- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 2 weeks ago by GVI Forex 2.

-

AuthorPosts

-

April 24, 2024 at 12:27 pm #5128April 24, 2024 at 12:20 pm #5127April 24, 2024 at 11:14 am #5121

A look at the day ahead in U.S. and global markets from Mike Dolan

Ailing Tesla shares (TSLA.O), opens new tab caught a rare 10% break overnight despite the electric auto giant’s quarterly revenue miss, underscoring a better market mood as Meta (META.O), opens new tab steps up to the earnings dock later and U.S. business activity cools in April.

Morning Bid: Tesla catches break, Meta next; TikTok countdown

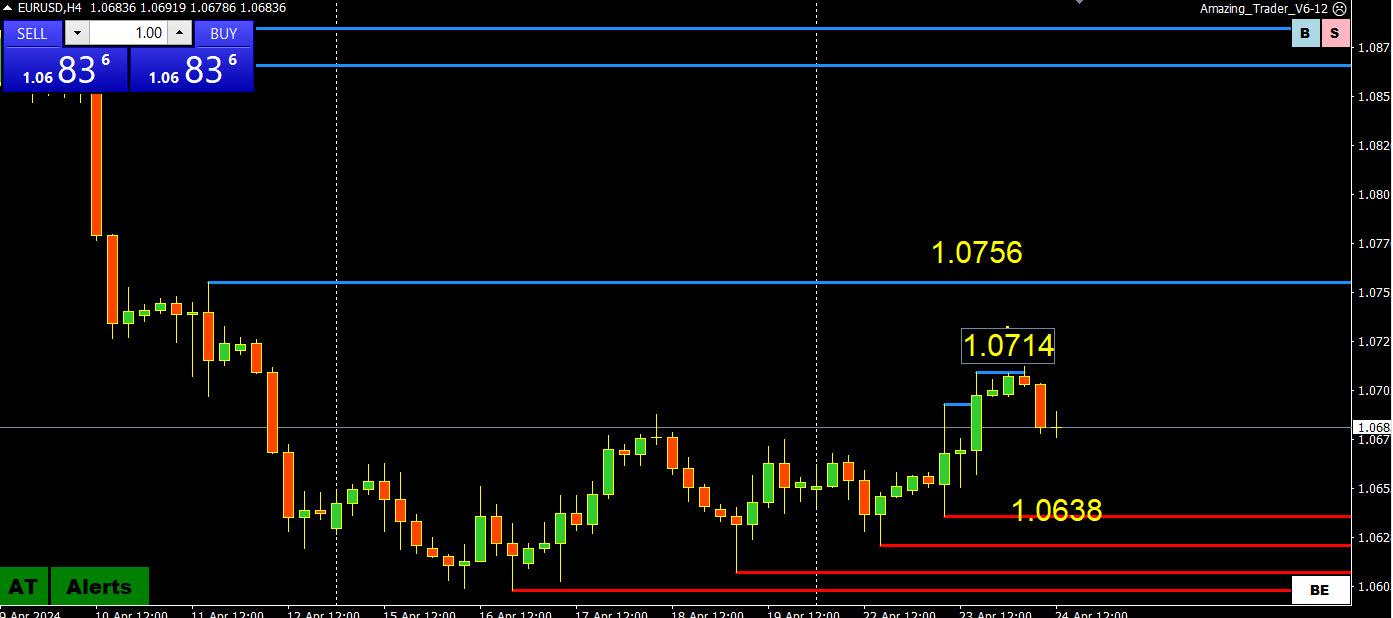

April 24, 2024 at 10:58 am #5117EURUSD Daily

Yesterday we have seen a strong move Up , driven by the data .

Resistance at 1.06700 was taken out ( now acts as a support ) , and we have closed the day Above the sharp downtrend Resistance line.

There are no important data today , so we’ll see if this move can be sustained .

If it does, we’ll have two consecutive Closed bars above the downtrend resistance line, and that would signal a change of trend.

However, if close will be bellow 1.06500 , it would be a perfect Sell signal and run at 1.05500 would be inevitable.

Supports at 1.06800, 1.06700 , 1.06500 & 1.06250

Resistances at 1.07250 , 1.07700 & 1.08250 Continue reading...

April 24, 2024 at 10:02 am #5112

April 24, 2024 at 10:02 am #5112NQ outperforms, benefiting from gains in TSLA, USD firmer & AUD bid post-CPI, Bonds at lows

Good morning USA traders, hope your day is off to a great start! Here are the top 4 things you need to know for today’s market.

4 Things You Need to Know

European bourses are mostly firmer; NQ outperforms, propped up by gains in Tech names – TSLA +10.5% pre-market, TXN +7.3%Dollar is firmer, AUD benefits from the risk tone and on hotter Aussie CPI, USD/JPY printed a high of 154.96

USTs are pressured, giving back some of the PMI-induced gains; Bunds follow suit and eye YTD lows

Crude and XAU are subdued by Dollar strength, base metals remain resilient

Try Newsquawk for 7 Days Free

April 24, 2024 at 9:24 am #5111April 24, 2024 at 9:12 am #5110April 24, 2024 at 9:11 am #5109April 24, 2024 at 9:08 am #5108April 24, 2024 at 8:43 am #5106April 24, 2024 at 8:41 am #5105USDJPY MONTHLY CHART

Let’s try something different by looking at a monthly chart with USDJPY extending its high to within 3 pips of 155.

The pattern that stands out is higher lows/higher highs each month this year. For any intervention to have a hope of stemming the tide, this pattern would need to be broken.

It is hard to remember a stalemate or should I say a pressure cooker like this,,, which will be put to the test on Friday (if not before) when the BoJ meets and Japanese and US inflation data come out… See full previews and detailed analysis

April 24, 2024 at 8:33 am #5104April 24, 2024 at 8:09 am

wfakhoury Amman

GOLD

Time to sell

2303 has been confirmed and will be reached. then at 2281.

Any rise above 2328 will return to it.

Also, 2323 is a consolidation level.

____________________________

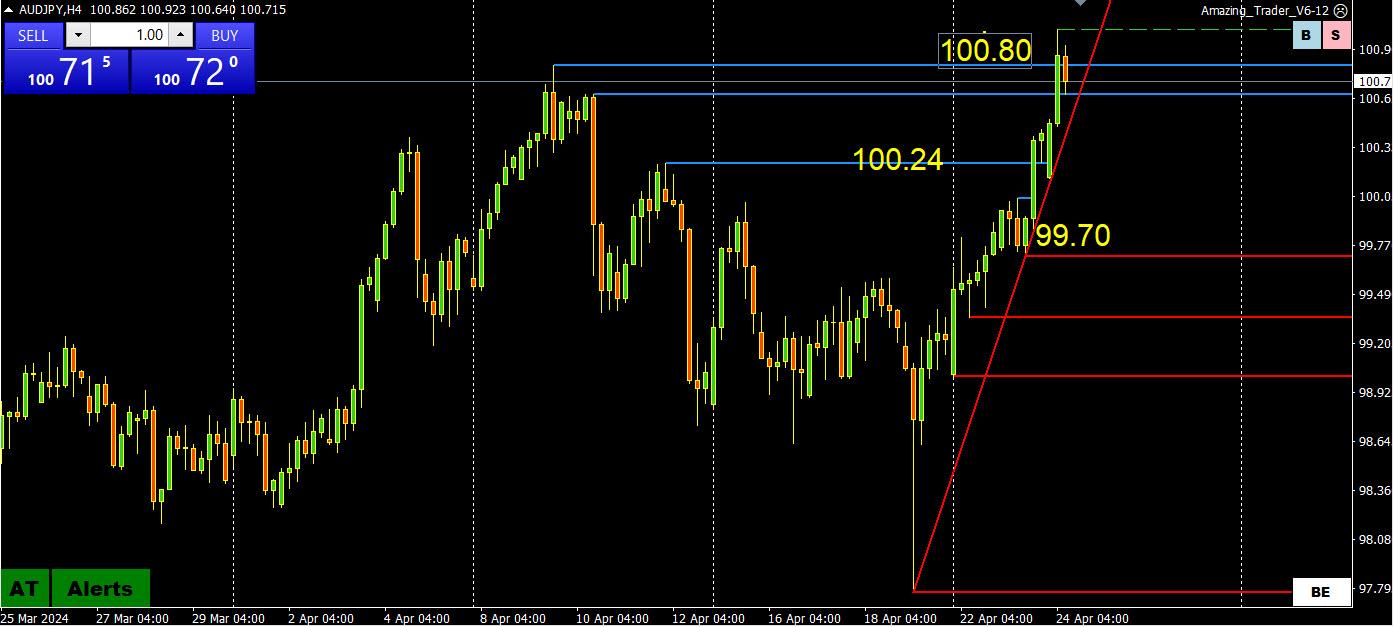

2323 still active as a consolidation level and will be reached from the 2317 area.April 24, 2024 at 8:29 am #5102April 24, 2024 at 8:22 am #5101AUDJPY 4 HOUR CHART – TRYING FOR A BREAKOUT

AUDUSD OUTPERFORMING AFTER CPI DATA WHILE USDJPY REMAINS POISED JUST BELOW 155 DESPITE MARKET ON INTERVENTION WATCH

AS FOR THIS CROSS, THE KEY LEVEL IS 100.80, SO FAR ONLY BRIEFLY TRADING ABOVE AND NEEDING TO BECOME SUPPORT TO BUILD MOMENTUM INTO UNCHARTERED WATERS (I.E. NO CLEAR RESISTANCE OTHER THAN THE MOST RECENT HIGH = 101.01 SET EARLIER).

April 24, 2024 at 8:09 am #5100April 24, 2024 at 8:00 am #5099SYDNEY, April 24 (Reuters) – Australian consumer price inflation slowed less than expected in the first quarter as service cost pressures stayed stubbornly high, a disappointing result for policymakers that led markets to abandon hopes for any rate cuts this year.

Australia Q1 inflation slowdown disappoints, rate cut bets gone

April 24, 2024 at 12:34 am #5097Economic advisers close to former President Donald Trump are actively debating ways to devalue the U.S. dollar if he’s elected to a second term — a dramatic move that could boost U.S. exports but also reignite inflation and threaten the dollar’s position as the world’s dominant currency.

April 23, 2024 at 11:21 pm #5096GVI 11:07 / sounds like a good time for a real-life experiment using your 5:59 post’s tactic:

go flat into the release, evaluate the reaction and maybe

– go with it or

— fade it***

IF I had interest in trading the release I might activate my OCO robot and gnaw at my fingers I survive any dealer widening of spreads, holding off on a fill or price ying-yanging forward n back and maybe try to take out my sl, sometime in the red.April 23, 2024 at 11:07 pm #5095April 23, 2024 at 11:03 pm #5094AUDUSD 4 HOUR CHART – CPI LOOMS

AUDUSD staging a nice rally that would need to get through .6493 (tested) and .6500 to put .6543-53 on the radar.

A test comes in a few hours when AUST CPI comes out… see our Economic Calendar

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View

US30 4 HOUR CHART

US30 4 HOUR CHART

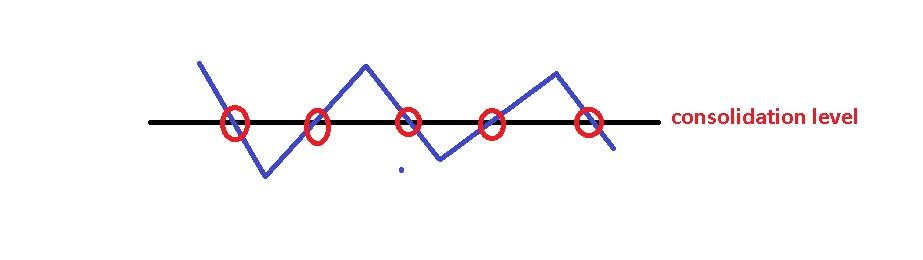

Consolidation is used in technical analysis to describe the movement of a price within a well-defined range of trading levels. Consolidation generally means the price will hit a defined level several times.

Consolidation is used in technical analysis to describe the movement of a price within a well-defined range of trading levels. Consolidation generally means the price will hit a defined level several times.