- This topic has 11,679 replies, 48 voices, and was last updated 5 months ago by GVI Forex 2.

-

AuthorPosts

-

June 5, 2024 at 10:07 am #7276June 5, 2024 at 9:36 am #7275June 5, 2024 at 9:26 am #7274

EURUSD 4 HOUR CHART – WAITING FOR THE ECB

EURUSD seems to be in a holding pattern waiting for Thursday’s ECB decision.

Chart show momentum to the upside but consolidating. A breal of 1.0858 would suggest some risk on the downside BUT only a break of 1.0827 would suggest the high is in for now. Otherwise, trend stays intact.

June 5, 2024 at 9:15 am #7273BTC DAILY CHART – 70000

BTC has been flying under the radar lately but as this Amazing Trader chart shows it has been in a consolidation but also slowly building momentum to the upside.

Key chart levels are clear:

‘

If 70K can hold as support there is only one obstacle to the record high.If 70K fails to hold, it is back to flying under the radar.

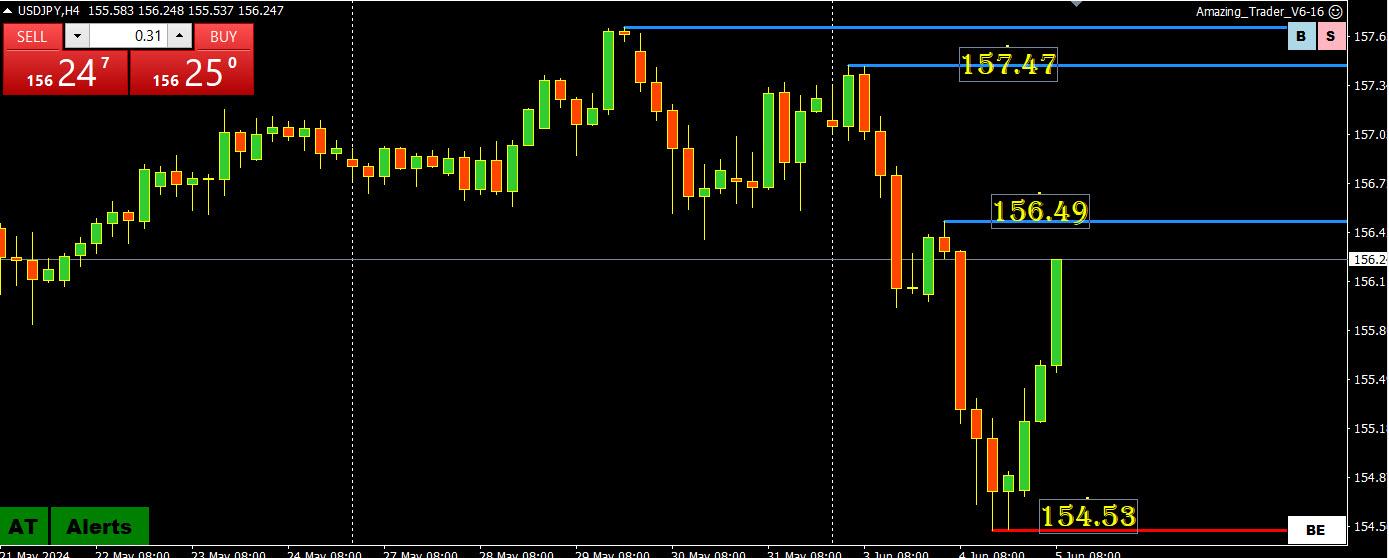

June 5, 2024 at 9:05 am #7272USDJPY 4 HOUR CHART – JPY GOES FROM OVERPERFORMER TO UNDERPERFORMER

The failure to sustain a move below 155 has seen a pop in USDJPY and JPY weaken on crosses

Looking at this chart, the risk is still on the downside as long as it stays below 156.49

Using FIBOS:

156.35 = 61.8% of 157.47-154.53

156.50 = 61.8 pf 157.71-154.53

So if I had to choose two levels to watch it would be

156.50 (above would break current momentum)

155.00 (no change to my view as the bias setter)

June 5, 2024 at 7:49 am #7271I got this off the web

As of June 3, 2024, the Citigroup Economic Surprise Index (CESI) for the United States was -8.90. The CESI is the difference between official economic results and forecasts, and a sum above zero indicates that economic performance is generally better than expected. The CESI increases as the economy recovers, but decreases quickly as the economy declines

June 5, 2024 at 6:55 am #7270EURO 1.0876

Here is one good example why one should be selective and discerning of the news sourceE.C.B. Is Likely to Leapfrog the Fed on Interest Rate Cuts – New York Times

With eurozone inflation falling, the European Central Bank has signaled it is ready to lower rates this week, diverging from the U.S. Federal Reserve.By Eshe Nelson

Jun 05, 2024 04:00 AMEuropean Central Bank officials are expected to cut interest rates this week for the first time in more than five years, drawing a line under the worst of the eurozone’s inflation crisis and easing the pressure on the region’s weak economy.

… blablabla

June 4, 2024 at 11:07 pm #7269June 4, 2024 at 10:45 pm #7268June 4, 2024 at 10:40 pm #7267EYE on yellen

–StreetInsider

Yellen says bill issuance not aimed at ‘sugar high’

By David Lawder. WASHINGTON (Reuters) – U.S. Treasury Secretary Janet Yellen on Tuesday rejected suggestions by Republican senators that the Treasury is deliberately increasing issuance of short-term Treasury bills at higher interest rates to try to stimulate the economy ahead of the November presidential election.Yellen told a U.S. Senate subcommittee hearing that Treasury’s mix of debt issuance, despite a higher share of short-term bills since the COVID-19 pandemic, is in line with historical norms and with the advice of market participants in the Treasury Borrowing Advisory Committee.

“First of all, let me say that we never time the market. A tenet of Treasury debt management is that issuance should be regular and predictable, and that’s appropriate over time,” Yellen

Forexlive

Treasury Secretary Yellen:Treasury never tries to time market in debt managementJune 4, 2024 at 10:06 pm #7266June 5 (Reuters) – A look at the day ahead in Asian markets.

Investor sentiment is fragile as Asian markets reach the mid-point of the week, with bubbling angst and political volatility across the emerging world compounding deepening concern over U.S. and global economic growth.

June 4, 2024 at 6:48 pm #7265June 4, 2024 at 5:49 pm #7264The “Global-View Trading Club Challenge ” is completely free to enter. Registration is from the 1st to the 16th of June, and the competition starts on the 17th. You will also get to use the Amazing Trader charting algo and receive help from our experts. The competition ends on the 28th

It is FREE – this is THE perfect opportunity.

Click below to entrer

June 4, 2024 at 5:23 pm #7263June 4, 2024 at 4:45 pm #7262June 4, 2024 at 4:03 pm #7261June 4, 2024 at 3:58 pm #7260June 4, 2024 at 3:03 pm #7259June 4, 2024 at 3:01 pm #7258UsdMexicanPeso is a screaming buy due to uncertainty with Mexico’s 1st female President voted in the other day. Not to mention an historic 37 candidates have been assassinated. Perhaps we can factor in, as one official pointed out, “she is also a mother and used to dealing with tantrums and meltdowns.” Nice outlook.

June 4, 2024 at 2:48 pm #7257It is a new quarter. There has been a bit of disconnect between yields and Dxy of late in some sessions, and quite a bit of adjusting convictions in everything including commodities. Some pivotal areas at question. My stake is back to the dollar overall until proven otherwise albeit facing rate cut expectations.

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View