- This topic has 11,679 replies, 48 voices, and was last updated 4 months, 3 weeks ago by GVI Forex 2.

-

AuthorPosts

-

May 28, 2024 at 10:28 am #6916

Check out Economic Data Calendar for today

May 28, 2024 at 10:20 am #6915May 28, 2024 at 10:06 am #6914May 28, 2024 at 9:58 am #6913May 28, 2024 at 9:55 am #6912May 28, 2024 at 9:52 am #6911USDJPY 4 HOUR CHART – PATH PF LEAST RESISTANCE

With the market seemingly not ready to push the upside too hard and prompt intervention, it seems to be following the path of least resistance by selling JPY on its crosses.

Offsets may be one source of demand for currencies like the AUD, EUR and GBP.

For USDJPY, the current range is around 156.50-157.20.

A key focus this week will be on Japan CPI with some seeing the window closing on rate hikes as inflation is cookling.

Suggested reading: Jay Meisler’s Common Sense Trading: How You Can Identify the Path of Least Resistance?

May 28, 2024 at 9:27 am #6909GBPUSD 4 HOUR CHART – LAGGING?

GBPUSD break of 1.2761 so far not going far and is dependent on 1.2761+ to keep a strong bid and then 1.2725 and the trendline holding below it to keep a focus on 1.28+

If you look at GBP crosses you will see where some of the demand is coming from… in this regard, EURGBP bounce from .85 today has seen GBPUSD lag today.

May 28, 2024 at 8:36 am #6903EURUSD 30 MINUTE CHART – Too tight to last

EURUSD testing upside but would need to get through 1.0895 to break the current range.

As this 30 minute chart shows, it has been trading in a 9-pip range for over 2 hours, one so tight that it will not last for much longer (the intra-day range has so far been just 20 pips, 1.0860-80)

So there is nothing to get excited about the upside unless 1.0895 is decisively taken out.

Otherwise, look for 1.o850 tp continue to set its intra-day tone.

May 28, 2024 at 8:24 am #6902ECB Consumer Expectations Survey (Apr) – 12 month inflation 2.9% (prev 3.0%), 3-tear ahead 2.4% (prev 2.5&); growth outlook less negative and labour market seen stable.

Source; Newsquawk.com

May 28, 2024 at 7:10 am #6899A look at the day ahead in European and global markets from Tom Westbrook

The European Central Bank publishes inflation expectation surveys on Tuesday, which along with policymaker speeches are the highlight of an otherwise quiet calendar

May 27, 2024 at 8:38 pm #6898May 27, 2024 at 4:32 pm #6897May 27, 2024 at 4:01 pm #6896Thanks Bobby on your 8:38pm post, and sincere congratulations for making it that far.

As noted by BMO Capital Markets chief investment strategist Brian BelskiIn years where the S&P 500 rallies more than 8% in the first five months of the year, as it just did, the index gains more than 7% to finish the year 70% of the time. Euro should ordinarily benefit if such a percentage sticks this year. So regardless of inflation effect, rates of decline in pullbacks, interest rates, or anything else such as economic slowdown, that is something to consider. The bottom line is what is the market doing this week for most active participants.

For those who transact on bi-weekly or longer time frames the options markets, sovereign, and bank positioning matters a bit more. For those who are tuned to larger time frames then the economics matter in different ways and so you have 10,000 economists saying the age old phrase “on the other hand.”

May 27, 2024 at 2:53 pm #6895May 27, 2024 at 12:11 pm #6885EURUSD failed to break 1.0863

Last 1.0842

The only news I have seen

ECB’s Villeroy said that a June interest rate cut is a done deal barring a surprises

His comments are not a surprise – the focus should be on what comes next in terms of rate cuts

If you are trading today it is like you are trading with yourself.

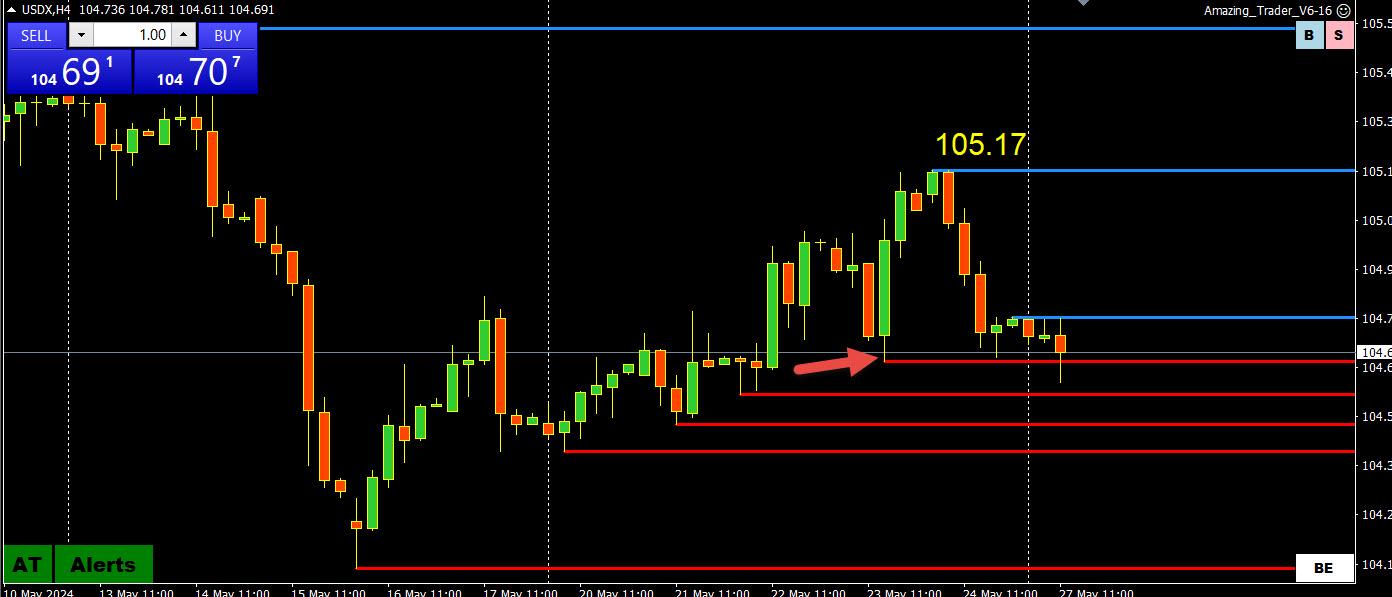

May 27, 2024 at 10:31 am #6884USDX 4 HOUR CHART – EURUSD PROXY?

As I noted, with EURUSD representing 57.6% of the index, it often acts as a proxy for the currency.

In this chart, the highlighted red AT line being broken would need to be sustained and then confirmed by a solid EURUSD move above 1.0863 to suggest a potential shift in direction or at least a loss of upward momentum

May 27, 2024 at 10:24 am #6883EURUSD 4 HOUR CHART – TOO TIGHT A RANGE TO LAST FOR TOO LONG’

The best I can say in this holiday-thinned session is how EURUSD ends the week is more important than how it starts.

I can also say that the current 1.0805-1.0895 range is too tight to last for too long.

Is it a coincidence that 1.085, the intra-day bias setter, is also the midpoint of the current range?

Otherwise, chart levels are clear as indicated on this chart.

‘May 27, 2024 at 12:52 am #6882May 27, 2024 at 12:08 am #6881Let me state from the outset that the forex market is one of limits. It’s a fickle market more prone to intra-day reversals than breakouts and sustained moves.

This is why I look at the forex market as trading in episodes rather than trends.

Why You Need to Focus on Trading Episodes and Not Trends

May 27, 2024 at 12:04 am #6880

May 27, 2024 at 12:04 am #6880THIS WEEK’S MARKET-MOVING EVENTS (all days local)

The week’s inflation news will start with Australia on Wednesday where no meaningful improvement is expected at 3.4 percent for April. Wednesday’s consumer price data from Germany are expected to accelerate but remain with quiet looking 2 percent handles. Eurozone HICP flashes for May are also expected to look normal, at 2.5 percent overall and 2.7 percent for the narrow core. Tokyo consumer prices are expected to firm in May following a jolt lower in April on special factors.

Other Japanese data will include industrial production and retail sales, both on Friday. China’s CFLP PMIs on Friday are expected to hold steady in data for May. Monthly GDP from Canada is expected to stall in March though the first quarter as a whole is seen posting respectable growth of 2.3 percent.

Econoday

US PCE and month end on Friday could make it an active end to the week.

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View