- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 3 weeks ago by GVI Forex 2.

-

AuthorPosts

-

March 20, 2024 at 10:35 am #3327

EURJPY DAILY CHART

EURJPY is currently an outperformer, following the “path of least resistance:, trading above its major resistance at 164.29. This leaves the next target as guesswork (165 is one of those magic levels). Back below 164.29, at a minimum, would be needed to slow the move up.

Much might depend on whether USDJPY can trade similarly by taking out its major resistance at 151.92.

So far, offsets out of this cross are helping to keep EURUSD above its supports (see prior posts).

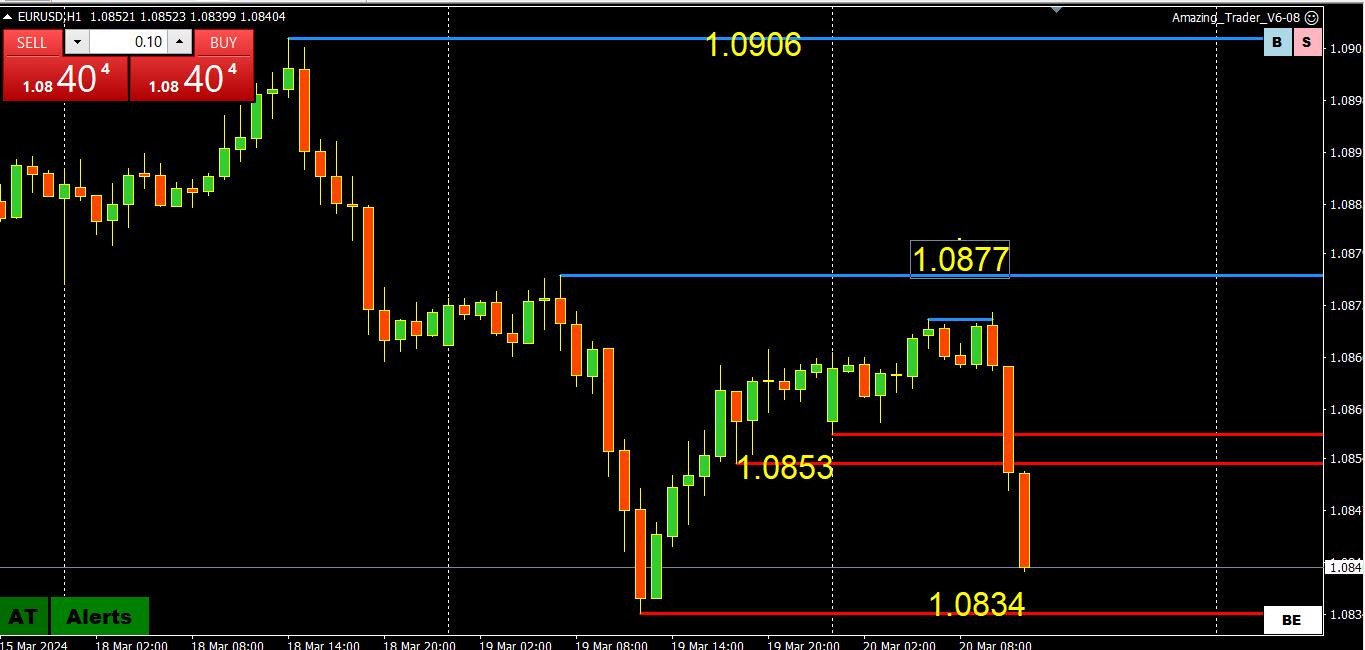

March 20, 2024 at 10:24 am #3326March 20, 2024 at 10:22 am #3325EURUSD 1 HOUR CHART

It took 17 1-hour candles to go from 1.0853 to 1.0873 and just 2 to break back below it. This tells you the current risk in a market that has had bouts of what we like to say “trading bid in an offered market” with buying driven more by its crosses (e.g. eurjpy) than outright vs the USD.

I don’t like to draw conclusions from a pair trading in a 43 pip range (1.0834-77) other than to say 1.0887 and 1.0906 would need to be broken to change the picture.

4 hour chart to follow .

March 20, 2024 at 10:18 am #3324March 20, 2024 at 9:39 am #3323March 20, 2024 at 8:37 am #3322from two market nurses:

–

The Fed Is Playing a Waiting Game on Rate Cuts. The Rules Are Starting to Change. – By Nick Timiraos in WSJ

While investors focus on whether officials project fewer rate cuts, the Fed looks ahead to recession risksJeff Cox

* The Fed has a lot to do at its meeting this week, but ultimately may not end up doing a whole lot in terms of changing the outlook for monetary policy.* This meeting likely will be all about the Federal Open Market Committee’s “dot plot” of individual member’s interest rate expectations.

* Officials also will release their quarterly update on the economy, specifically for gross domestic product, inflation and the unemployment rate.

Here’s everything to expect from the Federal Reserve’s policy meeting Wednesday

March 20, 2024 at 8:31 am #332110-yr 4.279; 2-yr 4.677; DLRx 103.50 (flat)

THE qtn now is …

– is jerome a presidential lackie and will he do things to juice the economy (and therefore help revive price-inflation)

— can he even provide hints of whether the FED is edging close to rate cutsall is in diplomacy, tackt and jerome communication skill determining player perception of what he ll be saying.

Jerome’s own legacy as inflation fighter is on the line, the qtn is does he care.

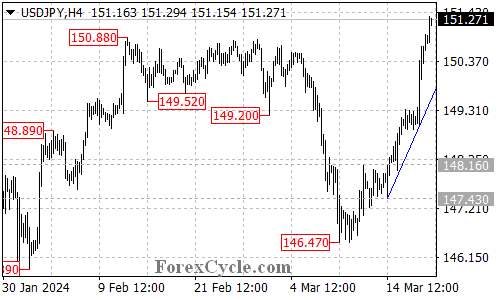

I think he does. BUt … I may be wrong: I do suffer from imperfect judge of character.March 20, 2024 at 4:48 am #3320USDJPY Analysis: Breakout and Potential for Further Upside Movement

USDJPY has successfully surpassed the 150.88 resistance level, with the upward movement from 146.47 extending to a peak of 151.33.

As long as the price remains above the ascending trend line on the 4-hour chart, there is still potential for additional upward movement in the upcoming days, with the next target estimated around 160.00.

The initial support level to monitor is at 150.35. If the price breaks below this level, it could suggest a period of consolidation for the uptrend starting from 146.47, with the pair likely finding support at the rising trend line.

A decisive break below the support provided by the trend line could indicate the potential completion of the current uptrend.

March 20, 2024 at 1:28 am #3319March 19, 2024 at 9:15 pm #3314March 19, 2024 at 7:46 pm #3313March 19, 2024 at 7:38 pm #3312March 19, 2024 at 7:37 pm #3311March 19, 2024 at 7:23 pm #3310GBPJPY DAILY CHART

I had to go to the daily chart looking for a chart level.

All that is left is a breakout above 191.191.32 as support and a monthly resistance above 185.

The key support area is distance at 187.94 as seen on this chart.

In a market like this look for the new high to act as a key resistance.

Be o alert in GBP as CPI, expected to dip, will be released overnight.

‘

March 19, 2024 at 6:23 pm #3308March 19, 2024 at 5:57 pm #3304March 19, 2024 at 5:51 pm #3302March 19, 2024 at 5:09 pm #3300March 19, 2024 at 4:46 pm #3298fun for some, not so much for some others

–

Bitcoin Drops After Flash Crash. Why Prices Could Keep Dropping.as I have mentioned numerous times before … opinions are like ass-holes: everyone has one

March 19, 2024 at 4:33 pm #3297 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View

Gold is in a buy mood to reach 2161.70, as confirmed.

Gold is in a buy mood to reach 2161.70, as confirmed.

tp at it.

tp at it.