- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 3 weeks ago by GVI Forex 2.

-

AuthorPosts

-

May 21, 2024 at 4:39 pm #6591

Monedge views a lot of “internals” including those pertaining to stocks, not only in the US, to find a consensus of market flows. This morning one thing catching our attention is the Nasdaq 50 index rejecting 3 months highs. It would arguably require something strong to move Nasdaq up further this week and stick. This translates to currencies like Euro which are quite largely risk on/off motivated.

May 21, 2024 at 4:05 pm #6590May 21, 2024 at 3:47 pm #6589May 21, 2024 at 3:40 pm #6588May 21, 2024 at 3:31 pm #6587May 21, 2024 at 3:16 pm #6583May 21, 2024 at 3:00 pm #6573May 21, 2024 at 2:57 pm #6572Canada’s consumer price index

–

* cooled to 2.7 per cent in April, down from 2.9 per cent in March, led by the slower growth of food prices, Statistics Canada said Tuesday.CBC – basically a gov’t mouthpiece – says abaout the CPI:

– “The Bank of Canada’s preferred measures of core inflation also eased — a happy sign for the central bank, which will make its next interest rate decision on June 5.Many economists expect that the bank will start cutting rates at that meeting.”

May 21, 2024 at 2:52 pm #6571GVI 01:27 / illogical eh ?

BUT that is where the retail trader can game theme of what the CB suits wish to instill into player psychie and the degeree of resistance by player collective to “assimilate” or resist assimilation.

the degree of ease (or not) of assimilation to CB gang’s theme can be reflected by a few indicators such as the name of the CB interloculator, his/her clarity of insistent communication, and flow and frequency of the messaging peddlers. Reading and interpreting the FED yakkers is science of psychology and english language communication skill. That is why “they” have some alleged whisperes around like cox or kashkari or timiraos. (who, incidentally, are not perfect as messaging interpretters)

May 21, 2024 at 2:39 pm #6570The monthly average of US holdings of US Treasuries by the Federal Reserve have dropped from roughly $5.7 trillion to roughly $4.6 trillion from roughly a year on year basis. In January 2020 the holdings were roughly $2.5 trillion. There has also been significant decrease over time of foreign buyers of bonds, especially Japan and China, with Japan having been the largest foreign buyer for some time. It is a risk management approach, with the bonds being a guaranteed asset.

If I were a CTA with a long term portfolio I would be keenly watching the 4.5% mark if/when that becomes present. It would be a significant area to either shift agendas or load up depending on which side of the fence you are on.

May 21, 2024 at 2:15 pm #6569EURGBP 4 HOUR CHART – FACING KEY SUPPORT

If the market was concerned about an expected sharp drop in headline UK inflation tomorrow it is showing no signs of it.

You can see by the blue AT laffer lines pointing down that EURGBP is coming in range of key support at .8526.

Key support is at .8484-.8502 below it.

Note one reason why EURUSD has been trading soft and GBPUSD bid are flows in this cross.

May 21, 2024 at 2:13 pm #6568May 21, 2024 at 2:06 pm #6567USDJPY 1 HOUR CHART – RETRACEMENT OVER?

As I have been noting, the failure to take oiut 156.98 = 61.8% of 160.16=151.85 keeps the retracement scenario alive

On the downside, 155.99 (suggests 156.00) would need to be firmly taken out to shift the risk to 155.24 with 155.00 looming below. So far it has just been nicked.

May 21, 2024 at 1:27 pm #6566Newsquawk.com paid for itself today reporting Waller comments vs. an illogical market reaction to them.

May 21, 2024 at 1:10 pm #6565May 21, 2024 at 12:35 pm #6562May 21, 2024 at 12:14 pm #6561I have a serious question. When do Fed officials find time to work given they seem to be making speeches all the time?

Federal Reserve Board Governor Christopher Waller, New York Fed President John Williams, Fed Vice Chair for Supervision Michael Barr, Atlanta Fed President Raphael Bostic, Cleveland Fed chief Loretta Mester, Boston Fed chief Susan Collins and Richmond Fed boss Thomas Barkin all speak.

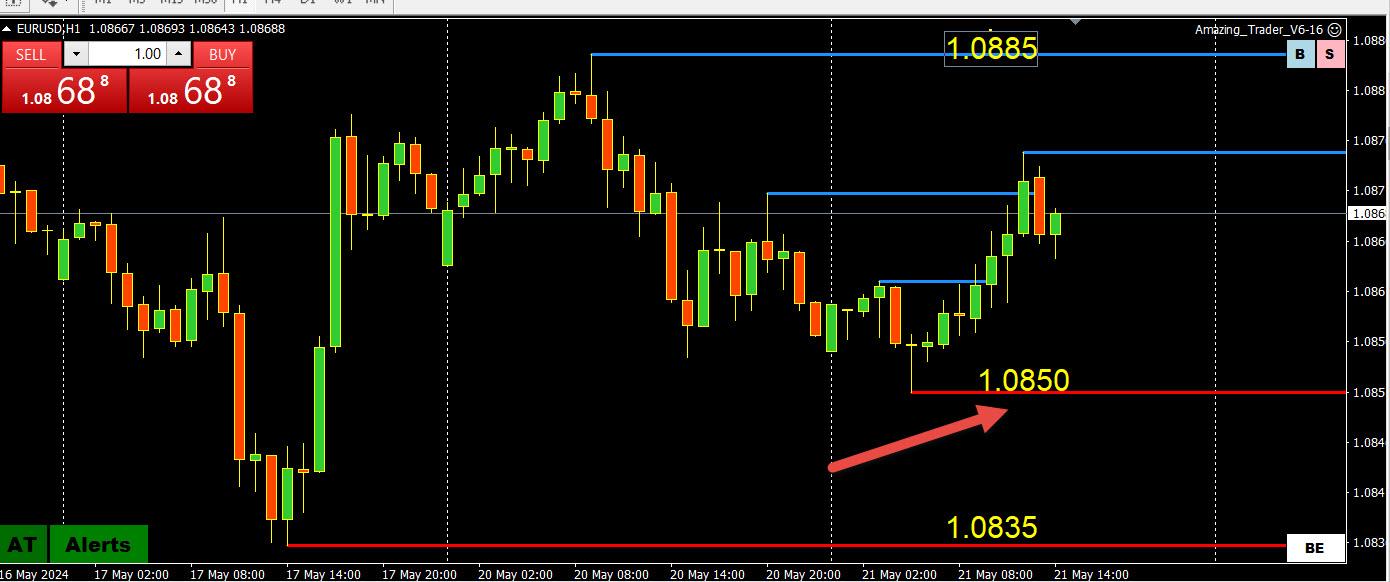

May 21, 2024 at 12:00 pm #6560EURUSD 1 HOUR CHART – GUESS WHERE THE LOW HAS BEEN?

i could repeat the Power of the “50” Level and how it impacts trading sentiment.

So, guess where the EURUSD low has been so far today – you are right if you said 1.0850

By itself, it is just one indicator but you can see that it changed the early mood in this currency but nothing to get excited about in a 24 pip range.

May 21, 2024 at 11:07 am #6559With Gold taking a breather, the question asked in this article, which has stood the test of time ….

Is the Gold rally going to stop, and when?

May 21, 2024 at 10:25 am #6557

May 21, 2024 at 10:25 am #6557 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View