- This topic has 11,679 replies, 48 voices, and was last updated 3 months ago by GVI Forex 2.

-

AuthorPosts

-

May 7, 2024 at 4:35 pm #5898

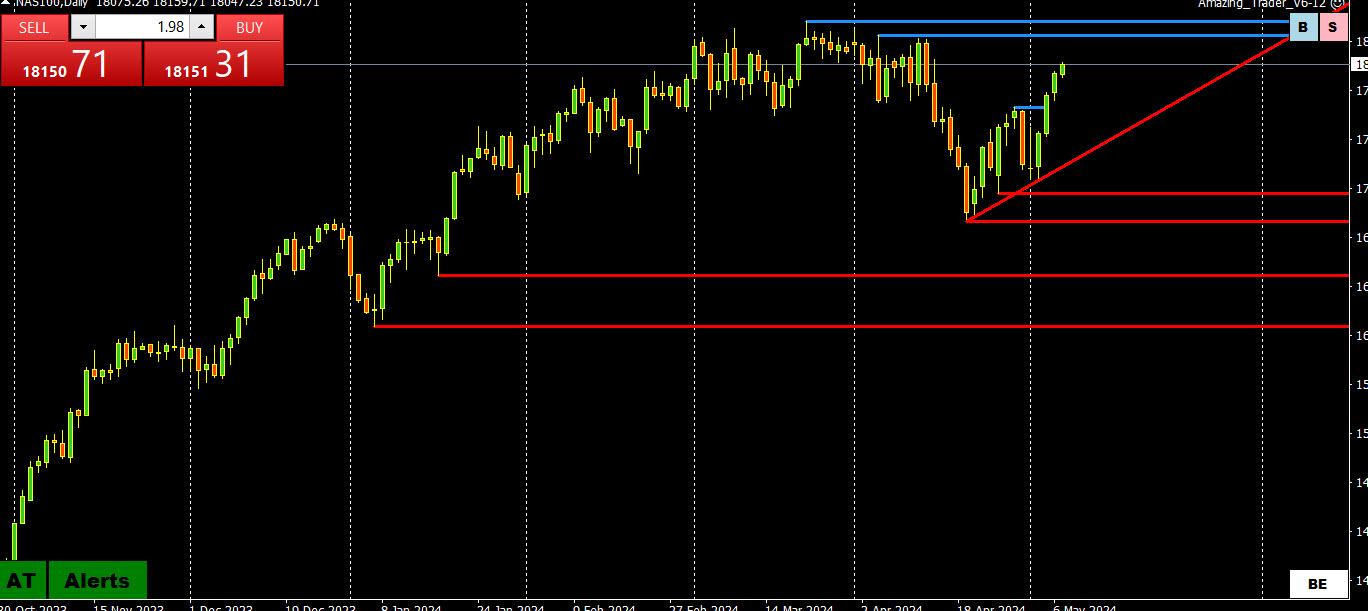

NAS100 DAILY CHART – TESTING 18K

NAS00 reacting to the retreat in bond yields and fresh rate cut expectations.

As this chart shows, it is coming in sight of the major resistance zone where 18000 needs to become support to put it on the radar.

Note CFD price feeds differ between brokers, even with the same symbols so I show the chart patterns rather than specific levels.

May 7, 2024 at 4:26 pm #5897May 7, 2024 at 4:22 pm #5896maybe kashkari’s piece – https://www.minneapolisfed.org/article/2024/policy-has-tightened-a-lot-how-tight-is-it-an-update – caused a little scattering of the cats

May 7, 2024 at 4:18 pm #5895Put to Call ratio in S/P 500 is right in the middle, up overall, most other gauges are the same, including the volume ratio I noted earlier that had a sudden drop off which was somebody big either getting out or taking some money off of the table. Bottom line with these and other gauges are ending up with EurUsd up overall but not convincingly to this point intra-day. Stocks and Eur often move well together.

May 7, 2024 at 4:15 pm #5894May 7, 2024 at 4:14 pm #5893May 7, 2024 at 4:04 pm #5892May 7, 2024 at 4:01 pm #5891May 7, 2024 at 4:00 pm #5890May 7, 2024 at 3:41 pm #5889May 7, 2024 at 3:38 pm #5888AUDUSD 4 HOUR CHART – CONSOLIDATING

Similar to other pairs AUDUSD is trading below highs set after Friday’; US jobs report.

What I like about this type of chart is that the key levels are clear, which gives a framework to trade with shorter time frames.

In this regard, ,6565 needs to hold to keep the .6648 high on the radar while the upside is limited unless the high is taken out,

May 7, 2024 at 2:17 pm #5883May 7, 2024 at 1:35 pm #5882May 7, 2024 at 1:17 pm #5876May 7, 2024 at 12:34 pm #5874EURJPY 1 HOUR CHART

i assume I am not alone in only trading the JPY very selectively and shying away from being on the short JPY side other than for a scalp.

However, I look at this cross (along with other EUR crosses)for clues trading EURUSD (currently supported by firmer EUR cross offsets).

As for EURJPY, the key level is at 167.38/ Momentum is currently tilted up in this cross but expect caution at any approach to this level.

May 7, 2024 at 10:59 am #5871May 7, 2024 at 10:20 am #5870A look at the day ahead in U.S. and global markets from Mike Dolan

World markets have returned to levels of almost month ago as fears of an overheated U.S. economy abate even as corporate profit growth remains brisk.

The April miss on new payrolls and the sight of annual wage growth ebbing below 4% have been enough to switch the narrative back to a Federal Reserve which is on hold for now, rather than one that may even consider further interest rate hikes.

Morning Bid: Cooler US takes edginess off markets, UBS jumps

May 7, 2024 at 10:06 am #5869With the US economic calendar basically empty of key events this week it is like an addict having a tough time without his/her latest fix.

What we are left with is some revived Fed risk cut expectations as seen by slipping bond yields but little to go after on the dollar downside unless last Friday’s post-US job USD lows are threatened.

Otherwise, a mixed bag with JPY and AUD the underperformers.

EURUSD is holding up while above 1.0752, close to unchanged as it has been the benficaiory of varioius cross flows (note firmer EURGBP).

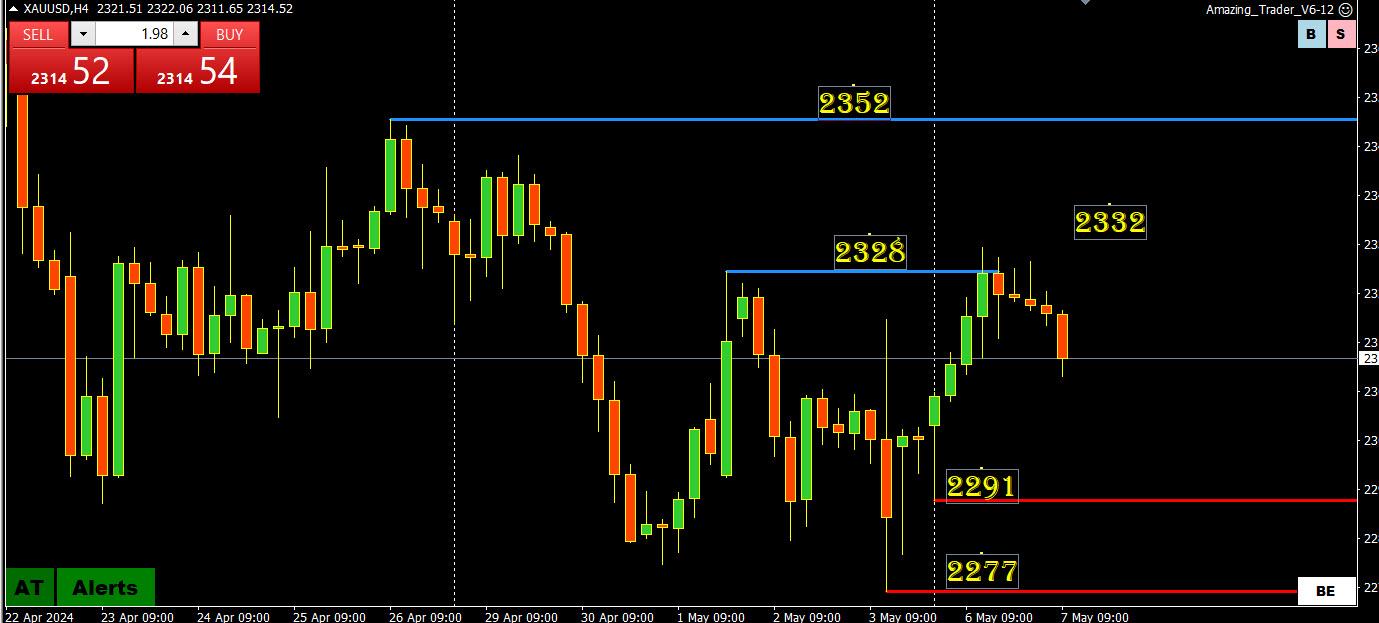

May 7, 2024 at 9:51 am #5868XAUUSD 4-HOUR CHART – CUP HALF FILLED OR HALF EMPTY?

XAUUSD struggling to regain momentum, after a brief blip above 2328 failed to hold.

This leaves the ranges at 2291-2332, broader at 2277-2352

Taking a cup half-empty or half-filled approach,

– Finds support as long as 2300+ trades

– Limited upside as long as it trades below 2350ish

-Revert to shorter time frame charts while within these ranges.

May 7, 2024 at 9:24 am #5867USDJPY 4 HOUR CHART – WHAT THE SAVVY TRADER IS SAYING

I have passed on the view of what I call the “savvy trader” (long-time GV member) and here is another one just emailed to me (note I am only acting as the messenger)

155.66 – 155.92 could be a good area to start a strategic campaign short

closes below 153 on a daily basis would not be good for the bulls

and anticipate an acceleration below 152 and 151

1st target 147.xx from which anticipate a bounce before eventually drilling for much deeper targets.

I suspect that the maximum it can drop is around 126 and then it will range back up

everything must be done with patience -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View