- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 2 weeks ago by GVI Forex 2.

-

AuthorPosts

-

April 29, 2024 at 10:17 am #5395

THIS BLOG ARTICLE POSTED LAST WEEK INCLUDES A PRIMER ON INTERVENTION AND WHICH TYPE TENDS TO BE MOST EFFECTIVE,. I SUGGEST READING IT NOW THAT THE BOJ HAS SHOWN ITS HAND.

Many new traders have not experienced intervention and even those who have traded on this event, it pays to have a refresher to see which type tends to be most effective. I call it an intervention primer.

April 29, 2024 at 10:17 am #5394April 29, 2024 at 9:42 am #5393

April 29, 2024 at 10:17 am #5394April 29, 2024 at 9:42 am #5393DID THE BOJ READ OUR BLOG ARTICLE POSTED ON FRIDAY?

Is it Time for the Bank of Japan to Put Their Money Where Their Mouth Is?

Should the BoJ decide to take a stand and intervene, it would look to get the most bang for its buck. In other words, pick a time where it would use the least resources and produce the greatest impact from intervention.

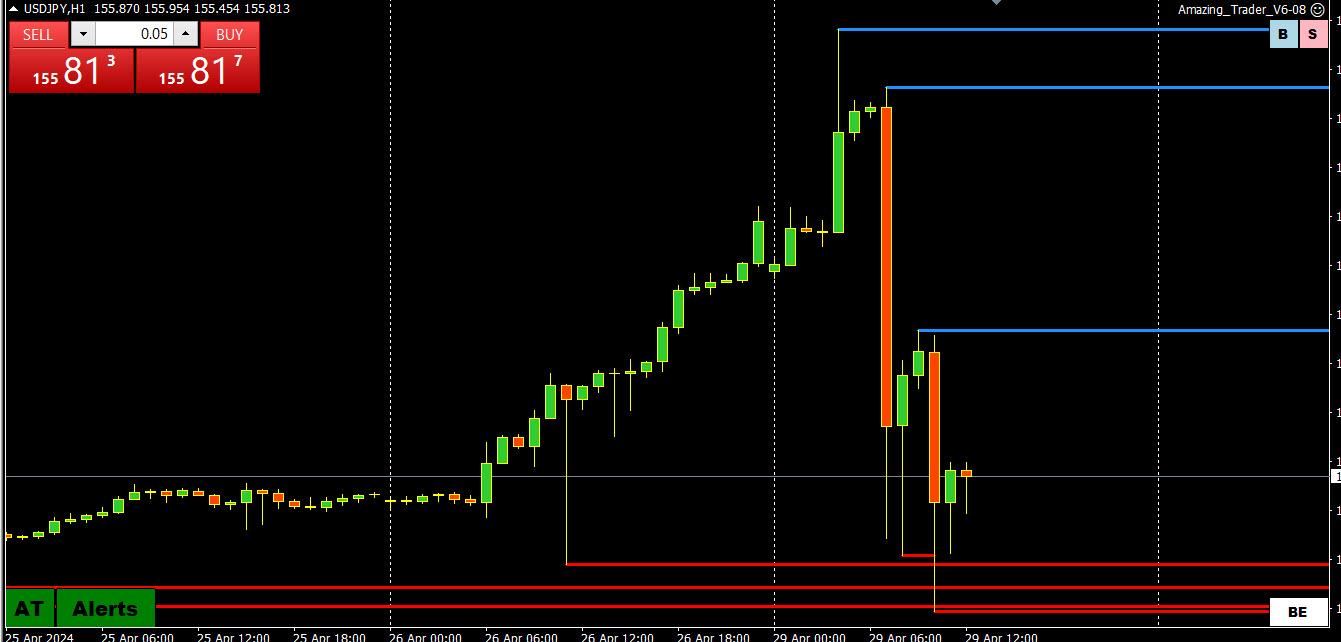

If I was in the BoJ’s shoes I would wait until just after the Tokyo opening on Monday, let the market push USDJPY up and come in with both barrels blazing. I would then smash USDJPY below 155, sit at that level with an offer to make it a resistance and let the market do the rest.

is it Time for the Bank of Japan to Put Their Money Where Their Mouth Is?

April 29, 2024 at 9:23 am #5392USDJPY Weekly

If BoJ means serious business and not just slowing down , they will have to get in again…and strong…This YoYo has to go at least 1.200 pips down to confirm the Reversal.

Although there is a chance for another Intervention, but right now the pressure is shifting to the Upper side…once again…

So let’s see who prevails 😀

April 29, 2024 at 9:17 am #5391April 29, 2024 at 9:13 am #5390April 29, 2024 at 9:06 am #5389April 29, 2024 at 8:04 am #5388April 29, 2024 at 7:26 am #5387April 29, 2024 at 7:14 am #5386April 29, 2024 at 6:56 am #5385

April 29, 2024 at 9:17 am #5391April 29, 2024 at 9:13 am #5390April 29, 2024 at 9:06 am #5389April 29, 2024 at 8:04 am #5388April 29, 2024 at 7:26 am #5387April 29, 2024 at 7:14 am #5386April 29, 2024 at 6:56 am #5385April 29 (Reuters) – The yen jumped suddenly against the dollar on Monday, with traders citing yen-buying intervention by Japanese authorities to try to underpin a relentless tumble in the currency to levels last seen over three decades ago.

The dollar fell sharply to 155.01 yen from as high as 160.245 earlier in the day. Trade sources said Japanese banks were seen selling dollars for yen . It was last fetching 156.21 yen.

Japan’s yen jumps against the dollar on suspected intervention

April 29, 2024 at 6:31 am #5384Dear SF

USDJPY is in a buying mood,158.50 is confirmed and will be reached.

There is no confirmed price downside yet. But the close below 158.50 will go to 157.90 and the close below 157.90 will go to 157.35 .the close below 15725 will go to 156.75

100% guaranteed.

———————————–

158.50 Reached.

157.90 157.35 156.75 all reached.

100% guaranteedApril 29, 2024 at 12:52 am #5383April 29, 2024 at 12:24 am #5382It looks to me like Dxy is intact as long as the 105.70-80 area holds any sell bouts. Consequently I have zero indication UsdJpy is a sell at this point. If you must, I think a good practice would be following it with sell stop entries instead of trying to be a superstar calling tops and bottoms. I think Aussie is a consistent buy overall on down drafts especially against crosses.

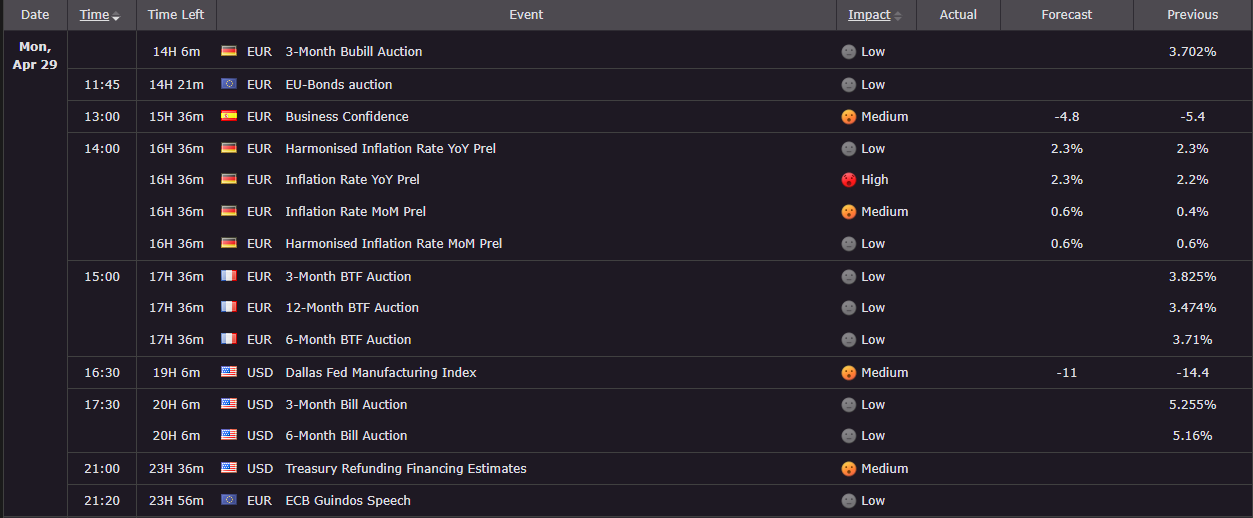

April 28, 2024 at 11:20 pm #5380THIS WEEK’S MARKET-MOVING EVENTS (all days local)

France will lead off Tuesday’s first estimates for first-quarter GDP followed by Germany and Italy with flat to modestly positive results the general consensus. Eurozone results will follow close behind (11:00 local time) with 0.2 percent quarterly growth the consensus. The first estimate for harmonised Eurozone inflation will be posted at the same time as Eurozone GDP with only the most marginal improvement expected.

But Tuesday’s session will actually open in China with the official CFLP PMIs, which are expected to slow, while rounding out the day will be monthly GDP from Canada, which is also expected to slow, and the quarterly employment cost index from the US which is expected to hold steady.

Wednesday’s session will center on an expected no-action Federal Reserve meeting. Monthly US employment data are another of the week’s mainliners opening with ADP on Wednesday followed on Friday by nonfarm payrolls which are expected to rise a strong 230,000.

Econoday

April 28, 2024 at 10:22 pm #5378April 29 (Reuters) – A look at the day ahead in Asian markets.

Asian stocks should open on Monday buoyed by Friday’s tech-led surge on Wall Street, while investors will be scrambling to make sense of the latest twist in the Japanese yen’s extraordinary helter-skelter slide against the dollar and other currencies.

April 28, 2024 at 9:08 pm #5376April 28, 2024 at 9:05 pm #5374fun n gaming with inflation fighter jerome

on wednesday

–

and then powell flipped to a hawkish tone muttering something about less cuts and in not exactly super clear terms has mumbled something about no cuts and in agonizingly confused linguistics suggest that a potential hike can not be off the table.srce.: attempted futurologist Mtl JP

April 28, 2024 at 8:25 pm #5373April 28, 2024 at 7:31 pm #5372USDJPY Daily

In my 3 decades of experience with Yen ( my first major lost was shorting it in similar situation ) , what I see is continuous run to 162.

As long as 157 holds its ground.

And to be even more exact, I expect tomorrow another leg Up , just like on Friday – straight for the 162.

Second possibility is to see a pull back to 157 area and then within few days to hit that target.

Call me a degenerate trader ( no offence taken) but I just can’t see it any other way…yes, there is always a first time for everything, but not on Yen .

If BoJ tries to stop it right now, they are degenerate bankers….as I said : Blow of Rally, and then they step in , together with major players taking their profits.

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View