- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 3 weeks ago by GVI Forex 2.

-

AuthorPosts

-

May 14, 2024 at 1:36 pm #6239

NAS100 30 MINUTE CHART – DOWN LIKE AN ELEVATOR UP LIKE AN ELEVATOR

The usual phrase is up like an escalator, down like an elevator but price action after the US PPI report whipsaws in all markets.

This included US bond yields where the 20–year spiked to 4.525% and then fell to 4.455% (last 4.467%)

Looking at this chart, iNAS100 has yet to test its pre-PPI blue AT line high at 18220 so a key level on top. Note CFD price feeds can vary between brokers so match the chart patterns you see on this chart with what you see on yours.

Next up is Fed Chair Powell

May 14, 2024 at 1:34 pm #6238May 14, 2024 at 1:33 pm #6237May 14, 2024 at 12:49 pm #6230May 14, 2024 at 12:46 pm #6229May 14, 2024 at 12:20 pm #6226May 14, 2024 at 12:20 pm #6225May 14, 2024 at 12:03 pm #6224GBPUSD 4 HOUR CHART – 1.25-1.26?

While the earlier fall-off-a-cliff move was unnerving, GBPUSD remains within 1.25-1.26, suggesting the 1.2550 level will dictate its intra-day bias.

As noted earlier, 1.2500-02 is a key level as there is qa voud below it.

On the upside, 1.2570-94 guards the key 1.2634 level.

May 14, 2024 at 11:14 am #6219URUSD 4 HOUR CHART -CUP HALF EMPTY OR HALF FILLED

Depending on how you look at it EURUSD has shown some resilience but would need to take out 1.0813, which is in its 2nd week of not being tested, and stay above 1.08 to suggest more scope on the upside.

Support is clear at 1.0760 with supp[ort as long as it holds.’

There is a lower top at 1.0807 from yesterday but only a break of 1.0760 would turn this into a shift in directional risk.

May 14, 2024 at 11:06 am #6218Summary

Euro/dollar down 2.4% this year, off 5-month lows

Euro weakness limited as economic divergence with US ebbs

Parity still a possibility further out, analysts say

LONDON/MILAN, May 14 (Reuters) – The euro has resisted falling to parity with the dollar for now, thanks to a rosier economic backdrop, to the relief of European Central Bank policymakers who could be struggling to detach themselves from the Federal Reserve’s monetary policy outlook.

Euro keeps dollar ‘gorilla’ from scuppe ring ECB rate outlook

May 14, 2024 at 10:54 am #6217A look at the day ahead in U.S. and global markets from Mike Dolan

Macro markets have basically frozen ahead of this week’s big U.S. inflation releases, with sideshow entertainment provided by a fresh burst in activity in so-called ‘meme stocks’ while earnings updates and deals sagas dominated overseas.

May 14, 2024 at 10:30 am #6214Biden raises tariffs on $18 billion of Chinese imports: EVs, solar panels, batteries and more

* President Joe Biden plans to impose a 100% tariff on Chinese electric vehicle imports, a 50% tariff on Chinese solar cells and a 25% tariff on certain Chinese steel and aluminum imports.

*The announcement comes after weeks of White House officials warning Beijing to amend certain trade practices that the Washington argues have weakened global supply chains.

* Administration officials predicted that these tariffs will have “no inflationary impact.”Biden administration has so far maintained that these tariffs will have “no inflationary impact” because they are not “across the board”

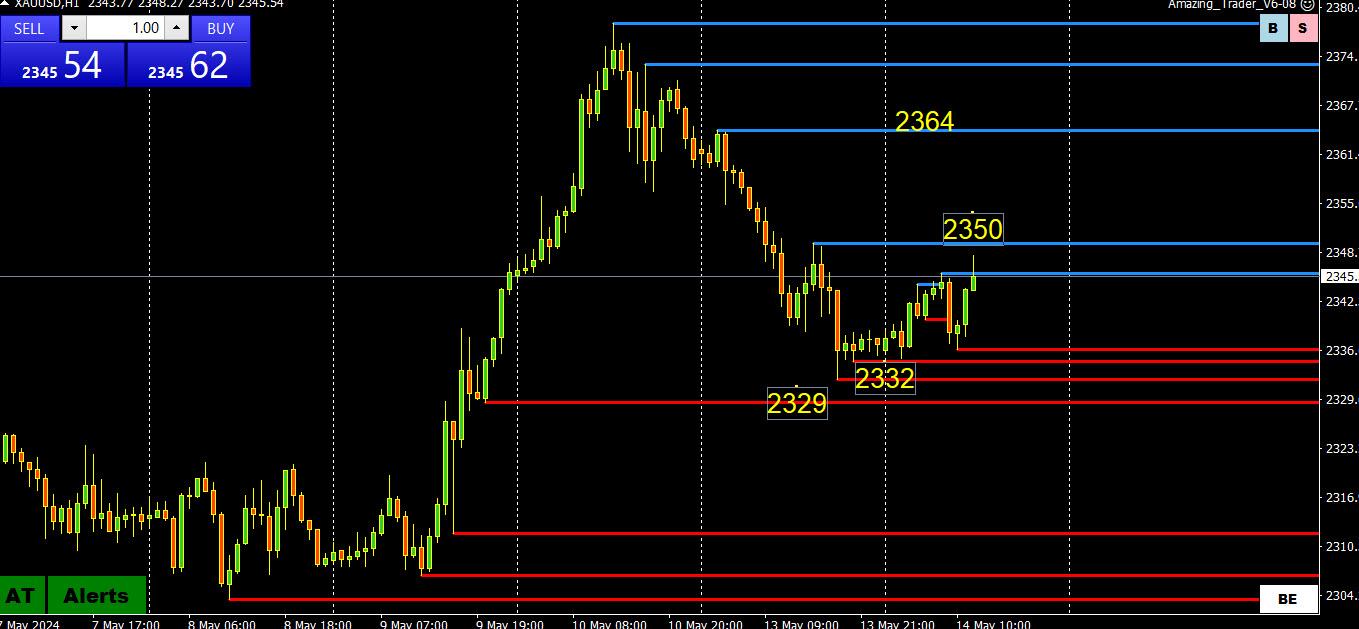

May 14, 2024 at 10:25 am #6213May 14, 2024 at 9:45 am #6212XAUUSD 1 HOUR CHART – RETRACEMENT OVER?

As I pointed out yesterday, 2328 = 61.8% of 2303-2328.

The low at 2332 paused above this level so for now treat the move down as a retracement,

To confirm, XAUUSD would need to move back above the 2350 level indicated on this chart (another example of the Power of 50).May 14, 2024 at 9:33 am #6211I just added this to the USDJPY post below:

POWER OF 50: Notice that yesterday’s low was just below 155.50 and today’s high stalled just above 156.50 (156.54)_, which is another example of the power of the “60” level.

May 14, 2024 at 9:26 am #6210EURUSD 4H

May 13, 2024 at 5:10 pm

Support 1.07750 & 1.07500

For the continuation of Uptrend, I would like to see support at 1.07750 holding it’s ground (smaller time frames indicate a test of it )

So that was right on spot…what now?? Let’s see if 1.07900 will give a way for attack at 1.08500.

Small time frames indicates Buy mode…watch for Data today

May 14, 2024 at 9:08 am #6208May 14, 2024 at 9:05 am #6207

May 14, 2024 at 9:08 am #6208May 14, 2024 at 9:05 am #6207USDJPY 4 HOUR CHART – WHO’S AFRAID OF THE BOJ>

USDJPY, which stayed bid yesterday even as the USD was softer elsewhere, has extended its high through 156.27 resistance.

Is this the key level that might trigger intervention;

It could be but more likely it would put traders on high alert if it managed to make a move toward 158.

Using this chart, it would need to stay above 156.27 to keep a strong bid but would likely find support below the market unless 155.49 is taken out (assuming no intervention).

POWER OF 50: Notice that yesterday’s low was just below 155.50 and today’s high stalled just above 156.50 (156.54)_, which is another example of the power of the “60” level.

May 14, 2024 at 8:44 am #6204The only news I saw other than the UK jobs report, which was not the catalyst for the GBPUSD nosedive, was this that came out within the past hour:

BOE Chief Economic Pill says there is still some work to do on the persistence of inflation; not unreasonable;e to believe that over the summer the BOE will see enough confidence to consider rate cuts….Source; Newsquawk.com

If this was the catalyst for the (over?) reaction down in GBPUSD, it is yet another indication of how hyper-sensitive markets are to any news that might impact interest rate cut expectations.

May 14, 2024 at 8:40 am #6203GBPUSD 1-HOUR CHART – LOOKS LIKE IY FELL OFF A CLIFF?

I am using this chart as it looks like GBPUSD fell off a cliff. This may reflect a thin market that has been buying GBPUSD this week.

Whatever the case, the key level on the downside, as pointed out yesterday, is 1.2502 as there is a void of key levels below it. So far, GBPUSD has paused above it.

On the upside, back above 1.2546, at a minimum, would be needed to ease the risk on the downside.

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View