- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 2 weeks ago by GVI Forex 2.

-

AuthorPosts

-

April 12, 2024 at 2:56 pm #4487

EURUSD 1h

As you can see from the chart, we had a second leg down today, so one prolonged move.

We need to rebound to at least 1.06850 and even 1.07050 , and still will be in Down mode.

Support comes at 1.06150.

Keep in mind that it is Friday, so trading interest is fading fast.

I am going to prepare some rules and tips on how to follow my trades /ideas over this weekend.

Probably will write the whole article, so everyone can go slowly over it and be ready for things to come J

I have to do lots of accounting for my wife (her company) , and if I don’t …well you know how it goes

I’ll be around later tonight as well…

April 12, 2024 at 2:39 pm #4485

April 12, 2024 at 2:39 pm #4485A slightly longer view of the eur/jpy charyt will show a break below the trendline that came off the lows from Dec 7, 2023 that came in today around 163.00.

If you like macro explanations of why you can check out this podcast that talks about a tweek in jpy management policy between the BoJ and MoF. JPY talk starts around 28 minutes…

Cognitive Dissidents #190 Weekly Update: 47 Crises in 17 Years

https://www.cognitive.investments/podcastApril 12, 2024 at 2:36 pm #4484Ok I hope everyone enjoyed Monedge yesterday lol. Back to business. Could use some calls from you Bobby. I am spread in every major and a few minors,basically long dollar, could use input on levels like Jy just did, lets make sure I don’t lose money today. My first mistake was watching Christina Aguilera videos while trading, and because I literally was a fighter, a real fighter, like in the ring, I was trading and watching “Fighter” by Christina while trading and got too darn emotional lol. So sitting on multiple positions, can give levels it needed lol. Green almost across the board. Its getting easy.

April 12, 2024 at 2:14 pm #4479April 12, 2024 at 1:46 pm #4478XAUUSD 1 HOUR CHART – 2400 TESTED

XAUUSD Backing off from its test of 2400

Risk off takinb over elsewhere as geopolitical fears of an Iranian retaliatory strike on headlines that Israel is preparing for an attack, either directly or via proxies.

\USD up, sticks down, bond yields down on flight to safety.

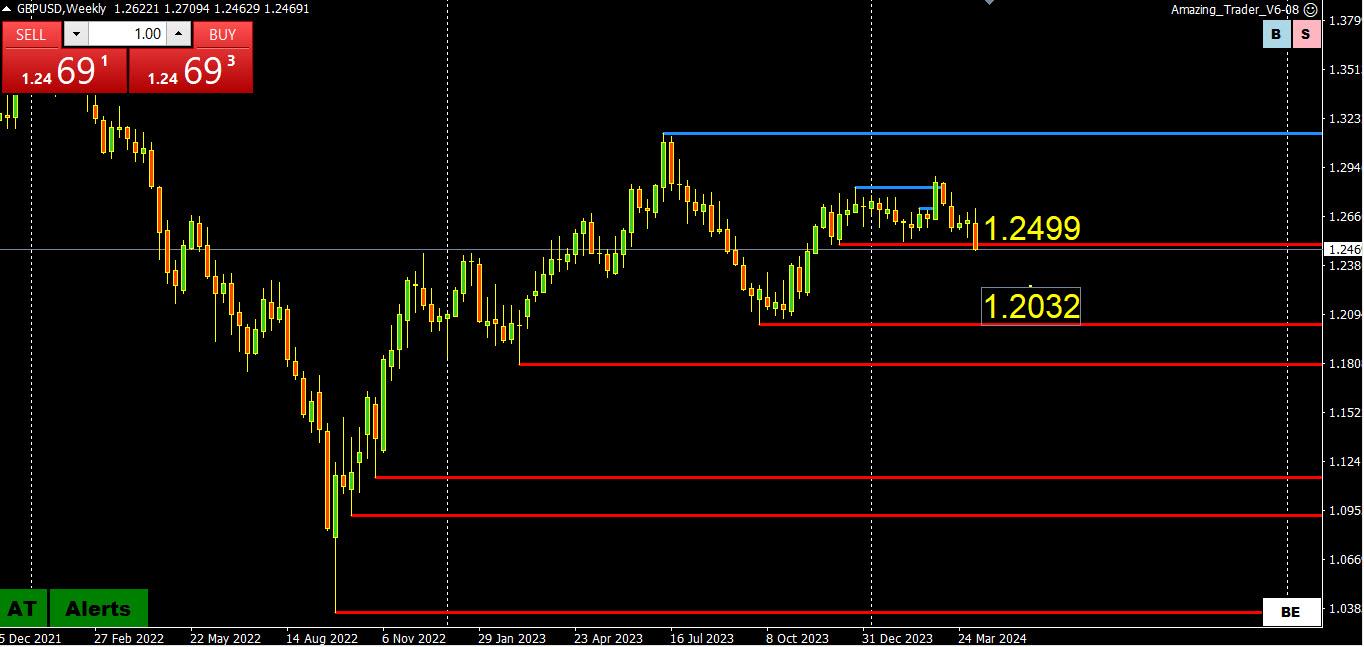

‘April 12, 2024 at 1:22 pm #4477GPBUSD WEEKLY – UNCHARTERED TERRITORY AS WELL

I had to go to a weekly chart to find key levels following the 1.2499 break (now resistance).

As long as it stays below 1.25, risk is down. With a void of nearby supports, look for 1.2450 to be pivotal.

Of interest, shirt JPU crosses are being unwound, which is one soiurce of USD demand oither than vs USDJOY, which is a touch lower.

April 12, 2024 at 12:28 pm #4468FRANKFURT, April 12 (Reuters) – Economists are sticking to their view that inflation in the euro zone will fall to 2% and stay there, a European Central Bank poll showed on Friday, in comforting news as the ECB prepares to cut interest rates.

The ECB’s latest Survey of Professional Forecasters (SPF) put inflation at 2.4% this year and 2.0% in 2025, 2026 and in the longer term — unchanged from the previous round of the poll three months earlier.

Economists confident euro zone inflation will fall to 2% – ECB poll

April 12, 2024 at 12:26 pm #4467A look at the day ahead in U.S. and global markets from Mike Dolan

With markets now re-shuffling central bank rate cut calendars, attention switches abruptly to the first quarter U.S. corporate earnings season on Friday – against a backdrop of an alarming swoon in China trade last month and rising Middle East tension.

Morning Bid: Eyes switch to earnings, China trade miss, tense Middle East

April 12, 2024 at 11:55 am #4463April 12, 2024 at 11:51 am #4462April 12, 2024 at 11:32 am #4458April 12, 2024 at 11:30 am #4457April 12, 2024 at 11:30 am #4456April 12, 2024 at 11:23 am #4454April 12, 2024 at 11:08 am #4453April 12, 2024 at 11:01 am #4452April 12, 2024 at 11:00 am #4451April 12, 2024 at 10:39 am

GVI Forex

I am not sure if these comments, which came out overnight, were a catalyst for the EURUSD breakdown but it bears repeatingECB’s Stournaras says now is the time to diverge from the Fed, reiterates call for four rate cuts this year, here is a risk inflation will undershoot 2%

——————————————————

European leaders can’t decide anything without US not even do they want to keep daylight savings time or not…..same with the rates ….. it will be what Fed decide and say ECB what to do

April 12, 2024 at 10:43 am #4450April 12, 2024 at 10:39 am #4448I am not sure if these comments, which came out overnight, were a catalyst for the EURUSD breakdown but it bears repeating

ECB’s Stournaras says now is the time to diverge from the Fed, reiterates call for four rate cuts this year, here is a risk inflation will undershoot 2%

Source: Newsquawk.com

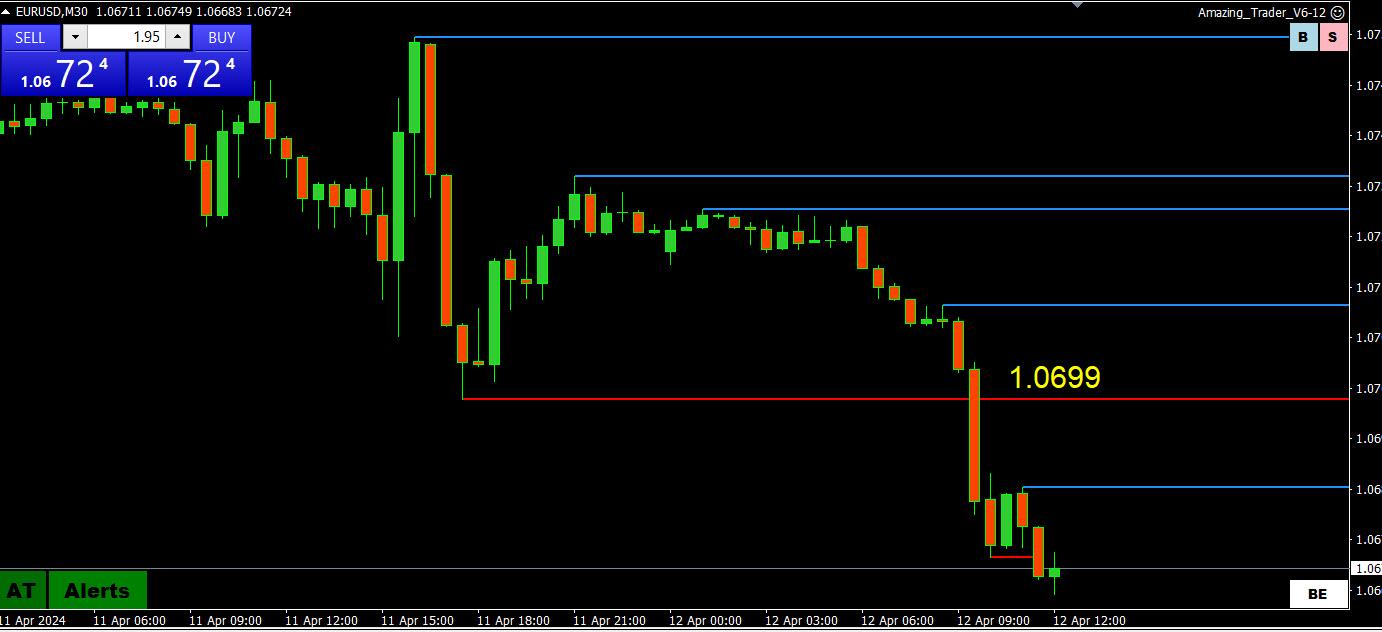

April 12, 2024 at 10:18 am #4447EURUSD 30 MINUTE CHART – REAKOUT?

While the technical focus of longer-term charts is on the break of 1.0693, short-term charts show yesterday’s 1.0699 as a key resistance

with a sell bias below it.On the downside, there are no obvious levels so use the day low as the closest one. As noted earlier, the Power of 50 level at 1.0650 becomes a pivotal key level in the absence of near-term support.

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View