- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 3 weeks ago by GVI Forex 2.

-

AuthorPosts

-

May 6, 2024 at 2:24 pm #5834

10-yr 4.504

apparently “slip” as hope (haha) for FED rate cuts increases after latest us jobs data (cnbc)so players not heeding goolsbee’s (gentle ?) hint and so are now pricing a 25bps cut in sept and so we are now gaming relative yields (ie. spreads)

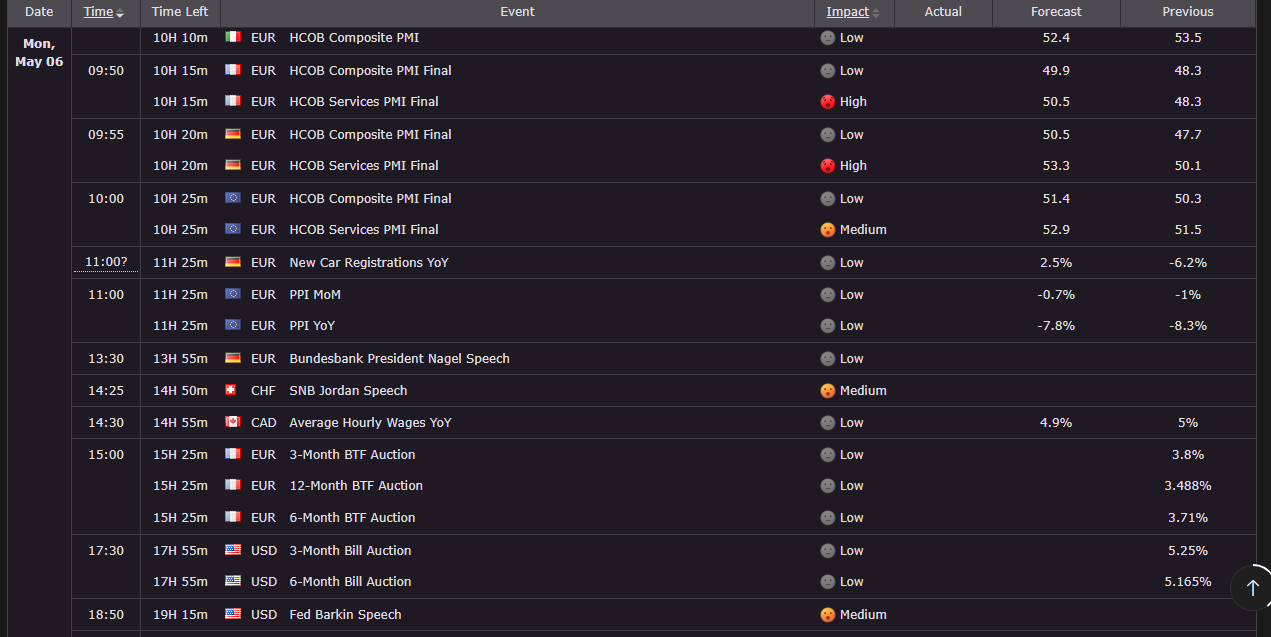

Not much of potential moving consequence this week

voter barkin and voter Williams are yakking little later todayfollows Loan Officers Survey after

May 6, 2024 at 1:33 pm #5833May 6, 2024 at 1:23 pm #5832May 6, 2024 at 1:20 pm #5831May 6, 2024 at 12:49 pm #5826I am impressed with the durability of Bitcoin to sustain waves of apprehension before and after the “halving.” Enthusiasts were sure it would cause the not-yet viable instrument which is a not-yet viable asset to bolt to 100,000. Seeing how the non-instrument is the most ripe non-instrument for fraud and crime, such as terrorist money being transferred without roadblocks, one might expect the next major case of fraud similar to the FTX matter to cause some strong decline into the 30,000 area. Would like to see that as I would put money into it again down there if so. At this point it appears the 50,000 area might hold for a while.

May 6, 2024 at 12:33 pm #5824May 6, 2024 at 10:09 am #5822a show: dog stepping on the tail – and the meaning ….. https://www.axios.com/2024/05/05/israel-us-ammunition-shipment-hold – maybe

–

maybe last Friday’s goolsbee interview was meaningful to peasant traders.

with reference to the jobs print and player ethusiastic reaction:

… one thing is daytrader timetable reaction but the FED marches to economic timetable …

—

as if pre-planned … two FED suits on yak deck on FED’s policyMay 6, 2024 at 10:08 am #5821A look at the day ahead in U.S. and global markets from Dhara Ranasinghe.

The relief across world markets as signs of a softening in the U.S. jobs markets strengthens the case for Federal Reserve rate cuts to start later this year remains palpable.

Not only did U.S. 10-year Treasury yields end Friday down 17 basis points , in their biggest weekly drop of the year, but the S&P 500 stock index had its best day in over two months.

May 6, 2024 at 9:29 am #5820GBUSD 15 minute CHART – Better bid but consolidating

GBPUSD is a bit of an outperformer so far today (note firmer GBPJPY_ but consolidating with the UK closed today for a holiday/.

As this chart shows, there are layers of support ahead of the pivotal 1.25 level with key resistance above 1.26 (Friday’s high).

This suggests little to go for within a 1.25-1.26 range other than intra-day levels as show on this chart.

May 6, 2024 at 9:03 am #5819EURUSD 4 HOUR CHART – CONSOLIDATING

EURUSD has so far traded in a tight range as it consolidates below Friday’s 1.0812 post-USjobs report high.

A key level to keeping a bid is to stay above the 1.0752 mini breakout level (Power of “50”) with support at 1.0724 below it.

On the upside, the key level is obvious at 1.0812 as only above it would add legs to the upside.

May 6, 2024 at 8:54 am #5818USDJPY 4 HOUR CHART- Is BoJ lurking?

When you see 2 currencies moving in opposite directions vs the dollar you can assume there are real market flows in a cross.

This is the case so far on Monday with USDJPY moving higher and currencies like the EUR, GBP, AUD, etc up (marginally so far) vs the USD.

Given what happened last time Japan was closed for a holiday (i.e. intervention) expect some caution pushing USDJPY higher but if I were in the BoJ’s shoes I would not want to become predictable.

Looking at this chart, the key level is not until above 156 and BoJ will likely want to see USDJPY stay below 155, suggesting 152-155 is sort of a no man;’s land for trading.

May 6, 2024 at 12:15 am #5817May 5, 2024 at 11:21 pm #5816THIS WEEK’S MARKET-MOVING EVENTS (all days local)

Both the Reserve Bank of Australia on Tuesday and the Bank of England on Thursday are expected to keep policy steady. Inflation in both countries remains above target with improvement slow especially in Australia.

China’s merchandise trade surplus on Thursday is expected to show a sharp jump on an April rebound in exports. Chinese CPI for April on Saturday is expected to remain near zero.

Underperformance is the call for German manufacturing orders on Tuesday and German industrial production on Wednesday.

The UK will post the first estimate for first-quarter GDP on Friday and modest growth is the consensus. Canada’s labour force survey on Friday is seen rebounding modestly in April following disappointment in March.

Econoday

May 5, 2024 at 10:53 pm #5815Bobby – very, very nice touch indeed. And exactly (although he was doing very well) a Co-Chairman of the now closed Pacific Stock Exchange told me over lunch one day in San Francisco after we walked through the exchange for a while told me he was moving to Mexico to grow the plants and produce tequila lol. Yes, different times. Most of the same principles apply as you point out.

May 5, 2024 at 10:27 pm #5814I felt urge to concur with our California colleagues from Monedge , regarding possible Longs in USDJPY above 155…

Back in days when I was trading OPM ( Other people’s money J , the sheer sizes of the positions held didn’t let me play on small time frames, paired with spread at the time and clients expectations , not to mention that every stop loss could have been yet another signal for a client or two to withdraw their funds…

Executing a stop was like inviting the Devil to take your soul…

We have used hedging as a first aid , but again – different times…we had all different European currencies that were pretty much pegged to each other , so USD could have been bought and sold at the same time, with the same margin , and you could even make money just sitting hedged…

HOW you’re asking…well, interest rate differentials…Long USDCHF, Short USD FF – in both cases you were earning interest….there have been some even more drastic examples , but not really hedging…

I remember when a client of mine didn’t want his profits to be calculated any other way but in USD – Dollar was rallying up like crazy…so those of you who are or were on that side of the game surely understand the problem – for those of you who have no idea what am I talking about – If your Home currency is the one that is appreciating the most, all the profits that are going to be made will lose some ( at least in percentages) till year’s end….Got it ??

So in one moment of genius ( or maybe that was just a desperation on my end) , after deep research and some help from a friend ( few of them to be exact – all on the dealing desk of SA Central Bank ) I went Short USDZAR – interest rate differential was about 16% in my favour .

It was one extremely risky move on my part, but within next 4 months paid me truckloads – 8% on Traded amount , plus about 15% of ZAR appreciation vs USD….Mind you, Leverage was not nearly as high as today and we could go as much as 1:10 . But in this devilish trade I made around 215% on funds held. Call me a lunatic, but that’s how the game was played back then…eat or be eaten..

Have to admit that it was kind of easier to trade then, with pretty clear positions of Central Banks and Gov’s in general, not to mention that we had Alan Greenspan 😀

So you got the hint of my experience – and I am going to tell you what No sane advisor, analyst, influencer or a Guru won’t:

When caught with your pants down, but still breathing a bit, use every and any move in your direction to exit the doomed position. Book the loss. And never turn back again. If market decides to go your direction further, well hell…it is not on you – it is on that guy who entered the original trade in the beginning…But that is the only way to survive for sure , to be able to fight another day…

Or just let it be, kiss your margin good buy and start doing something else…like tomato growing plantation…

May 5, 2024 at 10:20 pm #5813May 5, 2024 at 9:55 pm #5812May 5, 2024 at 9:37 pm #5811May 5, 2024 at 9:17 pm #5810May 5, 2024 at 8:55 pm #5809I see (hopefully) one more round of USD buying which I expect will run out of steam around or above UsdChf 9100 where I like the sell side for duration. Same with UsdJpy in kind.

Note to those of us who have limited experience in forex trading — Macd and Stochastics will remove you of your money. You are better off listening to people in here with experience.

And for the love of God if you think some youtube or facebook “guru” is going to make you money with “signals” on your cell phone you are in for a rude awakening. Monedge, for example, was formed by CTA’s and other industry professionals, GVI is frequented by real bank traders with real experience. Big, big difference.

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View