- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 3 weeks ago by GVI Forex 2.

-

AuthorPosts

-

May 2, 2024 at 1:02 pm #5601May 2, 2024 at 12:37 pm #5600May 2, 2024 at 12:10 pm #5599May 2, 2024 at 11:22 am #5596

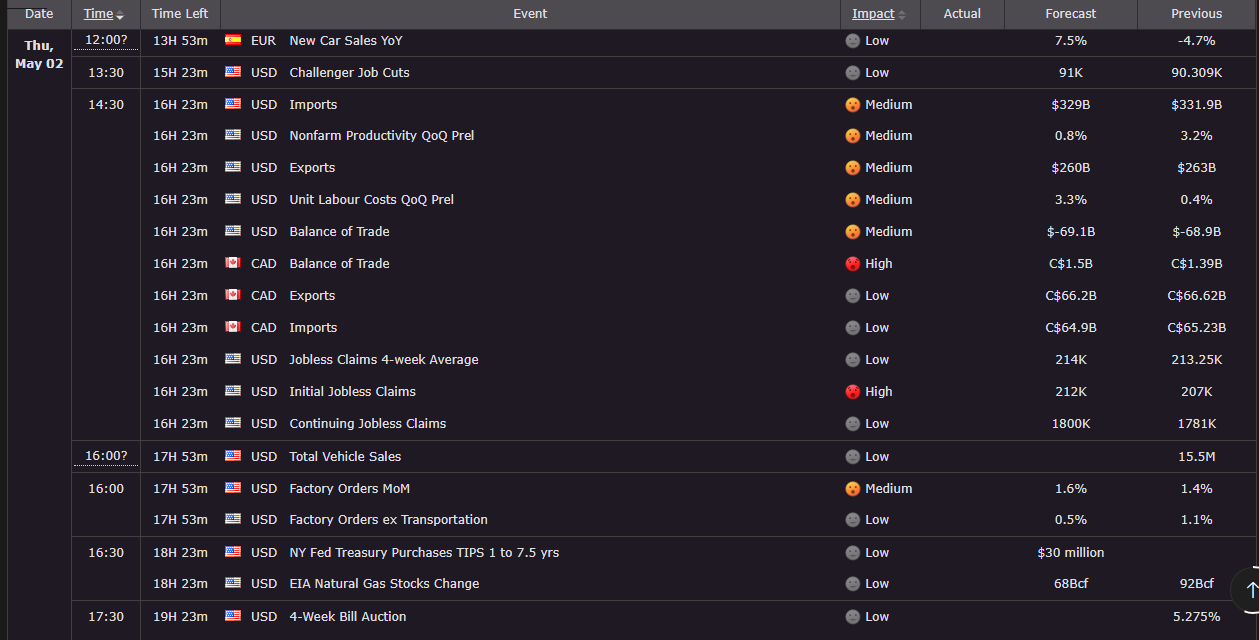

EURUSD Daily

After FOMC and some not so clear blubber coming from the Feds, EUR is left hanging…

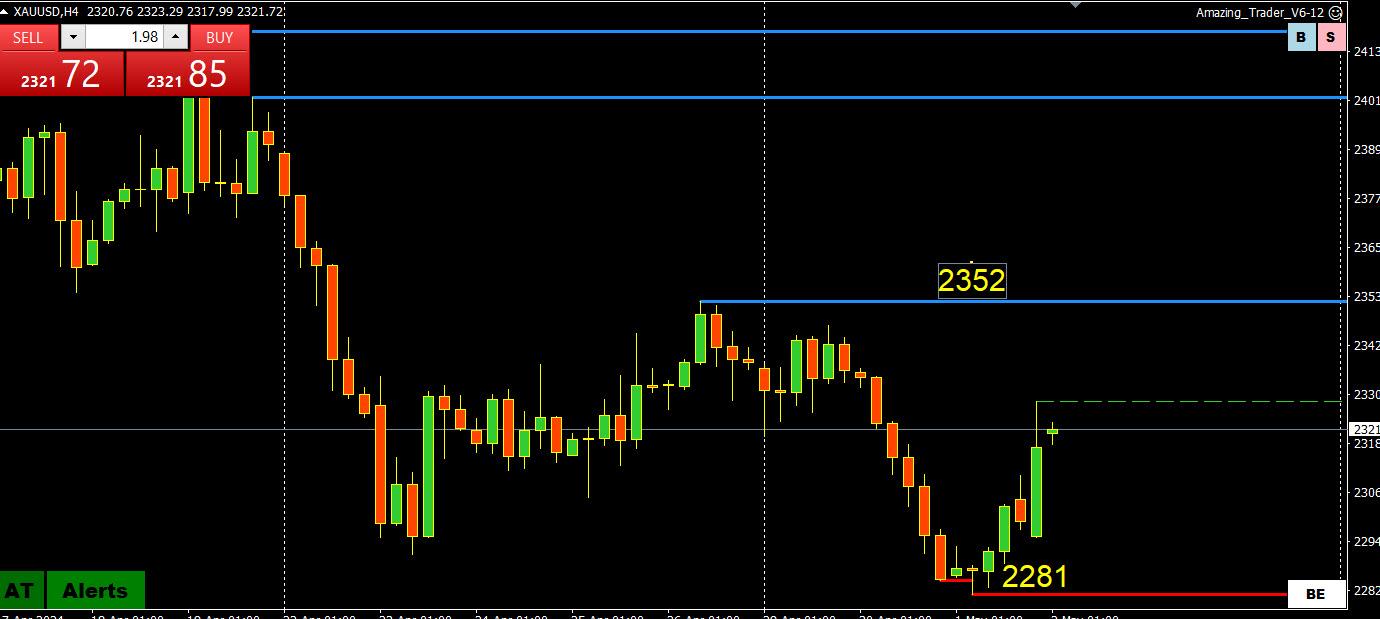

Because of Today’s USD Initial Jobless Claims and Friday’s Important EUR data, we might see continuous YoYo effects – Economic Data Calendar

Technically speaking, this does not look good for the EUR , and as we can see lower and lower Daily Highs in previous days, picture is slowly starting to get some sense…

1.06450 is the Major Support right now, and needs to be taken for a run to 1.04950

Only decisive break of 1.08350 would change this current picture.

May 2, 2024 at 11:08 am #5595May 2, 2024 at 11:02 am #5594

May 2, 2024 at 11:08 am #5595May 2, 2024 at 11:02 am #5594A look at the day ahead in U.S. and global markets from Mike Dolan

Anxious bond traders seem to have taken solace from the Federal Reserve’s surprisingly sharp brake on its “quantitative tightening” process on Wednesday, while the yen capitalized on an easier dollar after what seemed like the second bout of Japanese intervention this week.

May 2, 2024 at 10:30 am #5593May 2, 2024 at 10:15 am #5589May 2, 2024 at 9:45 am #5588EURUSD DAILY CHART – 1.07 PATTERN

I am always on the lookout for patterns and one I watch is when a currency trades on both sides of a big figure (round number).

There is currently such a pattern in the EURUSD:

8 days trading on both sides of 1.07

4 closes below 1.07

3 closes above 1.07

No 2 days of consecutive closes above or below

I have found the longer a pattern like this goes on the greater risk of a directional move once it is decisively broken . So keep an eye on this levels as an 8 day pattern like this is a long one.

Notice how your sentiment changes (feels bid or offered) when EURUSD trades above or below 1.07.

May 2, 2024 at 9:20 am #5587May 2, 2024 at 9:08 am #5586May 2, 2024 at 9:02 am #5585(160 THE NEW LINE IN THE SAND)

TOKYO, May 2 (Reuters) – Japan will likely keep intervening to prop up the yen until the risk of speculators triggering a free fall in the currency has been eliminated, said a former central bank official who was involved in Tokyo’s market forays a decade ago.

Yen: Ex-BOJ official predicts Japan will keep intervening

(Data dependebt)

NEW YORK (Reuters) – Federal Reserve Chairman Jerome Powell’s reassuring message following the central bank’s monetary policy meeting may not calm frazzled U.S. stock and bond investors, as uncertainty over the path of inflation intensifies the focus on upcoming data.

Analysis-Powell’s soothing tone may not be enough for inflation-spooked marketsMay 1, 2024 at 11:49 pm #5583AFTER A SECOND ROUND OF INTERVENTION THIS ARTICLE IS WORTH READING

Currency Intervention and Why the JPY is Called : “The Devil”</a>

Currency Intervention and Why the JPY is Called : “The Devil”</a>

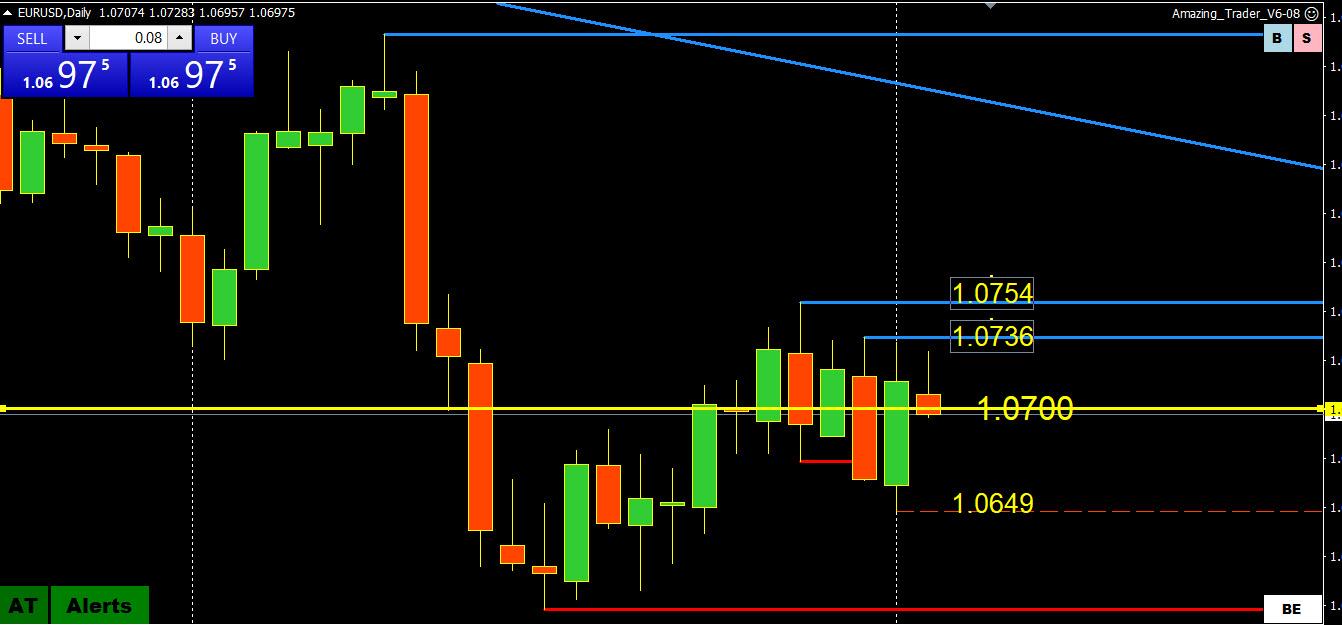

May 1, 2024 at 11:39 pm #5582XAUUSD 4 HOUR CHART – Back above 2300

\

After a brief run below 2300 XAUUSD is back above it.

As you can tell by this chart 2352 remains a key level on top.

With its record high far away, 2300 will likely set its tone with a break of 2352 needed to shift the focus back towards 2400.

Keep an eye on BTC 60000 to see if it follows XAUUSD’s lead.

May 1, 2024 at 11:11 pm #5581May 1, 2024 at 10:54 pm #5580May 1, 2024 at 9:40 pm #5579USDJPY 4 HOUR CHART – THE EMPIRE STRIKES AGAIN

The BoJ is taking a risk of overplaying its hand by presumably slamming the market at its thinnest hour.

With that said, it is a warning to be on guard but unless it can get USDJPY below 155 (low on this round was 152.99, last at 155.10) it risks only restoring a two-way risk, not reversing it.

Technically, there is a lower top and a lower bottom so some damage done but still an aftershock unless sub-155 is established.

May 1, 2024 at 9:38 pm #5578May 1, 2024 at 9:34 pm #5577according to bbrg

–

Treasuries Rally With Fed Not as Hawkish as Feared: Markets Wrap

(Bloomberg) — The world’s biggest bond market surged as Jerome Powell downplayed the possibility of rate hikes and the Federal Reserve said it will shrink its balance sheet at a slower pace to ease strains in money markets.May 1, 2024 at 9:04 pm #5576 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View