- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 2 weeks ago by GVI Forex 2.

-

AuthorPosts

-

April 19, 2024 at 10:53 am #4875

Yen futures are near the absolute lows tested several times this week. It would be a stretch in my opinion to justify the concept of the price to go lower under current conditions (Asian central banks verbally drawing boundary lines in the strength of their currencies-widespread volatility-geopolitical) so the futures sustaining a bid (sell side of Usd/Jpy) is clearly dominant. So we have highly likely seen the highs of the day in Usd/Jpy and Usd/Chf over the prior 6 hours (4am PST right now). Buy side of oil and gold obviously. Usd/Chf sell side. Usd buy side elsewhere. I’ve been on the sell side since Asia in both pairs as I mentioned for two weeks. See zero reason to change that right now.

April 19, 2024 at 10:42 am #4874AS WE HAVE SEEN TODAY, TRADING IN A GEOPOLITICAL CRISIS MARKET CAN BE CHALLENGING.

IN THIS REGARD, GIVEN TODAY’S EVENTS, WE HAVE UPDATED OUR BLOG POST, TRADING IN A GEOPOLITICAL CRISIS, WITH AN ADDENDUM THAT IS WORTH READING

April 19, 2024 at 9:37 am #4866April 19, 2024 at 9:22 am #4862April 19, 2024 at 8:50 am #4861April 19, 2024 at 8:45 am #48601:45 Monedge // The belligerents appear to be tactically playing to their internal political ego – “Iranian air base reportedly attacked in ‘limited’ Israeli reprisal strike and a look at me how meek and ginger I am “Iran downplays apparent retaliation and Israel keeps mum in sign both sides are looking to climb back from brink of war following international pressure for restraint” (timesofisreal) for international propaganda posturing purposes while the leader of the indisdensible nation and most powerful military pipsqueeks that “The US was given advance notification Thursday of an intended Israeli strike in the coming days, but did not endorse the response, a second senior US official said.” (cnn) trying to plead innocence.

In the meantime MY price of a liter of gasoline went up from $1.65 to 1.9x overnite. I have not yet looked at some of my energy digging and distribution stocks.

Odds of escalation appear – to me – low atm, as even published records out of Iran seem to highlight its heroic and defense and that the attacker did not go after cenrifuges at nuclear installation (al j)

April 19, 2024 at 8:25 am #4859April 19, 2024 at 8:25 am #4858April 19, 2024 at 1:45 am #4857Tonights military stikes against Iran and other countries is causing a high degree of volatility across the Usd, Gold, Oil, Treasuries, Stocks et al. This could strongly affect the macro picture across the board over time. It could even cause alternate items such as bitcoin. Commodities as well. Depending on severity.

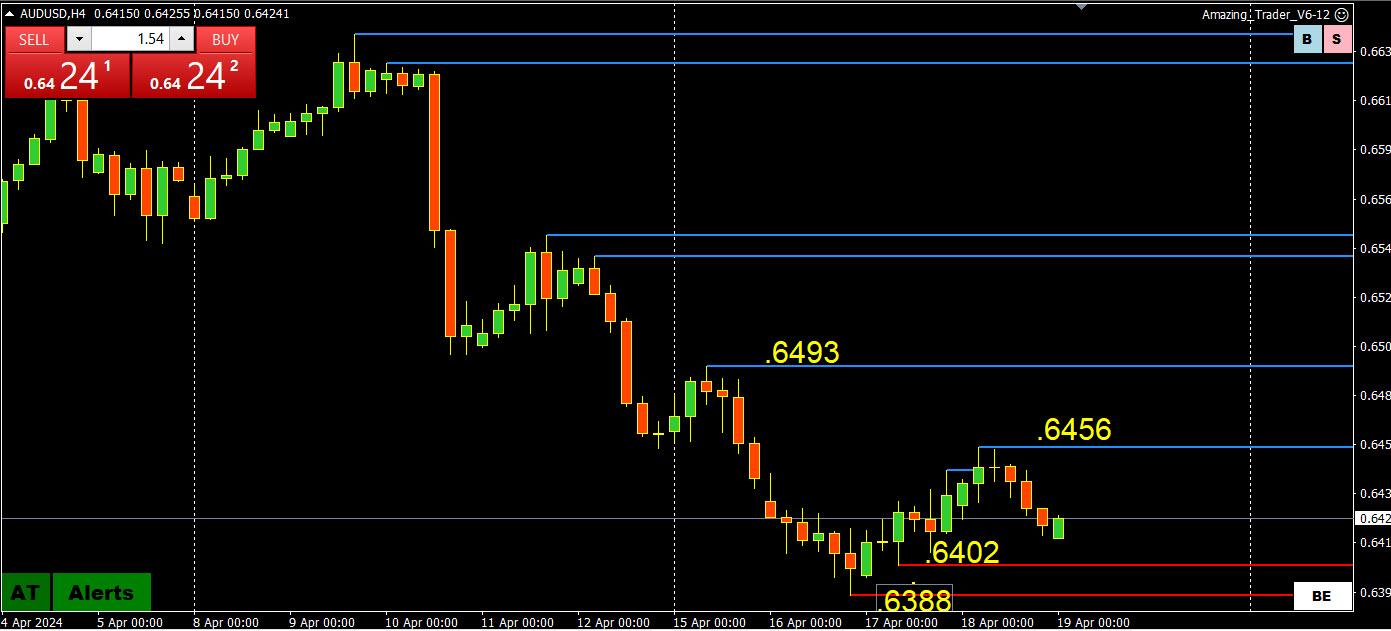

April 19, 2024 at 12:15 am #4856AUDUSD 4 HOIR CHART – MODEST RETRACEMENT

2 RED aT LINES DRAWN OFF THE LOW SIGNALED A CGNAGE IN DIRECTIONAL RISK AND THIS WAS FOLLOWED BY A MODEST RETRACEMENT.

kEY LEVELS ARE AT .6388 AND .6493

WHAT AT SAYS:

FOR,6456 TO BECOME THE KEY RESISTANCE LEVEL, THERE WOULD NEED TO BE A KEY LOW.

TO SUGGEST A BIGGER RETRACMENT.A THIRD AT RED LINE WOULD NEED TO BE FORMED FOLLOWED BY A .6456 BREAK.

BOTTOM LINE, THE TREND IS STILL YOUR FRIEND UNLESS .6456 IS BROKEN.

April 18, 2024 at 10:52 pm #4855April 19 (Reuters) – A look at the day ahead in Asian markets.

Asian markets will hope to end a bruising week on a positive note on Friday, but fraying global sentiment and a reluctance to take on much risk ahead of the weekend amid persistent Middle East tensions could limit any upside.

April 18, 2024 at 8:36 pm #4854EURUSD 30 MINUTE CHART – HOW I LOOK AT THIS CHART

The lines on my charts are drawn automatically in real-time using the Amazing Trader charting algo

On this chart, the three descending blue (ladder) lines indicate risk to the downside.

The strategy says if putting on a trade, sell with a stop above the most recent blue ladder line that preceded a new low.

Risk stays on the downside as long as the most recent nue line that preceded a new low stays intact.

Vice versa for red lines when risk is on the upside.

April 18, 2024 at 6:46 pm #4853April 18, 2024 at 6:39 pm #4852April 18, 2024 at 6:33 pm #4851April 18, 2024 at 6:31 pm #4850US500 4 HOUR CHART -Make or break time for the S&P

Falling blue AT lines indicate momentum continues to build to the downside as equities in general remain under pressure as the reality of a Fed on hold sinks in.

The key focus for all equities is on the S&P 5000 level… it is probably more important than any technical level at this stage.

April 18, 2024 at 5:57 pm #4849April 18, 2024 at 5:22 pm #4848April 18, 2024 at 4:10 pm #4845April 18, 2024 at 4:02 pm #4844 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View

.

.