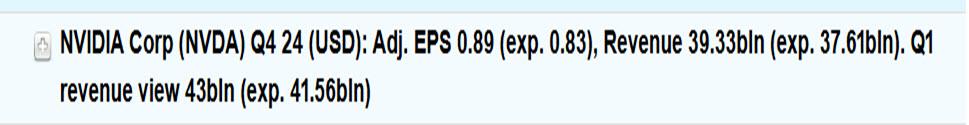

4 Things You Need to KnowNVIDIA +1.1% in US pre-market after headline beats whilst Q1 gross margins are seen easing.

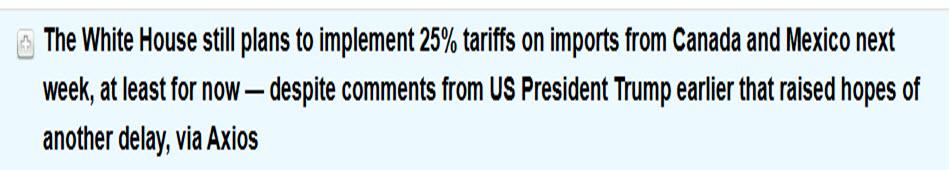

European bourses on the backfoot with sentiment hit in Europe amid Trump’s EU tariff threats; US futures gain.Pick-up in US yields provides reprieve for USD, USD/JPY eyes a test of 150.

Crude trims recent losses but metals pressured by a firmer Dollar.

<p style=”text-align: center;”><strong><a href=”https://newsquawk.com?fpr=c3imf”>Try Newsquawk for 7 Days Free</a></strong></p>

February 27, 2025 at 11:34 am #20167A look at the day ahead in U.S. and global markets from Mike Dolan

What appeared like a solid earnings beat from AI-bellwether Nvidia (NASDAQ:NVDA) failed to impress nervy tech investors, with anxiety about the wider U.S. economy persisting as trade tariff drums keep beating.

Morning Bid: Even Nvidia beat gets a shrug, tariff war looms

February 27, 2025 at 11:06 am #20166February 27, 2025 at 10:41 am #20165February 27, 2025 at 10:06 am #20164EURUSD 4 HOUR CHART – -FOCUS ON 1.05

EURUSD is back below 1.05 following a double top at 1.0528 yesterday and yet to test 1.05, which has printed 5 days in a row.

While a break of this pattern would send a bearish signal it would only be confirmed if 1.0449=50 is firmly broken.

Meanwhile, there is a full day ahead for this pattern to be extended or fail.

Range so far today: 1.0459-92

February 27, 2025 at 9:57 am #20163XAUUSD 4 HOUR CHART – Watch the Weekly Pattern

Tested last week’s low at 2877 (note I had it at 2878 but 2877 is confirmed as the level) which is clear support. The sdignificance of this level is that a move belownit would produce an outside week.

To slow the risk, 2888 needs to be regained. To nagte the risk, 2920+ would be needed.

In any case this has turned into a classic Monday Effect trading pattern weej

February 27, 2025 at 9:41 am #20162Using my platform as a HEATMAP shows

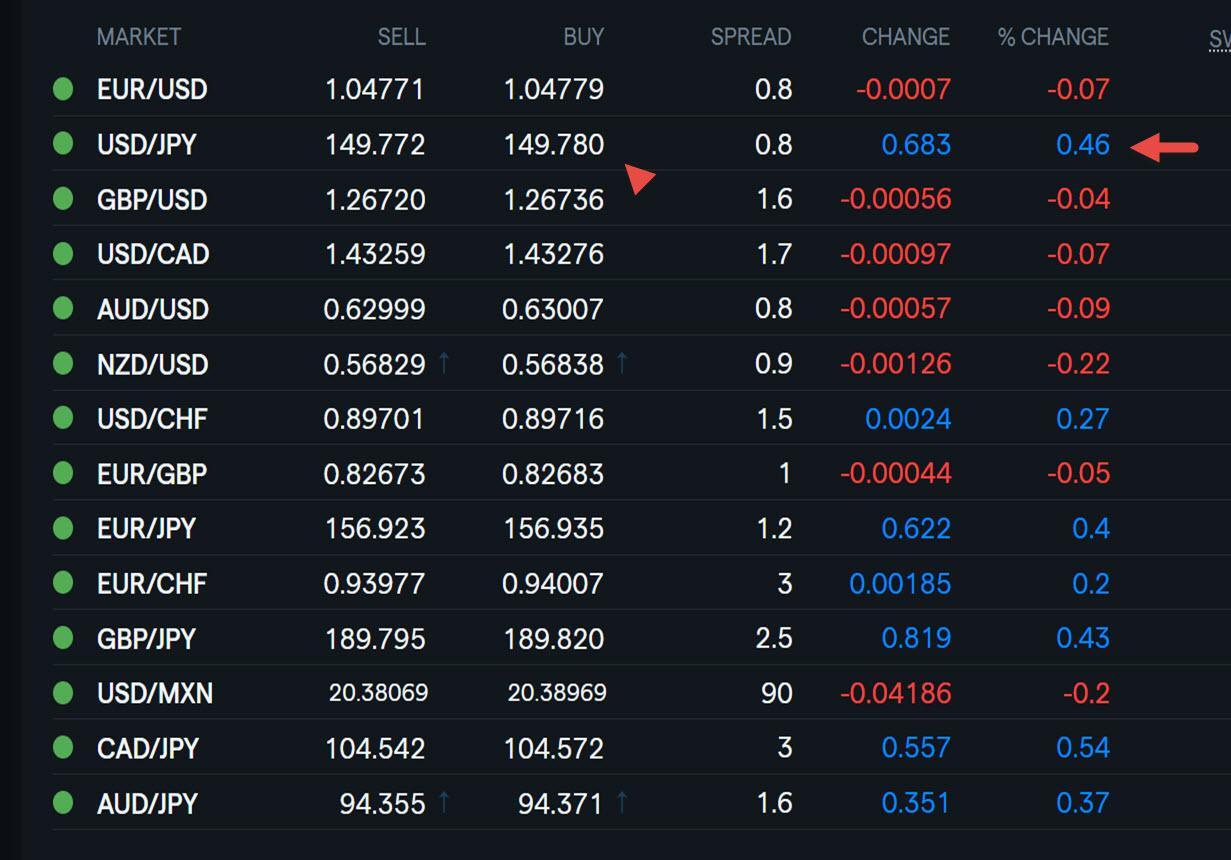

The dollar trading a touch firmer day before month end gyrations.

EURUSD yet to print 1.05 and extend its 5 day pattern around this level

USDJPY the outperformer after again finding support in the 148s but is still below 150.

Elsewhere

Gold is weaker

US bond yields are up after a sharp fall to 4.25% (10 yr) yesterday

Stocks up a touch

Watch for

US economic data durable goods 2nd GDP revision, weekly jobless claims) : see our Economic Daya Calendar

Trump speak: Watch headlines on tariffs after conflicting talk yesterday on Mexico and Canada

Trump due to speak in the morning and then an afternoon presser with the UK PM

February 26, 2025 at 11:35 pm #20161as the rtrs piece informs: “Thus far, Trump and Musk have failed to slow the rate of spending. According to a Reuters analysis, the government spent 13% more during Trump’s first month in office than during the same time last year, largely due to higher interest payments on the debt and rising health and retirement costs incurred by an aging population.”

February 26, 2025 at 11:29 pm #20160REUTERS February 26, 20256:05 PM EST

“Trump orders more layoffs, Musk touts cuts at cabinet meeting

U.S. President Donald Trump’s administration on Wednesday ordered federal agencies to undertake more large-scale layoffs of federal workers, as downsizing czar Elon Musk vowed at Trump’s first cabinet meeting to pursue deeper spending cuts.”but but but will it even as much as dent the fed’s deficit;

how deep will the cuts have to go to – say – cut the deficit by only 25%February 26, 2025 at 10:13 pm #20159Maybe I’ve missed it but nowhere is anyone talking recession.

Is the U.S. headed for a recession by the Savvy Trader?

February 26, 2025 at 9:35 pm #20158February 26, 2025 at 9:00 pm #20157February 26, 2025 at 8:52 pm #20156BTCUSD Daily

Ah, feels a bit too much , lots of bragging and self promotion – but I can’t help it…

Last night: So, tomorrow we should expect to see 89.500 before more down – but wouldn’t be surprised to see it going straight down without reaching it.

It actually opened at almost that level…and went straight down from 89.388 ( now interesting part is that this is a crazy crypto coin and getting exact levels is close to impossible )

76.700 next support

February 26, 2025 at 8:41 pm #20155

February 26, 2025 at 8:41 pm #20155NIO Inc.

February 18, 2025 at 8:48 pm

I mentioned this particular scenario days ago : First sharp drop to 4.00, followed by a strong rebound Up.

next hurdle is at 4.70

So that hurdle was today at 4.75 ( as time goes by, moving averages slowly goes Up.

High for the day – exactly 4.75

If Nio can go through it, new universe opens – one with borders between 4.75 and 6.15

February 26, 2025 at 8:34 pm #20154

February 26, 2025 at 8:34 pm #20154DAX – GER 30

Previously:

As long as above 22.150 DAX can Rally again and suddenly.

And Rally it did…

Previous high at 22.935 is a natural resistance – one that if taken out might provide enough stops for a further rally .

Now I would like to share one possible scenario with you:

Stops above previous high taken out, new high reached…and…sharp move down.

Not only possible, but probable…so we’ll see 😀

February 26, 2025 at 8:27 pm #20153February 26, 2025 at 8:25 pm #20152

February 26, 2025 at 8:27 pm #20153February 26, 2025 at 8:25 pm #20152 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View