- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 3 weeks ago by GVI Forex 2.

-

AuthorPosts

-

May 15, 2024 at 12:02 pm #6318May 15, 2024 at 11:54 am #6317May 15, 2024 at 11:43 am #6316May 15, 2024 at 11:37 am #6315May 15, 2024 at 11:28 am #6314May 15, 2024 at 11:12 am #6313May 15, 2024 at 10:57 am #6308

GBPUSD 15 MINUTE CHART – TRADING LESSON

You have seen me talk about the influence of cross on spot trading and this is how I look at it using EURGBP to illustrate:.

– When you see a straight line move down as in this chart (I look at the 15 min chart), it suggests there is a real money flow (order) driving, in this case, EURGBP lower.

– So you know GBPUSD is being bought and EURUSD is being sold.

= During this straight-line move, given the current trend, GBPUSD will be supported.

– Once EURGBP finds support, either GBPUSD will lose its strong bid or EURUSD will play catch-up.

– In this case, GBPUSD has lost its bid and slipped once the EURGBP bounced off its low.

If you ever played the game “Hot Potato” you can go with the flow until the music stops (i.e. order is filled)

May 15, 2024 at 10:31 am #6307May 15, 2024 at 10:28 am #6306May 15, 2024 at 10:25 am #6305A look at the day ahead in U.S. and global markets from Mike Dolan

Markets seem to have got bored waiting for today’s big U.S. inflation print and stocks zoomed to new records in advance, taking slivers of comfort from Tuesday’s producer price readout and a relatively relaxed Federal Reserve chairman.

May 15, 2024 at 10:25 am #6304gaaawd … wsj f/page :

–

Inflation to Give Investors Latest Clues on Fed Path

Consumer-price index data is set to land after Fed Chair Jerome Powell said he still expected inflation to head lower, but was less confident than he had been on the outlook.Powell Maintains Wait-and-See Posture

How Rising Gas Prices Complicate the Fed’s Inflation StrategyMay 15, 2024 at 10:01 am #6303Given how EURGBP is influencing EURUSD and GBPUSD, it seems like a good time to revisit this insightful article.

How You Can Use Currency Crosses to Trade Spot Forex

May 15, 2024 at 9:45 am #6302

May 15, 2024 at 9:45 am #6302EURGBP 4 HOUR CHART – BACK BELOW .8600

If you trade EURIUSD and/or GBPUSD you need to keep an eye on EURGBP, which is trading lower today.

This, in turn, is helping to give GBPUSD a bid and so far keeping a lid on EURUSD.

Given the trends, the market is having more trouble absorbing the GBPUSD buy side.

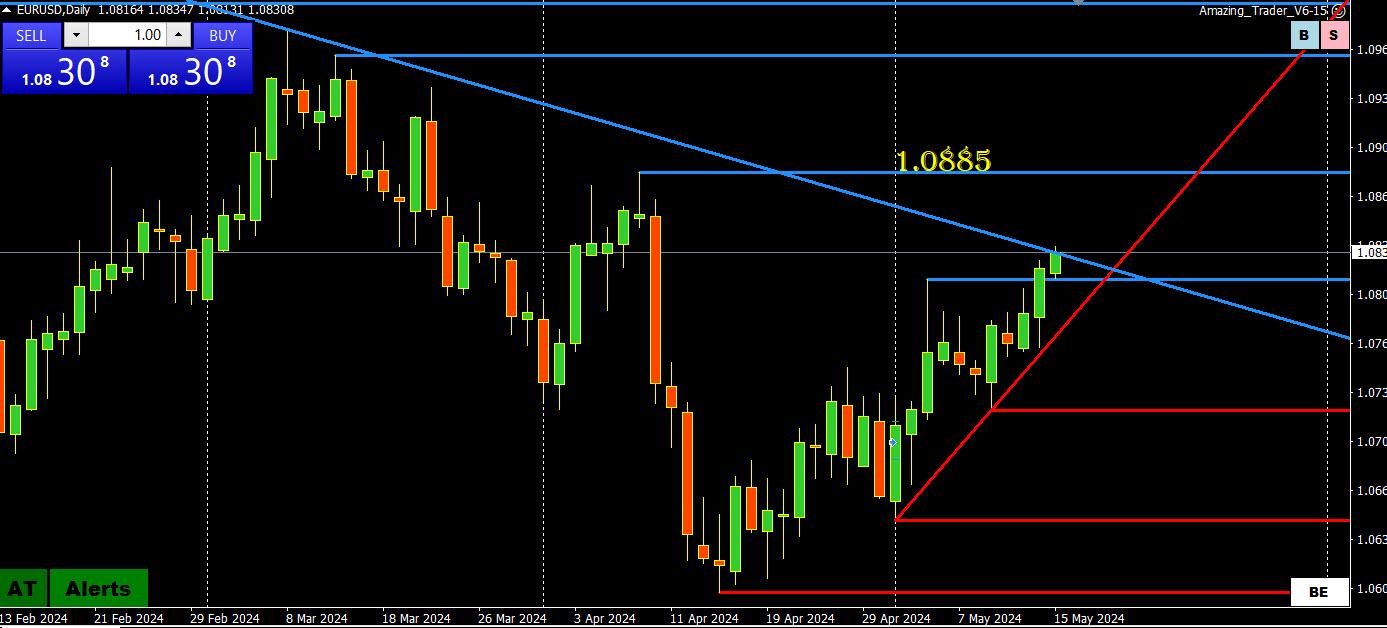

May 15, 2024 at 9:09 am #6301EURUSD DAILY CHART – WATCHING A KEY TRENDLINE

EURUSD: technicals pointing up but so far just nicking its key daily trendline at 1.0831 without a clean break as it lags as it trades softer on various crosses (e.g. EURJPY, EURGBP). A firm break would expose 1.0884 as the next target.

Time now to roll the dice as US data is the next key focus.

May 15, 2024 at 8:58 am #6300USDX DAILY CHART – USD UNDER ATTACK

I am taking a look at a USDX chart as the USD is down vs. all major currencies as the JPY has joined in as it follows the drop in US bond yields.

As I have noted, with the EURO 57.6% of the index, I look at USDX as a proxy for the currency.

To confirm what I am seeing in the EURUSD, a break of 104.61 would be needed.

May 15, 2024 at 8:47 am #6299USDJPY 4 HOUR CHART – FOLLOWING US YIELDS LOWER

USDJPY correlating with a further fall in US yields to break the first support of 145.97-155.49-155.14 posted late yesterday

From a technical perspective, the pause below the 61.8% level at 156.98 makes this rebound from 151.85 a retracement that now has a third lower high at 156.74.

On the downside, 155.49 is a key support blocking 155.00-14

US data later on is clearly the next focus.

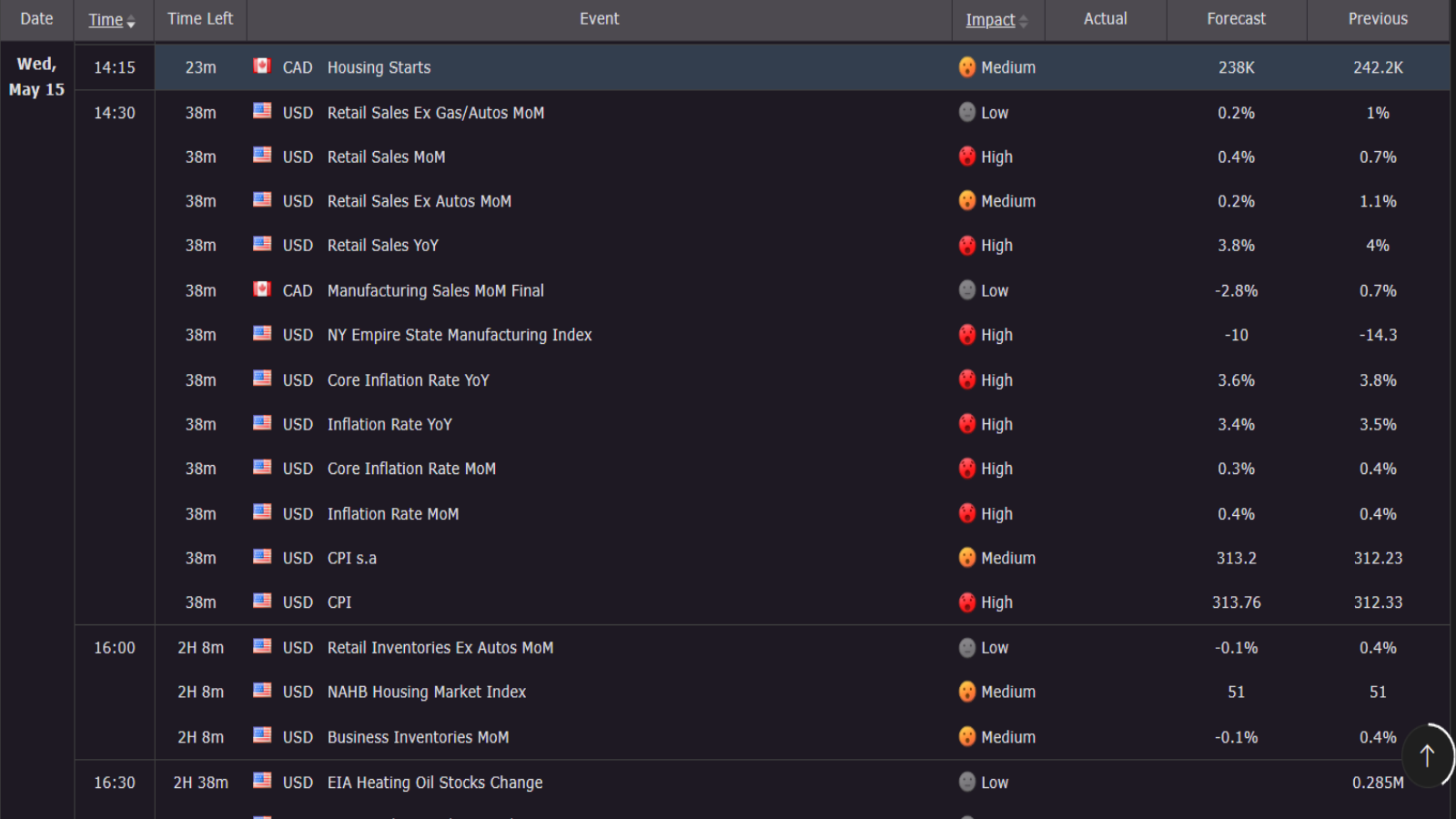

May 15, 2024 at 3:43 am #6298May 15, 2024 at 2:47 am #6297May 15, 2024 at 1:29 am #6296May 15, 2024 at 12:43 am #6295This is the key data day everyone has been focused on, US CPI and Retail Sales. Be prepared with this

A Detailed Preview….

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View