- This topic has 11,679 replies, 48 voices, and was last updated 5 months, 1 week ago by GVI Forex 2.

-

AuthorPosts

-

June 24, 2024 at 1:36 pm #8048June 24, 2024 at 1:08 pm #8047June 24, 2024 at 12:32 pm #8046June 24, 2024 at 11:55 am #8045

EURO 1.0729

Puppy is , so far, holding up and off last week’s 1.0667 low–

Little comic relief about that EU E-commission’s

“threat” to the frog

June 24, 2024 at 11:34 am #8044June 24, 2024 at 10:44 am #8042A look at the day ahead in U.S. and global markets from Mike Dolan

Global investors head to the half-year point this week trying to get across numerous political narratives, a hiccup in tech and a reopening of the transatlantic gap in business activity.

June 24, 2024 at 10:18 am #8041USDJPY 30 -MINUTE CHART – BOJ?

Did the BOJ just take a swing at the market or was it just an order that spooked the market?

Only the price move (down) is what matters and now needs to hold 158.66 to contain the downside and keep 160 on the radar, keeps a bid while 159+

Hint for trading the JPY:

When you see a sharp move in USDJPY, more often than not you should look at other currencies to see what the offset is as it usually involves a cross trade/order flow.

June 24, 2024 at 10:18 am #8040according to (Reuters) – Oil prices fell in early Asian trade on Monday for a second straight session, weighed down by a stronger dollar after concerns of higher-for-longer interest rates resurfaced and cooled investors’ risk appetite.

Brent crude futures slid 40 cents, or 0.5%, to $84.84 a barrel by 0036 GMT, after settling down 0.6% on Friday. U.S. West Texas Intermediate crude futures were at $80.34 a barrel, down 39 cents, or 0.5%.

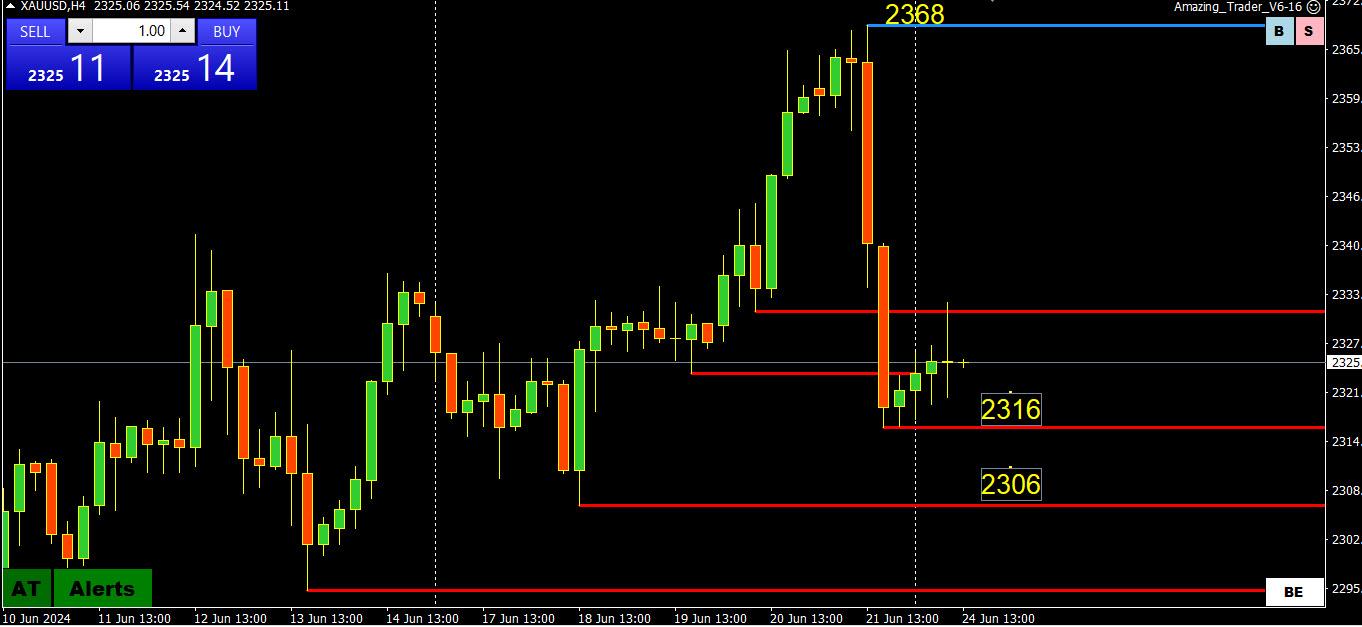

June 24, 2024 at 10:09 am #8039XAUUSD 4 HOUR CHART – STILL FEELING THE EFFECTS

XAUUSD is still feeling the effects of Friday’;s sell-off, which did not break2306 but was painful to the bull side.

With no key levels within 2316-68, suggest using retracement levels to find levels within this range.

June 24, 2024 at 9:57 am #8038EURUSD 4 HOUR CHART –

Break of 1.0720 indicates current momentum pattern is broken… needs to stay above it to keep a strong bid

…But only a break of 1.0748-61 would indicate more than just a retracement or bounce within the range.

Perhaps more significant is 1.0750 as only above it would suggest more legs to this recovery.

On the downside, 1.0698 is the level that needs to hold to keep thoughts away from last Friday’s low

June 24, 2024 at 9:44 am #8037USDX 4 HOUR CHART -EURUSD PROXY (57.6% OF THE INDEX)

Using USDX as a EURUSD proxy shows the retreat off Friday’s high/EURUSD low has broken a trendline. It is trading just above 105.57 support, below which would break the Amazing Trader up ladder pattern and end the cyrrent momentum to the upside.

Looking at the various currencies:

EURUSD is the current outperformer today (+0.33%) while the dollar is down about the same vs. all other pairs.

Wirth noting, USDJPY came withIN 8 pips of 160 as the BoJ threat kept it fro making s serious challenge.

June 24, 2024 at 12:50 am #8036THIS WEEK’S MARKET-MOVING EVENTS (all days local)

The week’s inflation data open with Canada on Tuesday and Australia on Wednesday, the former expected to ease a tenth to 2.6 percent and the latter to rise 2 tenths to a noticeably overheated 3.8 percent. Friday will open with Tokyo consumer prices which are expected to hold steady with US PCE indexes to close the week amid expectations for marginal monthly gains and nearly benign looking 2.6 percent annual rates both overall and for the core.

Other data to watch are Japanese retail sales and US durable goods orders on Thursday, and Japanese industrial production on Friday. Germany will post retail sales and unemployment on Friday. A market-mover for Canada will be Friday’s monthly GDP report which is expected show a 0.3 percent bounce.

Econoday

June 23, 2024 at 10:48 pm #8025June 23, 2024 at 7:40 pm #8019June 23, 2024 at 7:16 pm #8018June 23, 2024 at 6:21 pm #8014USDJPY 4 HOUR CHART

I am posting a 4 hour chart in addition to the daily chart just posted to show the strength of this trend that started at 155.70.

As you can see by the rising red Amazing Trader lines, each dip has found support with the last on at 158.66.

To keep it simple for ther BOJ, either get USDJPY back below 158 or 160 will stay on the radar.

June 23, 2024 at 5:51 pm #8013June 23, 2024 at 5:27 pm #8012USDJPY DAILY CHART –WILL 160 BE DEFENDED?

Current daily pattern, higher for 7 days in a row

Major level 160.16 (34 year high)All BOJ can do is try to contain the upside as this chart shows, 155.70 would need to be broken to change the technical. Otherwise, bids will be lying in wait.

As I nited,

The initial focus should be on USDJPY after it closed within spitting distance of 160 and the 160.16 high. I am not in the BoJ’s shoes but if I am serious about defending 160 I would let the market run through the high and then come in hard with intervention. However, this plays out, 159-50-160.00 is going to be the nervous zone.

June 23, 2024 at 10:36 am #7985There is enough data this week to keep the market on its toes culminating with US PCE on Friday that coincides with quarter/month end.

The initial focus should be on USDJPY after it closed within spitting distance of 160 and the 160.16 high. I am not in the BoJ’s shoes but if I am serious about defending 160 I would let the market run through the high and then come in hard with intervention. However, this plays out, 159-50-160.00 is going to be the nervous zone.

A key event will be Thursday’s Biden-Trump debate where the focus will likely be more on performance than substance and mental fitness to hold office for both candidates. At this stage it is hard to gauge which candidate would be better or worse for markets in a race that seems filled with more negatives than positives.

This all comes ahead of Sunday’s first round of French elections where logic says should put a limit on the EURUSD upside ahead of it.

June 22, 2024 at 1:28 pm #7961 -

AuthorPosts

- You must be logged in to reply to this topic.

© 2024 Global View