- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 3 weeks ago by GVI Forex 2.

-

AuthorPosts

-

May 16, 2024 at 7:06 pm #6405

BTC 4 HOUR CHART – FOCUS ON 65000

i POSTED THIS LATE YESTERDAY AND THERE IS NO CHANGE TI THE WAY i LOOK AT THIS CRYPTO

Technical traders may like this but I am not sure about how valid technical levels are in something that can move 5-10% in one day.

This is why I prefer to focus on psychological or what I call “magic” levels such as 60k,65k, and 70k.as well as the patterns formed on a chart

In this regard, 65000 is now a key level that needs to HOLD to put 70000 back on the radar.

May 16, 2024 at 6:29 pm #6403USDX DAILY CHART – PAUSED ABOVE KEY INTERSECTING LEVEL

The run to the downside paused above the key 103.93 level, both at a chart point and intersecting with the key trendline.

The significance of 103.93 is it is the last at LOW BEFORE THE HIGH AND THUS THE KEY LEVEL ON THIS CHART. A firm break would be needed to confirm the end of the USD uptrend.

On the upside, still bearish if it stays below 104.61.

Note EURUSD is 57.6% of the index.

May 16, 2024 at 6:02 pm #6401May 16, 2024 at 5:31 pm #6400May 16, 2024 at 4:20 pm #6399May 16, 2024 at 4:19 pm #6398May 16, 2024 at 4:00 pm #6397May 16, 2024 at 3:04 pm #6396FOR THOSE WHO MISSED THIS OR WERE TO REMIND YOURSELF, IT IS WORTH READING

This is a really good tip to keep in mind,… Look at THE price action so far in the US session

Actionable Forex Trading Strategy When to Fade a Correction

Actionable Forex Trading Strategy When to PORICE Fade a Correction

May 16, 2024 at 3:04 pm #6395May 16, 2024 at 2:44 pm #6394May 16, 2024 at 2:39 pm #6393May 16, 2024 at 2:17 pm #6392interesting …

“EXCLUSIVE (WSJ)

Russian Spacecraft Tested Components for Antisatellite Weapon, U.S. Says”

–

actually there is nothing new about this type of toys. they date back decades.the only thing that might be new(s) is if anyone or all start to … biding badang each others’ satellites.

my Q is … how would I manage my trades , eh ?

May 16, 2024 at 2:11 pm #639110-yr Yield | 9:59 AM EDT 4.369%

still stinks

–

If neel k wanted my nickle’s worth: the FED’s monetary policy is nowhere near exerting downward pressure on the economy.I d still inform him that it is NOT an unknown and that he should get in line with his chairman’s “higher for longer”. ditto for williams.

I am currently bit perplexed what game these two suits are playing.

May 16, 2024 at 1:58 pm #6390Sam had THE pulse of the market earlier today:

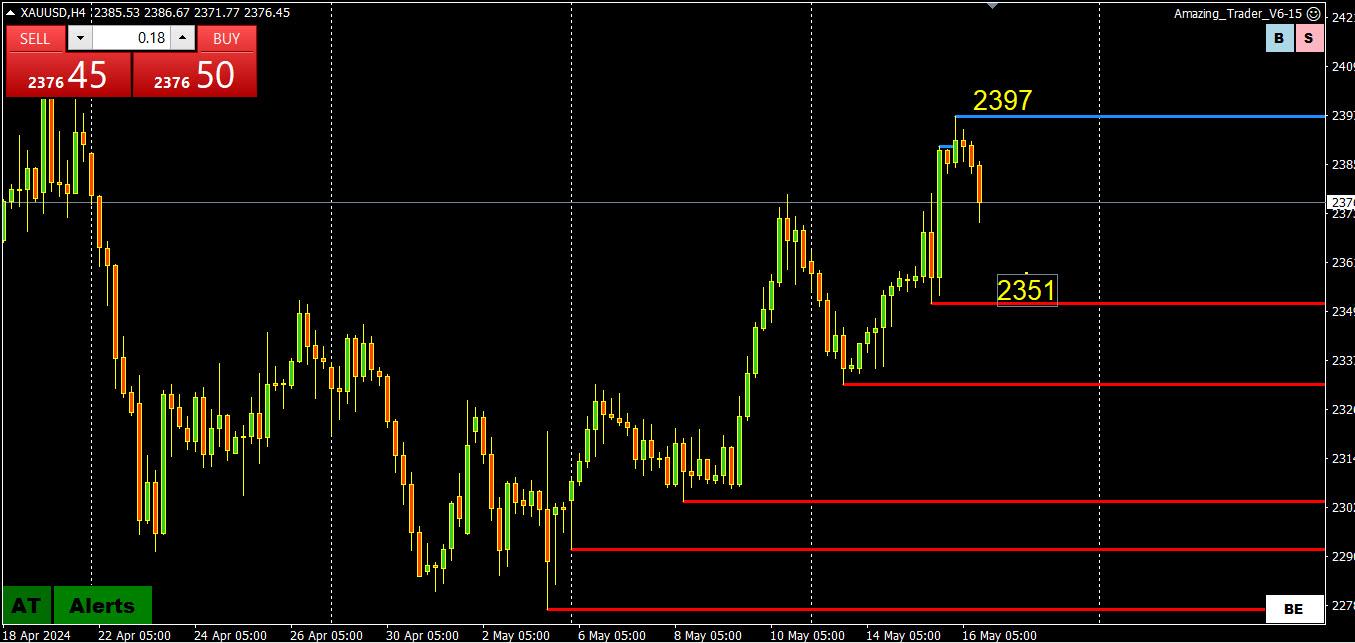

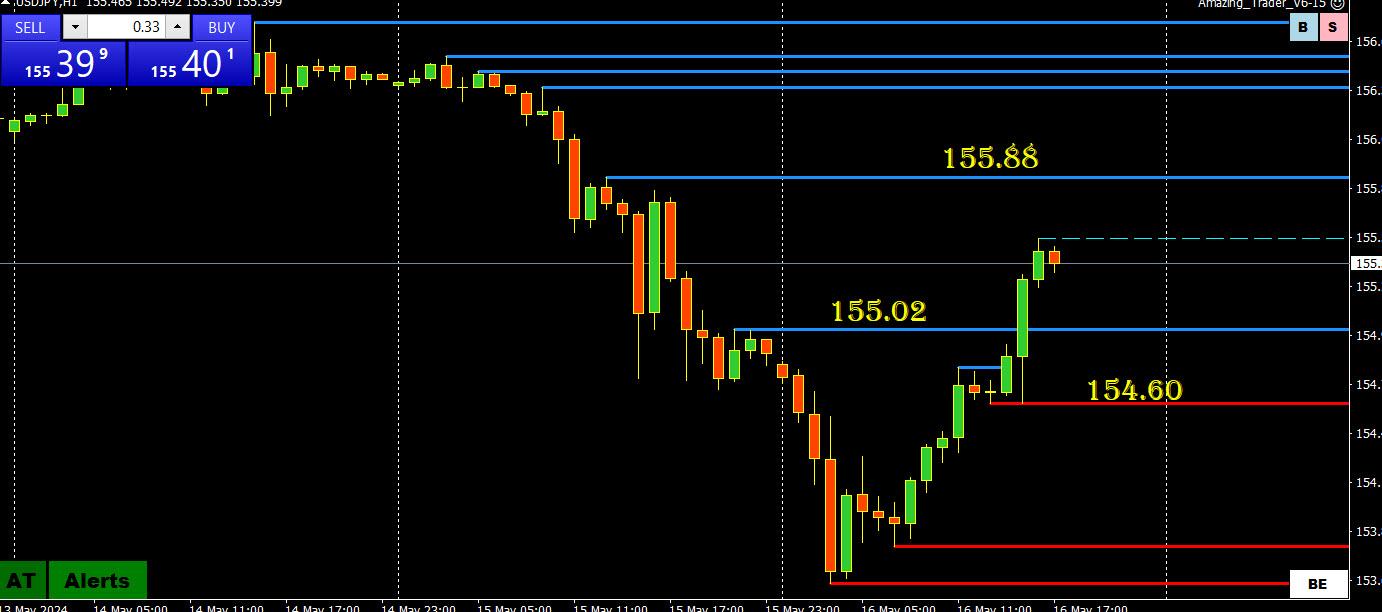

May 16, 2024 at 1:56 pm #6389May 16, 2024 at 1:40 pm #6388May 16, 2024 at 1:15 pm #6387USDJPY 1 HOUR CHART – 155 REMAINS THE FOCUS

As I noted last night, the only level that matters to me is 155 as that will set the overall bias.

Weak Japanese GDP data seems to have been the catalyst for a move back above 155. To suggest more scope on the rebound, 155.50 would probably need to be cleared.

May 16, 2024 at 11:16 am #6386EURUSD 15 MIN CHART – WAITING FOR US DATA

As markets wait for the next batch of US data here is a snapshot of the EURUSD

1.0866 double bottom’

Red arrows indicate the levels that need to be broken to break this retracement.

50% = 1.0851See our Economic Calendar for consensus forecast

May 16, 2024 at 10:57 am #6384dlr downtrend theme ?

williams helping ignite animal spirits:

–

Williams said April’s U.S. inflation data was a “positive” development after a string of disappointments and he said the overall price trend “looks reasonably good.”“I try not to take too much signal from one month or two months and look at the broader context of of the inflation trends. So I do think it’s a kind of a positive development after a few months where the data were disappointing, but you don’t want to over emphasize any one month or another month reading,” Williams said…

May 16, 2024 at 10:53 am #63836 May 2024 – A look at the day ahead in U.S. and global markets from Mike Dolan

World stocks (.MIWD000000PUS), opens new tab notched new records and the dollar (.DXY), opens new tab nursed its worst day of the year as fears of an overheating U.S. economy dissipate – stirring hopes that the coast is clearing for Federal Reserve easing at last.

Morning Bid: New highs hold as disinflation resumes, US cools

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View