- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 2 weeks ago by GVI Forex 2.

-

AuthorPosts

-

April 29, 2024 at 11:05 pm #5428

USDJPY ONE HOUR CHART

Unless the BoJ is willing to back up its interventions with a hike in interest rates or commit to large-scale USDJOY selling, the best we can say at this stage is that it has, at least for now, restored a two0way risk in what had become a one-way market

What hasn’t changed is that 155 remains pivotal and only firmly below it would suggest the BoJ has won this battle. If not, then it is just a shot across the market’s bow.

April 29, 2024 at 10:13 pm #5423EURUSD 4H

Supports 1.07150 & 1.07000

Resistance at 1.07350

As long as supports hold, we are targeting 1.08000 and subsequently 1.08350

Pattern in creation suggest move Up.

But can it be opposite…of course…never say never – in which case we would hit 1.06350

However, pigs can’t fly, yet….maybe if they produce AI pigs one day…who knows

April 29, 2024 at 9:21 pm #5422April 29, 2024 at 7:30 pm #5421April 29, 2024 at 6:56 pm #5417April 29, 2024 at 5:50 pm #5416April 29, 2024 at 5:42 pm #5415April 29, 2024 at 5:07 pm #5414

April 29, 2024 at 9:21 pm #5422April 29, 2024 at 7:30 pm #5421April 29, 2024 at 6:56 pm #5417April 29, 2024 at 5:50 pm #5416April 29, 2024 at 5:42 pm #5415April 29, 2024 at 5:07 pm #5414Covered calls are bid for stocks as well as some other facets, but some internals are not solid so it appears to me that the bid in stocks in moderately on the apprehensive side but bid so far. Dxy withstood the overnight selling but has to clear 106.05 and hold to accelerate in my view, otherwise the 105 area might be seen. I’m looking to sell GbpUsd around 2600 but am biased long overall until the tune changes. Staying on the bid in AudUsd and crosses on pullbacks and believe it might temporarily stall around 6600 in both spot and futures.

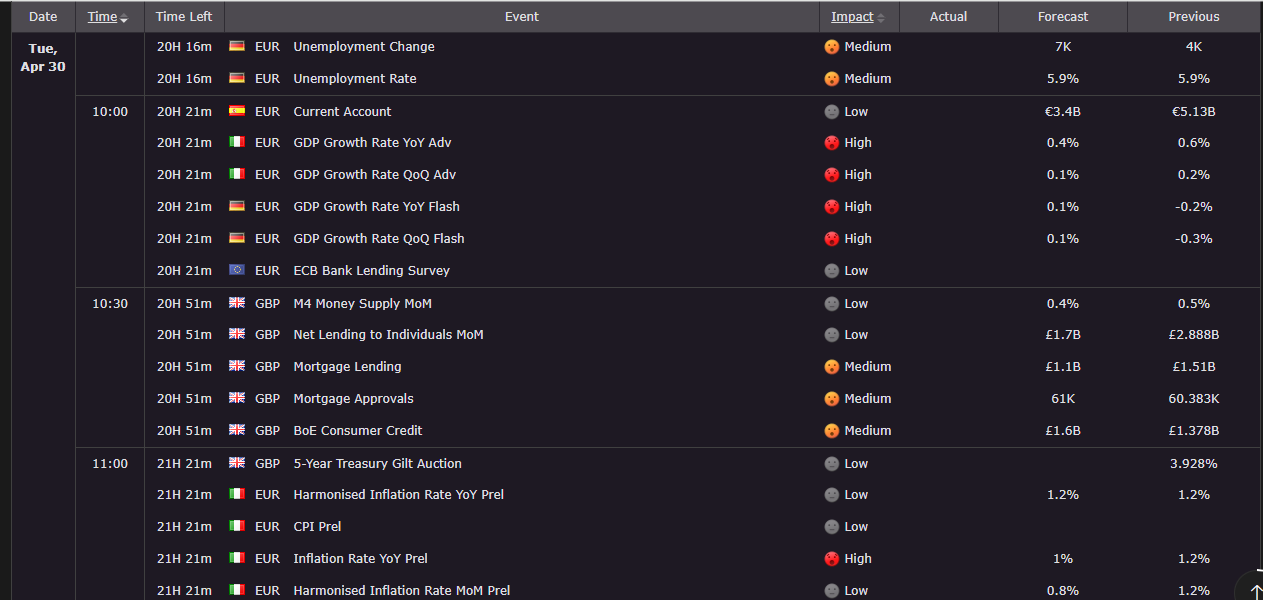

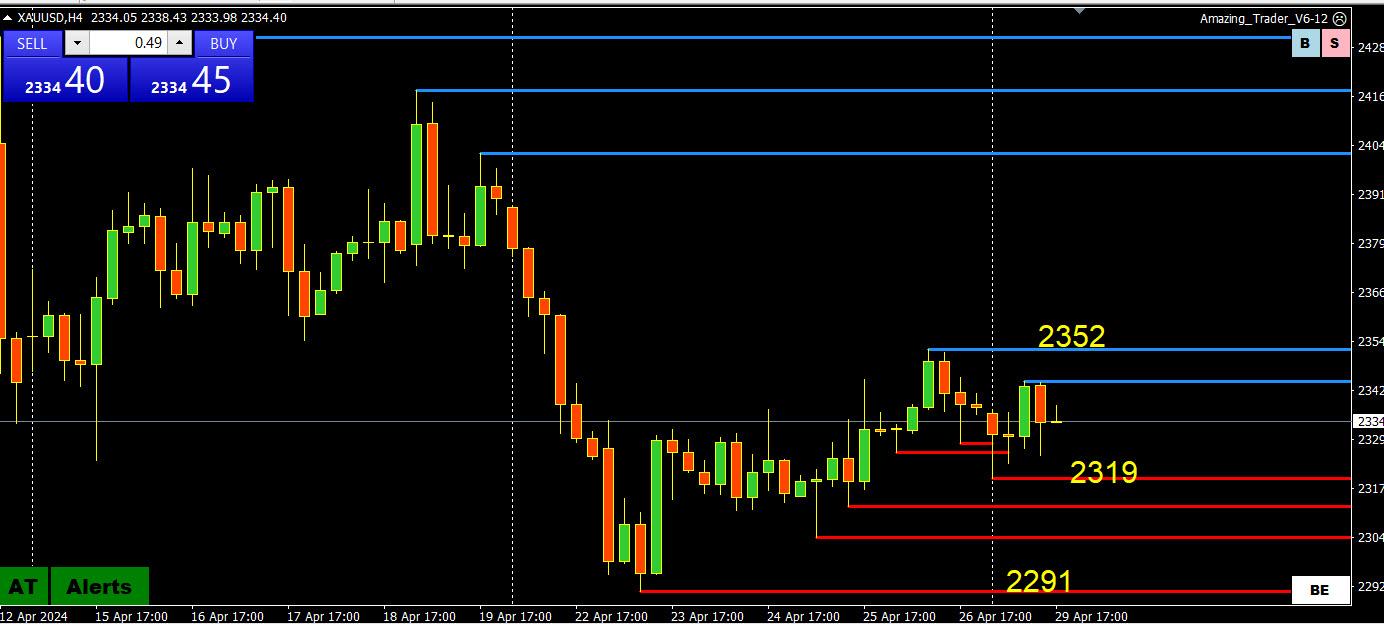

April 29, 2024 at 3:46 pm #5410April 29, 2024 at 2:55 pm #5409April 29, 2024 at 2:34 pm #5408XAUUSD 4 HIYR CHART – ON THE SIDELINES?

SO FAR, THERE W]HAS BEEN LITTLE REACTION TO THE LATEST PROPOSAL FOR AN ISRAEL-HAMAS CEASEFIRE.

WHAT CAUGHT MY ATTENTION IN THIS CHART IS THAT MOVES OUTSIDE OF 2300-2400 HAVE LACKED FOLLOW-THROUGH.

WITHIN THIS RANGE EXPECT 2350 TO BE PIVOTAL IN SETTING THE BIAS, ESPECIALLY FOR DAY TRADERS..cURRENT TIGHT RANGE IS 2319-52

April 29, 2024 at 2:18 pm #5407April 29, 2024 at 2:17 pm #5406Geoploitical news

RIYADH, April 29 (Reuters) – U.S. Secretary of State Antony Blinken on Monday urged Hamas to swiftly accept an Israeli proposal for a truce in the Gaza war and the release of Israeli hostages held by the Palestinian militant group.

Hamas negotiators were expected to meet Qatari and Egyptian mediators in Cairo on Monday to deliver a response to the phased truce proposal which Israel presented at the weekend.

“Hamas has before it a proposal that is extraordinarily, extraordinarily generous on the part of Israel,” Blinken said at a meeting of the World Economic Forum in the Saudi capital Riyadh..truncated

April 29, 2024 at 2:16 pm #5405DLRx 105.70 / 10-YR 4.642%

–

I gage that player collective is expecting and therefore pricing in what is generally termed “jerome’s FED’s hawkish pivot” on wednesday. odds calcs suggest around 25bps by december.10-yr… 2yr … probably on “watch” radar.

europe, incidentaly, is on holiday on Wednesday (the so what: likely thin participation)

Bottom Line

I am biased but this time around I am not enthusiastic about much upside potential for the DLR.Maybe friday’s incoming US jobs data will stirr the juices pot some

April 29, 2024 at 1:13 pm #5404SCROLL BELOW AND YOU WILL SEE MY REFERENCE TO THE “MONDAY EFFECT.’

SEE WHAT IT MEANS IN THE FOLLOWING

April 29, 2024 at 12:48 pm #5403

April 29, 2024 at 12:48 pm #5403EURUSD 1 HOUR CHART – OUT OF STEAM?

With EURJPY still above key levels but losing its strong momentum it remains to be seen whether EURUSD can keep its bid ahead of key events this week.

What caught my attention looking at this chart is the failure to seriously take out the 1.0750 level (power of 60).

Mark down today’s high for if it holds, pressure could re-emerge on the downside as the week progresses (“Monday Effect”).

April 29, 2024 at 12:28 pm #5402THIS IS ONE OF MY FAVORITE TIPS AND WORTH REPEATING AS IT IS A TIMELY ONE NOW THAT THE BOJ HAS FINALLY INTERVENED IN USDJPY.

‘

The forex market is on a constant search for the path of least resistance, whether it be on the up or downside for a currency. A trend starts like the gently flowing stream, picks up momentum as with the cascading water, and then reaches a climax when it hits the waterfall.Jay Meisler’s Common Sense Trading: How You Can Identify the Path of Least Resistance?

Jay Meisler’s Common Sense Trading: How You Can Identify the Path of Least Resistance?

April 29, 2024 at 11:42 am #5401April 29, 2024 at 10:36 am #5397EURJPY DAILY CHART = DAMAGE NOT YET FATAL

While intervention has been in USDJPY, crosses have felt the impact as well. With that said, if you want to be short JPY there is less chance of intervention in crosses than in USDJPY.

EURJPY retreat from 171.55 shows key supports still untouched

165.34

163.36 (Trendline)

163.01While the damage is not yet fatal the intervention has restored a two-way risk to a one-way market. .

April 29, 2024 at 10:31 am #5396 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View