- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 3 weeks ago by GVI Forex 2.

-

AuthorPosts

-

March 3, 2025 at 1:23 pm #20332March 3, 2025 at 1:18 pm #20331

BTCUSD Daily

That was a fair warning: Be aware – this is a Yo-yo coin –it can touch 80 K and instantly try for 90…10K up and down…not a problem.

It went over 90K – so surprising part accounted for as well…

Support at 90K & 85K – Resistance at 95K

Without Trump tariffs and all other data this week, I would tell you that Bitcoin will continue down in this correction, with usual crazy upticks and wild down moves …but….expect unexpected…

March 3, 2025 at 1:03 pm #20330

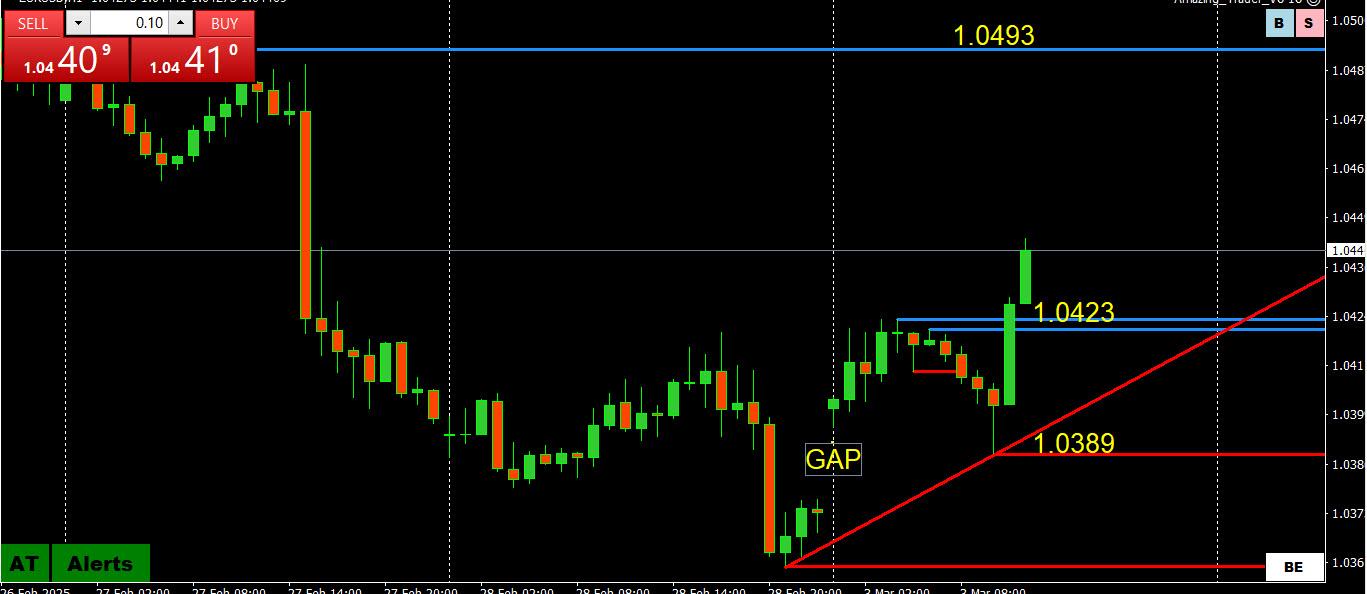

March 3, 2025 at 1:03 pm #20330EURUSD 4h

Start of the week with an Uptick Gap – this is going to be one of those crazy weeks…lots of Major Events , and each one can change the overall picture within ten seconds.

So I am going to avoid trying to guess how it’s going to go – I’ll stick with day in and day out predictions.

Right now:

Supports: 1.04450, 1.04050 & 1.03600

Resistances: 1.04750, 1.04900 & 1.05300

1.04750 is a Major intraday level to watch – if EUR goes above it and finds a footing, the road to 1.06 area is open again.

Loss of 1.03600 will drive it straight to the 1.02250

March 3, 2025 at 12:44 pm #20327

March 3, 2025 at 12:44 pm #20327A look at the day ahead in U.S. and global markets from Mike Dolan.

We’ve revamped Morning Bid U.S. to offer you more in-depth markets analysis and commentary. Mike Dolan will help you make sense of the key trends shaping global markets each day.

World markets are entering March with Friday’s alarming Oval Office row reverberating on both sides of the Atlantic, raising more questions about increasingly unpredictable geopolitics just as investors are also turning anxious about a potential economic slowdown.

March 3, 2025 at 12:16 pm #20325March 3, 2025 at 11:56 am #20324

UAS OPEN

US futures gain, USD lower & EUR benefits post EZ HICP, EGBs sink amid expectations of EU defence spending

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European indices at session highs, Defence stocks roar on EU spending talks. US futures also gain, with the RTY outperforming.

USD is on the backfoot as tariff deadline looms; EUR benefits from hotter-than-expected EZ HICP.

Bonds are weighed on by developments around geopols/defence, currently at session lows.

Crude clipped from APAC highs, Precious metals continue to benefit from the geopolitical risk-premia and softer Dollar.

March 3, 2025 at 11:16 am #20322March 3, 2025 at 10:57 am #20321March 3, 2025 at 10:48 am #20320USDJPY 1 HOUR – 150-151

Tested just outside both sides of 150-151 with JPY crosses (weaker) keeping it above 150.

The key level is on the upside as there is about a 1 JPY void (151.94) above it.

While within 150-151, pivotal 150.50 seta the tine.

As I have noted, when you see two currencies moving in opposite directions (e.g. EURJPY) it indicates real money cross currency flows.

March 3, 2025 at 10:32 am #20319March 3, 2025 at 10:18 am #20318New month, new ball game

Using my platform as a HEATMAP shows::

USD trading weaker… opening week gaps (EURUSD, GBPUSD) remain unfilled

Risk on start for stocks

Geopolitics a factor… Europe trying to take the lead in bid to find a peace plan for Ukraine-Russia war

Next key data release: ISM manufacturing PMI

Tuesday is Trump Tariff day for Canada, Mexico and China..

March 3, 2025 at 10:14 am #20317A good morning to you this 3rd day of March 2025. The time is 11am and the mood is good. GOLD (XAU/USD) opened at price 2854 and has since midnight been on a long bias. The metal got to its highest point at price 2877 this moening and has since retraced to the lowest price at 2858.

From the price action i’m projecting a further buy bias to the rice area of 2884 at least. The gold is a buy metal and i see a further push upwards this week. Let’s see how it goes.

Please let’s be careful with out lot sizes and not place more than between 2-5% on any Trade. Protect your capital. A word is enough for the wise.

Thanks,

TOPNINE.March 3, 2025 at 1:12 am #20316March 3, 2025 at 1:00 am #20315…Reports of Europe taking the lead for a peace deal…

EU must ‘urgently’ rearm and turn Ukraine into ‘steel porcupine,’ says von der Leyen

and

British Prime Minister Keir Starmer said European leaders on Sunday agreed to steps to beef defence efforts and secure peace in Ukraine and stability across the continent at a summit staged as a show of support for President Volodymyr Zelenskyy.

But he said that the support and buy in of the US was essential to make the plan work.

March 3, 2025 at 12:15 am #20314March 2, 2025 at 11:43 pm #20313March 2, 2025 at 11:35 pm #20312March 2, 2025 at 11:26 pm #20311THIS WEEK’S MARKET-MOVING EVENTS (all days local)

Economic data releases in the coming week will focus heavily on PMI surveys across Asia, Europe, and the United States, providing insight into early 2025 growth momentum. In Asia, attention centers on February PMIs after January data were clouded by Lunar New Year timing, while South Korea reports inflation, industrial production, and retail sales. Chinese inflation is due over the weekend, likely showing continued subdued price pressures. Meanwhile, Australia’s busy calendar includes fourth-quarter GDP, retail sales, and trade figures; the Reserve Bank of Australia’s latest meeting minutes will draw special interest following its first policy rate cut since 2020.

In Europe, the key event is the European Central Bank’s policy meeting, with a widely expected 25-basis-point rate cut as Eurozone data remain soft. February PMI readings are expected to confirm ongoing sluggishness, while Germany will release volatile manufacturing orders data. Across the Atlantic, the United States will feature February employment data and the Fed’s Beige Book. Analysts will watch for any signs of government job cuts in the federal data, though the consensus points to another month of moderate payroll gains and a stable unemployment rate around 4.0%. The U.S. trade balance may widen further after a rush of imports ahead of anticipated tariffs, and overall economic signals will remain sensitive to evolving policy developments.

\

Econoday

March 2, 2025 at 10:48 pm #20310March 2, 2025 at 10:29 pm #20309 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View