- This topic has 11,679 replies, 48 voices, and was last updated 5 months, 1 week ago by GVI Forex 2.

-

AuthorPosts

-

June 21, 2024 at 2:03 pm #7934June 21, 2024 at 1:54 pm #7933June 21, 2024 at 1:52 pm #7931June 21, 2024 at 1:35 pm #7929June 21, 2024 at 1:28 pm #7928

AT TRading alerts

AT Trading Alerts are what the term says, alerts presented in read time by The Amazing Trader algo in the form of trades indicating a potential change in direction off the high or low for today.’

It is then left up to the trader to decide whether it is a trade they choose to follow (we show a way to evaluate an alert).

Which ones of the 12 alerts today would you have followed

Visit The Amazing Trader and email jay@theamazingtrader.com for current promotions

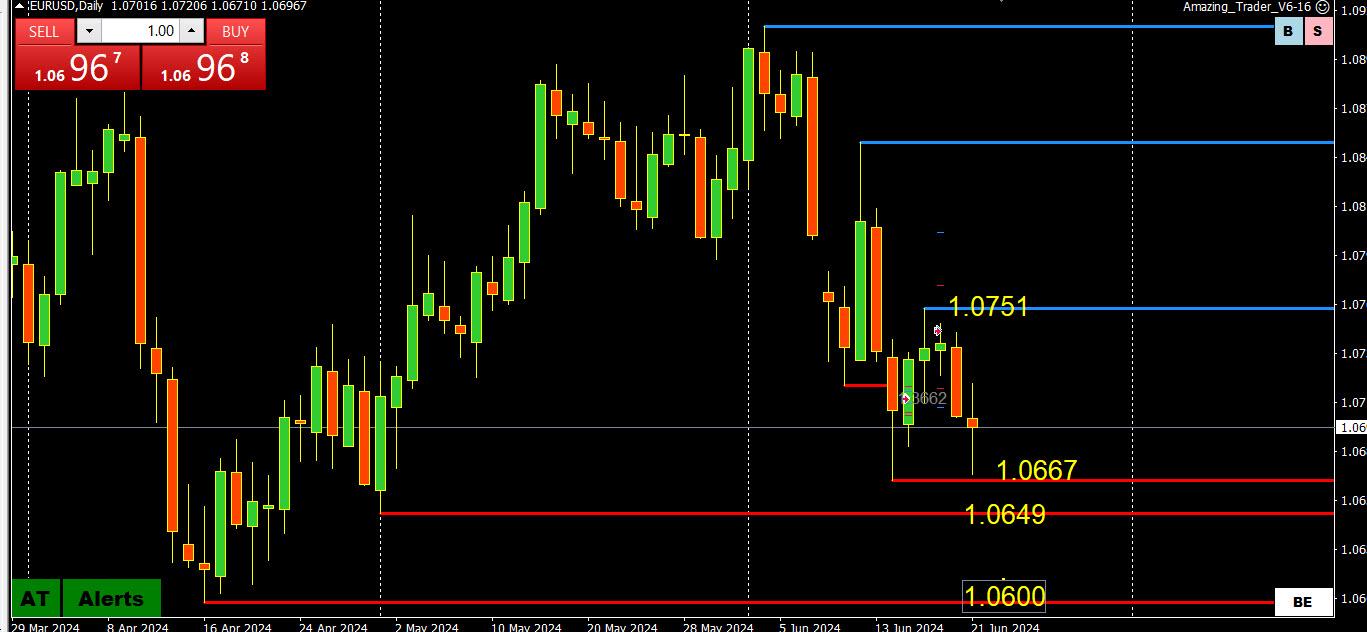

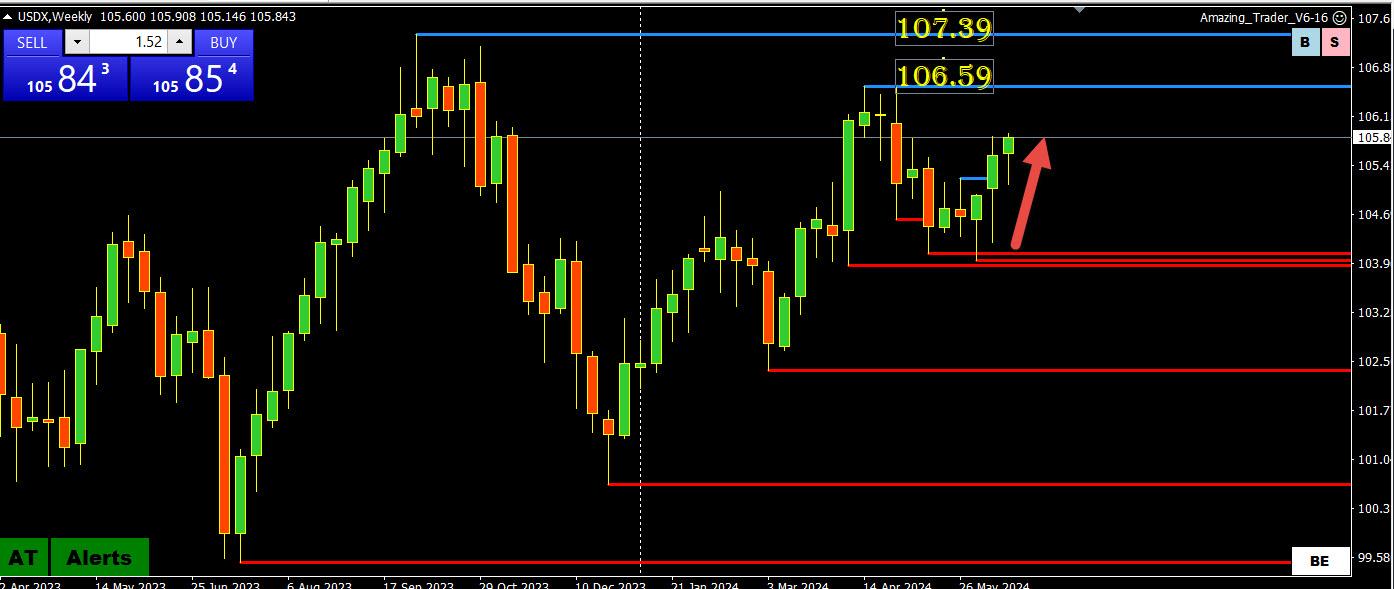

June 21, 2024 at 12:04 pm #7927June 21, 2024 at 11:35 am #7926USDX WEEKLY CHART – EURUSD PROXY (57.5% OF THE INDEX)

USDX weekly is up 3 weeks in a row, which is a good proxy for the directional risk in the EURUSD.

Key resistance levels, as the chart shows, are still above the market.

Note outliers are the commodity currencies (CAD, AUD, NZD)

USDJPY tested 159+ but with caution given the threat of intervention or stepped up warnings of such.

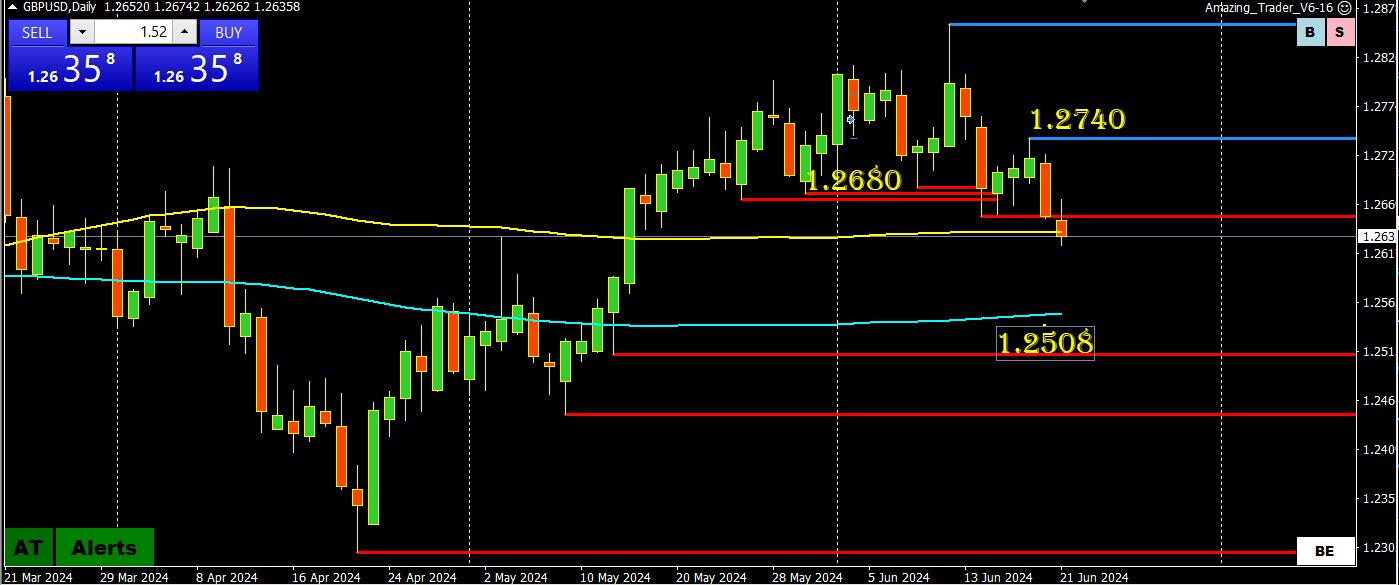

June 21, 2024 at 11:23 am #7925GBPUSD DAILY CHART – TESTING 100 DAY MVA

GBPUSD failure to recover 1.27+ and break of 1.2680 leaves little on charts until around 1.25.

In the absence of nearby support, expect the most recent low to act as a key level.

Otherwise, downside is exposed as long as it trades below 1.2680-00, stronger if it stays below 1,.2650.

ALSO, watch the 100 day mva (yellow) has been tested and 200 day mav (blue) below it.

June 21, 2024 at 11:11 am #7924June 21, 2024 at 10:52 am #7923A look at the day ahead in U.S. and global markets from Mike Dolan

Nvidia, the Nasdaq and the S&P500 got dizzy at record highs on Thursday as world markets start to take stock of a bumper 2024 as we near the half-year point next week – but with the dollar (.DXY), opens new tab back on the march regardless.

June 21, 2024 at 10:05 am #7922June 21, 2024 at 9:53 am #7921June 21, 2024 at 9:24 am #7920Friday

–

the rate cut confidence reinforcing incoming data theme will continue to be all the market has ears and eyes for again today,Allegedly, US economy is hot. So hot that it is hard to find a hotter economy. So today’s PMI release will likely be traded with rate enthusiasts in mind.

EURO 1.0685

– Major support on the line at 1.0667 (check out the daily chart)DLRYEN 158.85 – BoJ and MoF for their own internal reasons, just don’t appear to get their sh!t together as players keep the carry trade alive.

Weakness in both these puppies is currently adding up to DLRx bouts of strength (curr 105.40)

June 20, 2024 at 8:06 pm #7919June 20, 2024 at 7:28 pm #7918Finally Everything You need from a Borket in ain a Prop FirmProp Broker

Click for more information (and a 10% discount)

\

June 20, 2024 at 6:55 pm #7917June 20, 2024 at 6:49 pm #7916June 20, 2024 at 6:44 pm #7915GME – GameStop Corp

GME: GameStop Stock Down 63% from Frothy Highs Last Month. Is Meme Trading Fading?

Roaring Kitty can only do so much — his PR stunts and screenshots took degen traders on a wild ride that ended where it started. Now, many are left holding the bag.

· GameStop shares in bad place.

· Flurry of events batters traders.

· CEO Ryan Cohen to cut costs.

GameStop Corp GME stock has lost close to 16% this week following its annual shareholder meeting, where CEO Ryan Cohen emphasized a strategic pivot towards profitability through cost reduction.

Cohen also emphasized the need to avoid the “hype” associated with the meme-stock frenzy.

June 20, 2024 at 6:36 pm #7914June 20, 2024 at 6:17 pm #7913

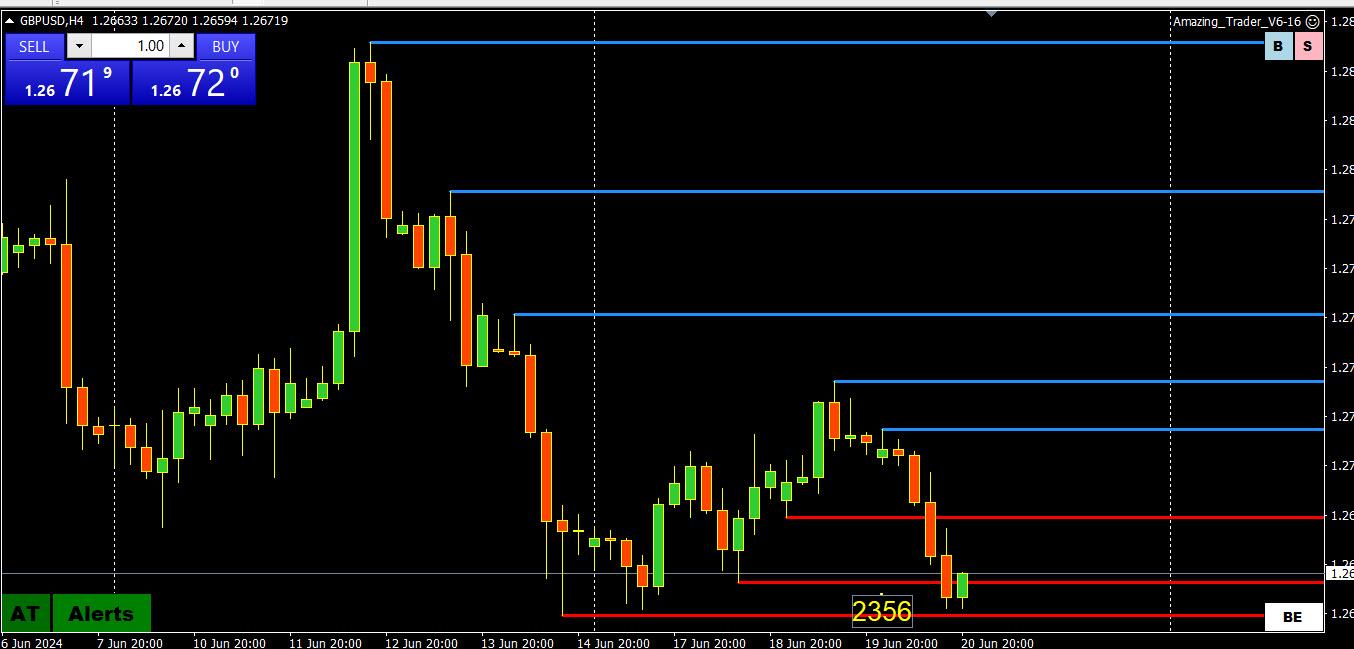

June 20, 2024 at 6:36 pm #7914June 20, 2024 at 6:17 pm #7913GBPUSD 4 HOUR CHART – PAUSES ABOVE SUPPORT

It still amazes me how uncanny The Amazing Traders can be with its chart levels and this chart shows the 1.2756 level what I posted much earlier.

Note how GBPUSD paused above 1.2656 and after a period of going sideways, has given up and staged a bounce.

-

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View