- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 3 weeks ago by GVI Forex 2.

-

AuthorPosts

-

April 4, 2024 at 10:26 am #4010

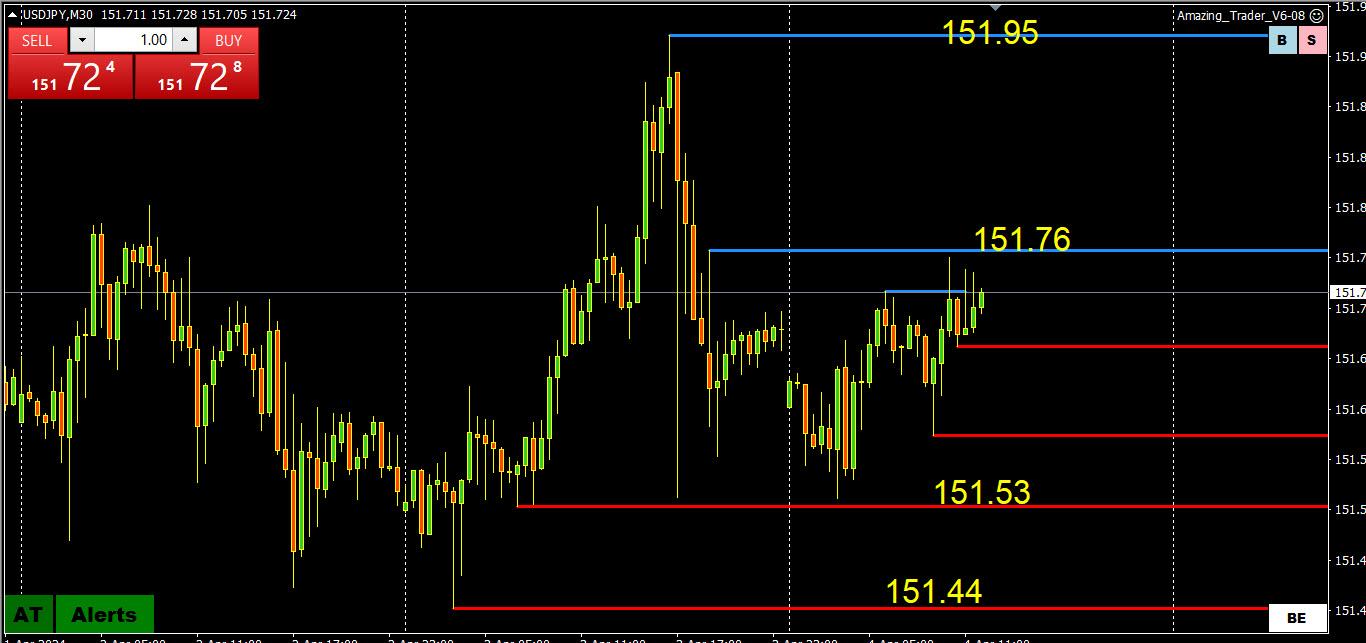

USDJPY 30 MINUTE CHART – AN ALERT OR WARNNG?

USDJPY came within a couple of pips of 151.97 yesterday and has backed off a touch but remains bid despite the BoJ intervention threat (note weak JPY crosses.

AN ALERT OR A WARNING

I RECEIVED AN EMAIL ABOUT USDJPY THAT I WOULD NORMALLY IGNORE EXCEPT IT CAME FROM SOMEONE WHO IS A WELL-CONNECTED SOURCE.

THE XXX (NAME OMITTED BUT IT WASN’T THE BOJ) MAY DROP THE BALL ON USDJPY ONE FINE MORNING.

I am only the messenger but would be remiss if I did not pass this on given the source.

April 4, 2024 at 10:05 am #4007AUDUSD 4 HOUR CHART – THE OUTPERFORMER

Note, my posts yesterday about following the oath of least resistance.

AUDUSD has so far been the outperformer today as flows from the JPY continue to keep USDJPY in sight of 152 but reluctant to challenge the BoJ while the USD trades soft elsewhere, helped by offsets from JOPY crosses.

I had to go to a 4-hour chart to find the key resistance, which is not until .6635 so damage so far has not been fatal.

In the absence of nearby support, look at former resistance for the first levels. of support or revert to shorter time frames.

April 4, 2024 at 8:55 am #4006LONDON, April 4 (Reuters) – Traders and investors are looking to global interest rate cuts and a closely-fought U.S. election to drag the world’s currency markets from their deepest lull in almost four years.

Measures of historical and expected volatility – how much prices move over a set time period – have sunk in recent months with the world’s biggest central banks stuck in a holding pattern, depriving FX traders of the divergent moves between regional bond yields on which they thrive.Currency markets are in a deep freeze. Rate cuts and Trump could thaw them

April 4, 2024 at 1:30 am #4005April 4, 2024 at 1:10 am #4004April 4, 2024 at 12:56 am #4003April 4, 2024 at 12:26 am #4000A global economic recovery is fueling a blistering commodities rally in 2024 — threatening to derail the Federal Reserve’s efforts to curb inflation and potentially clouding its path to cutting interest rates by mid-year, according to market strategists.

Oil, gold and the dollar are surging. Here’s why that could derail the Fed’s rate-cut outlook.

April 4, 2024 at 12:19 am #3999April 3, 2024 at 11:43 pm #3998STANFORD, California, April 3 (Reuters) – Federal Reserve officials including U.S. central bank chief Jerome Powell on Wednesday continued focusing on the need for more debate and data before interest rates are cut, a move financial markets expect to occur in June.

April 3, 2024 at 11:43 pm #3997STANFORD, California, April 3 (Reuters) – Federal Reserve officials including U.S. central bank chief Jerome Powell on Wednesday continued focusing on the need for more debate and data before interest rates are cut, a move financial markets expect to occur in June.Powell sticks with Fed’s cautious rate-cut strategym

April 3, 2024 at 8:53 pm #3995EURUSD – Fight of System Titans 😀

Bears wouldn’t like to see it above 1.08450 , and prefer a sharp drop from there Bellow 1.08000, straight for the 1.07100

Bulls would love to pick it up in 1.08000 area, or slightly below and go for 1.08800 in first attempt.

Pay attention to the red channel – you can be both – a bear and a bull , as long as you pick up the right time and the right place 😀

April 3, 2024 at 7:11 pm #3988

April 3, 2024 at 7:11 pm #3988EURUSD 4-HOUR CHART – Typical Start to the Quarter

Those who follow me should know how I feel about the start of a new year and new quarter, this one had liquidity dry up even more due to the 4-day Easter break.

This makes it hard to absorb flows and often sees false starts and whipsaws, as has been seen so far this week.

With that said the dollar is on its back fOOt and the level EURISD bears do not want to see trade is above 1.0868.

Whatever the case, EURUSD 1.08 will set the near-term bias.

April 3, 2024 at 7:08 pm #3987April 3, 2024 at 6:51 pm #3986April 3, 2024 at 5:46 pm #3985April 3, 2024 at 5:43 pm #3984April 3, 2024 at 5:41 pm #3983April 3, 2024 at 5:36 pm #3982April 3, 2024 at 5:28 pm #3981April 3, 2024 at 4:51 pm #3974 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View