- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 3 weeks ago by GVI Forex 2.

-

AuthorPosts

-

March 20, 2024 at 3:58 pm #3361March 20, 2024 at 3:56 pm #3360March 20, 2024 at 3:51 pm #3356

10-yr 4.287

FOMC and jerome’s yak

–

Unlikely that we will see anything different than 5.5% and anything different than 75bps from their famous dot plot.the FOMC-ers will goad jerome to whine about some stickiness in inflation and potential for a bit of a rise BUT – on the other hand – offset that with optimism about lower growth and ouch ouch out shed a tear lower jobs.

Are players positioned for a hawkish jerome ? There-in lies the bet, especially if jerome comes out and be perceived by players even minutely leaning towards easing, even if just not yet.

Lets see IF I can make some moolah off a communication breakdown (cue Led Zeppelin)

March 20, 2024 at 3:42 pm #3351March 20, 2024 at 3:27 pm #3350March 20, 2024 at 3:23 pm #3349March 20, 2024 at 3:04 pm #3347March 20, 2024 at 3:00 pm #3346March 20, 2024 at 2:58 pm #3345What there seems to be especially in eur/usd and to some degree gbp/usd is a lack of desire to commit. The weaker links (jpy and chf) are easier to punch down on so there in lies the path of least resistance. That said I don’t get the feeling there are that many people that have been short jpy for months or even weeks…..

March 20, 2024 at 2:55 pm #3344I think Fed stays data dependent and not influenced by elections either way. History since 1980 supports this.

Since data has tended to come stronger than not, there shouldn’t be any urgency from the Fed to start the cutting cycle.

I would however expect a high degree of coordination between the Fed and the Treasury on managing federal cash flow….

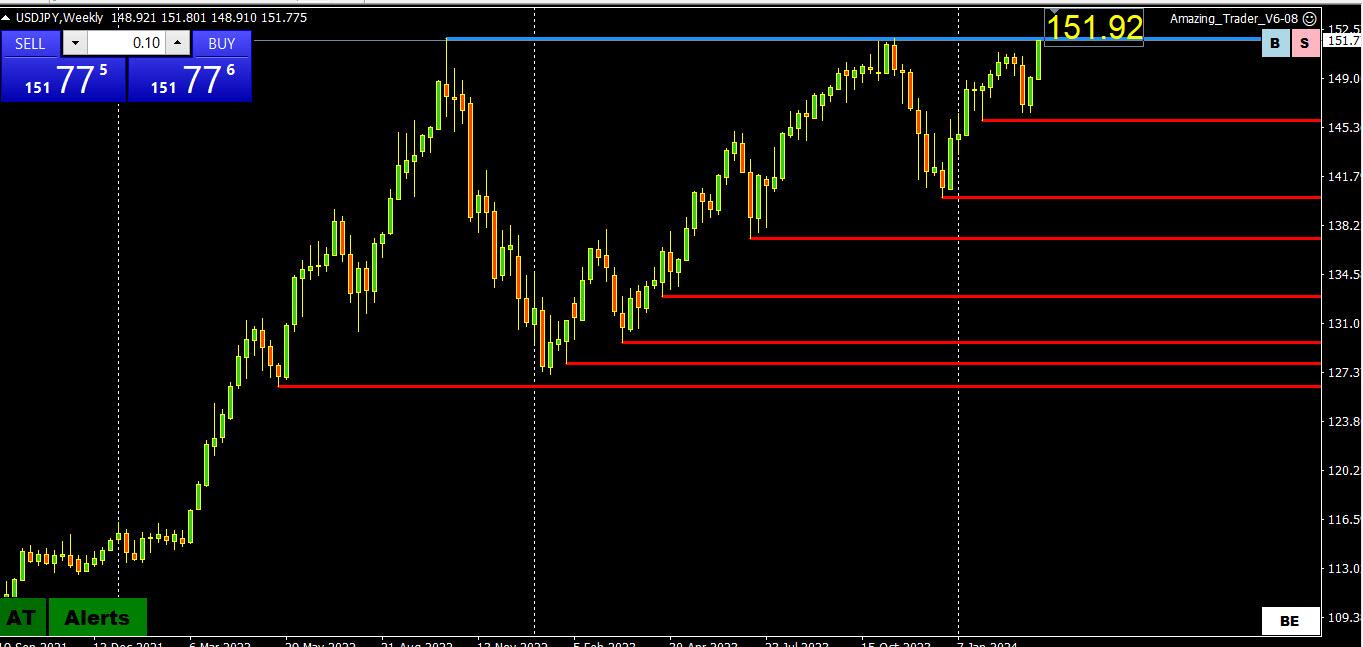

March 20, 2024 at 2:50 pm #3343USDJPY WEEKLY CHART – Major RResistance In Sight

There is only one level worth noting in USDJPY, the major resistance at 151.92

A break above this level would leave a blank on charts so use magic levels (152, 155, etc) as potential targets.

So it is a case of boom or bust at 151.92. If I were in the BoJ’s shoes, I would have 2 choices: defend 151.92 or let it run through 152 and then come in covertly to smack it back down but its shoes are too big for me to fill.

Whatever the case, watch 152 as this will dictate whether there is a run at 153.50 and 155.00 or form a range to 150.00.

March 20, 2024 at 2:08 pm #3339Bobby

Zero chance that rates will change.

No chance Fed will turn dovish.

Surorise would be if the Dot plot shows 2 cuts (see JP’s post on this)

The other surprise would be if the first-rate cut is pushed out past June although as I posted the other say, I heard that the odds had shrunk to 50/50 for the first-rate cut in June.

FX will probably take its cue from how bond yields move but this should be a non-event meeting unless Dot plot turns more hawkish.

More comments welcomed

March 20, 2024 at 1:18 pm #3336Would anyone care to explain here how the FOMC decision and any speculation further on will reflect on USD…

What is going to happen with EURUSD if rates are cut ?

What if not ?

What if rates are raised ??

And why…what is behind the strength/weakness of USD i cases above ?

What is the logic of all of it ?

March 20, 2024 at 12:40 pm #3334March 20, 2024 at 12:03 pm #3333from my earlier post link to jeff cox’s piece

fwiw

–

…”investors will look at how the 19 FOMC members, both voters and nonvoters, will indicate their expectations for rates through the end of the year and out to 2026 and beyond … it would only take two FOMC members to get more hawkish to reduce the rate cuts this year to two. That, however, is not the general expectation.” …March 20, 2024 at 11:37 am #3332March 20, 2024 at 11:37 am #3331EURUSD Daily

Resistances : 1.08850 1.09450

Supports : 1.07950 1.07550

Aside of these obvious levels, and the fact that we are in Sell mode right now, there are few facts that has to be taken into account…

That downtrend line up there – it is more of a correction angle , then anything else…

So they still might try for the 1.10+ area

I would like to see it bellow 1.06 , before we declare the doom for EUR…and some real sharp angles as well.

Intraday – watch for 1.08350 support zone , and go with your Sell signals accordingly .

Tonight FOMC – Economic Calendar – stay clear of it !

March 20, 2024 at 11:23 am #3330March 20, 2024 at 11:15 am #3329March 20, 2024 at 10:53 am #3328

March 20, 2024 at 11:23 am #3330March 20, 2024 at 11:15 am #3329March 20, 2024 at 10:53 am #3328Here is our blog article describing “trading bid in an offered market.”

What Does it Mean When a Currency Feels “Bid in an Offered Market?”

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View