- This topic has 11,679 replies, 48 voices, and was last updated 5 months, 1 week ago by GVI Forex 2.

-

AuthorPosts

-

June 16, 2024 at 11:48 pm #7763

EURUSD 4 HOUR CHART When politics dominates?

In a politically driven market (French electio) a key is to identify when the market is trading on this upcoming event and when it is in the background.

This chart is clear —

Key levels are at the 1.0667 low (major levels 1.0649 and 1.0600) and 1.0745 (suggests limited upside unless 1.0750 trades, stronger bias if it stays below 1.0719

June 16, 2024 at 11:11 pm #7762THIS WEEK’S MARKET-MOVING EVENTS (all days local)

A run of Chinese monthly data open the week on Monday amid expectations for steady, unspectacular results. But it will be central bank announcements that will be the week’s key focus beginning with the Reserve Bank of Australia on Tuesday followed on Thursday by China’s loan prime rates then the Swiss National Bank and finally the Bank of England. No rate changes are expected with the exception of the SNB where forecasts range from no change to rate cuts of either 12.5 or 25 basis points. Note that Wednesday’s consumer price report from the UK could have a bearing on future expectations for BoE action with moderation to a benign 2.1 percent Econoday’s CPI consensus.

Retail sales on Tuesday will be the most watched US report; forecasters are looking for no more than modest gains across key readings. Japanese data will open with machinery orders on Monday, merchandise trade on Tuesday, and will be capped by May consumer prices on Friday where higher costs for renewable energy are expected to heat up the headline print. The week will close with Friday’s run of June PMI flashes where incremental improvement is the general consensus.

Econoday

June 16, 2024 at 10:28 pm #7761June 16, 2024 at 10:21 pm #7760Kashkari said (Sunday the 16th)

–

* it’s ‘reasonable’ to predict December rate cut

* Fed Well-Placed to Take Its Time Ahead of Rate Cut

* “We need to see more evidence to convince us that inflation is well on our way back down to 2 percent. The good news is as you’re reporting this indicator, the job market remains strong,”thansk neel !

June 16, 2024 at 7:06 pm #7759Summary

Political uncertainty hits French marketsPolls put far-right National Rally in first place

Polls put left-wing ‘Popular Front’ coalition in second

BORGO EGNAZIA, June 14, Italy (Reuters) – France is facing a “very serious” moment as parliamentary elections loom, said President Emmanuel Macron on Friday, with financial markets rattled by the country’s far-right and far-left political blocs currently leading polls.

Macron: France facing ‘very serious’ moment as far-right and far-left lead polls

June 16, 2024 at 7:06 pm #7758Summary

Political uncertainty hits French marketsPolls put far-right National Rally in first place

Polls put left-wing ‘Popular Front’ coalition in second

BORGO EGNAZIA, June 14, Italy (Reuters) – France is facing a “very serious” moment as parliamentary elections loom, said President Emmanuel Macron on Friday, with financial markets rattled by the country’s far-right and far-left political blocs currently leading polls.

Macron: France facing ‘very serious’ moment as far-right and far-left lead polls

June 16, 2024 at 5:07 pm #7757June 16, 2024 at 1:09 pm #775310-yr 4.221; 2-yr 4.707

The FED keeps on yakking about CUT. Cut(s) is/are coming.

The economy is at “full employment” & financial markets are at 10,000 degrees F. Their dots are supposed tell THE market what they are expecting (hahaha bamboozle) , Jerome likes to hear himself talk about being flexible (i.e. by allegedly custom-fitting response to incoming data IF this comes in then that blablah)

With reference to the 10-yr yield:

As a degenerate trader focused on using the FED (and the Treasury) for juicing profits from their policies and the simple reality that the FED is buying Treasury Bonds (thereby allowing congress to spend n spend) I am working on this assumption:

While 10-yr yield is under 4.5% the FED is

1) in the market buying Treasuries

2) suppressing yield and

3) screaming at Congress: “spend. SPEND!”

and so their supposed quest at quenching inflation is not serious.For me any incoming data that would suggest a turn in “higher for longer” or even an imminent cut is smoke while 10-yr yield is below 4.5%

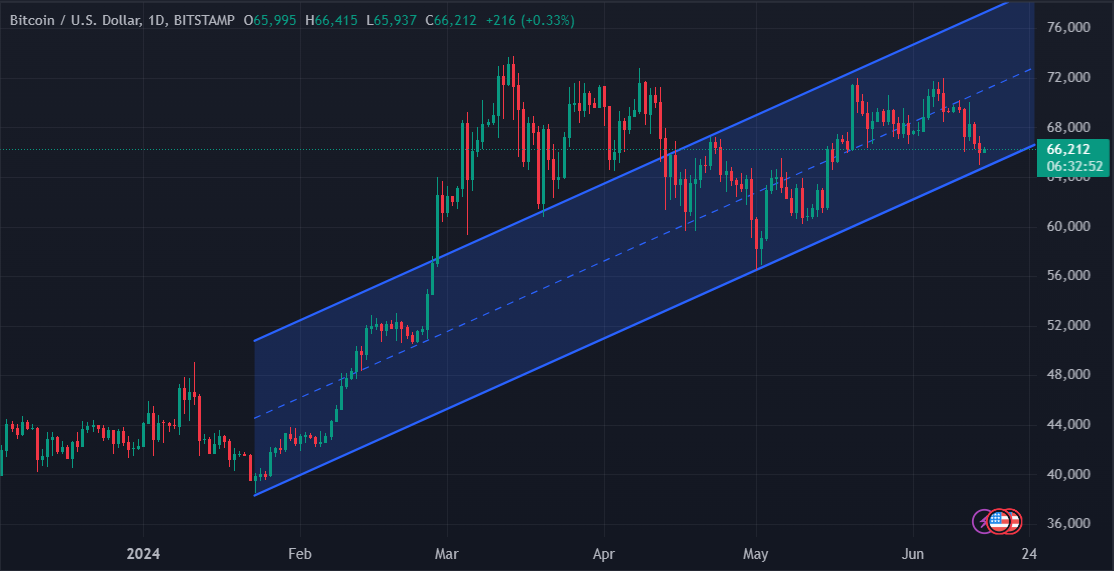

June 15, 2024 at 5:28 pm #7749BTCUSD Daily

Bitcoin crashes below $66K, More pain ahead?

Bitcoin dropped more than 2% in the last 24 hours to drop the $65,000 price level during the US trading session straight down from around $67,000. Over the past seven days, BTC has declined by 7.5%, marking its weakest price in four weeks.Technical support comes at 64.850

June 15, 2024 at 5:21 pm #7748June 15, 2024 at 5:12 pm #7747

June 15, 2024 at 5:21 pm #7748June 15, 2024 at 5:12 pm #7747S&P 500 Posts Weekly Gain, Closes Near Record Highs as Technology Sector Rallies

The Standard & Poor’s 500 index rose 1.6% this week, reaching new highs, led by the technology sector.

The market benchmark closed Friday’s session at 5,431.60, slightly below its record closing level of 5,433.74 reached on Thursday. The S&P 500 also hit a new intraday high on Wednesday at 5,447.25. It is now up 2.9% for the month to date and up 14% this year.

June 15, 2024 at 3:03 pm #7745June 15, 2024 at 3:03 pm #7746June 15, 2024 at 10:51 am #7735

June 15, 2024 at 3:03 pm #7745June 15, 2024 at 3:03 pm #7746June 15, 2024 at 10:51 am #7735Nasdaq closed at a record high for 5 th day in a row.

I read calls for another Bank of Canada rate cut in July

Biden-Trump debate in 10 days

First French poll on June 30

IS data has mainly missed on downside but a light calendar next week

No one is talking about stagflation or recession. I read there has only bern one soft landing and that was in 1995

June 15, 2024 at 12:06 am #7726As a trader, all you should want from a broker is one that is repotable, provides you with a level playing field, and one you don’t have to worry about being in business when you wake up.

This article shows you…

June 14, 2024 at 11:55 pm #7725

June 14, 2024 at 11:55 pm #7725This past week started out with the EURO coming under selling pressure on French political concerns, got a reprieve mid-week when US CPI came in soft, and ended it on a weaker note with French politics again the focus. However, it did manage to come off its lows after EURUSD paused above its 2024 low.

This sets the stage for the coming week where a light US calendar leaving the focus elsewhere.

June 14, 2024 at 11:28 pm #7721

June 14, 2024 at 11:28 pm #7721The prop industry has been shaken of late with traders wary if the irfirm will be around if they get funded and have profits to withdraw.

We had given up promoying prop firms until we came across one we feel is repitable. See foir yourself.

June 14, 2024 at 3:59 pm #7720June 14, 2024 at 3:33 pm #7719

June 14, 2024 at 3:59 pm #7720June 14, 2024 at 3:33 pm #7719I should qualify my earlier statement. My recommendation is strong, I am the furthest thing from stupid. There was a time THE Vice President of a national title company would drive me all over California, and I was given VIP status where the order was “Ay time Mr. ___ shows up at your office you give him whatever he needs. I went from broke to having the trust of major banks. I called THE Vice president of a major bank and said “Rob its Tom I have another one, GMAC has it the numbers will work, and he called the courthouse steps to stop the foreclosure, and the Widow calls you up crying thanking you and your wife is crying saying I love you … and I didn’t charge that widow a penny. That is they type of person you should be working with. I have spoken with Jay. He is one of them.

June 14, 2024 at 3:00 pm #7718Not to hog the foum but I also have a recommendation, as someone who has dealt with bank traders across the globe, and in person in various cities. There was a rule in my office, when I literally was doing so much business I took over an entire building and everyone in that building ended up working with me. They had a home and loved the vibe. We burned out 3 fax machines in one month we were so busy. The unspoken rule was that if you are a sour person you would simply not last in that office. They would just evaporate on their own, the nice people stuck. I did not tolerate sour attitudes. Surround yourselves with nice people like Jay at Global View.

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View