- This topic has 11,679 replies, 48 voices, and was last updated 5 months, 1 week ago by GVI Forex 2.

-

AuthorPosts

-

June 12, 2024 at 12:33 pm #7594June 12, 2024 at 12:21 pm #7593June 12, 2024 at 11:07 am #7592June 12, 2024 at 11:06 am #7591June 12, 2024 at 11:01 am #7590June 12, 2024 at 10:37 am #7589

June 12 (Reuters) – A look at the day ahead in U.S. and global markets by markets correspondent Naomi Rovnick

What a difference half a year makes. Traders started 2024 convinced that the U.S. Federal Reserve would be able to cut interest rates up to seven times by December.

Analysts now widely expect Fed officials not only to keep the funds rate at its 23-year high of 5.25% to 5.5% at the end of their monetary policy meeting on Wednesday, but also to project just one or two rate cuts this year, down from three.

June 12, 2024 at 8:43 am #7588EURUSD 4 HOUR CHART – HAS IT BOTTOMED?

One way or another the gap should be resolved today depending on how markets react to US CPI and the FOMC.

Using Amazing Trader logic, the second red line on this chart (1.0733) forms what is called a Directional Indicator, indicating a potential change in direction.

For this to play out, 1.0733 needs to hold as supportand 1.0774 would need to be taken out.

In any case, for filling the gap to be a risk, 1.0719-20 would need to become support. Otherwise, the downside is at risk unless the gap is filled and more.

With all that said, 1.0750 will set he intra-day tone on a day where the reaction to news will be more more important than the news itself.

June 12, 2024 at 12:41 am #7586June 11, 2024 at 9:29 pm #7584Apple and AI

Includes the word “generative”. This also means “can make decisions”. Not just peruse and classify information. It means ability to generate new contents (new text, new images, decisions from a data base). Making a deal with ChatGPT – an open AI – and what is interesting is that to make use of that one will need iPhone 15+ . In this new version, there will actually be less applications on one’s phone. One will be able to imagine some scenario, verbalize it by typing it out on the iPhone and hit “go” (or “generate”) . This is the future: I ll have no application, I have done nothing, I ll have not lived anything. All I ll have done is imagined / invented something. This … is where things are heading. Talking of “fake news” : one will have invented fake memories, images, videos without having touched anything. This is where things are heading: into tomorrow where tomorrow is “just a moment ago”. It is, maybe, good for Apple’s stock. Maybe in one, two years, GVI Forex will type out A look at the day ahead in U.S. and global markets by GVI Forex and hit “go” and …

have a good day

June 11, 2024 at 8:18 pm #7583AAPL

Apple’s shares reached a record, exceeding $3 trillion market cap following a partnership with OpenAI and new product launches incorporating OpenAI technology and Affirm payments in Apple Pay.

Apple’s stock rose 6.6% in one day, adding $194 billion to its market cap, nearing Microsoft as the top U.S. company. June 11, 2024 at 8:18 pm #7582June 11, 2024 at 6:43 pm #7580June 11, 2024 at 5:29 pm #7579June 11, 2024 at 4:27 pm #7578June 11, 2024 at 4:21 pm #7577June 11, 2024 at 3:38 pm #7576June 11, 2024 at 2:58 pm #7575

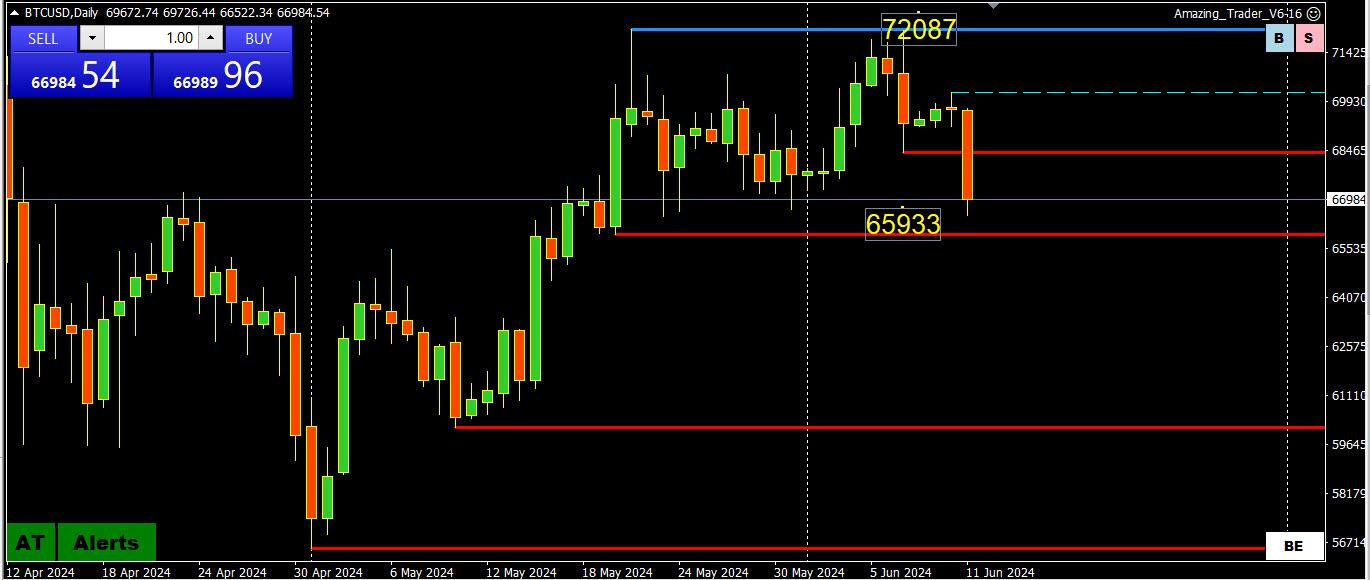

June 11, 2024 at 8:18 pm #7582June 11, 2024 at 6:43 pm #7580June 11, 2024 at 5:29 pm #7579June 11, 2024 at 4:27 pm #7578June 11, 2024 at 4:21 pm #7577June 11, 2024 at 3:38 pm #7576June 11, 2024 at 2:58 pm #7575BTC 4 HOUR CHART – KEY LEVEL

I hate to look at a BTC chart strictly by levels but doing so shows a risk to a key 65933 level, below which would indicate a shift in risk away from the upside.

‘

On the other hand, looking at what I call pivotal levels, it would take a firm break of 65K to put thoughts of 70k+ at rest for now.June 11, 2024 at 2:44 pm #7573June 11, 2024 at 2:30 pm #7567June 11, 2024 at 2:07 pm #7566 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View

EURO 1.0727

EURO 1.0727