- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 2 weeks ago by GVI Forex 2.

-

AuthorPosts

-

April 17, 2024 at 11:35 am #4742

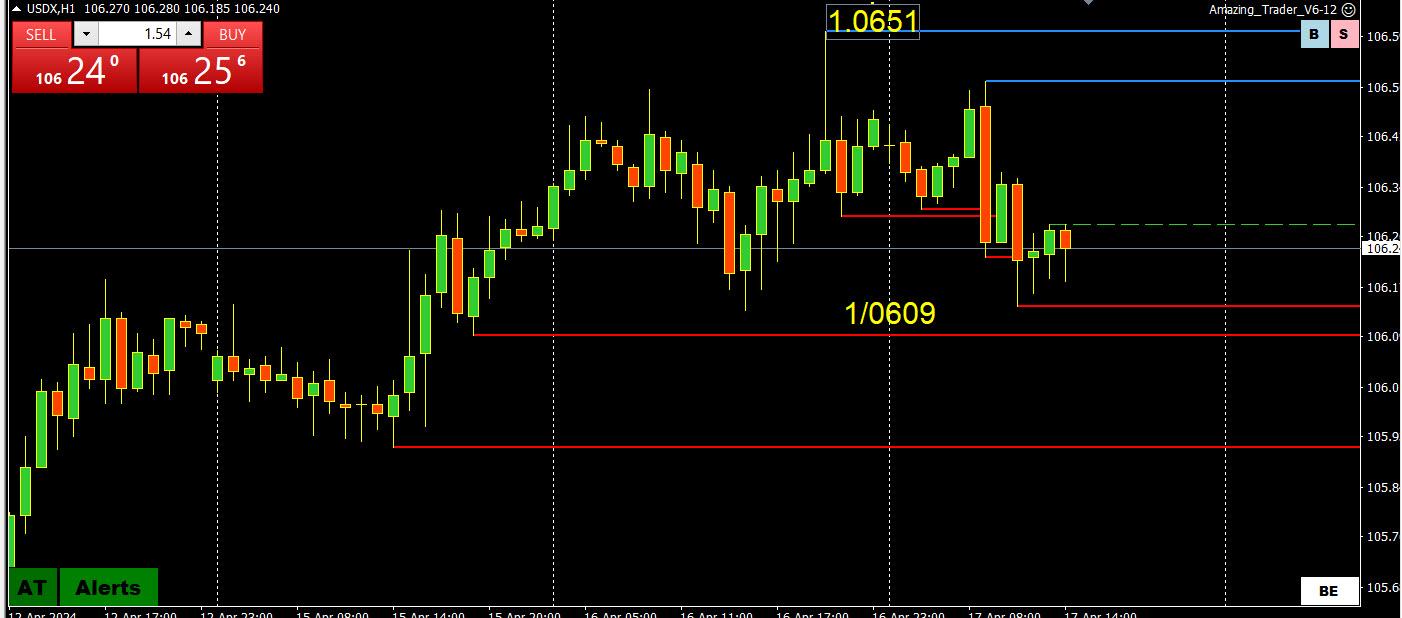

USDX ONE-HOUR CHART – OFFERED IN A BID MARKET

I never used to pay attention to USDX until JP alerted me to its use.

With EURUSD representing 57.6% of the USDX, it can be used as a semi-proxy for the EURUSD.

In this case, USDX has backed off its high but EURUSD has so far been stymied by 1.0650 after bouncing from an invisible hand protecting 1.06. A more significant resistance area is at 1.0660-65.

April 17, 2024 at 11:28 am #4741EURUSD 4h Intraday outlook

The base is formed for try outs to the Upper levels of the Daily Downtrend.

Targets to watch out for are 1.06700 & 1.07200 – all depends on time-space development.

Supports are at 1.06300 & 1.06050

By the pattern that is forming, it is unlikely to see downward follow through right now.

It is more of a possibility to watch Upticks for a day or two.

So base your small time frames trades accordingly .

With no serious data ( except for US Initial Jobless Claims tomorrow ), there is a calm till Friday.

Check out Economic Calendar

April 17, 2024 at 11:02 am #4740April 17, 2024 at 11:01 am #4739

April 17, 2024 at 11:02 am #4740April 17, 2024 at 11:01 am #4739A look at the day ahead in U.S. and global markets from Mike Dolan

There’s no doubt there’s a doubt about any U.S. interest rate cuts this year.

After weeks of market trepidation about stalling U.S. disinflation amid still-brisk economic growth, Federal Reserve top brass are making clear that this year’s rate cut plans are on ice until further notice.

April 17, 2024 at 10:49 am #4738April 17, 2024 at 10:33 am #4737I have not checked Jared Malsin and Benoit Faucon affiliations / biases so fwiw

this is what they write in WSJ this morning:

–

Emboldened Iran Makes Dangerous Gamble on Open Confrontation

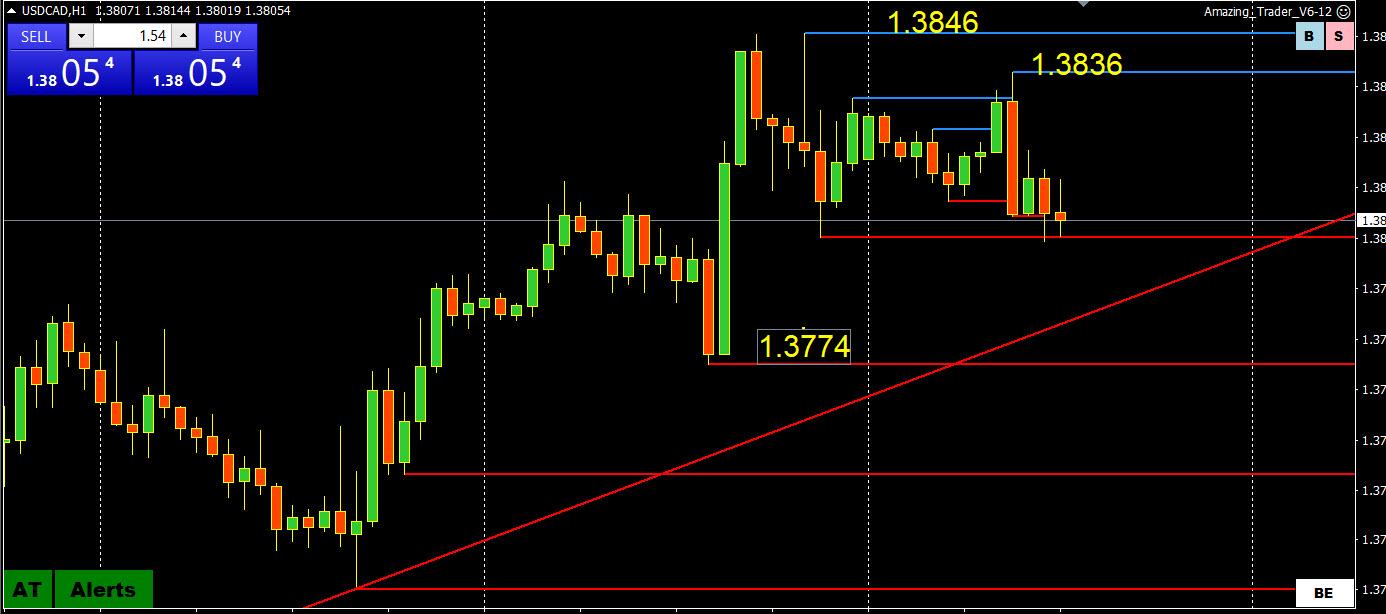

Iran and Israel stand on the brink of an escalatory cycle of violence after Tehran’s attack showed its shift away from accommodation with the West.April 17, 2024 at 10:03 am #4728USDCAD ONE HOUR CHART — MAKE OR BREAK TIME?

With USDCAD’s 2023 high at 1.3899 looming above, it would seem we are approaching a make-or-break time for this major move higher.

What I mean is in this current run to the upside it would have to take out 1.3899 to put the move up into higher gear targeting 1.3975

Looking at this chart, expect support as long as it trades above 1.3774, stronger bid if 1,38 holds.

April 17, 2024 at 9:30 am #4727April 17, 2024 at 8:47 am #4726April 17, 2024 at 8:41 am #4725April 17, 2024 at 8:33 am #4724FLIPOFF to BIDEN ?

–

APRIL 17 UPDATED 51SEC AGO

After meeting Herzog, UK’s Cameron says it’s clear Israel will respond to Iran attack – timesofisrael“It’s clear the Israelis are making a decision to act,” Cameron, who was speaking to reporters in Israel, says. “We hope they do so in a way that does as little to escalate this as possible.”

April 17, 2024 at 8:25 am #4723April 17, 2024 at 8:12 am #4722April 17, 2024 at 7:56 am #4721April 16, 2024 at 11:55 pm #4720April 16, 2024 at 10:57 pm #4719April 17 (Reuters) – A look at the day ahead in Asian markets.

Investors in Asia hoping for some relief from surging, opens new tab U.S. bond yields and a rampant dollar would have been deflated by remarks on Tuesday from Federal Reserve Chair Jerome Powell, and will likely go into Wednesday’s trading with their guard up.

Morning bid: Powell dashes easing hopes, markets dented again

April 16, 2024 at 9:51 pm #4718oohhh well…

–

FEDERAL RESERVE

Fed Chair Powell says there has been a ‘lack of further progress’ this year on inflation – Jeff Cox– Fed Chair Jerome Powell said the U.S. economy has not seen inflation come back to the central bank’s goal, pointing to the further unlikelihood that interest rate cuts are in the offing anytime soon.

– “The recent data have clearly not given us greater confidence, and instead indicate that it’s likely to take longer than expected to achieve that confidence,” he said during a central banking forum.

plenty folks were commenting that “the last” mile to FED’s 2% inflation target would be like giving birth to a 12-pounder.

So the chief is the last guy to come to reflect on that distinct reality.

Bottom Line

– is that players have to game the FED’s game next.April 16, 2024 at 6:23 pm #4716April 16, 2024 at 6:20 pm #4715April 16, 2024 at 6:05 pm #4714 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View

CHART

CHART