- This topic has 11,679 replies, 48 voices, and was last updated 5 months, 1 week ago by GVI Forex 2.

-

AuthorPosts

-

June 13, 2024 at 2:13 pm #7646June 13, 2024 at 1:41 pm #7645June 13, 2024 at 1:37 pm #7644

Why your predesigned indicators don’t work – by a former blackballed CTA – so I hit Aussie right on the chin purely out of experience when every indicator said otherwise, knowing if I go to sleep the banks will do a stop run on my position overnight but they can’t afford to take it further and so I sat on it and the profit target filled. So was flat on the backdraft and now back in flipping the bird and listening to “Crazy Babies” by Ozzie Ozzborne lol. They didn’t get me this time. That, ladies and gentlemen, is trading. Other than Amazing Trader, not much else works other than option contracts.

June 13, 2024 at 1:26 pm #7643Why your predesigned indicators don’t work – by a former blackballed CTA because I was that good and stepped on some toes lol – so I hit Aussie right on the chin purely out of experience when every indicator said otherwise, knowing if I go to sleep the banks will do a stop run on my position overnight but they can’t afford to take it further and so I sat on it and the profit target filled. So was flat on the backdraft and now back in flipping the bird and listening to “Crazy Babies” by Ozzie Ozzborne lol. They didn’t get me this time. That, ladies and gentlemen, is trading. Other than Amazing Trader, not much else works other than option contracts.

June 13, 2024 at 12:56 pm #7642June 13, 2024 at 11:19 am #7641June 13, 2024 at 10:48 am #7640(Reuters) – A look at the day ahead in markets from Dhara Ranasinghe.

It’s back to the markets versus the U.S. Federal Reserve.

June 13, 2024 at 10:41 am #7639June 13, 2024 at 9:56 am #7638June 13, 2024 at 9:17 am #7637GBPUSD 4 HOUR CHATRT – FIBO TIME

With key supports not close, suggest looking at retracement levels here as well.

So far, it has paused around the 50% FIBO at 1.2774 (low 1.2772)

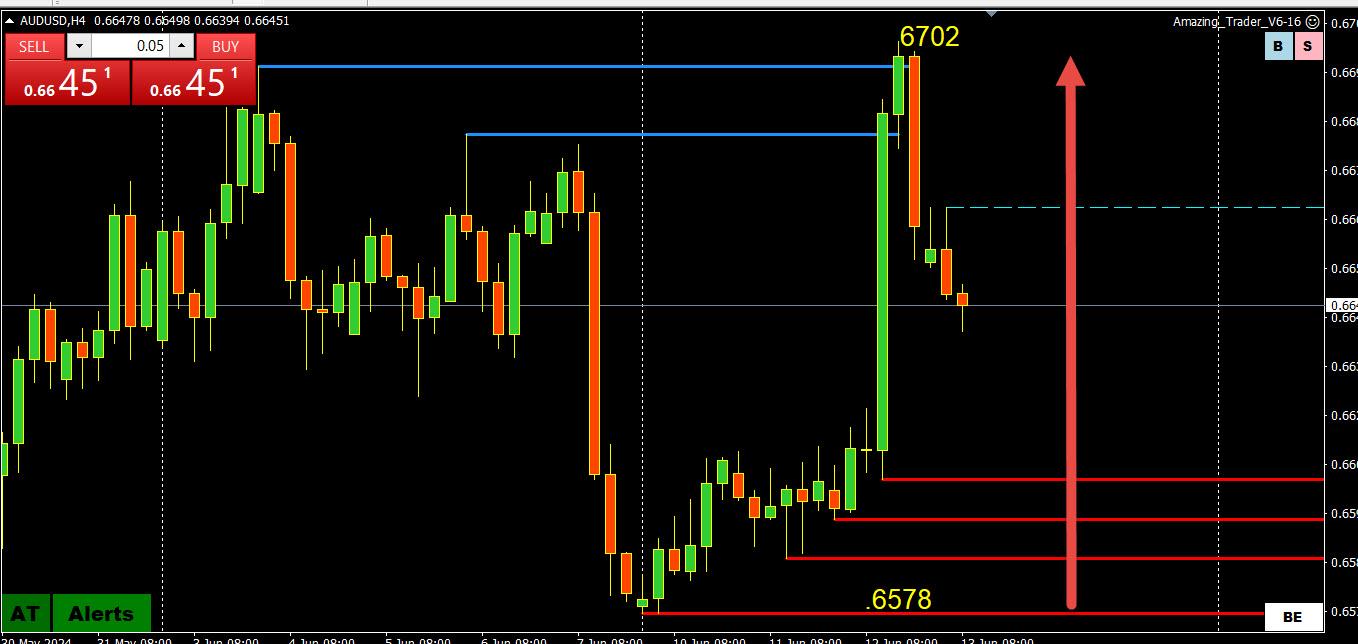

June 13, 2024 at 7:10 am #7636AUDUSD 4 HOUR CHART – Retracements or faikures?

With the dollar recovering after yesterday’s stright line data driven moves that paused shy of recent dollar lows, look at FIBO levels if yiu do not see any nearby levels.(e.g. 50% of 6578-6702 = 6639)

June 13, 2024 at 3:27 am #7635June 12, 2024 at 11:21 pm #7634June 12, 2024 at 10:12 pm #7633June 12, 2024 at 9:50 pm #7632So I saw the same old thing yesterday pre-data, with the stalls and the contra-activity. If they are buying into data that heavy what do you think they are doing? Is big money confused? Is it a conspiracy? No. They are running 100k times what you do. They compete with other banks who don’t oblige to be on the same team. So, price discovery happens. Big guns win every time. Right now the market is dazed and waiting for the next conviction post-Fed. Something is going to break. My thought is maybe not the Fed. So unless something profound changes it is hgher for longer and they will price in mistakes. Dollar is bid, which is why I sold AudUsd this morning vs Euro because they are a little fluffy over there. The only thing that would make Aussie go higher is a gold run or war. From here.

June 12, 2024 at 9:22 pm #7631Bobby – it seems, as one of our esteemed posters pointed out to me in private earlier, Apple and Musk are fighting. Who would you bet on if it were a boxing match? I’m going Apple because of muscle but Elon packs a punch too. I’m going Elon, the Apple squeals to the regulators and puts Elon on the hot seat. But he doesn’t care. He has a chip and is far from dumb. Apple reached with the latest release, albeit pretty cool. Elon just keeps launching rockets. At some point, as a former boxer, one of those is going to land and the other guy is in trouble lol.

June 12, 2024 at 7:48 pm #7630Aapl Apple

Apple shares are on a notable hot streak that’s helping the company reclaim the title of most valuable in the U.S.

The stock (AAPL) is up 13.8% across the past two trading sessions, putting it on track for its biggest two-day percentage gain since the stretch that ended Nov. 24, 2008.

In turn, Apple’s market capitalization has exploded. With shares up about 6% in intraday action, those gains would translate to a $3.37 trillion market cap at Wednesday’s close.

June 12, 2024 at 7:37 pm #7629June 12, 2024 at 7:37 pm #7628June 12, 2024 at 7:31 pm #7627

June 12, 2024 at 7:37 pm #7629June 12, 2024 at 7:37 pm #7628June 12, 2024 at 7:31 pm #7627 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View